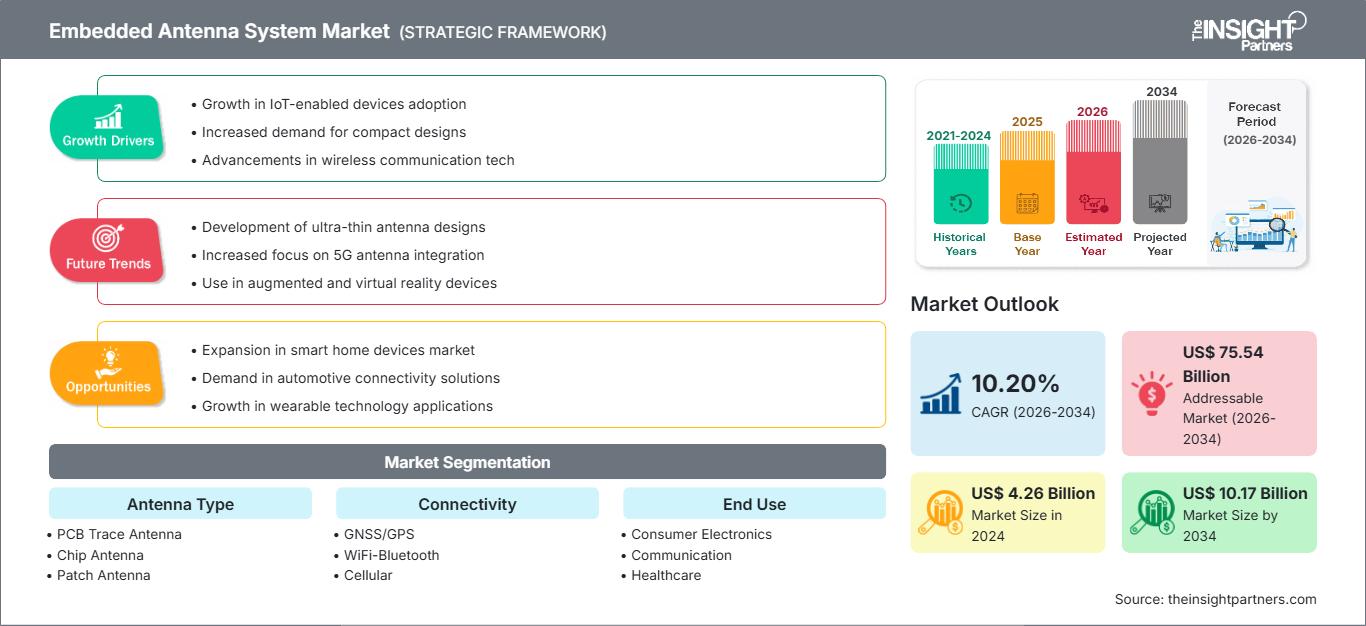

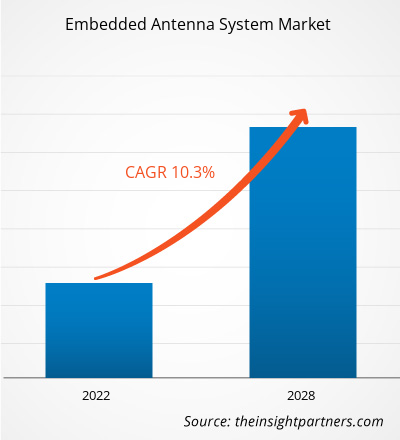

Se espera que el tamaño del mercado de sistemas de antenas integradas alcance los 10.170 millones de dólares estadounidenses en 2034, desde los 4.260 millones de dólares estadounidenses en 2024. Se anticipa que el mercado registre una CAGR del 10,20 % durante el período 2026-2034.

Análisis del mercado de sistemas de antenas integradas

El mercado de sistemas de antenas integradas está experimentando un fuerte crecimiento debido a la creciente demanda de antenas compactas e integradas en dispositivos inalámbricos. Entre los impulsores de este crecimiento se encuentran la proliferación de dispositivos IoT, el rápido despliegue de redes 5G que exigen antenas multibanda sofisticadas y la creciente miniaturización en la electrónica de consumo. Las antenas integradas son cruciales para aplicaciones en smartphones, wearables, vehículos conectados, sensores industriales IoT y más. Por ejemplo, el sector automotriz integra cada vez más antenas integradas para la comunicación V2X, el GPS y la conectividad en el automóvil.

