Aerial Firefighting Market Segments and Growth by 2031

Aerial Firefighting Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By End Use (Forest Firefighting, Urban Firefighting, and Others), Aircraft Type (Fixed Wing and Rotary Wing), and Geography

Historic Data: 2021-2022 | Base Year: 2022 | Forecast Period: 2024-2031- Report Date : May 2024

- Report Code : TIPRE00039030

- Category : Aerospace and Defense

- Status : Published

- Available Report Formats :

- No. of Pages : 128

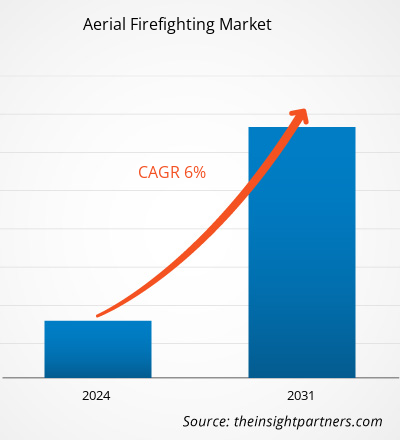

The aerial firefighting market size is projected to reach US$ 1,657.47 million by 2031 from US$ 1,043.22 million in 2022. The market is expected to register a CAGR of 6.0% in 2022–2031.

With the technological advancements in recent years, the prospects for aerial firefighting hold significant potential. Groundbreaking developments such as drones equipped with thermal imaging cameras and artificial intelligence algorithms have the potential to transform wildfire detection and response completely. Autonomous firefighting aircraft could offer a faster and safer approach to extinguishing fires, while improved fire-retardant delivery systems aim to improve the accuracy and effectiveness of drops. Ongoing research into advanced materials and designs aims to create more efficient and environmentally friendly aerial firefighting solutions.

Aerial Firefighting Market Analysis

The aerial firefighting market ecosystem comprises stakeholders such as helicopter manufacturers, system suppliers, and end users. Many aerial firefighting service providers procure fixed wing and rotary wing aircraft from aircraft manufacturers. Textron Inc., Airbus, Boeing, Lockheed Martin Corporation, Air Tractor Inc., Kaman K-MAX, Leonardo S.p.A., ShinMaywa Industries, and Bombardier Inc. are among the notable aircraft manufacturers. The manufacturers hold a majority stake in the firefighting aircraft industry. The adoption of rotary wing helicopters is more than fixed wing owing to the requirement of high initial investments for the fixed aircraft. The second stakeholder in the aerial firefighting market is system suppliers. Once the aircraft is procured from the aircraft manufacturers, system suppliers provide aerial firefighting systems. The system includes water or foam tanks and pumps. It is then installed on the procured aircraft. Some of the aerial firefighting service provides manufacturers with their firefighting systems.

Aerial Firefighting Market Overview

Aerial firefighting is the usage of fixed and rotary wing aircraft for the suppression of wildfires. In wildfire suppression, air and ground operations are used combinedly to combat wildfires. These operations include various tactics and techniques. Aerial firefighting has a wide range of benefits, including a clear view of wildfire and the safety of the firefighters.

In 2021, the forest fires caused 9.34 million hectares of tree cover loss across the world, which represented ~33% of the overall tree cover loss. In addition, the period of fire seasons across the world continues to extend year by year, which resulted in the overlap of seasons across different regions. According to the NFPA journal, the forecasted expenditure on firefighting owing to the global climate-change-induced forest fires is expected to rise from US$ 2 billion in 2020 to US$ 5 billion–US$ 30 billion annually by 2050. Hence, the growing number of forest fire incidents drives the demand for aerial firefighting services to combat forest fires from further spread. In addition, increased awareness and government initiatives toward forest conservation support the aerial firefighting market growth. Governments of various countries are playing a key role in investments or funding in forest preservation from wildfires. The European Council extended the utilization of funding for firefighting planes and helicopters in November 2023. This will allow EU member states to avail benefit from the European Union financing for leasing aerial firefighting solutions. In addition, in January 2024, the acting Deputy Secretary of the Interior in the US declared to dedicate US$ 138 million to combating forest fires and mitigation.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAerial Firefighting Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aerial Firefighting Market Drivers and Opportunities

Growing Instances of Forest Fire Bolster Aerial Firefighting Market

The number of forest fire instances across the globe is growing owing to climate change and rapid urbanization. According to the World Resources Institute, the rise in tree cover loss associated with wildfires across the globe from 2018 to 2021 is shown in the figure below:

Advantages Associated with Aerial Firefighting in Combating Wildfires Over Ground Firefighting

Aerial firefighting is highly preferred when the wildfire site is difficult to approach or faces challenges in gaining access to ground-based firefighting solutions. Aerial firefighting services can reach the highest altitude, whereas ground-based firefighting takes a longer time to reach and can efficiently extinguish the fire from a safe distance. In addition, aerial firefighting solutions provide quick mobilization and efficient fire suppression owing to the quick initial efforts in combating wildfires as compared to conventional ground-based firefighting services.

