AI overview of Aerial Firefighting Market

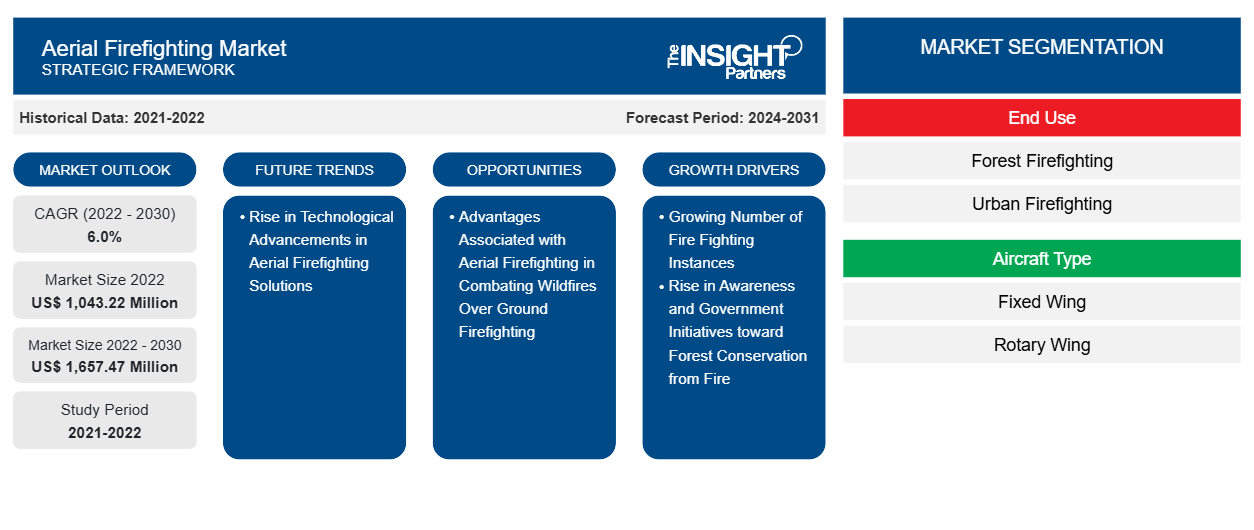

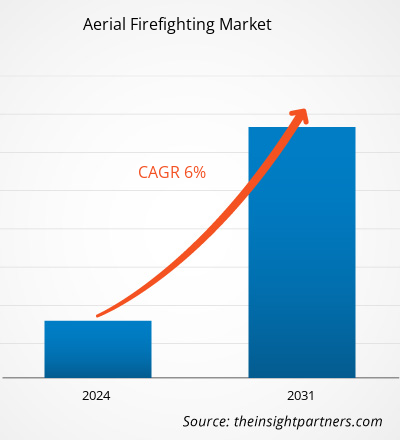

The Aerial Firefighting Market is poised for significant growth, projected to reach a market size of approximately US$ 1,657.47 million by 2030, up from US$ 1,043.22 million in 2022, reflecting a robust CAGR of 6.0% from 2022 to 2030. This growth is driven by an increasing number of firefighting incidents and heightened awareness of forest conservation initiatives. The market is segmented into end uses such as forest and urban firefighting, and aircraft types including fixed and rotary wings. Notably, advancements in technology are shaping future trends in the Aerial Firefighting Market, enhancing its effectiveness compared to traditional ground firefighting methods. As governments and organizations prioritize aerial solutions, the market share is expected to expand, presenting new opportunities for stakeholders.

The aerial firefighting market size is projected to reach US$ 1,657.47 million by 2031 from US$ 1,043.22 million in 2022. The market is expected to register a CAGR of 6.0% in 2022–2031.

With the technological advancements in recent years, the prospects for aerial firefighting hold significant potential. Groundbreaking developments such as drones equipped with thermal imaging cameras and artificial intelligence algorithms have the potential to transform wildfire detection and response completely. Autonomous firefighting aircraft could offer a faster and safer approach to extinguishing fires, while improved fire-retardant delivery systems aim to improve the accuracy and effectiveness of drops. Ongoing research into advanced materials and designs aims to create more efficient and environmentally friendly aerial firefighting solutions.

Aerial Firefighting Market Analysis

The aerial firefighting market ecosystem comprises stakeholders such as helicopter manufacturers, system suppliers, and end users. Many aerial firefighting service providers procure fixed wing and rotary wing aircraft from aircraft manufacturers. Textron Inc., Airbus, Boeing, Lockheed Martin Corporation, Air Tractor Inc., Kaman K-MAX, Leonardo S.p.A., ShinMaywa Industries, and Bombardier Inc. are among the notable aircraft manufacturers. The manufacturers hold a majority stake in the firefighting aircraft industry. The adoption of rotary wing helicopters is more than fixed wing owing to the requirement of high initial investments for the fixed aircraft. The second stakeholder in the aerial firefighting market is system suppliers. Once the aircraft is procured from the aircraft manufacturers, system suppliers provide aerial firefighting systems. The system includes water or foam tanks and pumps. It is then installed on the procured aircraft. Some of the aerial firefighting service provides manufacturers with their firefighting systems.