Descripción general del mercado de sistemas de antenas integradas

Los sistemas de antenas embebidas son antenas diminutas e integradas, diseñadas para integrarse en dispositivos electrónicos, lo que permite una comunicación inalámbrica fluida. A diferencia de las antenas externas, las soluciones embebidas ahorran espacio, reducen la complejidad de producción y mejoran la fiabilidad al formar parte de la PCB o la estructura del dispositivo. Estos sistemas son especialmente valiosos en los dispositivos modernos gracias a su compatibilidad con múltiples estándares de comunicación (p. ej., Wi-Fi/Bluetooth, telefonía móvil (incluido 5G) y GNSS), sus configuraciones MIMO y su capacidad de adaptación mediante un ajuste inteligente.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado de sistemas de antenas integradas: perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de sistemas de antenas integradas

Factores impulsores del mercado:

- Implementación de 5G: el lanzamiento global de 5G (incluidas las bandas sub-6 GHz y mmWave) es un catalizador importante que impulsa la demanda de antenas integradas avanzadas capaces de manejar altas frecuencias y formación de haz.

- Proliferación de la IoT: la explosión de dispositivos de la IoT (desde wearables hasta sensores industriales) requiere soluciones de antena compactas, energéticamente eficientes y de alto rendimiento.

- Necesidades de miniaturización: A medida que los dispositivos electrónicos se reducen, aumenta la necesidad de antenas de formato pequeño. Las antenas integradas proporcionan una conectividad fiable sin ocupar espacio externo.

Oportunidades de mercado:

- Antenas flexibles/conformes: las antenas FPC (circuito impreso flexible) están ganando terreno debido a su flexibilidad y capacidad para adaptarse a diferentes formas de dispositivos.

- Conectividad automotriz: con los vehículos conectados, ADAS, V2X y la conducción autónoma, las antenas integradas están cada vez más integradas en los automóviles.

- IoT industrial y sanitario: su uso en sensores industriales y telemetría médica abre nuevos casos de uso, especialmente cuando el tamaño y la fiabilidad de la antena son fundamentales.

Análisis de segmentación del informe de mercado de sistemas de antenas integradas

La cuota de mercado de los sistemas de antenas integradas se analiza en varios segmentos para comprender mejor su estructura, potencial de crecimiento y tendencias emergentes. A continuación, se presenta el enfoque de segmentación estándar utilizado en la mayoría de los informes del sector:

Por tipo de antena:

- Antena de traza de PCB

- Antena de chip

- Antena de parche

- Antena de circuito impreso flexible

Por conectividad:

- Sistema global de navegación por satélite (GNSS)/GPS

- WiFi-Bluetooth

- Celular

- ondas milimétricas

- LPWAn

- RFID

- UWB

Por uso final:

- Electrónica de consumo

- Comunicación

- Cuidado de la salud

- Aeroespacial y defensa

- Industrial

- Automoción y transporte

Por geografía/región:

- América del norte

- Europa

- Asia Pacífico

- América Latina

- Oriente Medio y África

Perspectivas regionales del mercado de sistemas de antenas integradas

Los analistas de The Insight Partners han explicado detalladamente las tendencias y los factores regionales que influyen en el mercado de sistemas de antenas integradas durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de sistemas de antenas integradas en Norteamérica, Europa, Asia Pacífico, Oriente Medio y África, y Sudamérica y Centroamérica.

