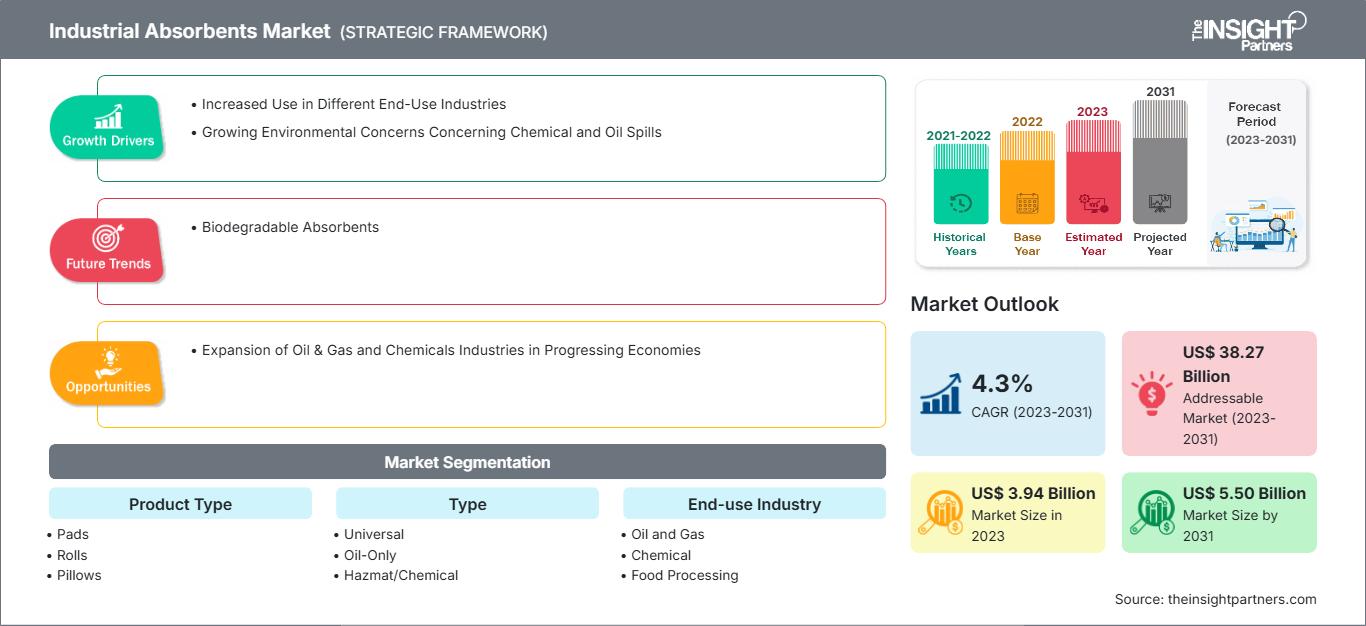

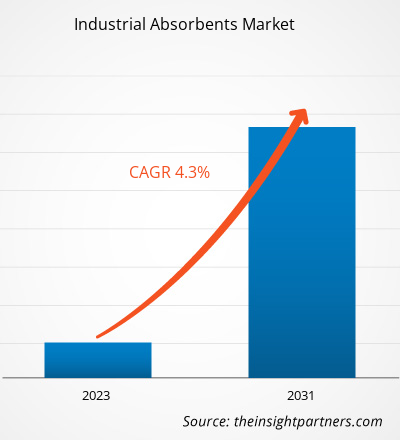

Se proyecta que el mercado de absorbentes industriales crecerá de US$ 3.940 millones en 2023 a US$ 5.500 millones en 2031; se espera que el mercado registre una CAGR del 4,3% entre 2023 y 2031. Es probable que la conceptualización de absorbentes industriales naturales siga siendo una tendencia clave, ya que desempeña un papel vital para garantizar la sostenibilidad ambiental al absorber derrames de petróleo y otros fluidos en diversos procesos industriales.

Análisis del mercado de absorbentes industriales.

