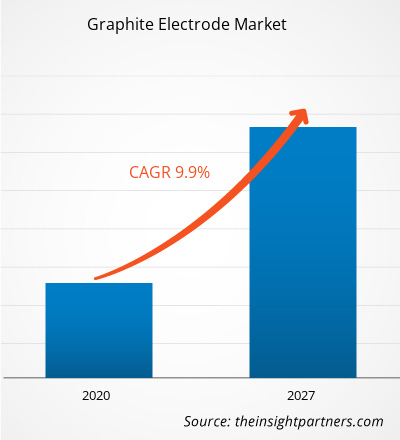

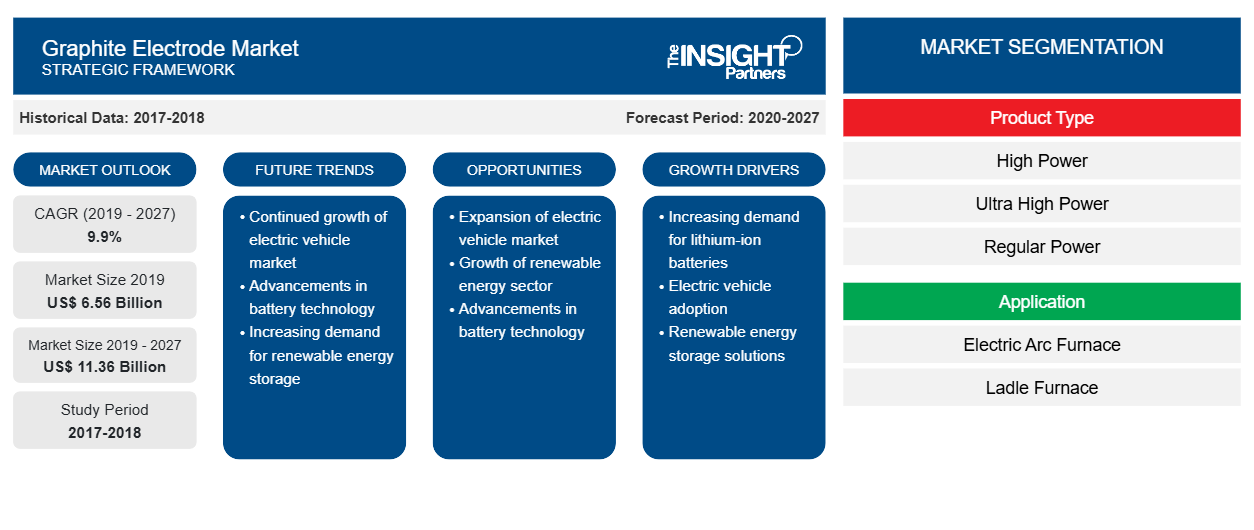

[Informe de investigación] En términos de ingresos, el mercado de electrodos de grafito se valoró en US$ 6.564,2 millones en 2019 y se espera que alcance los US$ 11.356,4 millones en 2027 con una CAGR del 9,9% de 2020 a 2027.