Aerial Firefighting Market Overview

Aerial firefighting is the usage of fixed and rotary wing aircraft for the suppression of wildfires. In wildfire suppression, air and ground operations are used combinedly to combat wildfires. These operations include various tactics and techniques. Aerial firefighting has a wide range of benefits, including a clear view of wildfire and the safety of the firefighters.

In 2021, the forest fires caused 9.34 million hectares of tree cover loss across the world, which represented ~33% of the overall tree cover loss. In addition, the period of fire seasons across the world continues to extend year by year, which resulted in the overlap of seasons across different regions. According to the NFPA journal, the forecasted expenditure on firefighting owing to the global climate-change-induced forest fires is expected to rise from US$ 2 billion in 2020 to US$ 5 billion–US$ 30 billion annually by 2050. Hence, the growing number of forest fire incidents drives the demand for aerial firefighting services to combat forest fires from further spread. In addition, increased awareness and government initiatives toward forest conservation support the aerial firefighting market growth. Governments of various countries are playing a key role in investments or funding in forest preservation from wildfires. The European Council extended the utilization of funding for firefighting planes and helicopters in November 2023. This will allow EU member states to avail benefit from the European Union financing for leasing aerial firefighting solutions. In addition, in January 2024, the acting Deputy Secretary of the Interior in the US declared to dedicate US$ 138 million to combating forest fires and mitigation.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aerial Firefighting Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aerial Firefighting Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aerial Firefighting Market Drivers and Opportunities

Growing Instances of Forest Fire Bolster Aerial Firefighting Market

The number of forest fire instances across the globe is growing owing to climate change and rapid urbanization. According to the World Resources Institute, the rise in tree cover loss associated with wildfires across the globe from 2018 to 2021 is shown in the figure below:

Advantages Associated with Aerial Firefighting in Combating Wildfires Over Ground Firefighting

Aerial firefighting is highly preferred when the wildfire site is difficult to approach or faces challenges in gaining access to ground-based firefighting solutions. Aerial firefighting services can reach the highest altitude, whereas ground-based firefighting takes a longer time to reach and can efficiently extinguish the fire from a safe distance. In addition, aerial firefighting solutions provide quick mobilization and efficient fire suppression owing to the quick initial efforts in combating wildfires as compared to conventional ground-based firefighting services.

Aerial Firefighting Market Report Segmentation Analysis

Key segments that contributed to the derivation of the aerial firefighting market analysis are end use and aircraft type.

- Based on end Use, the aerial firefighting market is segmented into forest firefighting, urban firefighting, and others. The forest firefighting segment held the largest market share in 2023.

- By aircraft type, the market is divided into fixed wing and rotary wing. The rotary wing segment held a larger share of the market in 2023.

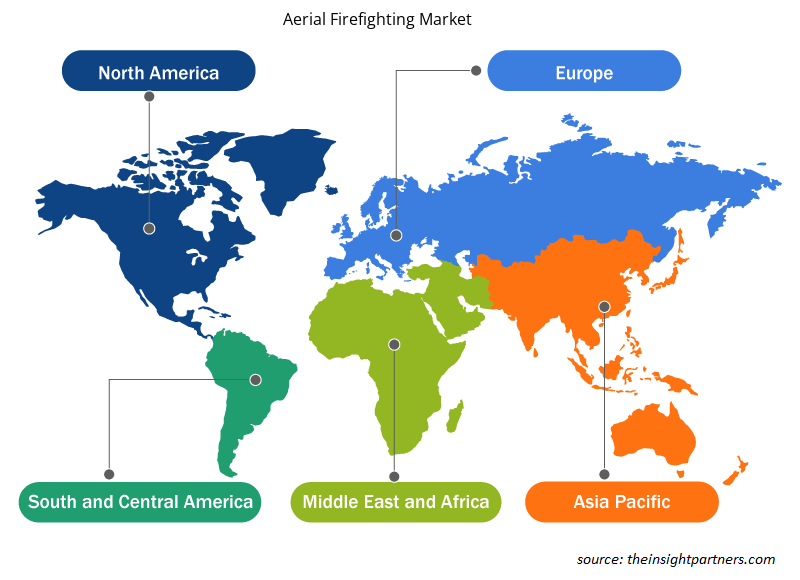

Aerial Firefighting Market Share Analysis by Geography

The geographic scope of the aerial firefighting market report is mainly segmented into five regions: North America, Asia Pacific, Europe, and the Rest of the World.

