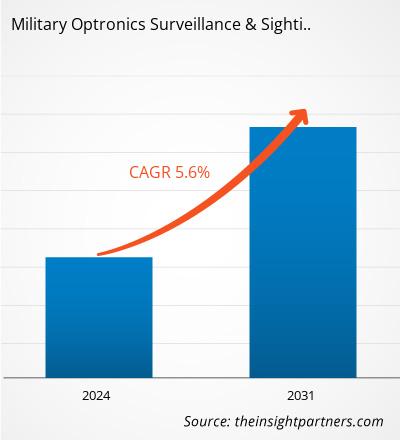

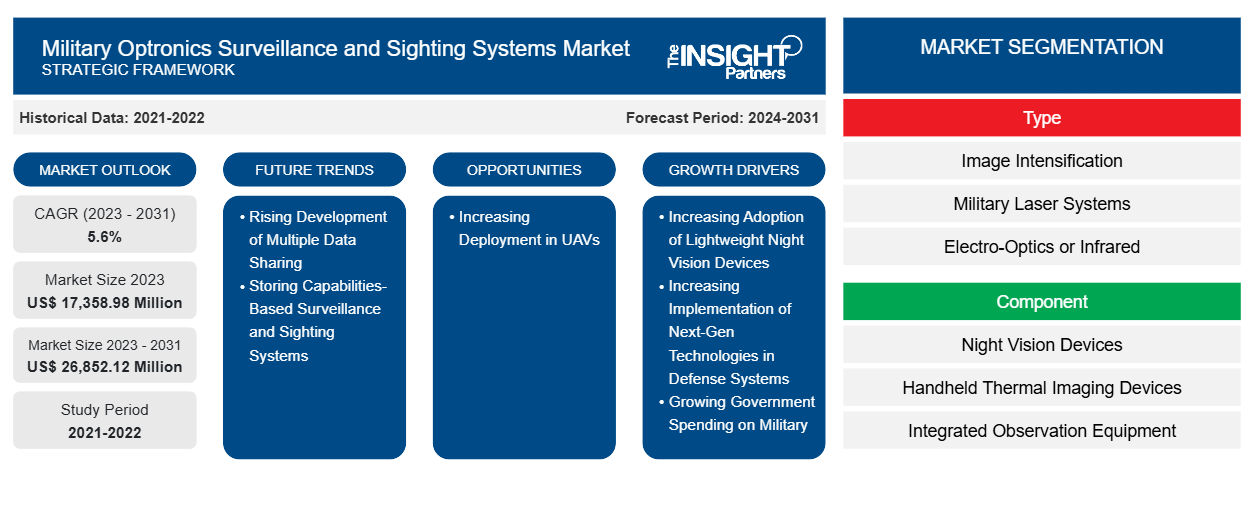

Se prevé que el tamaño del mercado de sistemas de vigilancia y observación optrónicos militares alcance los 26.852,12 millones de dólares en 2031, frente a los 17.358,98 millones de dólares en 2023. Se espera que el mercado registre una CAGR del 5,6 % durante el período 2023-2031. Es probable que el creciente desarrollo de sistemas de vigilancia y observación basados en capacidades de almacenamiento e intercambio de datos múltiples traiga nuevas tendencias clave al mercado en los próximos años.

Análisis del mercado de sistemas de vigilancia y observación optrónicos militares

Con la creciente innovación y la creciente amenaza de ataques terroristas por la noche, la adopción de dispositivos de visión nocturna está aumentando. Asimismo, la termografía ayuda a los soldados a localizar un objetivo en condiciones de poca visibilidad. Los dispositivos de visión nocturna con termografía están ganando popularidad en todo el mundo para fortalecer los sistemas individuales de los combatientes. Los dispositivos de visión nocturna brindan a los soldados una mayor conciencia de la situación al iluminar su entorno durante las operaciones nocturnas. Las crecientes iniciativas gubernamentales para desarrollar y adoptar dispositivos de visión nocturna livianos basados en tecnologías avanzadas han creado una demanda masiva para el crecimiento del mercado de sistemas de vigilancia y observación optrónicos militares. Por ejemplo, en enero de 2022, la Agencia de Proyectos de Investigación Avanzada de Defensa (DARPA) del Departamento de Defensa de los EE. UU. seleccionó a 10 equipos de investigación de defensa y universidades para el desarrollo de ópticas de visión nocturna livianas para soldados militares en Estados Unidos. El departamento diseñó el programa Enhanced Night Vision in Eyeglass Form (ENVision) para adoptar la nueva tecnología para desarrollar sistemas de visión nocturna.

