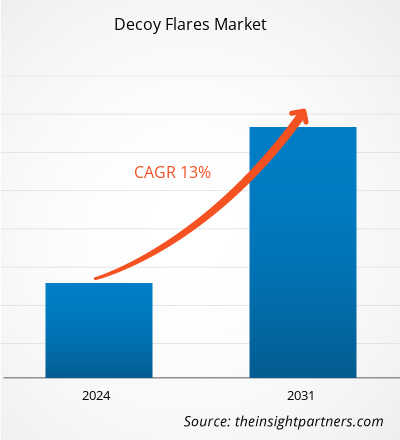

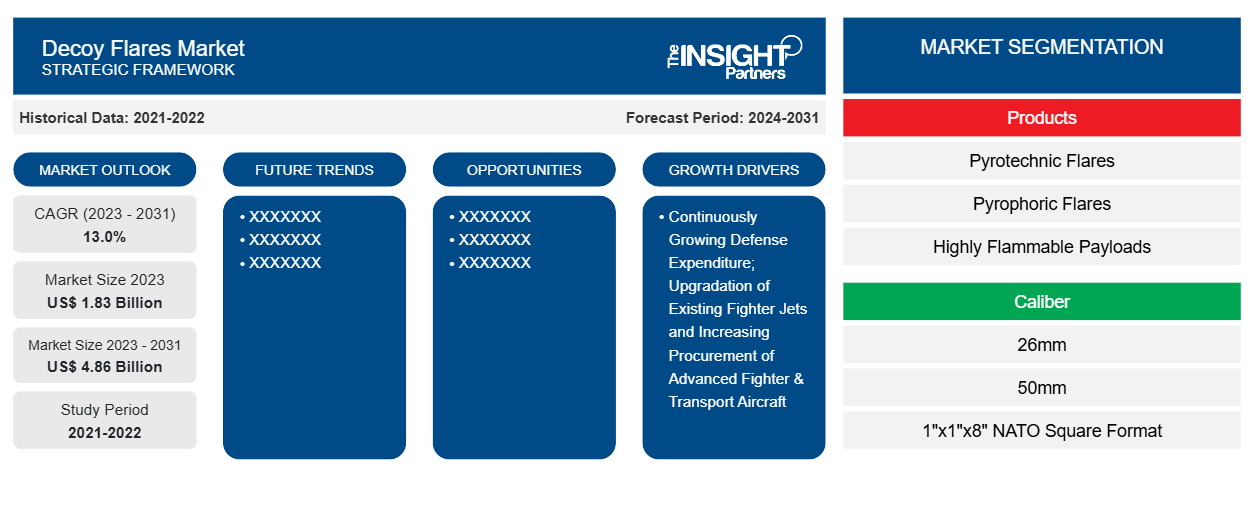

Se proyecta que el tamaño del mercado de bengalas señuelo alcance los 4.860 millones de dólares estadounidenses en 2031, frente a los 1.830 millones de dólares estadounidenses en 2023. Se espera que el mercado registre una CAGR del 13,0 % entre 2023 y 2031. La introducción de bengalas señuelo inteligentes y señuelos inhibidores de misiles es una de las principales tendencias que probablemente impulsarán el mercado de bengalas señuelo en los próximos años. Varios países las han estado integrando en sus respectivas fuerzas armadas para mejorar sus armamentos.

Análisis del mercado de bengalas señuelo

Las bengalas señuelo de formato cuadrado OTAN de 1x1x8 pulgadas se encuentran entre los calibres de bengalas señuelo más aceptados. Esto se debe a la versatilidad del calibre para integrarse en varios modelos de aeronaves. Los fabricantes de aeronaves norteamericanos y europeos (excepto Rusia) prefieren integrar bengalas señuelo de formato cuadrado OTAN de 1x1x8 pulgadas. Algunos de los modelos de aeronaves que son capaces de llevar bengalas señuelo de formato cuadrado OTAN de 1x1x8 pulgadas incluyen: Apache AH-64, F-16, A-10, Ch-47 Chinook, C-130 y A400M. Los volúmenes de producción de los modelos de aeronaves mencionados anteriormente continúan aumentando cada año, lo que refleja el aumento de la demanda de bengalas señuelo de formato cuadrado OTAN de 1x1x8 pulgadas, que impulsa el mercado de bengalas señuelo.

