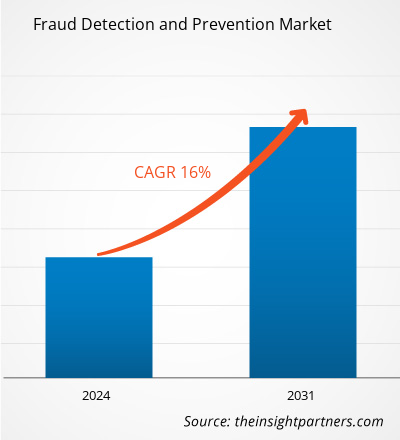

Se prevé que el tamaño del mercado de detección y prevención de fraudes alcance los 116,96 mil millones de dólares en 2031, frente a los 35,67 mil millones de dólares en 2023. Se espera que el mercado registre una CAGR del 16,0 % durante el período 2023-2031. Es probable que la incorporación de tecnologías avanzadas como la IA siga siendo una tendencia clave en el mercado.CAGR of 16.0% during 2023–2031. The incorporation of advanced technologies such as AI is likely to remain a key trend in the market.

Análisis del mercado de detección y prevención de fraudes

La creciente prevalencia del fraude en línea y los ciberataques avanzados a nivel mundial está impulsando la necesidad de soluciones de detección y prevención de fraudes. Además, la creciente tendencia a utilizar análisis avanzados para identificar patrones de amenazas está contribuyendo a la expansión del mercado de detección y prevención de fraudes. Además, debido a la creciente tendencia a la digitalización y la popularidad de las transacciones de comercio electrónico, también existe una creciente necesidad de soluciones de detección y prevención de fraudes para combatir las crecientes amenazas de fraude en línea que involucran datos confidenciales, información de identidad e información personal de personas y empresas. Además, el crecimiento previsto del mercado de detección y prevención de fraudes en el futuro estará impulsado por el uso creciente de tecnologías avanzadas como IA y ML para identificar y prevenir el fraude.cyberattacks globally is driving the need for fraud detection and prevention solutions. Moreover, the increasing trend toward utilizing advanced analytics for identifying threat patterns is contributing to the expansion of the fraud detection and prevention market. Furthermore, due to the rising trend of digitization and the popularity of e-commerce transactions, there is also a growing need for fraud detection and prevention solutions to combat the increasing online fraud threats that involve sensitive data, identity information, and personal information of individuals and businesses. Moreover, the anticipated growth of the fraud detection and prevention market in the future will be driven by the rising use of advanced technologies such as Al and ML to identify and prevent fraud.

Descripción general del mercado de detección y prevención de fraudes

La publicación digital, conocida como publicación electrónica o en línea , implica la difusión de diversos contenidos en línea, como revistas, periódicos y libros electrónicos. Al pasar por este proceso, cualquier empresa o entidad editorial puede convertir documentos y datos en papel a formato digital, al que se puede acceder en línea, descargar, editar e imprimir o compartir a discreción de los usuarios.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado de detección y prevención de fraudes: perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Factores impulsores y oportunidades del mercado de detección y prevención de fraudes

El creciente número de ciberataques en las empresas favorece al mercado

Los riesgos de ciberseguridad son un problema importante en el panorama digital actual. Las graves repercusiones afectan a personas, empresas y gobiernos. Es fundamental prevenir los ciberataques. El aumento de los ciberataques ha aumentado la importancia de la ciberseguridad para proteger infraestructuras cruciales y garantizar la seguridad de las personas y las empresas. Las soluciones de detección y prevención de fraudes ahora se consideran herramientas esenciales para que las empresas se protejan de los ataques en línea. El uso del software puede ayudar a las empresas a aumentar las ventas con clientes valiosos, aumentar las tasas de aprobación, minimizar las necesidades de cuentas de reserva, evitar devoluciones de cargos y mucho más. En consecuencia, el aumento de los ciberataques dentro de las empresas está generando una mayor necesidad de opciones de prevención del fraude, lo que impulsa la expansión de la industria de detección y prevención del fraude.

Demanda creciente de análisis predictivo en la gestión del fraude

El análisis predictivo es una estrategia avanzada para prevenir el fraude que utiliza datos, algoritmos estadísticos y métodos de aprendizaje automático para predecir eventos futuros basándose en el análisis de datos pasados. En esencia, el análisis predictivo implica predecir sucesos futuros imprevistos y, dentro del ámbito de la prevención del fraude, es esencial para detectar y minimizar posibles comportamientos fraudulentos de forma proactiva. Los modelos predictivos utilizan análisis de datos históricos y comportamiento de los usuarios para identificar patrones que sugieran la presencia de fraude. Por ejemplo, un modelo que se entrena con datos que contienen sucesos fraudulentos podrá identificar y resaltar patrones comparables en casos nuevos, como registros de llamadas, frecuencias o acciones anormales de los usuarios.

Análisis de segmentación del informe de mercado de detección y prevención de fraudes

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de detección y prevención de fraude son el componente de contenido, la implementación y el usuario final.