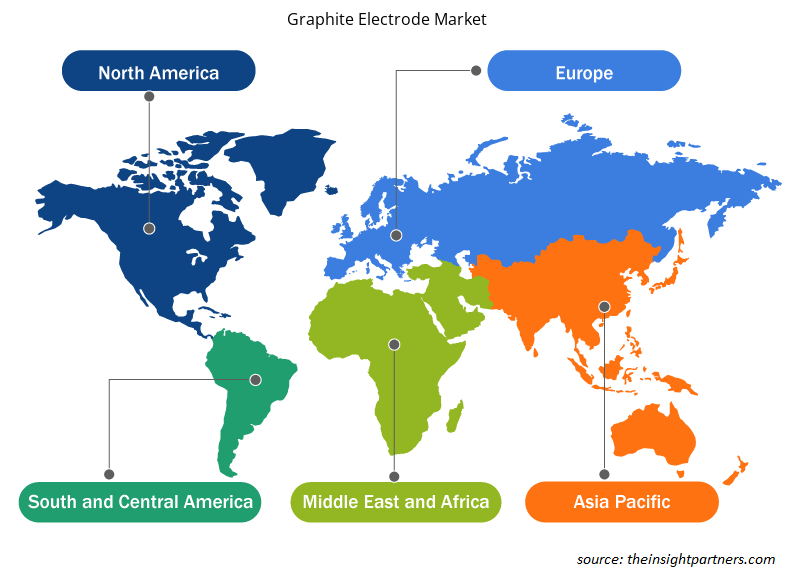

El mercado mundial de electrodos de grafito está dominado por la región de Asia Pacífico, que representa aproximadamente el 58 % del mercado mundial de electrodos de grafito en conjunto. La alta demanda de electrodos de grafito de estos países se atribuye al pronunciado aumento de la producción de acero crudo. Según la Asociación Mundial del Acero, en 2018, China y Japón produjeron 928,3 y 104,3 millones de toneladas de acero crudo respectivamente. En APAC, los hornos de arco eléctrico tienen una demanda significativa debido al aumento de la chatarra de acero y el aumento del suministro de energía eléctrica en China. Las crecientes estrategias de mercado de varias empresas en APAC están fomentando el crecimiento del mercado de electrodos de grafito en la región. Por ejemplo, Tokai Carbon Co., Ltd., una empresa japonesa, ha adquirido el negocio de electrodos de grafito de SGL GE Holding GmbH (SGL GE), a un costo de US$ 150 millones.

Los gobiernos de los principales países europeos han tomado diversas iniciativas para impulsar sus sectores manufacturero y de electrónica y semiconductores, entre otros. Europa ha mejorado significativamente sus soluciones industriales a través de las iniciativas de la Industria 4.0. La Comisión Europea se está centrando en aumentar la financiación para I+D para fortalecer la competitividad de la industria manufacturera y otros sectores de la región en el mundo. La demanda de electrodos de grafito está directamente relacionada con la producción de acero en hornos de arco eléctrico, y la región es uno de los productores de acero más importantes del mundo, siendo Rusia el mayor productor.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impacto de la pandemia de COVID-19 en el mercado de electrodos de grafito

Según el último informe de situación de la Organización Mundial de la Salud (OMS), Estados Unidos, India, España, Italia, Francia, Alemania, el Reino Unido, Rusia, Turquía, Brasil, Irán y China se encuentran entre los países más afectados por el brote de COVID-19. El brote comenzó en Wuhan (China) durante diciembre de 2019 y, desde entonces, se ha extendido a un ritmo rápido por todo el mundo. La crisis de COVID-19 está afectando a las industrias de todo el mundo y se prevé que la economía mundial sufra el mayor impacto en el año 2020 y probablemente en 2021. El brote ha creado importantes perturbaciones en la industria del acero. La fuerte caída del comercio internacional está afectando negativamente al crecimiento del electrodo de grafito. Los paros de producción, las restricciones a la cadena de suministro, la gestión de las adquisiciones, la escasez de mano de obra y los cierres fronterizos para combatir y contener el brote han afectado negativamente al sector de la construcción. La desaceleración de la producción en la industria de la construcción está afectando directamente a la adopción de varios productos de acero, lo que repercute en el mercado de electrodos de grafito.

Perspectivas del mercado

La transición en la industria siderúrgica china está impulsando el crecimiento del mercado de electrodos de grafito

En 2016 y 2017, el panorama de la industria siderúrgica de China se vio afectado por la desestimación del potencial de la fundición, impulsada por las políticas, mientras el gobierno se esforzaba por inscribir un exceso de oferta interna. Según worldsteel.org, el consumo de chatarra de acero en las acerías de hornos de arco eléctrico y hornos básicos de oxígeno (BOF) alcanzó un récord de más de 200 millones de toneladas métricas por año. Mientras tanto, la capacidad de hornos de arco eléctrico de China cedió un nuevo cenit de 130 millones de toneladas métricas por año, ya que las regulaciones gubernamentales restringen la generación de las acerías integradas en áreas clave y promueven su vigorosa sustitución por capacidad de hornos de arco eléctrico. Esto ha dado lugar a la producción de acero de hornos de arco eléctrico, lo que ha incitado al crecimiento del mercado de electrodos de grafito.

Información basada en el tipo de producto

En términos de tipo de producto, el segmento de potencia ultraalta capturó la mayor participación del mercado global de electrodos de grafito en 2019. El electrodo de grafito de potencia ultraalta se utiliza para reciclar acero en la industria del horno de arco eléctrico (EAF). Su componente principal es el coque de aguja de alto valor, que se produce a partir de petróleo o alquitrán de hulla. Los electrodos de grafito se perfeccionan con una forma cilíndrica y se fabrican con áreas roscadas en cada extremo. De esta manera, los electrodos de grafito se pueden ensamblar en una columna de electrodos utilizando boquillas de electrodos. Para satisfacer el requisito de menor costo y mayor eficiencia de trabajo, los hornos de arco de potencia ultraalta de gran capacidad se están volviendo más populares. Por lo tanto, se espera que los electrodos de grafito de potencia ultraalta tengan la mayor participación del mercado de electrodos de grafito. Además, se espera que el segmento sea testigo del mayor crecimiento de CAGR en el mercado de electrodos de grafito.