Descripción general del mercado de bengalas señuelo

Los principales interesados en el mercado de bengalas señuelo son los proveedores de materias primas, los fabricantes de bengalas señuelo y los usuarios finales. Los fabricantes de bengalas señuelo adquieren constantemente materia prima de los proveedores para producir mayores volúmenes de bengalas señuelo con el objetivo de satisfacer las demandas de los clientes. Las materias primas utilizadas en la producción de bengalas señuelo incluyen sustancias energéticas químicas (componentes pirotécnicos) y carcasas. La disponibilidad de un gran número de proveedores de materias primas permite a los actores del mercado de bengalas señuelo elegir al proveedor adecuado. Esto mejora la cadena de suministro del mercado de bengalas señuelo. Al adquirir materias primas, los actores del mercado de bengalas señuelo producen volúmenes significativos de bengalas señuelo con diversos calibres, satisfaciendo así las respectivas demandas de los clientes. Los usuarios finales en el mercado de bengalas señuelo incluyen fabricantes de aeronaves/helicópteros y las fuerzas de defensa. Estos usuarios finales requieren volúmenes significativos de bengalas señuelo para integrarlas en los modelos de aeronaves más nuevos, así como en las flotas existentes.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Factores impulsores y oportunidades del mercado de las bengalas señuelo

Aumento de las adquisiciones de aviones y helicópteros de combate

La creciente adquisición de aviones y helicópteros de combate militares en todo el mundo es uno de los principales factores que impulsan la instalación de bengalas señuelo en diferentes regiones. Por ejemplo, en abril de 2023, el Departamento de Defensa de Estados Unidos adjudicó un contrato por valor de 7.800 millones de dólares a Lockheed Martin Corporation para la modificación de 126 unidades del avión multifunción F-35. De manera similar, en diciembre de 2023, la Bundeswehr alemana y Airbus Helicopters firmaron un contrato para la compra de hasta 82 helicópteros multifunción H145M (62 pedidos en firme más 20 opciones). Además, en junio de 2022, España encargó 20 aviones Eurofighter a Airbus en virtud de un contrato histórico para modernizar su flota de aviones de combate. Estos contratos han impulsado el despliegue de bengalas señuelo en las plataformas de aviones y helicópteros militares .DoD awarded a contract worth US$ 7.8 billion to Lockheed Martin Corporation for the modification of 126 units of F-35 multi-role aircraft. Similarly, in December 2023, the German Bundeswehr and Airbus Helicopters signed a contract for the purchase of up to 82 multi-role H145M helicopters (62 firm orders plus 20 options). Additionally, in June 2022, Spain ordered 20 Eurofighter jets from Airbus under landmark contract to modernise its combat aircraft fleet. Such contracts have been pushing the deployment of decoy flares into the military aircraft and

El despliegue de vehículos aéreos no tripulados de combate impulsará el crecimiento del mercado en los próximos añosUAVs to Drive the Market Growth in The Coming Years

La creciente adquisición de drones militares para operaciones de ISR y combate es otro factor importante que probablemente genere nuevas oportunidades para los proveedores del mercado de bengalas señuelo en los próximos años. Varios países han comenzado a desplegar drones de combate en sus respectivas flotas militares para mejorar sus capacidades bélicas, lo que también está impulsando el mercado de diferentes tipos de armas y sistemas de contramedidas. Además, según varias fuentes del sector de defensa, Rusia ha desplegado recientemente (en 2024) misiles basados en bengalas señuelo en territorio de Ucrania para superar los radares ucranianos. Es probable que estas aplicaciones emergentes generen nuevas oportunidades para los proveedores del mercado durante el período de pronóstico.ISR & combat operations is another major factor likely to generate new opportunities for decoy flare market vendors in the coming years. Several countries have started deploying combat drones into their respective military fleets to advance their warfare capabilities which is driving the market for different types of weapons and countermeasure systems as well. Further, as per several defense sector sources, Russia recently (in 2024) have deployed decoy flares-based missile into Ukraine’s territory to surpass the Ukrainian radars. Such emerging applications are likely to generate new opportunities for market vendors during the forecast period.

Análisis de segmentación del informe de mercado de bengalas señuelo

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de bengalas señuelo son los productos, el calibre, la aplicación y la geografía.

