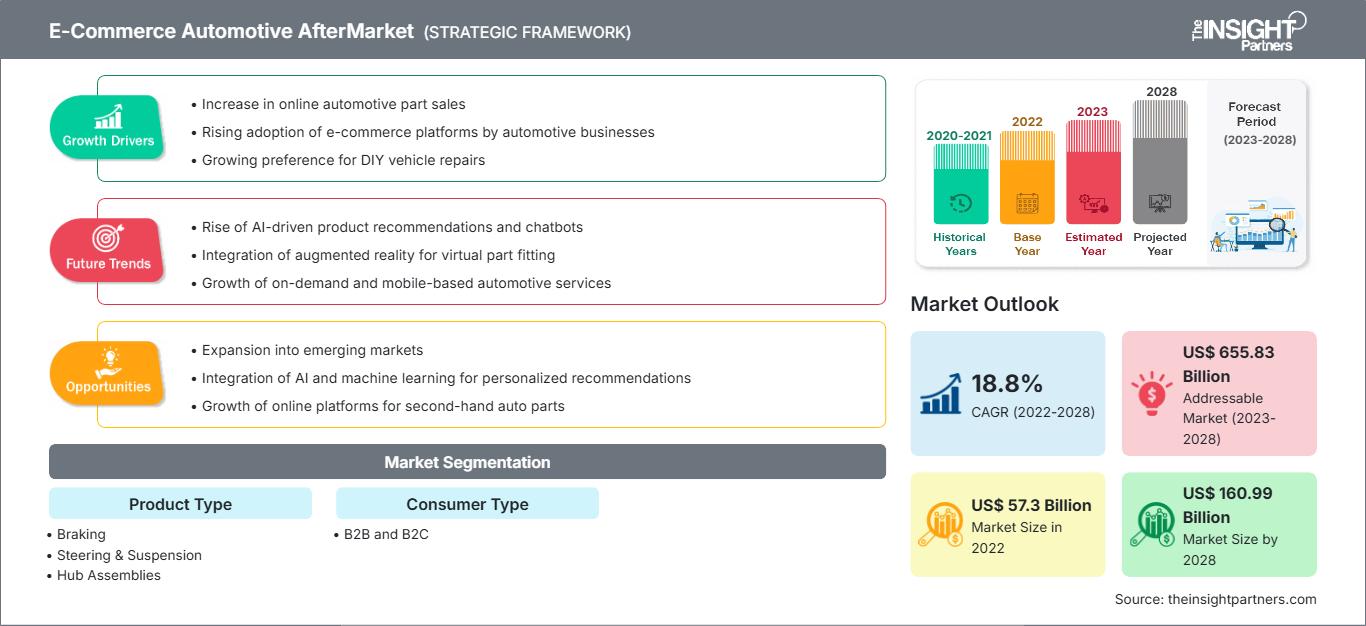

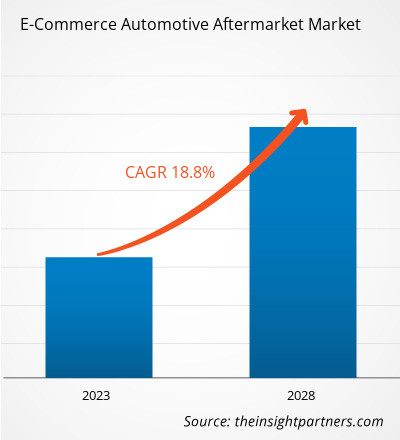

Se prevé que el mercado de repuestos y accesorios para automóviles en línea crezca de 57.301,1 millones de dólares estadounidenses en 2022 a 160.985,4 millones de dólares estadounidenses en 2028. Se estima que crecerá a una tasa de crecimiento anual compuesta (TCAC) del 18,8% entre 2022 y 2028.

América del Norte cuenta con una industria automotriz desarrollada gracias a la producción continua de vehículos comerciales. Según el informe de la Organización Internacional de Fabricantes de Automóviles (OICA) de 2021, Estados Unidos produjo 7.604.154 vehículos comerciales en 2021, 6.895.604 en 2020 y 8.367.239 en 2019. De igual manera, Canadá produjo 826.767 vehículos comerciales en 2021, 1.048.942 en 2020 y 1.455.215 en 2019, según el mismo informe. México produjo un total de 2.437.411 vehículos comerciales en 2021, 2.209.121 en 2020 y 2.604.080 en 2019, según el mismo informe. Estados Unidos, Canadá y México lideran la producción de vehículos comerciales a nivel mundial, según estadísticas de la OICA. Por lo tanto, la producción continua de vehículos comerciales en toda la región impulsa el crecimiento del mercado de repuestos y accesorios automotrices en línea en Norteamérica.

Impacto de la pandemia de COVID-19 en el mercado de repuestos automotrices de comercio electrónico

En Norteamérica, Estados Unidos, Canadá y México experimentaron un aumento significativo en el número de casos de COVID-19. Muchas plantas manufactureras cerraron, los municipios redujeron su actividad y las operaciones de las industrias automotriz y de semiconductores se interrumpieron en 2020, tras el inicio de la pandemia. En la región, la interrupción de la cadena de valor causada por el cierre de diversas plantas de producción y almacenes en Estados Unidos y Canadá a causa de la pandemia tuvo un impacto inmediato en la demanda a corto plazo, la infraestructura logística y los inventarios de productos. Sin embargo, la industria automotriz continuó creciendo gracias a los servicios exclusivos que ofrecen los canales en línea en cuanto a mantenimiento, reparación y reemplazo. Antes de la pandemia, el comercio electrónico se expandía rápidamente. Sin embargo, la pandemia incrementó el número de consumidores estadounidenses que utilizaban plataformas en línea, lo que los incentivó a gastar más. Estas actividades generaron una importante cuota de mercado gracias a la penetración de un ecosistema de comercio electrónico bien organizado que permite a los fabricantes de equipos automotrices participar en ventas de posventa específicas del comercio electrónico. En abril de 2021, las ventas de componentes, piezas y accesorios para automóviles en el mercado de repuestos automotrices de comercio electrónico en Estados Unidos y Canadá aumentaron en más del 60% en comparación con 2020.