Alcance del informe de mercado de sistemas de antenas integradas

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2024 | 4.260 millones de dólares estadounidenses |

| Tamaño del mercado en 2034 | US$ 10.17 mil millones |

| CAGR global (2026-2034) | 10,20% |

| Datos históricos | 2021-2024 |

| Período de pronóstico | 2026-2034 |

| Segmentos cubiertos |

Por tipo de antena

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de sistemas de antenas integradas: comprensión de su impacto en la dinámica empresarial

El mercado de sistemas de antenas integradas está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y un mayor conocimiento de las ventajas del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una descripción general de los principales actores clave del mercado de sistemas de antenas integradas

Análisis de la cuota de mercado de los sistemas de antenas integradas por geografía

El mercado norteamericano se beneficia de sólidos avances tecnológicos, la adopción generalizada del IoT y la creciente demanda de comunicaciones inalámbricas en sectores como la automoción, la defensa y la salud. Asia-Pacífico es la región de mayor crecimiento durante el período de pronóstico, impulsada por la rápida industrialización, el aumento de la producción de electrónica de consumo y la expansión de la infraestructura de telecomunicaciones, especialmente en países como China, India y Japón, que impulsan el crecimiento del mercado.

El mercado de sistemas de antenas integradas muestra una trayectoria de crecimiento diferente en cada región debido a factores como la expansión del IoT (Internet de las Cosas) y los dispositivos inteligentes. A continuación, se presenta un resumen de la cuota de mercado y las tendencias por región:

América del norte

- Cuota de mercado: El mercado de sistemas de antenas integradas se beneficia de fuertes avances tecnológicos, la adopción generalizada de IoT y la creciente demanda de comunicación inalámbrica en industrias como la automotriz, la defensa y la atención médica.

-

Factores clave:

- Fuerte adopción en electrónica de consumo, IoT industrial y conectividad automotriz.

- Implementación rápida de 5G e infraestructura de telecomunicaciones avanzada.

- Alta integración de antenas integradas en dispositivos portátiles, telemática y sistemas V2X, respaldada por una importante presencia de I+D en EE. UU. y Canadá.

- Tendencias: Demanda constante de miniaturización, antenas multibanda y módulos IoT energéticamente eficientes.

Europa

- Cuota de mercado: Demanda significativa impulsada por industrias de alta tecnología e infraestructura conectada.

-

Factores clave:

- Fuerte adopción en aplicaciones de automoción (coches conectados, telemática) y automatización industrial.

- Impulso regulatorio para estándares de conectividad, cumplimiento de seguridad y transformación digital (por ejemplo, en fábricas inteligentes).

- Tendencias: Crecimiento en fabricación inteligente, telemedicina y antenas integradas para módulos automotrices inteligentes.

Asia-Pacífico (APAC)

- Cuota de mercado: Se proyecta que será la región de más rápido crecimiento debido a la gran fabricación de productos electrónicos en China, Taiwán y Corea del Sur.

-

Factores clave:

- Fabricación de productos electrónicos de consumo a gran escala.

- Amplio despliegue de 5G e iniciativas de IoT y ciudades inteligentes respaldadas por el gobierno.

- Rápida industrialización y fuerte demanda de soluciones integradas en dispositivos automotrices y portátiles.

- Tendencias: Producción de gran volumen de antenas integradas, uso creciente en vehículos eléctricos y dispositivos inteligentes, y creciente localización del diseño y la fabricación.

América Latina (América del Sur y Central)

- Cuota de mercado: Mercado emergente con potencial de crecimiento debido a la creciente penetración de teléfonos inteligentes y la modernización digital.

-

Factores clave:

- Creciente penetración de teléfonos inteligentes y creciente infraestructura digital.

- Adopción emergente de IoT en logística, agricultura y manufactura.

- Tendencias: Adopción gradual de antenas integradas para telemática y dispositivos de consumo, aunque persisten la sensibilidad a los costos y los desafíos regulatorios.

Oriente Medio y África (MEA)

-

Factores clave:

- Inversión en infraestructura de ciudades inteligentes y despliegue de 5G, especialmente en los países del Golfo (por ejemplo, Emiratos Árabes Unidos, Arabia Saudita).

- Creciente demanda de transporte conectado, atención médica e IoT.

- Tendencias: asociaciones con actores tecnológicos globales, dependencia de las importaciones y una integración local cada vez mayor de módulos de antena integrados avanzados.

Densidad de actores del mercado de sistemas de antenas integradas: comprensión de su impacto en la dinámica empresarial

El mercado de sistemas de antenas integradas está experimentando una competencia intensificada debido a la presencia de importantes proveedores globales de tecnología junto con actores emergentes de nicho y startups especializadas. Las empresas están innovando activamente para fortalecer su posición en el mercado y satisfacer la creciente demanda de plataformas inteligentes para la toma de decisiones en todos los sectores.

