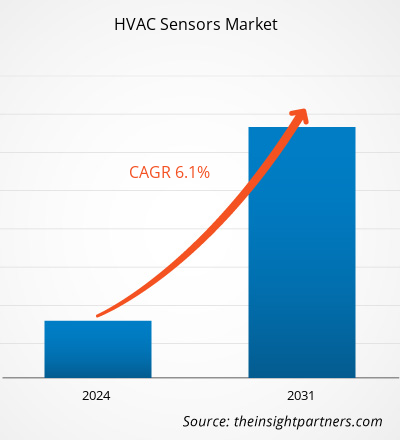

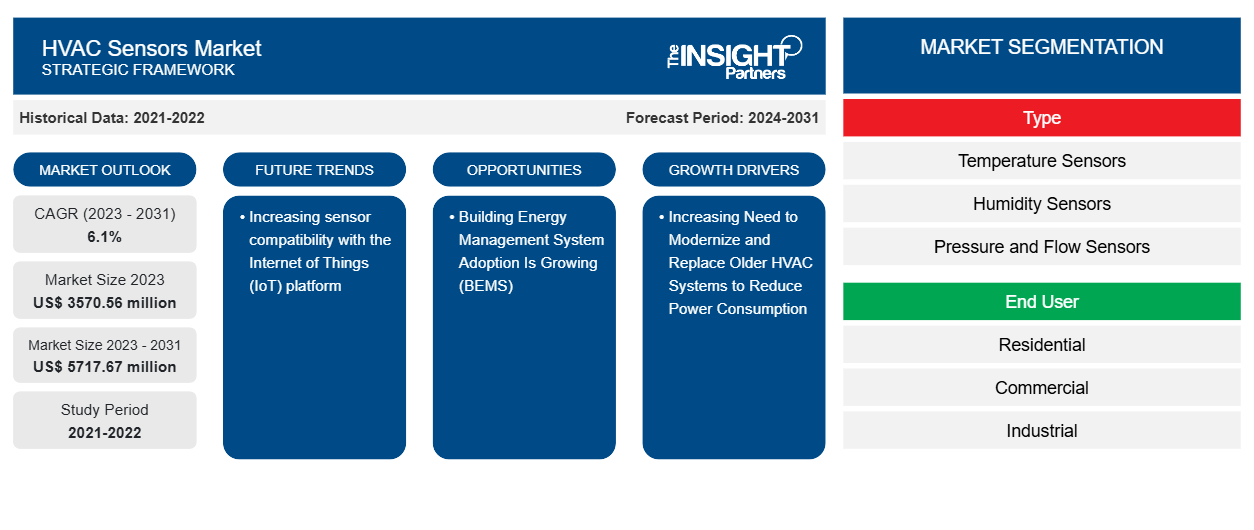

Se proyecta que el tamaño del mercado de sensores HVAC alcance los US$ 5717,67 millones para 2031 desde los US$ 3570,56 millones en 2023. Se espera que el mercado registre una CAGR del 6,1% en 2023-2031.

Es probable que la creciente compatibilidad de los sensores con la plataforma de Internet de las cosas (IoT) siga siendo una tendencia clave en el mercado de sensores HVAC.

Análisis del mercado de sensores HVAC

El mercado de sensores HVAC ha sido utilizado por varias industrias, como la comercial, residencial, automotriz y otras. Hoy en día, existe una feroz competencia en el mundo empresarial porque las organizaciones líderes deben priorizar la preservación del medio ambiente, la productividad, la calidad, la seguridad y la protección. En los últimos años, los sistemas HVAC se han utilizado ampliamente en muchos programas en todo el mundo. Numerosos sensores, incluidos sensores de presión y temperatura, entre otros, encuentran un uso que los hace posibles. Los sistemas HVAC brindan una buena calidad del aire y confort térmico tanto para el interior del automóvil como para el de la habitación. Los sensores HVAC se utilizan para abordar las necesidades de varios usuarios finales que están preocupados por la eficiencia energética. Ayudan a proporcionar espacios interiores adecuadamente mantenidos con un bajo consumo de energía.

Descripción general del mercado de sensores HVAC

Los sistemas HVAC se utilizan con frecuencia para mantener, controlar y, por lo tanto, reducir el consumo de energía. En la frecuencia se incluye un dispositivo de audio que imita una condición real, como la temperatura o el mundo objetivo. El tipo más importante de sensor HVAC ayuda a mantener la temperatura adecuada y modificar la temperatura necesaria diferenciando la temperatura de entrada de la temperatura del edificio o de la habitación. Para los usuarios finales, incluidos los edificios industriales, residenciales y comerciales , los sensores HVAC pueden administrar, controlar y monitorear varias operaciones como la presión del aire, la temperatura y la calidad. Como resultado, los sensores HVAC se están volviendo cada vez más comunes debido a la necesidad de ahorrar energía.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de sensores HVAC

Creciente necesidad de modernizar y reemplazar sistemas de calefacción, ventilación y aire acondicionado antiguos para reducir el consumo de energía