Aerial Firefighting Market Report Segmentation Analysis

Key segments that contributed to the derivation of the aerial firefighting market analysis are end use and aircraft type.

- Based on end Use, the aerial firefighting market is segmented into forest firefighting, urban firefighting, and others. The forest firefighting segment held the largest market share in 2023.

- By aircraft type, the market is divided into fixed wing and rotary wing. The rotary wing segment held a larger share of the market in 2023.

Aerial Firefighting Market Share Analysis by Geography

The geographic scope of the aerial firefighting market report is mainly segmented into five regions: North America, Asia Pacific, Europe, and the Rest of the World.

In North America, communities face an unrelenting threat of wildfires, scorching communities, displacing residents, and leaving a trail of devastation. Although wildfires are a part of the natural ecosystem, their frequency, intensity, and destructiveness are undeniable. The current system for responding to these fires is simply unreliable, which puts communities at risk and firefighters face insurmountable difficulties.

The rising instances of wildfires in the US, Canada, and Mexico drive the aerial firefighting market in the region from 2023 to 2031. Wildland fire aviation in North America involves a variety of aircraft and mission planning. Helicopters are primarily used for dropping huge volumes of water, crew transport, reconnaissance, infrared surveillance, and resource delivery to the fire line. Fixed wing aircraft include smokejumper transport aircraft, tactical air platforms, single-engine air tankers (SEATs), large tankers, and large transport aircraft. All aircraft, whether fixed wing or rotary wing, play a critical role in supporting firefighters on the ground. Currently, Erickson, Coulson, and others operate helicopters and fixed-wing aircraft in North America. Key players operating in the North America aerial firefighting market include Coulson Aviation (USA) Inc., Conair Group Inc., Neptune Aviation Services Inc., 10 Tanker, Erickson Inc, Billings Flying Service, and Dauntless Air Inc.

According to the National Interagency Fire Center (NIFC), the US experienced 66,255 firebreaks in total in 2022, which burned nearly 7.53 million acres of wildland. Texas registered the highest number of wildfires, while Alaska accounted for the largest area (acres) burned in the US in 2022. The country has been experiencing an upsurge in wildfire outbreaks from 58,950 to 68,988, which increased the focus on reducing wildfire spread. Thus, a rise in the incidences of forest fires fuels the demand for aerial firefighting solutions in the US to combat fires in their early stages.

Aerial Firefighting Market News and Recent Developments

The aerial firefighting market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for aerial firefighting and strategies:

- Coulson Aviation announced its partnership with Kawak Aviation to launch a modern, upgraded, and more cost-effective Firefighting Black Hawk aircraft platform. The world’s largest aerial firefighting company that designs, manufactures, installs, and operates aircraft, Coulson is leading the innovative charge for the proven UH-60-based firefighting aircraft to help ensure a safe solution for every customer and budget. (Source: Coulson Aviation, Press Release/Company Website/Newsletter, 2024)

- Coulson Aviation announced it was awarded a US$ 16 million firefighting contract to continue supporting Southern California’s Quick Reaction Force (QRF) year-round throughout 2024 as well as 2025. The QRF is a fully equipped wildfire suppression program for Los Angeles, Orange, and Ventura County fire departments that launches day or night at the first sign of fire. This is Coulson’s sixth year contracting with Southern California Edison (SCE) to support the QRF and its second year supporting the QRF 24/7/365. (Source: Coulson Aviation, Press Release/Company Website/Newsletter, 2023)

Aerial Firefighting Market Regional Insights

The regional trends and factors influencing the Aerial Firefighting Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Aerial Firefighting Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Aerial Firefighting Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,043.22 Million |

| Market Size by 2030 | US$ 1,657.47 Million |

| Global CAGR (2022 - 2030) | 6.0% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By End Use

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Aerial Firefighting Market Players Density: Understanding Its Impact on Business Dynamics

The Aerial Firefighting Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Aerial Firefighting Market top key players overview

Aerial Firefighting Market Report Coverage and Deliverables

The “Aerial Firefighting Market Size and Forecast (2023–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For