Se espera que el creciente despliegue de vehículos aéreos no tripulados en todo el mundo para proteger las tierras de los países vecinos cree amplias oportunidades para el crecimiento del mercado de sistemas de vigilancia y observación optrónica durante el período de pronóstico. Por ejemplo, en 2022, el ejército indio desplegó el primer lote de más de 25 vehículos aéreos no tripulados de fabricación israelí llamados Searcher Mark II. Además, en mayo de 2024, el gobierno de EE. UU. comenzó a entregar vehículos aéreos no tripulados a su ejército como parte de su programa gubernamental para contrarrestar las capacidades de defensa de China. Además, en marzo de 2023, los científicos de China desarrollaron un dron militar que es capaz de dividirse rápidamente en seis unidades separadas en el aire. Estos drones están hechos con tecnologías de separación de aire. Se espera que esta creciente inversión y despliegue de vehículos aéreos no tripulados por parte de los gobiernos de varios países cree amplias oportunidades para el mercado de sistemas de vigilancia y observación optrónica durante el período de pronóstico.

Descripción general del mercado de sistemas de vigilancia y observación optrónicos militares

Los sistemas optrónicos, de vigilancia y de observación militares proporcionan al personal las herramientas necesarias para identificar, rastrear, controlar y enfrentarse a amenazas en entornos de guerra aérea, terrestre y naval. Estos sistemas proporcionan a las fuerzas armadas detección, reconocimiento e identificación de objetivos con precisión y conocimiento de la situación mediante la integración de componentes ópticos de alto rendimiento y sensores avanzados. Además, los sistemas optrónicos, de vigilancia y de observación se utilizan para cumplir con los requisitos de las misiones de control de fronteras, protección de bases, reconocimiento y recopilación de inteligencia. Los avances tecnológicos en los sistemas optrónicos y de vigilancia, junto con la demanda constante de que las fuerzas de defensa actualicen sus equipos y sistemas existentes, están impulsando el mercado mundial de sistemas optrónicos, de vigilancia y de observación militares.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de sistemas de vigilancia y observación optrónicos militares

Aumento de la adopción de dispositivos de visión nocturna ligeros

Con la creciente innovación y la creciente amenaza de ataques terroristas por la noche, la adopción de dispositivos de visión nocturna está aumentando. Anteriormente, los dispositivos de visión nocturna utilizaban componentes relativamente más pesados, lo que añadía peso al soldado. Ahora, varios actores del mercado están introduciendo productos de visión nocturna ligeros. Por ejemplo, ACTinBlack ha desarrollado un dispositivo de visión nocturna binocular ligero con un alto rendimiento óptico y un diseño ergonómico. En octubre de 2023, Thermoteknix Systems, una empresa estadounidense de imagen térmica y realidad aumentada (RA), lanzó una solución de visión nocturna denominada Fused Night Vision Goggle with Advanced Augmented Reality (FNVG-AR). El sistema FNVG-AR es una gafa de visión nocturna binocular ligera (NVG) integrada con tubos de visión nocturna de fósforo blanco de 16 mm de última generación basados en tecnología avanzada y una cámara termográfica de alta resolución.

Aumento del despliegue de vehículos aéreos no tripulados

Los sistemas no tripulados se han convertido en una parte integral de las fuerzas militares en todo el mundo, ya que reducen el riesgo para las vidas humanas. Debido a los diversos beneficios que ofrecen los vehículos aéreos no tripulados (UAV), muchos países, como los EE. UU., la India y China, han asignado presupuestos sustanciales para implementar más UAV en sus fuerzas militares, principalmente para aplicaciones de vigilancia. La implementación de sistemas optrónicos de vigilancia y observación en plataformas no tripuladas facilita la transmisión de datos de vigilancia e imágenes. La integración de sistemas no tripulados con antenas de comunicación y otros equipos de vigilancia ayuda en varias misiones críticas. Por lo tanto, el creciente despliegue de UAV para misiones de vigilancia y mapeo aéreo y naval está dando como resultado una creciente necesidad de sistemas optrónicos de vigilancia y observación que puedan integrarse de manera efectiva dentro de la plataforma UAV sin obstaculizar su eficiencia general. Por lo tanto, varios actores importantes de la industria, incluidos Rafael Advanced Defense Systems Ltd. y Lockheed Martin, en el mercado de sistemas optrónicos de vigilancia y observación militares enfatizan el desarrollo y la oferta de sistemas optrónicos de vigilancia y observación para plataformas UAV.

Análisis de segmentación del informe de mercado de sistemas de vigilancia y observación optrónica militar

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de sistemas de vigilancia y observación optrónica militar sontipo, componente y usuarios finales.

- Según el tipo, el mercado de sistemas de vigilancia y observación optrónicos militares se clasifica en intensificación de imágenes, sistemas láser militares y electroóptica/infrarrojos. El segmento de electroóptica tuvo la mayor participación del mercado en 2023.

- Por componentes, el mercado se clasifica en dispositivos de visión nocturna, dispositivos termográficos portátiles, equipos de observación integrados, sensores infrarrojos, sísmicos y acústicos independientes, entre otros. El segmento de sensores sísmicos y acústicos dominó el mercado en 2023.

- En términos de usuarios finales, el mercado de sistemas de vigilancia y observación optrónicos militares se clasifica en terrestre, aéreo y naval. El segmento terrestre tuvo la mayor participación del mercado en 2023.

