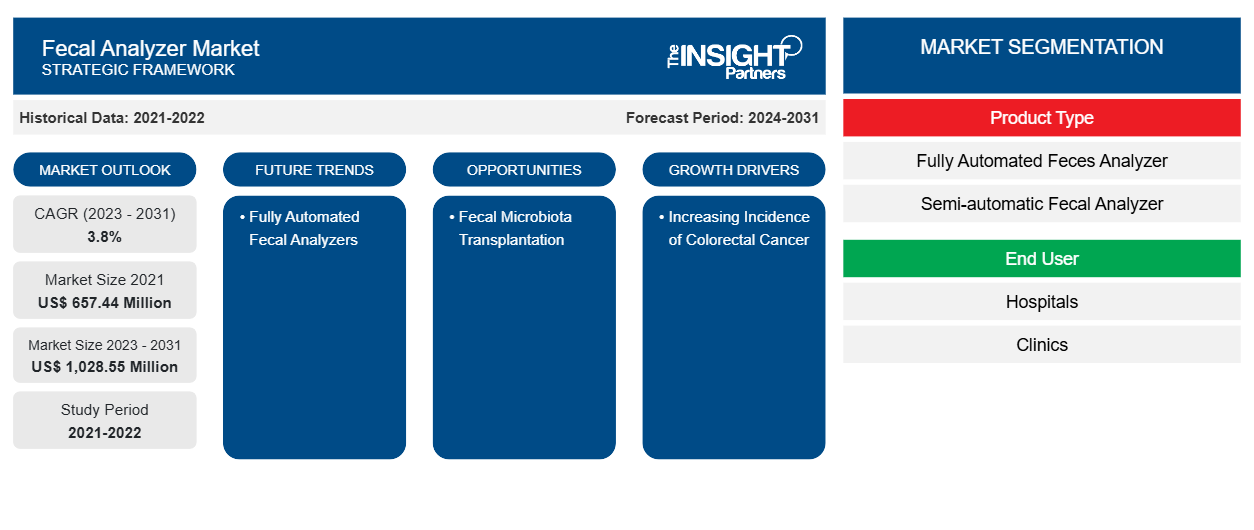

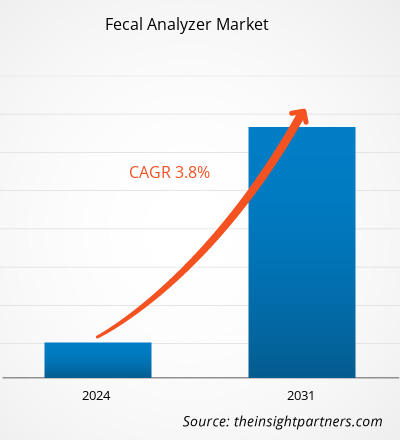

Français Le marché des analyseurs fécaux a été estimé à 657,44 millions USD en 2021 et à xx millions USD en 2023. Il devrait atteindre 1 028,55 millions USD d'ici 2031 et enregistrer un TCAC de 3,8 % jusqu'en 2031. Le développement d'analyseurs au point de service, l'intégration des tests d'analyseurs fécaux à la consultation en télésanté et le développement d'analyseurs fécaux abordables resteront probablement les principales tendances du marché des analyseurs fécaux.

Analyse du marché des analyseurs fécaux

L'incidence croissante du cancer colorectal devrait stimuler la croissance du marché des analyseurs fécaux. Le cancer colorectal fait également partie des types de cancer les plus chroniques. Les progrès de la technologie médicale ont conduit à l'introduction d'analyseurs fécaux qui aident au diagnostic précoce du cancer colorectal. Le cancer du côlon ou colorectal est l'un des types de cancer les plus courants . Selon les données de GLOBOCAN 2022, il s'agit du troisième cancer le plus fréquemment diagnostiqué au monde. Selon les estimations de Globocan, il y a eu 1 926 425 cas de cancer colorectal chez les deux sexes en 2022.

De même, l’American Cancer Association a estimé qu’il y aura environ 106 590 nouveaux cas de cancer du côlon (54 210 chez les hommes et 52 380 chez les femmes) et environ 46 220 nouveaux cas de cancer du rectum en 2024.