El panorama competitivo está impulsando a los proveedores a diferenciarse a través de:

- Innovación en miniaturización de antenas (antenas de chip, antenas flexibles)

- Compatibilidad multibanda (5G, GNSS, Wi-Fi)

- Capacidad de integración (los fabricantes de equipos originales quieren antenas que se integren fácilmente en las PCB)

- Eficiencia en costos y energía, especialmente para casos de uso de IoT

Oportunidades y movimientos estratégicos

- Asociaciones: Los fabricantes de antenas pueden asociarse con fabricantes de equipos originales (OEM) de teléfonos inteligentes y empresas automotrices para desarrollar conjuntamente módulos de antena integrados adaptados a dispositivos específicos.

- Inversión en I+D: existe una oportunidad para la I+D en antenas flexibles y conformes para dispositivos portátiles y superficies curvas.

- Mercados emergentes: expansión en regiones de rápido crecimiento como Asia Pacífico, América Latina y Medio Oriente, donde la adopción de IoT está aumentando.

- Personalización: desarrollo de soluciones de antena personalizadas para industrias específicas (por ejemplo, defensa, atención médica) donde el rendimiento y la confiabilidad son fundamentales.

Principales empresas que operan en el mercado de sistemas de antenas integradas

- Airgain, Inc

- Antenova Ltd.

- Infinite Electronics International, Inc

- Corporación de componentes AVX de Kyocera

- Corporación de materiales Mitsubishi

- MOLEX

- Tecnologías LINX

- Conectividad TE

- Corporación Tecnológica Walsin

Noticias y desarrollos recientes del mercado de sistemas de antenas integradas

- Por ejemplo, el 11 de noviembre de 2025, Airgain, Inc., un proveedor líder de soluciones de conectividad inalámbrica, anunció que había conseguido un contrato de diseño con un fabricante líder mundial de CPE para una puerta de enlace de banda ancha de fibra Wi-Fi 7 de próxima generación que se está desarrollando para un importante operador de banda ancha de América del Norte.

- El 30 de julio de 2025, Antenova Ltd., fabricante de antenas y módulos de antena RF para M2M e Internet de las Cosas, anunció una nueva antena GNSS integrada, denominada Sinica, que opera en las bandas satelitales de 1559-1609 MHz. Esta nueva antena utiliza un diseño innovador y nuevos materiales para lograr un alto rendimiento con un perfil ultrabajo.

- Por ejemplo, el 19 de junio de 2025, Airgain, Inc., proveedor líder de soluciones de conectividad inalámbrica, anunció el lanzamiento del módem integrado NimbeLink Skywire™ Cat 1 bis, el primer módem Cat 1 bis listo para usar de la industria para su uso en aplicaciones finales de IoT industrial. Diseñado para optimizar la integración celular en una amplia gama de aplicaciones, este nuevo módem supone un gran avance en la simplificación y aceleración de las implementaciones de IoT en entornos industriales, sanitarios, logísticos y de ciudades inteligentes.

- En abril de 2024, Infinite Electronics, una cartera global de marcas líderes de soluciones de conectividad en stock, anunció que había completado la venta de sus negocios KP Performance Antennas y RadioWaves a Alive Telecommunications, un proveedor global de equipos, sistemas y servicios de comunicaciones.

Informe de mercado sobre sistemas de antenas integradas: cobertura y resultados

El informe "Tamaño y pronóstico del mercado de sistemas de antenas integradas (2021-2034)" ofrece un análisis detallado del mercado que abarca las siguientes áreas:

- Tamaño del mercado de sistemas de antenas integradas y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Sistemas de antenas integradas Tendencias del mercado, así como dinámicas del mercado como impulsores, restricciones y oportunidades clave

- Análisis PEST y FODA detallado

- Análisis del mercado de sistemas de antenas integradas que cubre las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama industrial y de la competencia, que abarca la concentración del mercado, el análisis de mapas de calor, los actores principales y la evolución reciente del mercado de sistemas de antenas integradas. Perfiles detallados de las empresas.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de sistemas de antenas integradas

Obtenga una muestra gratuita para - Mercado de sistemas de antenas integradas