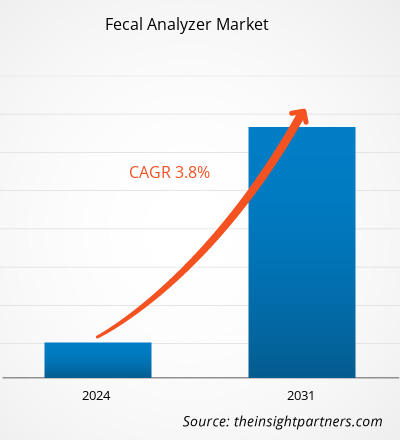

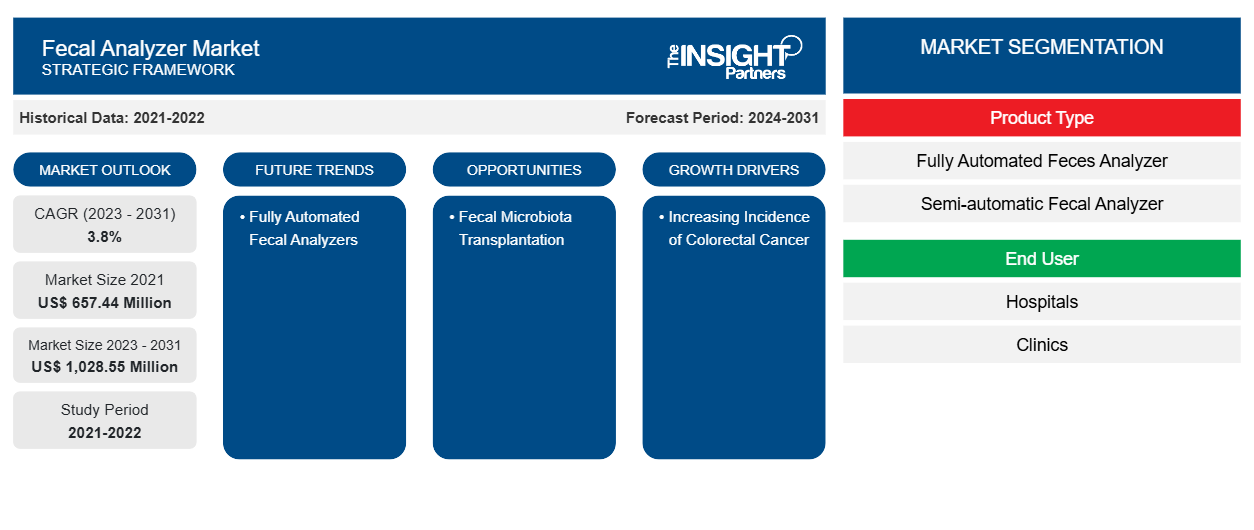

Der Markt für Stuhlanalysegeräte wurde im Jahr 2021 auf 657,44 Mio. USD und im Jahr 2023 auf xx Mio. USD geschätzt. Es wird erwartet, dass er bis 2031 1.028,55 Mio. USD erreicht und bis 2031 eine durchschnittliche jährliche Wachstumsrate von 3,8 % verzeichnet. Die Entwicklung von Point-of-Care-Analysegeräten, die Integration von Stuhlanalysetests mit Telemedizin-Beratung und die Entwicklung erschwinglicher Stuhlanalysegeräte werden wahrscheinlich weiterhin die wichtigsten Trends auf dem Stuhlanalysemarkt bleiben.

Marktanalyse für Stuhlanalysegeräte

Die zunehmende Inzidenz von Dickdarmkrebs wird voraussichtlich das Wachstum des Marktes für Stuhlanalysegeräte vorantreiben. Dickdarmkrebs gehört auch zu den chronischsten Krebsarten. Entwicklungen in der Medizintechnik haben zur Einführung von Stuhlanalysegeräten geführt, die bei der Frühdiagnose von Dickdarmkrebs helfen. Dickdarm- oder kolorektaler Krebs ist eine der häufigsten Krebsarten . Laut den Daten von GLOBOCAN 2022 ist es die dritthäufigste Krebsart weltweit. Laut den Schätzungen von Globocan gab es im Jahr 2022 1.926.425 Fälle von Dickdarmkrebs bei beiden Geschlechtern.

Ähnlich schätzt die American Cancer Association, dass es im Jahr 2024 etwa 106.590 neue Fälle von Dickdarmkrebs (54.210 bei Männern und 52.380 bei Frauen) und etwa 46.220 neue Fälle von Mastdarmkrebs geben wird.

