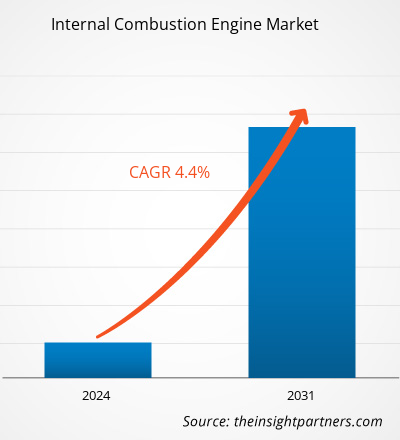

La taille du marché des moteurs à combustion interne devrait atteindre 84 170,16 millions USD d'ici 2031, contre 59 807,81 millions USD en 2023. Le marché devrait enregistrer un TCAC de 4,4 % en 2023-2031. L'acceptation du gaz naturel comme carburant pour la production d'électricité dans les secteurs industriel et commercial devrait rester l'une des principales tendances du marché des moteurs à combustion interne.

Analyse du marché des moteurs à combustion interne

La demande croissante de moteurs à gaz naturel dans les applications des industries lourdes telles que la métallurgie, la transformation des aliments et les produits chimiques stimule considérablement le marché. En outre, les préoccupations croissantes concernant les émissions et l'amélioration des normes réglementaires contribuent à la croissance du marché dans le secteur automobile. Sur le marché des moteurs à combustion interne, les utilisateurs finaux sont l'automobile, le pétrole et le gaz intermédiaires, les industries lourdes et éloignées, l'industrie légère, les services publics, le tout-terrain, les centres de données, les MUSH et le commerce.

Aperçu du marché des moteurs à combustion interne

Le réchauffement climatique est une préoccupation majeure pour l'environnement dans le monde entier. Les gouvernements de plusieurs pays imposent certaines restrictions pour contrôler les émissions des moteurs diesel et essence . L'importance croissante accordée aux alternatives respectueuses de l'environnement oblige donc les fabricants de moteurs à développer des technologies pour rendre les moteurs à combustion interne plus efficaces et produire moins d'émissions. Les fabricants et les clients se tournent désormais vers l'utilisation de carburants alternatifs dans les moteurs à combustion interne. Par exemple, les moteurs à combustion interne alimentés au gaz naturel émettent moins d'émissions pour produire la quantité nécessaire d'énergie avec un rendement élevé. Les organismes de surveillance et de réglementation des émissions de plusieurs pays appliquent des réglementations strictes sur l'utilisation des moteurs et des générateurs diesel. Pour respecter ces normes réglementaires, plusieurs industries mettent en œuvre des moteurs et des générateurs à gaz pour la production d'électricité.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que d'offres et de remises exceptionnelles pour les start-ups et les universités.

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Moteurs à combustion interne : moteurs et opportunités du marché

L'augmentation de la production de gaz naturel favoriserait le marché des moteurs à combustion interne

La demande de moteurs à gaz augmente dans le secteur de la production d'électricité avec de nouvelles politiques de contrôle des émissions. Le secteur industriel, notamment les industries des métaux, des produits chimiques et de la fabrication, contribue largement à la demande croissante de moteurs à gaz. La production de gaz naturel, qui est l'un des types de carburant nécessaires aux moteurs à combustion interne, augmente à un rythme soutenu. Les principales applications telles que la production d'électricité, le chauffage et le fonctionnement des véhicules renforcent le besoin de moteurs à combustion interne au gaz naturel. Par conséquent, pour offrir une solution aux pannes de courant soudaines, les sociétés de services publics utilisent des générateurs de gaz pour gérer les charges de pointe. Ainsi, l'augmentation constante de la demande des pays en développement est l'un des facteurs clés de la croissance du marché des moteurs à combustion interne.

Adoption croissante des moteurs à gaz dans les pays en développement – Une opportunité sur le marché des moteurs à gaz

L'augmentation de la population et le manque d'infrastructures de soutien aux technologies électriques sont les principaux facteurs qui soutiennent le marché des moteurs à combustion interne. Les appareils électriques, les moteurs électriques, les centrales solaires et les projets éoliens sont plus coûteux que les moteurs à gaz, ce qui incite de nombreux pays à préférer les moteurs à gaz comme alternative respectueuse de l'environnement. En outre, les normes d'émission des moteurs diesel évoluent, ce qui incite de nombreuses industries à se tourner vers les moteurs à gaz pour réduire leurs émissions. Les pays émergents sont enclins à adopter le gaz naturel pour la production d'électricité. Ainsi, la popularité croissante du gaz naturel devrait offrir des opportunités lucratives pour le marché des moteurs à combustion interne.

Analyse de segmentation du rapport sur le marché des moteurs à combustion interne

Les segments clés qui ont contribué à l’élaboration de l’analyse du marché des moteurs à combustion interne sont le type de carburant, la puissance de sortie et l’utilisateur final.

- En fonction du type de carburant, le marché des moteurs à combustion interne a été divisé en diesel, essence et gaz naturel. Le segment de l'essence détenait une part de marché plus importante en 2023.