- Según los componentes, el mercado se segmenta en soluciones y servicios. El segmento de soluciones tuvo una participación de mercado significativa en 2023.

- Según la implementación, el mercado se segmenta en local y en la nube. El segmento local tuvo una participación de mercado significativa en 2023.

- En términos de usuario final, el mercado se divide en BFSI, atención médica, manufactura, comercio minorista, telecomunicaciones y otros. El segmento BFSI tuvo una participación sustancial del mercado en 2023.

Análisis de la cuota de mercado de detección y prevención de fraudes por geografía

El alcance geográfico del informe de mercado de detección y prevención de fraude se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Medio Oriente y África, y América del Sur y Central.

Se espera que Estados Unidos domine el mercado de detección y prevención de fraudes en América del Norte en 2023. Los sectores minorista y de comercio electrónico en países norteamericanos como Estados Unidos y Canadá son fuertes. Más del 60% de los estadounidenses realizan compras en línea de artículos esenciales y de lujo que necesitan en sus rutinas diarias. Además, Estados Unidos se ubica como el segundo mercado de comercio electrónico más grande del mundo. La Oficina del Censo de Estados Unidos informó que las ventas minoristas de comercio electrónico en el primer trimestre de 2023 alcanzaron los 272.600 millones de dólares, lo que supone un crecimiento del 3% respecto al trimestre anterior de 2022. Asimismo, según lo indicado por la Administración de Comercio Internacional (ITA), alrededor de 27 millones de personas en Canadá utilizaban el comercio electrónico en 2022, lo que equivale al 75% de la población canadiense, con proyecciones que muestran un aumento al 77,6% para 2025. Las ventas de comercio electrónico ascendieron a aproximadamente 2.340 millones de dólares en el país en marzo de 2022, con un crecimiento proyectado a 40.300 millones de dólares para 2025. La creciente aceptación de las compras online en la zona está generando una importante necesidad de medidas para prevenir el fraude, ya que implica compartir información sensible de personas y empresas. Por tanto, la expansión del sector del comercio electrónico en la zona está impulsando el mercado en Norteamérica.ITA), around 27 million individuals in Canada were utilizing e-commerce in 2022, which equates to 75% of the Canadian populace, with projections showing an increase to 77.6% by 2025. E-commerce sales were at approximately US$ 2.34 billion in the country in March 2022, with projected growth to US$ 40.3 billion by 2025. The increasing acceptance of online shopping in the area is leading to a significant need for measures to prevent fraud, as it involves sharing sensitive information of individuals and companies. Therefore, the expansion of the e-commerce sector in the area is driving the market in North America.

Perspectivas regionales del mercado de detección y prevención de fraudes

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de detección y prevención de fraudes durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de detección y prevención de fraudes en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de detección y prevención de fraudes

Alcance del informe de mercado de detección y prevención de fraudes

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 35,67 mil millones |

| Tamaño del mercado en 2031 | US$ 116,96 mil millones |

| CAGR global (2023 - 2031) | 16% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por componente

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado: comprensión de su impacto en la dinámica empresarial

El mercado de detección y prevención de fraudes está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de detección y prevención de fraude son:

- Certificar, Inc.

- Sistemas BAE

- F5

- FICO

- Compañía: Fiserv, Inc.

- Corporación IBM

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de detección y prevención de fraudes

Noticias y desarrollos recientes del mercado de detección y prevención de fraudes

El mercado de detección y prevención de fraudes se evalúa mediante la recopilación de datos cualitativos y cuantitativos a partir de investigaciones primarias y secundarias, que incluyen importantes publicaciones corporativas, datos de asociaciones y bases de datos. A continuación, se enumeran algunos de los avances en el mercado de detección y prevención de fraudes:

- NICE Actimize, una empresa de NICE (Nasdaq: NICE), anunció hoy la disponibilidad de IFM 11 (Gestión integrada de fraudes), una nueva versión de su plataforma líder en el mercado de detección y gestión de fraudes basada en IA. La nueva versión aprovecha los últimos avances en inteligencia artificial junto con las capacidades únicas de inteligencia colectiva de NICE Actimize para introducir una precisión, agilidad y eficiencia sin precedentes en la detección de fraudes para proteger a las empresas de servicios financieros y a sus clientes de la próxima generación de fraudes y estafas basados en IA.

(Fuente: NICE Actimize, comunicado de prensa, abril de 2024)

Informe de mercado sobre detección y prevención de fraudes: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de detección y prevención de fraudes (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado de detección y prevención de fraudes y pronóstico a nivel mundial, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de detección y prevención de fraudes, así como dinámicas del mercado, como impulsores, restricciones y oportunidades clave

- Análisis detallado de las cinco fuerzas de Porter y PEST y FODA

- Análisis del mercado de detección y prevención de fraudes que abarca las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes para el mercado de detección y prevención de fraudes

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de detección y prevención de fraudes

Obtenga una muestra gratuita para - Mercado de detección y prevención de fraudes