Marktübersicht für Stuhlanalysegeräte

Der globale Markt für Stuhlanalysegeräte ist nach Regionen unterteilt in Nordamerika, Europa, Asien-Pazifik, Naher Osten und Afrika sowie Süd- und Mittelamerika. Das Marktwachstum in dieser Region wird aufgrund von Faktoren wie der Häufigkeit von Dickdarmkrebs und der Umsetzung von Screening-Programmen, dem Anstieg der geriatrischen Bevölkerung und technologischen Fortschritten bei Gesundheitsgeräten erwartet, die das Marktwachstum vorantreiben. Die Herausforderungen im Zusammenhang mit der Analyse und Handhabung von Stuhlanalysegeräten behindern jedoch das Marktwachstum.

Passen Sie diesen Bericht Ihren Anforderungen an

Sie erhalten kostenlos individuelle Anpassungen an jedem Bericht, einschließlich Teilen dieses Berichts oder einer Analyse auf Länderebene, eines Excel-Datenpakets sowie tolle Angebote und Rabatte für Start-ups und Universitäten.

-

Holen Sie sich die wichtigsten Markttrends aus diesem Bericht.Dieses KOSTENLOSE Beispiel umfasst eine Datenanalyse von Markttrends bis hin zu Schätzungen und Prognosen.

Markttreiber und Chancen für Stuhlanalysegeräte

Anstieg der geriatrischen Bevölkerung begünstigt den Markt.

Ältere Menschen sind anfälliger für Magen-Darm-Erkrankungen wie Morbus Crohn, Dickdarmkrebs und Reizdarmsyndrom (IBS). Nach Dickdarmkrebs ist IBS eine häufig diagnostizierte Krankheit bei älteren Menschen. Bei etwa 10–20 % der älteren Menschen weltweit werden die Symptome von IBS diagnostiziert. Laut Statistiken der Vereinten Nationen (UN) Global Population Prospects für 2022 gab es weltweit rund 771 Millionen Menschen im Alter von 65 Jahren und älter, was fast 10 % der Weltbevölkerung entspricht. Bis 2050 werden es voraussichtlich 16 % sein.Crohn's disease, colorectal cancer, and irritable bowel syndrome (IBS). After colorectal cancer, IBS is a commonly diagnosed disease among older people. ~10–20% of elderly people in the world are diagnosed with the symptoms of IBS. According to statistics from the United Nations (UN) Global Population Prospects for 2022, there were around 771 million people aged 65+ years across the globe, accounting for almost 10% of the world’s population and is projected to reach 16% in 2050.

Fäkale Mikrobiota-Transplantation – eine Chance auf dem Markt für StuhlanalysegeräteMicrobiota Transplantation – An Opportunity in Fecal Analyzer Market

Bei der fäkalen Mikrobiota-Transplantation (FMT) handelt es sich um den Prozess der Übertragung von Stuhl eines gesunden Spenders auf einen Patienten, der mit einer Clostridium-difficile-Infektion lebt. Fortschritte in der Medizintechnik haben eine effiziente Diagnose von Dickdarmkrebs und Reizdarmsyndrom durch Stuhlanalyse ermöglicht. Diese Entwicklungen haben auch dazu beigetragen, Forschung im Zusammenhang mit FMT durchzuführen und so die Einführung verschiedener Stuhlanalysegeräte zu fördern. Allerdings wird FMT nicht routinemäßig für andere Indikationen als rezidivierende C. difficile-Colitis durchgeführt, da mehr Forschung erforderlich ist, um die Stuhltransplantation für andere Erkrankungen zu bestimmen. Entwicklungen im Bereich FMT werden in den kommenden Jahren eine größere Nachfrage nach Stuhlanalysegeräten erzeugen. Darüber hinaus wird das wachsende Bewusstsein für FMT in Entwicklungsregionen wie dem asiatisch-pazifischen Raum und Afrika, in denen Magen-Darm-Erkrankungen häufiger auftreten als in entwickelten Regionen, den Akteuren auf dem Markt für Stuhlanalysegeräte wahrscheinlich wichtige Wachstumschancen bieten.microbiota transplantation (FMT) is the processes of transferring stool from a healthy donor to a patient living with Clostridium difficile infection. Advancements in colorectal cancer and IBS through fecal analysis. These developments have also helped conduct research related to FMT, thereby encouraging the launch of different fecal analyzers. However, FMT is not routinely performed for indications other than recurrent C. difficile colitis, as more research is required for determining the fecal transplantation for other medical conditions. Developments in FMT would generate greater demand for fecal analyzers in the coming years. Further, mounting awareness regarding FMT in developing regions such as Asia Pacific and Africa, with a greater incidence of gastrointestinal diseases than developed regions, is likely to serve vital growth opportunities to the fecal analyzer market players.