- En termes de puissance de sortie, le marché a été segmenté en 100-300 kW, 300-500 kW, 0,5-1 MW, 1-5 MW, 5-15 MW, 15-25 MW et 25 MW et plus. Le segment 100-300 kW a dominé le marché en 2023.

- En termes d'utilisateur final, le marché a été segmenté en secteurs industriel, maritime, de production d'énergie, aérospatiale et de défense, automobile, tout-terrain et autres. Le segment automobile a dominé le marché en 2023.

- En termes de cylindres, le marché a été segmenté en 1, 2, 3 et 4. Le segment des 4 cylindres a dominé le marché en 2023.

Analyse des parts de marché des moteurs à combustion interne par zone géographique

La portée géographique du rapport sur le marché des moteurs à combustion interne est principalement divisée en cinq régions : Amérique du Nord, Asie-Pacifique, Europe, Moyen-Orient et Afrique, et Amérique du Sud/Amérique du Sud et centrale.

Le marché des moteurs à combustion interne en Asie-Pacifique est segmenté en Inde, Japon, Australie, Chine, Corée du Sud et reste de l'Asie-Pacifique. La Chine est l'un des principaux pays fabricants de moteurs à combustion interne dans cette région, tandis que l'Inde et le Japon sont également considérés comme des contributeurs substantiels à la croissance régionale. En raison de la croissance démographique dans les pays en développement comme l'Inde et la Chine, la demande en électricité augmente ; ainsi, les utilisateurs finaux tels que les centrales électriques, les usines isolées et les industries manufacturières utilisent des moteurs à combustion interne pour la production d'électricité. Le nombre croissant d'entreprises manufacturières en Inde et en Chine se caractérise par la production de masse de moteurs à combustion interne pour l'automobile et la production d'électricité, en raison de la disponibilité substantielle de ressources humaines qualifiées. En raison du coût élevé des moteurs à énergie électrique et du manque d'infrastructures de soutien, l'adoption de moteurs à combustion interne conventionnels augmente, ce qui a complété la croissance du marché. De plus, les gouvernements de divers pays de la région encouragent principalement l'application du gaz naturel dans les moteurs à combustion interne pour réduire les émissions.

Aperçu régional du marché des moteurs à combustion interne

Les tendances et facteurs régionaux influençant le marché des moteurs à combustion interne tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché des moteurs à combustion interne en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des moteurs à combustion interne

Portée du rapport sur le marché des moteurs à combustion interne

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | 59 807,81 millions USD |

| Taille du marché d'ici 2031 | 84 170,16 millions USD |

| Taux de croissance annuel composé mondial (2023-2031) | 4,4% % |

| Données historiques | 2021-2022 |

| Période de prévision | 2024-2031 |

| Segments couverts |

Par type de carburant

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché : comprendre son impact sur la dynamique des entreprises

Le marché des moteurs à combustion interne connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des moteurs à combustion interne sont :

- INNIO Jenbacher GmBH & Co OG

- Caterpillar Inc.

- Cummins Inc.

- Fairbanks Morse, LLC

- Kawasaki Heavy Industries, Ltée.

- Liebherr

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché des moteurs à combustion interne

Actualités et développements récents du marché des moteurs à combustion interne

Le marché des moteurs à combustion interne est évalué en collectant des données qualitatives et quantitatives après des recherches primaires et secondaires, qui comprennent des publications d'entreprise importantes, des données d'association et des bases de données. Voici une liste des développements sur le marché des innovations, de l'expansion commerciale et des stratégies :

- En mai 2022, Caterpillar Inc. a annoncé un projet de trois ans avec District Energy St. Paul, une société basée au Minnesota, pour démontrer un système de cogénération à l'hydrogène. (Source : Caterpillar Inc., communiqué de presse/site Web de l'entreprise/bulletin d'information)

- En mai 2024, Cummins Inc. a annoncé le lancement de la production de ses moteurs à combustion interne à hydrogène pour Tata Motors à Jamshedpur, en Inde. (Source : Cummins Inc., Communiqué de presse/Site Web de l'entreprise/Bulletin d'information)

Rapport sur le marché des moteurs à combustion interne : couverture et livrables

Le rapport « Taille et prévisions du marché des moteurs à combustion interne (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines suivants :

- Taille du marché des moteurs à combustion interne et prévisions aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le périmètre

- Dynamique du marché, comme les facteurs moteurs, les contraintes et les opportunités clés

- Tendances du marché des moteurs à combustion interne

- Analyse PEST et SWOT détaillée

- Analyse du marché des moteurs à combustion interne couvrant les principales tendances du marché, le cadre mondial et régional, les principaux acteurs, les réglementations et les développements récents du marché

- Analyse de l'industrie des moteurs à combustion interne, du paysage et de la concurrence, couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents

- Profils d'entreprise détaillés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché des moteurs à combustion interne

Obtenez un échantillon gratuit pour - Marché des moteurs à combustion interne