El uso de absorbentes industriales es crucial en la industria de la gestión y seguridad ambiental, que se centra principalmente en productos diseñados para controlar y limpiar derrames de petróleo, productos químicos y otros materiales peligrosos. Estos absorbentes son vitales para mantener la seguridad en el lugar de trabajo y prevenir la contaminación ambiental, especialmente en industrias como la del petróleo y el gas, la fabricación de productos químicos, la farmacéutica y el procesamiento de alimentos. El mercado se ve impulsado por el auge de la actividad industrial a nivel mundial, así como por una mayor concienciación y las medidas regulatorias adoptadas para la protección del medio ambiente y la seguridad en el trabajo. Las operaciones de los sectores del petróleo y el gas y la química, junto con los derrames y vertidos accidentales, entre otros, tienen efectos peligrosos en los ecosistemas cercanos. Por lo tanto, las empresas están obligadas a implementar medidas efectivas de gestión y control de derrames. Es probable que la expansión de las industrias del petróleo y el gas y la química en las economías en desarrollo de Asia Pacífico, Oriente Medio y África genere importantes oportunidades de mercado en los próximos años.

Descripción general del mercado de absorbentes industriales

Las industrias de petróleo y gas, química, procesamiento de alimentos, atención médica y farmacéutica se encuentran entre los principales usuarios finales de absorbentes industriales. Se utilizan para limpiar derrames de petróleo a gran y pequeña escala en la industria del petróleo y gas. Los derrames accidentales de petróleo debido a descargas de combustible durante el procesamiento, fugas en unidades petroleras offshore a gran escala, accidentes durante la perforación petrolera y el transporte de petróleo por rutas oceánicas pueden representar una grave amenaza para el medio ambiente. Los derrames de petróleo deterioran la calidad del agua y afectan negativamente al ecosistema acuático. El aumento de los incidentes de derrames de petróleo impulsa la demanda de absorbentes industriales en la industria del petróleo y gas. Por ejemplo, según la International Tanker Owners Pollution Federation Limited, en 2023 se registró un derrame de petróleo de gran magnitud y nueve derrames de petróleo de tamaño mediano desde buques tanque, lo que representó aproximadamente 2000 toneladas de petróleo perdidas en el medio ambiente. Estos incidentes ocurrieron en Asia, África, Europa y América. El creciente número de refinerías de petróleo es otro factor que impulsa la demanda de absorbentes industriales. El creciente número de operaciones de perforación en la industria del petróleo y el gas en Norteamérica y Oriente Medio contribuye en gran medida a la creciente demanda de absorbentes industriales. En la industria química, los derrames de sustancias químicas suelen ocurrir durante el transporte de productos químicos almacenados. Los absorbentes industriales se utilizan ampliamente para la limpieza de productos químicos que pueden ser peligrosos si se dejan desatendidos. Por lo tanto, su creciente uso en diversas industrias, como la del petróleo y el gas, la química, el procesamiento de alimentos y la atención médica, impulsa el crecimiento del mercado de absorbentes industriales.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado de absorbentes industriales: perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluye análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de absorbentes industriales.

La creciente preocupación por los derrames de productos químicos y petróleo favorece el crecimiento del mercado.

Los derrames de petróleo son desastres ambientales duraderos con una amplia gama de impactos. Sus efectos pueden variar, desde mínimos hasta graves, según la magnitud y la ubicación del derrame. El petróleo puede matar animales y aves que viven en la superficie del agua, envenenándolos o asfixiándolos, o afectando su flotabilidad e impermeabilidad natural. La contaminación de los alimentos puede provocar desnutrición animal, que con el tiempo puede ir seguida de envenenamiento. Los daños pueden ser considerables si los derrames de petróleo ocurren en una zona con fauna silvestre. El petróleo obstruye la capacidad aislante del pelaje de los mamíferos y afecta la capacidad hidrófuga de las plumas de las aves. Sin aislamiento ni capacidad hidrófuga, los mamíferos y las aves pueden morir de hipotermia. Además, el petróleo y sus derivados contienen numerosos compuestos volátiles que se emiten en forma de gases. Estos gases pueden o no producir fuertes olores químicos, pero pueden contaminar el aire circundante, lo que podría suponer riesgos para la salud si se exponen a ellos durante un período prolongado. Además, una vez en el aire, los contaminantes pueden viajar largas distancias. Los niveles originales de contaminación en la fuente y las condiciones climáticas específicas pueden determinar la propagación final de los vapores atmosféricos contaminados con petróleo. Los derrames de petróleo, que dan lugar a manchas y brillos, también perjudican el atractivo estético y el valor recreativo de las aguas costeras, las costas, las playas, los humedales, etc. Las graves consecuencias incluyen la interrupción de las actividades recreativas en estas zonas, al menos temporalmente, hasta que se elimine el derrame y se complete el proceso de limpieza.