Aperçu du marché des analyseurs fécaux

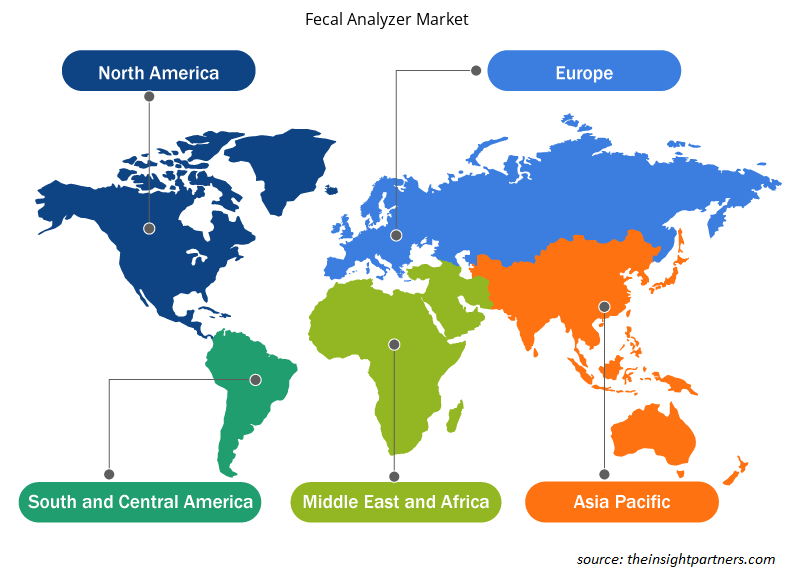

Le marché mondial des analyseurs de matières fécales est segmenté par région en Amérique du Nord, Europe, Asie-Pacifique, Moyen-Orient et Afrique et Amérique du Sud et centrale. La croissance du marché dans cette région est attendue en raison de facteurs tels que l'incidence du cancer colorectal et la mise en œuvre de programmes de dépistage, l'augmentation de la population gériatrique et les avancées technologiques dans les appareils de santé stimulent la croissance du marché. Cependant, les défis liés à l'analyse et à la manipulation des analyseurs de matières fécales entravent la croissance du marché.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que d'offres et de remises exceptionnelles pour les start-ups et les universités.

Marché des analyseurs fécaux : informations stratégiques

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Facteurs moteurs et opportunités du marché des analyseurs fécaux

L'augmentation de la population gériatrique favorise le marché.

Les personnes âgées sont plus susceptibles d'être touchées par des maladies gastro-intestinales telles que la maladie de Crohn, le cancer colorectal et le syndrome du côlon irritable (SCI). Après le cancer colorectal, le SCI est une maladie fréquemment diagnostiquée chez les personnes âgées. Environ 10 à 20 % des personnes âgées dans le monde présentent des symptômes du SCI. Selon les statistiques des Perspectives de la population mondiale des Nations unies (ONU) pour 2022, il y avait environ 771 millions de personnes âgées de 65 ans et plus dans le monde, ce qui représente près de 10 % de la population mondiale et devrait atteindre 16 % en 2050.Crohn's disease, colorectal cancer, and irritable bowel syndrome (IBS). After colorectal cancer, IBS is a commonly diagnosed disease among older people. ~10–20% of elderly people in the world are diagnosed with the symptoms of IBS. According to statistics from the United Nations (UN) Global Population Prospects for 2022, there were around 771 million people aged 65+ years across the globe, accounting for almost 10% of the world’s population and is projected to reach 16% in 2050.

Transplantation de microbiote fécal – Une opportunité sur le marché des analyseurs fécauxMicrobiota Transplantation – An Opportunity in Fecal Analyzer Market

La transplantation de microbiote fécal (FMT) est le processus de transfert des selles d'un donneur sain à un patient vivant avec une infection à Clostridium difficile. Les progrès de la technologie médicale ont permis un diagnostic efficace du cancer colorectal et du SCI grâce à l'analyse fécale. Ces développements ont également contribué à mener des recherches liées à la FMT, encourageant ainsi le lancement de différents analyseurs fécaux. Cependant, la FMT n'est pas systématiquement effectuée pour des indications autres que la colite récurrente à C. difficile, car des recherches supplémentaires sont nécessaires pour déterminer la transplantation fécale pour d'autres conditions médicales. Les développements de la FMT généreraient une plus grande demande d'analyseurs fécaux dans les années à venir. En outre, la sensibilisation croissante à la FMT dans les régions en développement telles que l'Asie-Pacifique et l'Afrique, où l'incidence des maladies gastro-intestinales est plus élevée que dans les régions développées, est susceptible de servir des opportunités de croissance vitales pour les acteurs du marché des analyseurs fécaux.microbiota transplantation (FMT) is the processes of transferring stool from a healthy donor to a patient living with Clostridium difficile infection. Advancements in colorectal cancer and IBS through fecal analysis. These developments have also helped conduct research related to FMT, thereby encouraging the launch of different fecal analyzers. However, FMT is not routinely performed for indications other than recurrent C. difficile colitis, as more research is required for determining the fecal transplantation for other medical conditions. Developments in FMT would generate greater demand for fecal analyzers in the coming years. Further, mounting awareness regarding FMT in developing regions such as Asia Pacific and Africa, with a greater incidence of gastrointestinal diseases than developed regions, is likely to serve vital growth opportunities to the fecal analyzer market players.

Analyse de segmentation du rapport sur le marché des analyseurs fécaux

Les segments clés qui ont contribué à la dérivation de l’analyse du marché des analyseurs fécaux sont les services et les applications.