Análisis de la cuota de mercado de los sistemas de vigilancia y observación optrónica militar

El alcance geográfico del informe de mercado de sistemas de vigilancia y observación optrónica militar ofrece un análisis global detallado. América del Norte, Europa y Asia Pacífico son regiones importantes que están experimentando un crecimiento significativo en el mercado de sistemas de vigilancia y observación optrónica militar. El mercado de sistemas de vigilancia y observación optrónica militar en América del Norte está segmentado en EE. UU., Canadá y México. En 2023, EE. UU. dominó el mercado de sistemas de vigilancia y observación optrónica militar en América del Norte con una participación de mercado significativa en 2023, seguido de Canadá y México. Estas economías desarrolladas gastan una parte considerable de su PIB en gasto militar. Según la recopilación de indicadores de desarrollo del Banco Mundial, que se compilan a partir de fuentes oficialmente reconocidas, se informó que el gasto militar en EE. UU. fue de aproximadamente el 3,5% de su PIB en 2023. Además, en el año fiscal 2023, el gobierno de EE. UU. gastó US $ 820 mil millones en el sector de defensa nacional, según el Departamento Federal de Presupuesto de EE. UU. Se estimó que la cantidad sería el 13% del gasto federal de EE. UU. Los principales actores del mercado están desarrollando tecnologías avanzadas basadas en sistemas de vigilancia optrónica aerotransportada, cámaras termográficas digitales avanzadas, sistemas de seguimiento y búsqueda, entre otros. Por ejemplo, la empresa estadounidense Obsidian Sensors Inc. lanzó en 2023 una nueva tecnología que procesa imágenes térmicas utilizando sensores asequibles de alta resolución.

Perspectivas regionales del mercado de sistemas de vigilancia y observación optrónica militar

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de sistemas de vigilancia y observación optrónica militar durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de sistemas de vigilancia y observación optrónica militar en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de sistemas de vigilancia y observación optrónicos militares

Alcance del informe de mercado de sistemas de vigilancia y observación optrónicos militares

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 17.358,98 millones |

| Tamaño del mercado en 2031 | US$ 26.852,12 millones |

| CAGR global (2023 - 2031) | 5,6% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de sistemas de vigilancia y observación optrónica militar: comprensión de su impacto en la dinámica empresarial

El mercado de sistemas de vigilancia y observación optrónicos militares está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de sistemas de vigilancia y observación optrónica militar son:

- Aerobús

- Corporación Lockheed Martin

- Grupo Thales

- Corporación General Dynamics

- Tecnologías L3Harris Inc.

- Industrias aeroespaciales de Israel

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de sistemas de vigilancia y observación optrónica militar

Noticias y desarrollos recientes del mercado de sistemas de vigilancia y observación optrónicos militares

El mercado de sistemas de vigilancia y observación optrónicos militares se evalúa mediante la recopilación de datos cualitativos y cuantitativos posteriores a la investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se enumeran algunos de los avances en el mercado de sistemas de vigilancia y observación optrónicos militares:

- El especialista en sensores HENSOLDT suministra un número indeterminado de sistemas de visión óptica de última generación para el vehículo de combate de infantería PUMA. Los clientes son los fabricantes de sistemas KNDS y Rheinmetall, que producen el vehículo de combate de infantería PUMA y lo distribuyen a través de la empresa conjunta PSM GmbH. El valor del pedido se sitúa en el rango de los dos dígitos en millones. Además de los sistemas de visión para las torretas de los vehículos de combate de infantería, el pedido incluye el equipamiento para doce torretas de entrenamiento para tripulaciones de vehículos de entrenamiento. Con este suministro, HENSOLDT contribuye a mejorar el PUMA en el K-Stand S1. (Fuente: HENSOLDT, nota de prensa, junio de 2024)

- Las fuerzas armadas francesas han recibido las primeras 300 gafas de visión nocturna Thales encargadas por la Dirección General de Defensa (DGA) francesa en 2020 en el marco del contrato Bi-NYX. Las 300 gafas entregadas a la DGA son el primer lote de un pedido de 2.000 unidades realizado en diciembre de 2023. Las 1.700 restantes se enviarán a finales de este año. (Fuente: Thales, comunicado de prensa, octubre de 2024)

Informe de mercado sobre sistemas de vigilancia y observación optrónica militar: cobertura y resultados

El informe "Tamaño y pronóstico del mercado de sistemas de vigilancia y observación optrónica militar (2021-2031)" proporciona un análisis detallado del mercado que cubre:

- Tamaño del mercado de sistemas de vigilancia y observación optrónica militar y pronóstico a nivel de país para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de sistemas de vigilancia y observación optrónica militar, así como dinámicas del mercado, como impulsores, restricciones y oportunidades clave

- Análisis PEST y FODA detallados

- Análisis del mercado de sistemas de vigilancia y observación optrónica militar que abarca las tendencias clave del mercado, el marco de cada país, los principales actores, las regulaciones y los desarrollos recientes del mercado

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes para el mercado de sistemas de vigilancia y observación optrónicos militares

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de sistemas de vigilancia y observación optrónica militar

Obtenga una muestra gratuita para - Mercado de sistemas de vigilancia y observación optrónica militar