In North America, communities face an unrelenting threat of wildfires, scorching communities, displacing residents, and leaving a trail of devastation. Although wildfires are a part of the natural ecosystem, their frequency, intensity, and destructiveness are undeniable. The current system for responding to these fires is simply unreliable, which puts communities at risk and firefighters face insurmountable difficulties.

The rising instances of wildfires in the US, Canada, and Mexico drive the aerial firefighting market in the region from 2023 to 2031. Wildland fire aviation in North America involves a variety of aircraft and mission planning. Helicopters are primarily used for dropping huge volumes of water, crew transport, reconnaissance, infrared surveillance, and resource delivery to the fire line. Fixed wing aircraft include smokejumper transport aircraft, tactical air platforms, single-engine air tankers (SEATs), large tankers, and large transport aircraft. All aircraft, whether fixed wing or rotary wing, play a critical role in supporting firefighters on the ground. Currently, Erickson, Coulson, and others operate helicopters and fixed-wing aircraft in North America. Key players operating in the North America aerial firefighting market include Coulson Aviation (USA) Inc., Conair Group Inc., Neptune Aviation Services Inc., 10 Tanker, Erickson Inc, Billings Flying Service, and Dauntless Air Inc.

According to the National Interagency Fire Center (NIFC), the US experienced 66,255 firebreaks in total in 2022, which burned nearly 7.53 million acres of wildland. Texas registered the highest number of wildfires, while Alaska accounted for the largest area (acres) burned in the US in 2022. The country has been experiencing an upsurge in wildfire outbreaks from 58,950 to 68,988, which increased the focus on reducing wildfire spread. Thus, a rise in the incidences of forest fires fuels the demand for aerial firefighting solutions in the US to combat fires in their early stages.

Aerial Firefighting Market News and Recent Developments

The aerial firefighting market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for aerial firefighting and strategies:

- Coulson Aviation announced its partnership with Kawak Aviation to launch a modern, upgraded, and more cost-effective Firefighting Black Hawk aircraft platform. The world’s largest aerial firefighting company that designs, manufactures, installs, and operates aircraft, Coulson is leading the innovative charge for the proven UH-60-based firefighting aircraft to help ensure a safe solution for every customer and budget. (Source: Coulson Aviation, Press Release/Company Website/Newsletter, 2024)

- Coulson Aviation announced it was awarded a US$ 16 million firefighting contract to continue supporting Southern California’s Quick Reaction Force (QRF) year-round throughout 2024 as well as 2025. The QRF is a fully equipped wildfire suppression program for Los Angeles, Orange, and Ventura County fire departments that launches day or night at the first sign of fire. This is Coulson’s sixth year contracting with Southern California Edison (SCE) to support the QRF and its second year supporting the QRF 24/7/365. (Source: Coulson Aviation, Press Release/Company Website/Newsletter, 2023)

Aerial Firefighting Market Regional Insights

The regional trends and factors influencing the Aerial Firefighting Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Aerial Firefighting Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Aerial Firefighting Market

Aerial Firefighting Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,043.22 Million |

| Market Size by 2030 | US$ 1,657.47 Million |

| Global CAGR (2022 - 2030) | 6.0% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By End Use

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Aerial Firefighting Market Players Density: Understanding Its Impact on Business Dynamics

The Aerial Firefighting Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Aerial Firefighting Market are:

- Coulson Aviation

- Conair Fire Aviation

- Neptune Aviation

- 10 Tanker Air Carrier

- Erickson Aero Tanker

- Billings Flying Service

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Aerial Firefighting Market top key players overview

Aerial Firefighting Market Report Coverage and Deliverables

The “Aerial Firefighting Market Size and Forecast (2023–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

Frequently Asked Questions

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Aircraft MRO Market

- Helicopter Hoists Winches and Hooks Market

- Fixed-Base Operator Market

- Aerospace Fasteners Market

- Aerospace Stainless Steel And Superalloy Fasteners Market

- Military Vehicle Market

- Aircraft Floor Panel Market

- Military Optronics Surveillance and Sighting Systems Market

- Smoke Grenade Market

- Airport Runway FOD Detection Systems Market

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Aerial Firefighting Market

- Coulson Aviation

- Conair Fire Aviation

- Neptune Aviation

- 10 Tanker Air Carrier

- Erickson Aero Tanker

- Billings Flying Services

- Dauntless Air Inc.

- Avincis

- Kishugu Aviation

- Babcock International Plc

Get Free Sample For

Get Free Sample For