El Foro Económico Mundial estima que los edificios son responsables de más del 40% de las emisiones de dióxido de carbono relacionadas con la energía y casi un tercio del consumo energético mundial. Alrededor de un tercio de esas emisiones, según el Consejo Mundial de Edificios Ecológicos, son causadas por la energía necesaria para las operaciones de un edificio, que incluyen calefacción, refrigeración y suministro eléctrico de la estructura. Según Iota Communications, el edificio de oficinas promedio gasta alrededor de $30,000 al año en electricidad. En una estructura comercial, los sistemas HVAC suelen consumir la mayor cantidad de energía. Según estimaciones del Departamento de Energía de EE. UU., los sistemas HVAC normalmente representan el 35% del uso de energía de un edificio. La necesidad de sistemas HVAC con características de filtración de aire aumentó durante la pandemia. Los sistemas de ventilación actualizados cumplen una función crucial de salud pública al filtrar el aire y reducir los contaminantes transportados por el aire, como las partículas que contienen virus.

La adopción de sistemas de gestión energética de edificios está en aumento (BEMS)

Los edificios no pueden funcionar sin sistemas de climatización, a pesar de su elevado coste. El Departamento australiano de Cambio Climático, Energía, Medio Ambiente y Agua estima que un sistema de climatización medio consume aproximadamente el 40% del consumo energético total de un edificio y el 70% de su consumo energético básico. Los sistemas automatizados basados en ordenador, conocidos como sistemas de gestión de la energía de los edificios (BEMS, por sus siglas en inglés), vigilan y regulan todos los sistemas relacionados con la energía de los edificios, incluidos los equipos mecánicos y eléctricos. Al permitir un control preciso y automatizado de los sistemas y el suministro de energía, la gestión energética protege a las empresas contra el gasto innecesario de energía. Una empresa puede reducir su consumo actual de energía hasta entre un 10% y un 30% con la ayuda de BEMS, afirma Radiocrafts. Como resultado del conflicto entre Rusia y Ucrania, los precios de la energía se están disparando en la UE. Por lo tanto, se prevé que la adopción del sistema de gestión de la energía de los edificios (BEMS, por sus siglas en inglés) presente nuevas oportunidades para los actores del sector de la climatización durante el período de previsión.

Análisis de segmentación de informes de HVAC

Los segmentos clave que contribuyeron a la derivación del análisis de HVAC son el tipo y los usuarios finales.

- Según el tipo, el sistema HVAC se segmenta en sensores de temperatura, sensores de humedad, sensores de presión y caudal, sensores de movimiento, sensores de humo y gas, entre otros. El segmento de sensores de temperatura tuvo una mayor participación de mercado en 2023.

Según el usuario final, el mercado de sensores HVAC se segmenta en residencial, comercial e industrial.

Análisis de la cuota de mercado de sensores HVAC por geografía

El alcance geográfico del informe de mercado de sensores HVAC se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Oriente Medio y África, y América del Sur/América del Sur y Central. Debido a una gran cantidad de infraestructura contemporánea y bien desarrollada, incluidos edificios comerciales, instalaciones industriales y propiedades residenciales, América del Norte tiene la mayor participación de mercado para sensores y controladores HVAC. Existe un mercado considerable para sensores y controladores HVAC debido a la abundancia de edificios con sistemas HVAC complejos.

Perspectivas regionales del mercado de sensores HVAC

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de sensores HVAC durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de sensores HVAC en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de sensores HVAC

Alcance del informe de mercado de sensores HVAC

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 3570,56 millones |

| Tamaño del mercado en 2031 | US$ 5717,67 millones |

| CAGR global (2023 - 2031) | 6,1% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de sensores HVAC: comprensión de su impacto en la dinámica empresarial

El mercado de sensores de HVAC está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de sensores HVAC son:

- Siemens AG

- Compañía Eléctrica Emerson

- Compañía: Honeywell International Inc.

- Controles Johnson, Inc.

- Schneider Electric

- TE Conectividad Ltda.

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los actores clave del mercado de sensores HVAC

Noticias y desarrollos recientes del mercado de sensores HVAC

El mercado de sensores de HVAC se evalúa mediante la recopilación de datos cualitativos y cuantitativos posteriores a la investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se incluye una lista de los avances en el mercado de trastornos del habla y el lenguaje y las estrategias:

- En octubre de 2023, Sensata Technologies anunció el lanzamiento del sensor Sensata Resonix RGD, el primer sensor de detección de fugas con certificación UL para múltiples gases refrigerantes A2L utilizados en equipos de calefacción, ventilación y aire acondicionado (HVAC). Los nuevos sensores de detección de fugas respaldan la transición de los fabricantes de HVAC a refrigerantes con un menor impacto en el calentamiento global. (Fuente: Sensata Technologies, comunicado de prensa)

- En enero de 2023, Third Reality lanzó un sensor de temperatura y humedad. (Fuente: Third Reality, comunicado de prensa)

Informe de mercado sobre sensores de HVAC: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de sensores HVAC (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Dinámica del mercado, como impulsores, restricciones y oportunidades clave

- Principales tendencias futuras

- Análisis detallado de las cinco fuerzas de Porter y PEST y FODA

- Análisis del mercado global y regional que cubre las tendencias clave del mercado, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de sensores HVAC

Obtenga una muestra gratuita para - Mercado de sensores HVAC