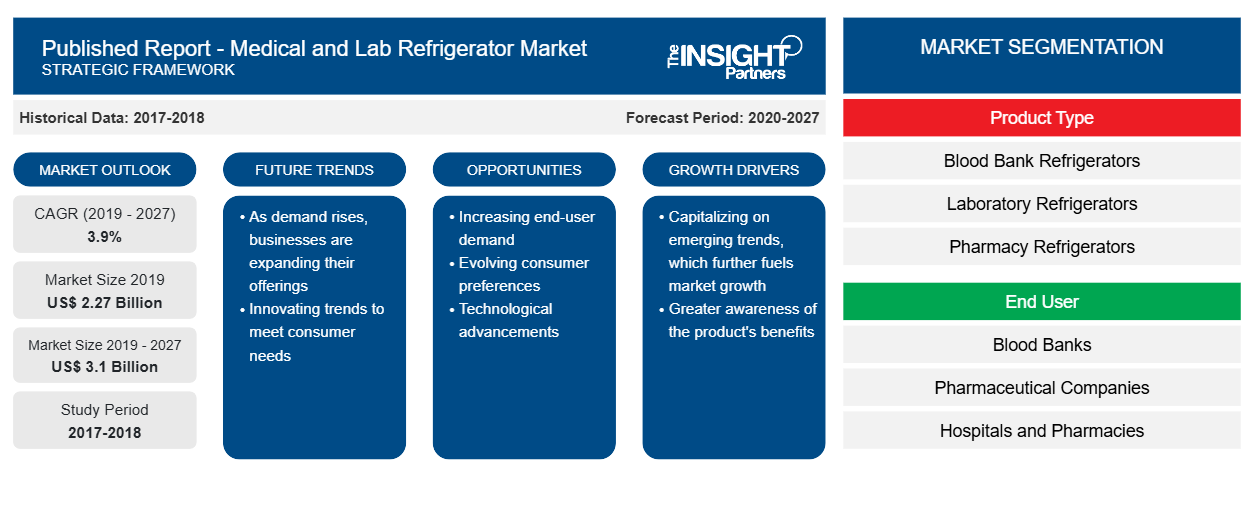

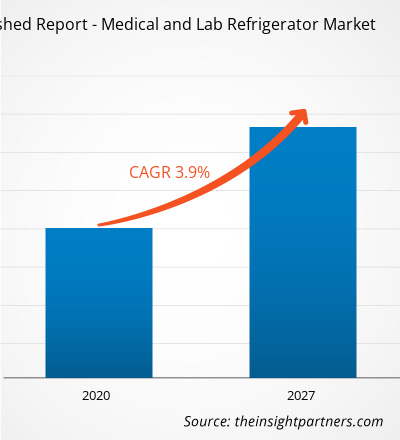

The medical and lab refrigerator market was valued at US$ 2,267.9 million in 2019 and is projected to reach US$ 3,096.6 million by 2027; it is expected to grow at a CAGR of 3.9% from 2020 to 2027.

Growing demand for safe storage of blood and blood derivatives from hospitals, pharmacies, clinics, and diagnostic centers is boosting the medical and lab refrigerator market growth across the world. Both in medical research and pharmaceutical sector, rising government funding is expected to increase the demand for medical and laboratory refrigerators further. For example, the Medical Device Directive of the European Commission has used specific requirements and regulations for biomedical freezers and refrigerators to store blood and blood components. Furthermore, the increasing prevalence of various chronic diseases such as cancer, cardiac diseases, and infectious diseases is leading to an increase in blood transfusion demand another critical factor that will boost the medical and lab refrigerators market growth. According to the European Society of Hemapheresis (ESFH), high preference toward plasmapheresis will raise the installation of plasma freezers in hospitals, blood banks, and research organizations for the storage of fresh frozen plasma, RBCs, and other blood derivatives. Increasing awareness about blood donation and government initiatives to encourage donations will also foster business growth. However, the high cost of refrigerators and freezers of medical grade, as well as increasing preference for refurbished equipment, may impede the medical and lab refrigerator market growth during the period of analysis.