Los derrames de petróleo pueden tener efectos inmediatos en humanos, peces, animales, aves y la vida silvestre en general, si entran en contacto directo con el petróleo derramado, inhalan componentes volatilizados del petróleo, consumen alimentos contaminados en cualquier nivel de la cadena alimentaria, etc. Los gobiernos de varios países han implementado regulaciones sobre derrames de petróleo y sustancias químicas. Por ejemplo, el artículo 14 de la Ley de Operaciones de Petróleo y Gas de Canadá prescribe las medidas necesarias para prevenir la contaminación del aire, la tierra y el agua debido a la exploración, perforación, producción, almacenamiento, transporte, distribución y otras operaciones en la industria del petróleo y el gas. Por lo tanto, la creciente preocupación por el medio ambiente y las regulaciones asociadas para prevenir derrames de petróleo impulsan la demanda de absorbentes industriales en todo el mundo.

La expansión de las industrias de petróleo y gas y productos químicos en las economías en progreso creará oportunidades significativas

Según la Agencia Internacional de Energía, China e India han sido los principales contribuyentes a la producción total de petróleo en Asia Pacífico. La Administración de Información Energética de Estados Unidos clasifica a China como el quinto mayor productor de petróleo del mundo. Si bien Asia ha experimentado una disminución lenta pero constante de su participación en la producción mundial de petróleo, se espera que represente aproximadamente el 77 % del aumento de la demanda mundial de petróleo hasta 2025. Además, su dependencia de las importaciones de petróleo aumentaría al 81 % para 2025. China también es un centro de procesamiento químico y representa una parte significativa de los productos químicos producidos a nivel mundial. El país contribuye a más del 35 % de las ventas mundiales de productos químicos. Ante la creciente demanda mundial de diversos productos químicos, esta industria está ampliando sus operaciones de producción.

Según Invest India, India es el tercer mayor consumidor de energía y petróleo del mundo. El consumo de petróleo crudo y productos derivados del petróleo en India ascendió a 223,04 millones de toneladas métricas en el año fiscal 2023. Por lo tanto, la industria del petróleo y el gas en el país ha experimentado un auge, con empresas que realizan inversiones para aumentar los volúmenes de producción y satisfacer la creciente demanda. El Gobierno de India ha aprobado una orden que permite el 100% de la inversión extranjera directa (IED) en sectores como productos petrolíferos, refinerías y gas natural, bajo la vía automática, para empresas del sector público del petróleo y el gas. El país también cuenta con una industria de procesamiento químico altamente diversificada, que fabrica más de 70.000 productos. Ocupa el tercer lugar entre los mayores productores de productos químicos de Asia en términos de volumen, y el séptimo lugar a nivel mundial en términos de producción. Según la India Brand Equity Foundation, India es el cuarto mayor productor de agroquímicos del mundo. El país representa aproximadamente el 16% de la producción mundial de colorantes e intermedios de colorantes. La industria de colorantes en el país ha emergido como un negocio con una participación de mercado global de ~15%.

La industria química en Oriente Medio mantiene su dominio en la producción petroquímica mundial. La estrategia de diversificación implementada por varias empresas del sector petroquímico es un factor que favorece el crecimiento de la industria química en esta región. Por ejemplo, Saudi Aramco se unió a Dow Chemical para establecer una empresa conjunta que incluye unidades de proceso para la producción de una amplia gama de productos químicos, como éteres de glicol, polioles de poliéter, elastómeros de poliolefina, isocianatos y propilenglicol. Saudi Aramco completó la adquisición del 70% de SABIC a través del Fondo de Inversión Pública de Arabia Saudita para integrar sus negocios petroquímicos y procesos de refinación y así abordar las necesidades competitivas del mercado global.

Por lo tanto, es probable que dichos avances en las industrias de petróleo y gas y de productos químicos en los países en desarrollo creen importantes oportunidades de expansión para los actores del mercado de absorbentes industriales durante el período de pronóstico.

Análisis de segmentación del informe de mercado de absorbentes industriales

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de absorbentes industriales son el tipo de producto, el tipo y la industria de uso final.

- El mercado de absorbentes industriales, según el tipo de producto, se segmenta en compresas, rollos, almohadas, barreras absorbentes, calcetines y otros. El segmento de barreras absorbentes tuvo la mayor participación de mercado en 2023.

- Por tipo, el mercado se segmenta en absorbentes universales, solo para aceite y absorbentes químicos/de materiales peligrosos. Este último segmento representó la mayor participación del mercado de absorbentes industriales en 2023.