Marktbericht über Stuhlanalysegeräte – Segmentierungsanalyse

Wichtige Segmente, die zur Ableitung der Marktanalyse für Stuhlanalysatoren beigetragen haben, sind Dienstleistungen und Anwendungen.

- Basierend auf dem Produkttyp ist der Markt für Stuhlanalysegeräte in vollautomatische Stuhlanalysegeräte und halbautomatische Stuhlanalysegeräte unterteilt. Das Segment der vollautomatischen Stuhlanalysegeräte hatte 2023 den größten Marktanteil und wird im Prognosezeitraum voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate (CAGR) auf dem Markt verzeichnen.

- Nach Endverbraucher wurde der Markt für Stuhlanalysegeräte in Krankenhäuser, Kliniken und andere segmentiert. Das Krankenhaussegment hielt im Jahr 2023 den größten Marktanteil und wird im Prognosezeitraum voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate (CAGR) auf dem Markt verzeichnen.

Marktanteilsanalyse für Stuhlanalysegeräte nach Geografie

Der geografische Umfang des Marktberichts zu Stuhlanalysegeräten ist hauptsächlich in fünf Regionen unterteilt: Nordamerika, Asien-Pazifik, Europa, Naher Osten und Afrika sowie Südamerika/Süd- und Mittelamerika.

Nordamerika umfasst die USA, Kanada und Mexiko. Der nordamerikanische Markt hatte im Jahr 2023 einen bedeutenden Anteil am Weltmarkt. Die Nachfrage nach dem Markt in der Region wird im Prognosezeitraum voraussichtlich aufgrund verschiedener Faktoren wie der hohen Inzidenzrate von Dickdarmkrebs, zunehmender Initiativen für obligatorische Screenings durch Stuhltests und der Präsenz von Marktteilnehmern, die in den Ländern fortschrittliche vollautomatische und halbautomatische Stuhlanalysegeräte anbieten, erheblich wachsen.

Der asiatisch-pazifische Raum ist der am schnellsten wachsende Markt für Stuhlanalysegeräte weltweit, was auf die zunehmende Entwicklung von Stuhlanalysegeräten in Ländern wie Japan und China zurückzuführen ist. Die zunehmende Besorgnis über Durchfall, Dickdarmkrebs und andere Krankheiten sowie die wachsende Zahl von Diagnoselabors in Indien bieten Wachstumschancen für das Marktwachstum. Darüber hinaus wird erwartet, dass steigende Investitionen in die Biotechnologiebranche in Südkorea und Australien die wichtigen Wachstumschancen des Marktes bedienen.

Regionale Einblicke in den Markt für Stuhlanalysegeräte

Die regionalen Trends und Faktoren, die den Markt für Stuhlanalysegeräte im Prognosezeitraum beeinflussen, wurden von den Analysten von Insight Partners ausführlich erläutert. In diesem Abschnitt werden auch die Marktsegmente und die Geografie von Stuhlanalysegeräten in Nordamerika, Europa, im asiatisch-pazifischen Raum, im Nahen Osten und Afrika sowie in Süd- und Mittelamerika erörtert.

- Holen Sie sich die regionalspezifischen Daten für den Stuhlanalysemarkt

Umfang des Marktberichts über Stuhlanalysegeräte

| Berichtsattribut | Details |

|---|---|

| Marktgröße im Jahr 2021 | 657,44 Millionen US-Dollar |

| Marktgröße bis 2031 | 1.028,55 Millionen US-Dollar |

| Globale CAGR (2023 - 2031) | 3,8 % |

| Historische Daten | 2021-2022 |

| Prognosezeitraum | 2024–2031 |

| Abgedeckte Segmente |

Nach Produkttyp

|

| Abgedeckte Regionen und Länder |

Nordamerika

|

| Marktführer und wichtige Unternehmensprofile |

|

Marktteilnehmerdichte: Der Einfluss auf die Geschäftsdynamik

Der Markt für Stuhlanalysegeräte wächst rasant, angetrieben durch die steigende Nachfrage der Endnutzer aufgrund von Faktoren wie sich entwickelnden Verbraucherpräferenzen, technologischen Fortschritten und einem größeren Bewusstsein für die Vorteile des Produkts. Mit steigender Nachfrage erweitern Unternehmen ihr Angebot, entwickeln Innovationen, um die Bedürfnisse der Verbraucher zu erfüllen, und nutzen neue Trends, was das Marktwachstum weiter ankurbelt.