- En función de los productos, el mercado de bengalas señuelo se ha segmentado en bengalas pirotécnicas, bengalas pirofóricas y cargas útiles altamente inflamables. El segmento de cargas útiles altamente inflamables tuvo una mayor participación de mercado en 2023.

- Por calibre, el mercado de bengalas señuelo se ha segmentado en 26 mm, 50 mm, formato cuadrado OTAN de 1” x 1” x 8” y formato cuadrado OTAN de 2” x 1” x 8”. El segmento de formato cuadrado OTAN de 1” x 1” x 8” tuvo la mayor participación del mercado en 2023.

- En función de la aplicación, el mercado de bengalas señuelo se ha dividido en ala fija y ala rotatoria. El segmento de ala fija tuvo una mayor participación de mercado en 2023.

Análisis de la cuota de mercado de bengalas señuelo por geografía

El alcance geográfico del informe del mercado de bengalas señuelo se divide principalmente en cinco regiones: América del Norte, Europa, Asia Pacífico, Medio Oriente y África, y América del Sur.

América del Norte ha dominado el mercado de bengalas señuelo en 2023, mientras que es probable que la región de Asia Pacífico sea testigo de un crecimiento significativo durante el período de pronóstico. Geográficamente, América del Norte es el principal inversor en el mercado de bengalas señuelo, debido a la presencia de un gran número de OEM de aviones militares en la región. Los actores incluyen empresas como Lockheed Martin Corporation, Boeing, General Dynamics y Airbus. Además, la demanda de bengalas señuelo en América del Norte también está impulsada por la presencia de EE. UU., que es el país con mayor gasto militar en todo el mundo y tiene la flota más grande de aviones y helicópteros militares en comparación con cualquier otro país del mundo. Estos factores han impulsado el crecimiento del mercado de bengalas señuelo en la región de América del Norte.

Perspectivas regionales del mercado de bengalas señuelo

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de bengalas señuelo durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de bengalas señuelo en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga los datos regionales específicos para el mercado de bengalas señuelo

Alcance del informe de mercado de bengalas señuelo

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | 1.830 millones de dólares estadounidenses |

| Tamaño del mercado en 2031 | 4.860 millones de dólares estadounidenses |

| CAGR global (2023 - 2031) | 13,0% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por productos

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado: comprensión de su impacto en la dinámica empresarial

El mercado de bengalas señuelo está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de bengalas señuelo son:

- Tecnologías de defensa Armtec

- Grupo Chemring PLC

- Anuncio de TARA Aerospace

- Grupo TransDigm Incorporated

- Sistemas Elbit Ltd.

- Lacroix

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de bengalas señuelo

Noticias y desarrollos recientes del mercado de bengalas señuelo

El mercado de bengalas señuelo se evalúa mediante la recopilación de datos cualitativos y cuantitativos posteriores a la investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se incluye una lista de los avances en el mercado de bengalas señuelo y las estrategias:

- En enero de 2024, Rheinmetall consiguió un contrato (2024-2029) por valor de 54,4 millones de dólares para el suministro de bengalas señuelo para aviones a las fuerzas armadas alemanas, en virtud del cual Rheinmetall suministrará 470.000 bengalas señuelo a las fuerzas armadas de Berlín. (Fuente: Rheinmetall, comunicado de prensa/sitio web de la empresa/boletín informativo)

- En octubre de 2021, Chemring Australia recibió una modificación de contrato por 18,69 millones de dólares (incluidos 2,67 millones de dólares en fondos FMS) del Comando de Sistemas Aéreos Navales para producir y entregar 9728 contramedidas de bengalas infrarrojas MJU-68/B: 7256 para la Marina de los EE. UU. y 1152 para la Fuerza Aérea de los EE. UU.; 528 para Noruega; 336 para Japón; 312 para los Países Bajos; y 144 para Italia. (Fuente: Chemring Group, comunicado de prensa/sitio web de la empresa/boletín informativo)

Informe de mercado sobre bengalas señuelo: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de bengalas señuelo (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Dinámica del mercado, como impulsores, restricciones y oportunidades clave

- Principales tendencias futuras

- Análisis detallado de las cinco fuerzas de Porter

- Análisis del mercado global y regional que cubre las tendencias clave del mercado, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes

- Perfiles de empresas detallados con análisis FODA

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de bengalas señuelo

Obtenga una muestra gratuita para - Mercado de bengalas señuelo