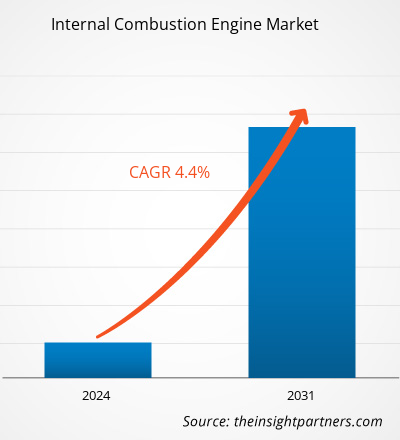

Se proyecta que el tamaño del mercado de motores de combustión interna alcance los 84.170,16 millones de dólares estadounidenses en 2031, frente a los 59.807,81 millones de dólares estadounidenses en 2023. Se espera que el mercado registre una CAGR del 4,4 % entre 2023 y 2031. Es probable que la aceptación del gas natural como combustible para la generación de energía en los sectores industrial y comercial siga siendo una tendencia clave en el mercado de motores de combustión interna.CAGR of 4.4% % in 2023–2031. The fueling acceptance of natural gas for power generation in, industrial, and commercial sectors is likely to remain key internal combustion engine market trends.

Análisis del mercado de motores de combustión interna

La creciente demanda de motores a gas natural en aplicaciones en industrias pesadas como la metalúrgica, la de procesamiento de alimentos y la química está impulsando significativamente el mercado. Además, la creciente preocupación por las emisiones y la mejora de los estándares regulatorios están ayudando al crecimiento del mercado en el sector automotriz. En el mercado de motores de combustión interna, los usuarios finales son la automoción, el petróleo y el gas intermedios, las industrias remotas, las industrias pesadas, la fabricación ligera, los servicios públicos, los vehículos todo terreno, los centros de datos, MUSH y el sector comercial.datacenters, MUSH, and commercial are end users.

Descripción general del mercado de motores de combustión interna

El aumento del calentamiento global es una de las principales preocupaciones ambientales en todo el mundo. Los gobiernos de varias naciones están imponiendo ciertas restricciones para controlar las emisiones de los motores diésel y de gasolina ; por lo tanto, el creciente énfasis en las alternativas respetuosas con el medio ambiente está obligando a los fabricantes de motores a desarrollar tecnologías para hacer que los motores de combustión interna sean más eficaces y produzcan menos emisiones. Los fabricantes y los clientes están dirigiendo ahora su atención hacia la aplicación de combustibles alternativos en los motores de combustión interna. Por ejemplo, los motores de combustión interna impulsados por gas natural emiten menos emisiones para producir la cantidad necesaria de energía con alta eficiencia. Las agencias de control y regulación de emisiones de varias naciones están aplicando estrictas regulaciones sobre el uso de motores diésel y generadores. Para cumplir con estas normas regulatorias, varias industrias están implementando motores y generadores de gas para la generación de energía.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Factores impulsores y oportunidades del mercado de motores de combustión interna

Aumento de producción de gas natural favorecerá mercado de motores de combustión interna

La demanda de motores de gas está aumentando en el sector de generación de energía con las nuevas políticas de control de emisiones. El sector industrial, que incluye las industrias de metales, productos químicos y manufactura, es un importante contribuyente a la creciente demanda de motores de gas. La generación de gas natural, que es un tipo de combustible necesario para los motores de combustión interna, está creciendo a un ritmo significativo. El sector industrial, que incluye las industrias de metales, productos químicos y manufactura, es un importante contribuyente a la creciente demanda de motores de combustión interna. La generación de gas natural, que es necesario para el funcionamiento de los motores de combustión interna, está aumentando a un ritmo sustancial. Las principales aplicaciones, como la generación de electricidad, la calefacción y el funcionamiento de los vehículos, están fortaleciendo la necesidad de motores de combustión interna a gas natural. Por lo tanto, para ofrecer una solución a los cortes de energía repentinos, las empresas de servicios públicos están utilizando generadores de gas para gestionar las cargas pico. Por lo tanto, el aumento constante de la demanda de los países en desarrollo es uno de los factores clave que impulsan el crecimiento del mercado de motores de combustión interna.

La creciente adopción de motores de gas en los países en desarrollo: una oportunidad en el mercado de motores de gas

El aumento de la población y la falta de infraestructura de apoyo para las tecnologías eléctricas son los principales factores que sustentan el mercado de los motores de combustión interna. Los dispositivos eléctricos, los motores eléctricos, las plantas solares y los proyectos eólicos son más costosos que los motores de gas, lo que obliga a varias naciones a preferir los motores de gas como una alternativa respetuosa con el medio ambiente. Además, los avances en las normas de emisión para los motores diésel han hecho que varias industrias de uso final estén cambiando a los motores de gas por sus bajas emisiones. Las naciones emergentes se están inclinando efectivamente por adoptar el gas natural para la generación de energía. Por lo tanto, se prevé que la creciente popularidad del gas natural ofrezca oportunidades lucrativas para el mercado de los motores de combustión interna.