Die Marktteilnehmerdichte bezieht sich auf die Verteilung der Firmen oder Unternehmen, die in einem bestimmten Markt oder einer bestimmten Branche tätig sind. Sie gibt an, wie viele Wettbewerber (Marktteilnehmer) in einem bestimmten Marktraum im Verhältnis zu seiner Größe oder seinem gesamten Marktwert präsent sind.

Die wichtigsten auf dem Markt für Stuhlanalysegeräte tätigen Unternehmen sind:

- Heska Corporation,

- AVE Wissenschaft und Technologie Co.Ltd,

- Eiken Chemical Co., Ltd.,

- iClear Limited,

- Verbesserung medizinischer Instrumente,

- Belson Medical System Co., Ltd,

Haftungsausschluss : Die oben aufgeführten Unternehmen sind nicht in einer bestimmten Reihenfolge aufgeführt.

- Überblick über die wichtigsten Akteure auf dem Markt für Stuhlanalysegeräte

Neuigkeiten und aktuelle Entwicklungen zum Stuhlanalysemarkt

Der Markt für Stuhlanalysegeräte wird durch die Erhebung qualitativer und quantitativer Daten nach Primär- und Sekundärforschung bewertet, die wichtige Unternehmensveröffentlichungen, Verbandsdaten und Datenbanken umfasst. Im Folgenden finden Sie eine Liste der Entwicklungen auf dem Markt für Stuhlanalysegeräte und Strategien:

- Im Juni 2022 brachte das italienische Unternehmen Sentinel Diagnostics den SENTiFIT 800 Analyzer auf den Markt, ein vollautomatisches Hochdurchsatzsystem für immunchemische Tests im Stuhl (Quelle: Pressemitteilung des Unternehmens)

- Im September 2020 brachte ISE SRL seinen neuen kompakten, zuverlässigen und vielseitigen vollautomatischen Analysator zum Testen von Stoffwechselstörungen auf den Markt, wie z. B. - Diabetes - Herz-Kreislauf-Erkrankungen - Vitaminmangel - Magen-Darm-Erkrankungen (Fäkal) - Nierenfunktion - Stoffwechselstörungen - Krankenhauseinweisungen - entzündliche Erkrankungen - bestimmte Proteine - klinische Chemie. (Quelle: Pressemitteilung des Unternehmens)

Marktbericht zu Stuhlanalysegeräten – Umfang und Ergebnisse

Der Bericht „Marktgröße und Prognose für Stuhlanalysatoren (2021–2031)“ bietet eine detaillierte Analyse des Marktes, die die folgenden Bereiche abdeckt:

- Marktgröße und Prognose auf globaler, regionaler und Länderebene für alle wichtigen Marktsegmente, die im Rahmen des Projekts abgedeckt sind

- Marktdynamik wie Treiber, Beschränkungen und wichtige Chancen

- Wichtige Zukunftstrends

- Detaillierte PEST/Porters Five Forces- und SWOT-Analyse

- Globale und regionale Marktanalyse mit wichtigen Markttrends, wichtigen Akteuren, Vorschriften und aktuellen Marktentwicklungen

- Branchenlandschaft und Wettbewerbsanalyse, einschließlich Marktkonzentration, Heatmap-Analyse, prominenten Akteuren und aktuellen Entwicklungen

- Detaillierte Firmenprofile

- Historische Analyse (2 Jahre), Basisjahr, Prognose (7 Jahre) mit CAGR

- PEST- und SWOT-Analyse

- Marktgröße Wert/Volumen – Global, Regional, Land

- Branchen- und Wettbewerbslandschaft

- Excel-Datensatz

Aktuelle Berichte

Verwandte Berichte

Erfahrungsberichte

Grund zum Kauf

- Fundierte Entscheidungsfindung

- Marktdynamik verstehen

- Wettbewerbsanalyse

- Kundeneinblicke

- Marktprognosen

- Risikominimierung

- Strategische Planung

- Investitionsbegründung

- Identifizierung neuer Märkte

- Verbesserung von Marketingstrategien

- Steigerung der Betriebseffizienz

- Anpassung an regulatorische Trends

Kostenlose Probe anfordern für - Markt für Stuhlanalysegeräte

Kostenlose Probe anfordern für - Markt für Stuhlanalysegeräte