- En cuanto a la industria de uso final, el mercado de absorbentes industriales se segmenta en petróleo y gas, química, procesamiento de alimentos, salud, automotriz, entre otros. El segmento de petróleo y gas lideró el mercado en 2023 con la mayor participación en ingresos.

Análisis de la cuota de mercado de absorbentes industriales por geografía

Geográficamente, el mercado de absorbentes industriales se segmenta principalmente en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central. Asia Pacífico tuvo la mayor participación de mercado en 2023 y se espera que registre la mayor tasa de crecimiento anual compuesta (TCAC) durante el período de pronóstico. Asia Pacífico ha sido uno de los mercados más importantes para los absorbentes industriales, gracias al rápido crecimiento de las industrias química, petrolera, sanitaria, automotriz y de procesamiento de alimentos, entre otras. Las iniciativas y políticas gubernamentales fomentan la instalación de diversas plantas de fabricación mediante el fomento de la inversión extranjera directa (IED), impulsando aún más la industrialización en sus respectivos países. China, Corea del Sur, India, Australia y Japón se encuentran entre los principales contribuyentes al mercado de absorbentes industriales en Asia Pacífico. China tuvo la mayor participación de mercado en 2023, seguida de India con la segunda mayor participación. La Administración de Seguridad Marítima de China supervisa los incidentes de contaminación marina en aguas chinas y también es responsable de realizar investigaciones y responder a estos incidentes. El país también implementó una serie de nuevas regulaciones contra la contaminación para controlar el transporte marítimo entre 2010 y 2012. Este estricto marco regulatorio favorece el crecimiento del mercado de absorbentes industriales en China.

Perspectivas regionales del mercado de absorbentes industriales

Los analistas de The Insight Partners han explicado detalladamente las tendencias regionales y los factores que influyen en el mercado de absorbentes industriales durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de absorbentes industriales en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

Alcance del informe de mercado de absorbentes industriales

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 3.94 mil millones |

| Tamaño del mercado en 2031 | 5.500 millones de dólares estadounidenses |

| CAGR global (2023-2031) | 4,3% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2023-2031 |

| Segmentos cubiertos |

Por tipo de producto

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de los actores del mercado de absorbentes industriales: comprensión de su impacto en la dinámica empresarial

El mercado de absorbentes industriales está creciendo rápidamente, impulsado por la creciente demanda del usuario final debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y un mayor conocimiento de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una descripción general de los principales actores clave del mercado de absorbentes industriales.

Noticias y desarrollos recientes del mercado de absorbentes industriales

El mercado de absorbentes industriales se evalúa mediante la recopilación de datos cualitativos y cuantitativos tras la investigación primaria y secundaria, que incluye importantes publicaciones corporativas, datos de asociaciones y bases de datos. A continuación, se enumeran algunas de las novedades del mercado:

- Finite Fiber lanzó PurAbsorb, un superabsorbente industrial para la limpieza eficiente de derrames. (Fuente: Fibra Finita, comunicado de prensa, enero de 2024)

- Progressive Planet Solutions Inc. adquirió Absorbent Products Ltd., un importante fabricante de productos minerales derivados de tierra de diatomeas, zeolita y bentonita. (Fuente: Progressive Planet Solutions Inc., comunicado de prensa, febrero de 2022)

- Domtar amplió su planta de fabricación de Materiales Absorbentes de Ingeniería (EAM) en Jesup, Georgia, para respaldar su negocio de telas no tejidas de tendido por aire. (Fuente: Domtar, comunicado de prensa, mayo de 2021)

Informe de mercado sobre absorbentes industriales: cobertura y resultados

El informe "Tamaño y pronóstico del mercado de absorbentes industriales (2021-2031)" proporciona un análisis detallado del mercado que abarca las siguientes áreas:

- Tamaño del mercado de absorbentes industriales y pronósticos para todos los segmentos clave del mercado cubiertos bajo el alcance.

- Tendencias del mercado de absorbentes industriales, así como dinámicas del mercado como impulsores, restricciones y oportunidades clave.

- Análisis detallado de las cinco fuerzas de Porter y FODA

- Análisis del mercado de absorbentes industriales que cubre las tendencias clave del mercado, el marco del país, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama industrial y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes del mercado de absorbentes industriales.

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de absorbentes industriales

Obtenga una muestra gratuita para - Mercado de absorbentes industriales