Perspectivas basadas en aplicaciones

Según la aplicación, el mercado de electrodos de grafito se segmenta en hornos de arco eléctrico, hornos de cuchara y otros. Se estima que el segmento de hornos de arco eléctrico crecerá a la CAGR más alta durante el período de pronóstico. El electrodo de grafito es un componente indispensable de la producción de acero a través del método de horno de arco eléctrico (EAF) y la purificación del acero en hornos de cuchara. Los electrodos de grafito también se utilizan para la producción de metales ferrosos no siderúrgicos, ferroaleaciones, silicio metálico y fósforo amarillo. El electrodo de grafito es un consumible indispensable en la producción de acero EAF, pero se necesita en cantidades muy pequeñas; una tonelada de producción de acero necesita solo ~1,7 kg de electrodo de grafito. El segmento tiene más del 80% de la participación del mercado total de electrodos de grafito.

El mercado de electrodos de grafito está muy consolidado y solo unos pocos actores dominan el mercado. A continuación, se enumeran algunos de los desarrollos recientes en el mercado de electrodos de grafito:

2020: Tokai Carbon y Tokai COBEX completaron la adquisición de Carbone Savoie International SAS, un fabricante de carbono y grafito.

2020: La Junta Directiva de GrafTech International Ltd. aprobó la recompra de hasta $100 millones de acciones ordinarias de la compañía en compras en el mercado abierto.

2019: Showa Denko (SDK) completó la adquisición de todas las acciones de SGL GE Holding GmbH, una empresa de producción de electrodos de grafito. Después de la adquisición, el nombre de la empresa cambió a SHOWA DENKO CARBON Holding GmbH.

Perspectivas regionales del mercado de electrodos de grafito

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de electrodos de grafito durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de electrodos de grafito en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de electrodos de grafito

Alcance del informe sobre el mercado de electrodos de grafito

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2019 | 6.560 millones de dólares estadounidenses |

| Tamaño del mercado en 2027 | US$ 11.36 mil millones |

| CAGR global (2019-2027) | 9,9% |

| Datos históricos | 2017-2018 |

| Período de pronóstico | 2020-2027 |

| Segmentos cubiertos |

Por tipo de producto

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de electrodos de grafito: comprensión de su impacto en la dinámica empresarial

El mercado de electrodos de grafito está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de electrodos de grafito son:

- Grupo EPM

- GRAFTECH INTERNACIONAL LTD

- Grafito India Limitada

- HEG limitada

- Compañía de carbono de Kaifeng, Ltd.

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de electrodos de grafito

Segmentación del mercado

Mercado de electrodos de grafito: por tipo de producto

- Energía alta

- Ultraalta potencia

- Poder regular

Mercado de electrodos de grafito: por aplicación

- Horno de arco eléctrico

- Horno de cuchara

- Otros

Mercado de electrodos de grafito por regiones

-

América del norte

- A NOSOTROS

- Canadá

- México

-

Europa

- Francia

- Alemania

- Italia

- Reino Unido

- Rusia

- Resto de Europa

-

Asia Pacífico (APAC)

- Porcelana

- India

- Corea del Sur

- Japón

- Australia

- Resto de APAC

-

Oriente Medio y África (MEA)

- Sudáfrica

- Arabia Saudita

- Emiratos Árabes Unidos

- Resto de MEA

-

América del Sur (SAM)

- Brasil

- Argentina

- Resto de SAM

Las empresas perfiladas en el mercado de electrodos de grafito son las siguientes:

- Grupo EPM

- GrafTech Internacional Ltd.

- Grafito India Limitada

- HEG Ltd

- Kaifeng Carbon Co., Ltd., Grupo químico y energético Zhongping (KFCC)

- Nantong Yangzi Carbon Co., Ltd.

- Compañía Nippon Carbon Ltd.

- Sangraf Internacional

- SHOWA DENKO KK

- Compañía de carbono Tokai Co., Ltd.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de electrodos de grafito

Obtenga una muestra gratuita para - Mercado de electrodos de grafito