Obtendrá personalización gratuita de cualquier informe, incluyendo partes de este informe, análisis a nivel de país y paquetes de datos de Excel. Además, podrá aprovechar excelentes ofertas y descuentos para empresas emergentes y universidades.

Mercado de posventa automotriz en línea: Perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado que se describen en este informe.Esta muestra GRATUITA incluirá análisis de datos, que abarcarán desde tendencias de mercado hasta estimaciones y pronósticos.

Perspectivas del mercado de repuestos automotrices de comercio electrónico

Aumento de los consumidores de bricolaje y DIFM (hágalo usted mismo)

Amazon y eBay ofrecen envíos el mismo día de repuestos para automóviles en muchas ubicaciones. Mantienen relaciones comerciales con importantes fabricantes de autopartes, como Robert Bosch GmbH, Denso Corp., Magna International Inc., Continental AG y ZF Friedrichshafen AG, que ofrecen servicios de instalación. Los proveedores tradicionales de autopartes saben que los clientes que compran componentes para reparaciones por su cuenta serán los primeros en migrar a plataformas de comercio electrónico en lugar de a los proveedores tradicionales. Por lo tanto, mantener una relación comercial constante con comerciantes y técnicos es una estrategia clave para seguir siendo competitivos. Las características estándar de los autos más recientes incluyen sensores para detectar cambios de carril, cámaras de 360° y tecnología que requiere asistencia especializada.

En la tendencia de los servicios de reparación a domicilio (DIFM, por sus siglas en inglés), se espera que los consumidores de vehículos de alta gama dependan de talleres y mecánicos. Por ejemplo, Advance Auto Parts utiliza el comercio electrónico para dirigirse específicamente a estos grupos de mercado, ofreciéndoles funciones de tecnología de asistencia al conductor. El mercado de repuestos automotrices en línea debe seguir aprovechando las plataformas digitales B2C (de empresa a consumidor) y B2B (de empresa a empresa), así como las crecientes cadenas de suministro que las sustentan, mientras la competencia continúa en este lucrativo mercado. En consecuencia, se prevé que el aumento de clientes que optan por la compra en línea de componentes automotrices genere nuevas oportunidades en el mercado de repuestos automotrices en línea.

Información de mercado basada en el tipo de producto

Según el tipo de producto, el mercado de repuestos automotrices en línea se segmenta en frenado (pastillas, sistemas hidráulicos y herrajes, discos y tambores), dirección y suspensión (rótulas, terminales de dirección, barras estabilizadoras, rodamientos/retenes, entre otros) y conjuntos de buje, juntas universales, empaquetaduras, filtros, bujías, entre otros. En 2021, el segmento "otros" lideró el mercado de repuestos automotrices en línea, con la mayor participación.

Información de mercado basada en el tipo de consumidor

Según el tipo de consumidor, el mercado de repuestos para automóviles en línea se segmenta en B2B y B2C. En 2021, el segmento B2C lideró el mercado de repuestos para automóviles en línea, representando una mayor cuota de mercado.

Los participantes del mercado adoptan estrategias, como fusiones, adquisiciones e iniciativas de marketing, para mantener sus posiciones en el mercado de repuestos automotrices en línea. A continuación, se enumeran algunos avances de los principales actores:

- En marzo de 2022, DENSO Aftermarket, la filial de posventa de DENSO, destacado fabricante de componentes de equipo original (OE), ganó el codiciado premio Proveedor del Año 2021, otorgado por GroupAuto International, una organización de compras global líder.

- En septiembre de 2020, LKQ Corporation completó la venta, previamente anunciada, de sus participaciones en dos mayoristas checos de repuestos para automóviles a Swiss Automotive Group AG. Los términos de la transacción no se hicieron públicos.

Comercio electrónico automotriz después

Perspectivas regionales del mercado de repuestos automotrices de comercio electrónico

Los analistas de The Insight Partners han explicado en detalle las tendencias y los factores regionales que influyen en el mercado de repuestos automotrices en línea durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de repuestos automotrices en línea en Norteamérica, Europa, Asia Pacífico, Oriente Medio y África, y Sudamérica y Centroamérica.

Alcance del informe de mercado de posventa automotriz de comercio electrónico

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2022 | 57.300 millones de dólares estadounidenses |

| Tamaño del mercado para 2028 | 160.990 millones de dólares estadounidenses |

| Tasa de crecimiento anual compuesto global (2022 - 2028) | 18,8% |

| Datos históricos | 2020-2021 |

| período de previsión | 2023-2028 |

| Segmentos cubiertos |

Por tipo de producto

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de los participantes en el mercado de repuestos automotrices de comercio electrónico: comprensión de su impacto en la dinámica empresarial

El mercado de repuestos y accesorios para automóviles en línea está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las nuevas tendencias, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una visión general de los principales actores del mercado de repuestos automotrices de comercio electrónico.

Perfiles de empresas

Alibaba Group Holding Limited; Amazon.com, Inc.; AutoZone, Inc.; Shopee365; CATI SpA; eBay Inc.; LKQ Corporation; The Pep Boys; CarParts.com, Inc; y Denso Corporation son actores clave líderes del mercado.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de repuestos automotrices de comercio electrónico

Obtenga una muestra gratuita para - Mercado de repuestos automotrices de comercio electrónico