The healthcare and medical device industry is at the epicenter of this unprecedented global pandemic challenge, and the private sector has come up with the opportunity to offer the government all the support it needs, whether it is testing support, preparing isolation beds for treating COVID-19 patients or deploying equipment and staff in identified nodal hospitals. It is anticipated that a series of demand shocks, both positive and negative, will occur in the coming six months as medical device OEMs and their suppliers respond to the changing needs of providers.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Published Report - Medical and Lab Refrigerator Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Lucrative Regions for Medical and Lab Refrigerator Market

Medical and Lab Refrigerator Market Insights

Increasing Number of Accidents, Surgery Interventions, and Others Result in the Growth of Medical and Lab Refrigerator Market

The increasing number of accidents, surgical interventions such as cancer, organ and bone marrow transplants, cardiovascular surgery, general surgery, nephrology, and dialysis lead to increased demand for blood components, thus driving the growth for medical and laboratory refrigerator market. For example, according to the American Cancer Society (ACS), in 2017, ~1.7 million people were diagnosed with cancer. Among these, some of the patients needed blood transfusion daily during their treatment along with chemotherapy. Lack of timely access to secure blood transfusion leads to increased demand for blood banks for efficient, safe, and real-time blood unit availability. Therefore, different organizations are getting involved in activities to launch innovative product solutions in the market. For example, in March 2018, India-based Strides Software Solutions, which enables the availability of safe and high-quality blood components, developed India's first centralized donor authentication and identification application based on Aadhaar, the D-Health app.

Product Type-Based Market Insights

The medical and lab refrigerator market, by type, is segmented into blood bank refrigerators, laboratory refrigerators, pharmacy refrigerators, enzyme refrigerators, and others. The medical and lab refrigerator market for the blood bank refrigerators segment is estimated to lead during the forecast period. These refrigerators are used in blood banks, laboratories, and hospitals. Temperature uniformity is the primary requirement for blood bag storage. In addition, other parameters required to select the blood bank refrigerator include bags capacity, number of shelves, safety features, the material of construction, and, most importantly, standards and certifications such as ISO and CE.

End User-Based Market Insights

The end-user segment of the medical and lab refrigerator market is categorized into blood banks, pharmaceutical companies, hospitals and pharmacies, research institutes, and others. The medical and lab refrigerator market for the hospitals and pharmacies segment dominated the market in 2019. Specialized hospitals and clinics offer complex services, which is associated with the use of modern techniques and equipment, as well as new drug discoveries.

In several cases, refrigeration systems have become vital resources to carry out procedures and maintain ideal conditions of diverse materials. Thus, medical-grade refrigerators are highly used in hospitals. These are commonly used to store blood bags, serums, tissues, and organs for transplant. Proper storage of these components is highly essential to prevent financial loss. Further, improper handling of these components can be life threatening for patients.

The players in the medical and lab refrigerator market focus on various strategic alliances such as mergers, acquisitions, and new product launches to maintain their positions in the medical and lab refrigerator market. A few developments are listed below:

In 2019, Accucold, a division of Felix Storch, Inc. (FSI), launched a new series of purpose-built refrigeration for meeting the demand from life science, laboratory, scientific, and medical cold storage applications. The Performance Series Med-Lab line, available in multiple sizes, expands Accucold's offering of cold storage equipment into the life sciences market.

In 2019, Lec Medical announced the launch of Control Plus - a new range of medical refrigeration that measures both the core temperature of the fridge, as well as the vaccine itself. Featuring an improved controller, larger internal capacities, and a flat door to save valuable space in a busy medical environment, the Control Plus range is designed for a variety of locations, from pharmacies and hospitals to laboratories and general practice.

Medical and Lab Refrigerator

Published Report - Medical and Lab Refrigerator Market Regional InsightsThe regional trends and factors influencing the Published Report - Medical and Lab Refrigerator Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Published Report - Medical and Lab Refrigerator Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Published Report - Medical and Lab Refrigerator Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 2.27 Billion |

| Market Size by 2027 | US$ 3.1 Billion |

| Global CAGR (2019 - 2027) | 3.9% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Published Report - Medical and Lab Refrigerator Market Players Density: Understanding Its Impact on Business Dynamics

The Published Report - Medical and Lab Refrigerator Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Published Report - Medical and Lab Refrigerator Market top key players overview

Medical and Lab Refrigerator Market - by Product Type

- Blood Bank Refrigerators

- Laboratory Refrigerators

- Pharmacy Refrigerators

- Enzyme Refrigerators

- Others

Medical and Lab Refrigerator Market - by End User

- Blood Banks

- Pharmaceutical Companies

- Hospitals And Pharmacies

- Research Institutes

- Others

Medical and Lab Refrigerator Market - by Geography

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- UK

- Russia

- Rest of Europe

-

Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Rest of APAC

-

Middle East & Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

-

South America (SAM)

- Brazil

- Argentina

- Rest of SAM

Company Profiles

- ZhongkeMeiling Cryogenics Company Limited

- Felix Storch, Inc

- Follett LLC

- Helmer Scientific Inc.

- Haier Biomedical

- Lec Medical

- Philipp Kirsch GmbH

- Thermo Fisher Scientific Inc.

- Vestfrost Solutions

- Blue Star Limited

Frequently Asked Questions

Which region led medical lab and refrigerator market?

Which end-user led the medical lab and refrigerator market?

Which factor is driving the medical lab and refrigerator market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For