- En fonction du type de produit, le marché des analyseurs de matières fécales est segmenté en analyseurs de matières fécales entièrement automatisés et analyseurs de matières fécales semi-automatiques. Le segment des analyseurs de matières fécales entièrement automatisés détenait la plus grande part du marché en 2023 et devrait enregistrer le TCAC le plus élevé du marché au cours de la période de prévision.

- En fonction de l'utilisateur final, le marché des analyseurs de selles a été segmenté en hôpitaux, cliniques et autres. Le segment des hôpitaux détenait la plus grande part du marché en 2023, et ce même segment devrait enregistrer le TCAC le plus élevé du marché au cours de la période de prévision.

Analyse des parts de marché des analyseurs fécaux par géographie

La portée géographique du rapport sur le marché des analyseurs fécaux est principalement divisée en cinq régions : Amérique du Nord, Asie-Pacifique, Europe, Moyen-Orient et Afrique, et Amérique du Sud/Amérique du Sud et centrale.

L'Amérique du Nord comprend les États-Unis, le Canada et le Mexique. Le marché nord-américain détenait une part importante du marché mondial au cours de l'année 2023. La demande pour le marché de la région devrait connaître une croissance significative au cours de la période de prévision en raison de divers facteurs tels que le taux d'incidence élevé du cancer du côlon, les initiatives croissantes de dépistage obligatoire par test de selles et la présence d'acteurs du marché qui proposent des analyseurs fécaux entièrement automatisés et semi-automatisés avancés dans tous les pays.

L'Asie-Pacifique est le marché mondial des analyseurs de matières fécales qui connaît la croissance la plus rapide en raison des développements croissants des analyseurs de matières fécales dans des pays comme le Japon et la Chine. Les préoccupations croissantes concernant la diarrhée, le cancer du côlon et d'autres maladies ainsi que le nombre croissant de laboratoires de diagnostic en Inde offrent des opportunités de croissance pour le marché. De plus, l'augmentation des investissements dans les secteurs de la biotechnologie en Corée du Sud et en Australie devrait servir les opportunités de croissance vitales du marché.

Aperçu régional du marché des analyseurs fécaux

Les tendances régionales et les facteurs influençant le marché des analyseurs fécaux tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché des analyseurs fécaux en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des analyseurs fécaux

Portée du rapport sur le marché des analyseurs fécaux

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2021 | 657,44 millions de dollars américains |

| Taille du marché d'ici 2031 | 1 028,55 millions de dollars américains |

| Taux de croissance annuel composé mondial (2023-2031) | 3,8% |

| Données historiques | 2021-2022 |

| Période de prévision | 2024-2031 |

| Segments couverts |

Par type de produit

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché : comprendre son impact sur la dynamique des entreprises

Le marché des analyseurs fécaux connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des analyseurs fécaux sont :

- Société Heska,

- AVE Science et Technologie Co. Ltd,

- Eiken Chemical Co., Ltd.,

- iClear Limitée,

- Améliorer les instruments médicaux,

- Belson Medical System Co., Ltd,

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs clés du marché des analyseurs fécaux

Actualités et développements récents du marché des analyseurs fécaux

Le marché des analyseurs fécaux est évalué en collectant des données qualitatives et quantitatives après des recherches primaires et secondaires, qui comprennent d'importantes publications d'entreprise, des données d'association et des bases de données. Voici une liste des développements sur le marché des analyseurs fécaux et des stratégies :

- En juin 2022, Sentinel Diagnostics - une société italienne, a lancé l'analyseur SENTiFIT 800, un système entièrement automatisé et à haut débit pour le test immunochimique fécal (Source : Communiqué de presse de la société)

- En septembre 2020, ISE SRL a lancé son nouvel analyseur entièrement automatisé, compact, fiable et polyvalent pour tester les troubles métaboliques tels que - Diabète - Bilan cardiaque - Carences en vitamines - Gastro-intestinal (FECAL) - Fonction rénale - Troubles métaboliques - Admission à l'hôpital - Maladies inflammatoires - Protéines spécifiques - Chimie clinique. (Source : Communiqué de presse de l'entreprise)

Rapport sur le marché des analyseurs fécaux : couverture et livrables

Le rapport « Taille et prévisions du marché des analyseurs de matières fécales (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille du marché et prévisions aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le périmètre

- Dynamique du marché, comme les facteurs moteurs, les contraintes et les opportunités clés

- Principales tendances futures

- Analyse détaillée des cinq forces de PEST/Porter et SWOT

- Analyse du marché mondial et régional couvrant les principales tendances du marché, les principaux acteurs, les réglementations et les développements récents du marché

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents

- Profils d'entreprise détaillés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Rapports connexes

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché des analyseurs fécaux

Obtenez un échantillon gratuit pour - Marché des analyseurs fécaux