Informe de mercado de motores de combustión interna Análisis de segmentación

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de motores de combustión interna son el tipo de combustible, la potencia de salida y el usuario final.

- Según el tipo de combustible, el mercado de motores de combustión interna se ha dividido en diésel, gasolina y gas natural. El segmento de gasolina tuvo una mayor participación de mercado en 2023.

- En términos de potencia de salida, el mercado se ha segmentado en 100-300 kW, 300-500 kW, 0,5-1 MW, 1-5 MW, 5-15 MW, 15-25 MW y 25 MW y más. El segmento de 100-300 kW dominó el mercado en 2023.

- En términos de usuario final, el mercado se ha segmentado en los sectores industrial, marítimo, de generación de energía, aeroespacial y de defensa, automotriz, todoterreno y otros. El segmento automotriz dominó el mercado en 2023.

- En términos de cilindros, el mercado se ha segmentado en 1, 2, 3 y 4. El segmento de 4 cilindros dominó el mercado en 2023.

Análisis de la cuota de mercado de los motores de combustión interna por geografía

El alcance geográfico del informe del mercado de motores de combustión interna se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Medio Oriente y África, y América del Sur / América del Sur y Central.

El mercado de motores de combustión interna en Asia Pacífico está segmentado en India, Japón, Australia, China, Corea del Sur y el resto de Asia Pacífico. China es uno de los principales países fabricantes de motores de combustión interna en esta región, mientras que India y Japón también se consideran contribuyentes sustanciales al crecimiento regional. Debido al aumento de la población en países en desarrollo como India y China, existe una creciente demanda de electricidad; por lo tanto, los usuarios finales, como las plantas generadoras de energía, las plantas remotas y las industrias manufactureras, están utilizando motores de combustión interna para la generación de energía. El creciente número de empresas manufactureras en India y China se caracteriza por la producción en masa de motores de combustión interna para automóviles y generación de energía, debido a la disponibilidad sustancial de recursos humanos capacitados. Debido al alto costo de los motores de energía eléctrica y la falta de infraestructura de apoyo, hay un aumento en la adopción de motores de combustión interna convencionales, lo que ha complementado el crecimiento del mercado. Además, los gobiernos de varias naciones de la región están promoviendo en gran medida la aplicación de gas natural en motores de combustión interna para bajas emisiones.

Perspectivas regionales del mercado de motores de combustión interna

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de motores de combustión interna durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de motores de combustión interna en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de motores de combustión interna

Alcance del informe de mercado de motores de combustión interna

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 59.807,81 millones |

| Tamaño del mercado en 2031 | US$ 84.170,16 millones |

| CAGR global (2023 - 2031) | 4,4% % |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por tipo de combustible

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado: comprensión de su impacto en la dinámica empresarial

El mercado de motores de combustión interna está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de motores de combustión interna son:

- INNIO Jenbacher GmBH & Co. OG

- Oruga inc.

- Fabricante: Cummins Inc.

- Fairbanks Morse, LLC

- Industrias pesadas Kawasaki, Ltd.

- Liebherr

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de motores de combustión interna

Noticias y desarrollos recientes del mercado de motores de combustión interna

El mercado de motores de combustión interna se evalúa mediante la recopilación de datos cualitativos y cuantitativos posteriores a la investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se incluye una lista de los avances en el mercado en materia de innovaciones, expansión comercial y estrategias:

- En mayo de 2022, Caterpillar Inc. anunció un proyecto de tres años con District Energy St. Paul, con sede en Minnesota, para demostrar un sistema combinado de calor y energía impulsado por hidrógeno. (Fuente: Caterpillar Inc., comunicado de prensa/sitio web de la empresa/boletín informativo)

- En mayo de 2024, Cummins Inc. anunció el inicio de la producción de sus motores de combustión interna de hidrógeno para Tata Motors en Jamshedpur, India. (Fuente: Cummins Inc., comunicado de prensa/sitio web de la empresa/boletín informativo)

Informe de mercado sobre motores de combustión interna: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de motores de combustión interna (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado de motores de combustión interna y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Dinámica del mercado, como impulsores, restricciones y oportunidades clave

- Tendencias del mercado de motores de combustión interna

- Análisis PEST y FODA detallados

- Análisis del mercado de motores de combustión interna que cubre las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado

- Análisis de la industria, panorama y competencia de los motores de combustión interna, que abarca la concentración del mercado, análisis de mapas de calor, actores destacados y desarrollos recientes

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de motores de combustión interna

Obtenga una muestra gratuita para - Mercado de motores de combustión interna