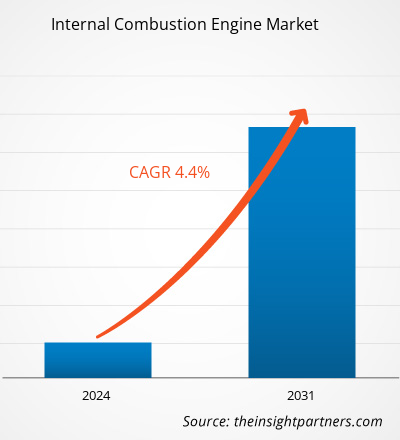

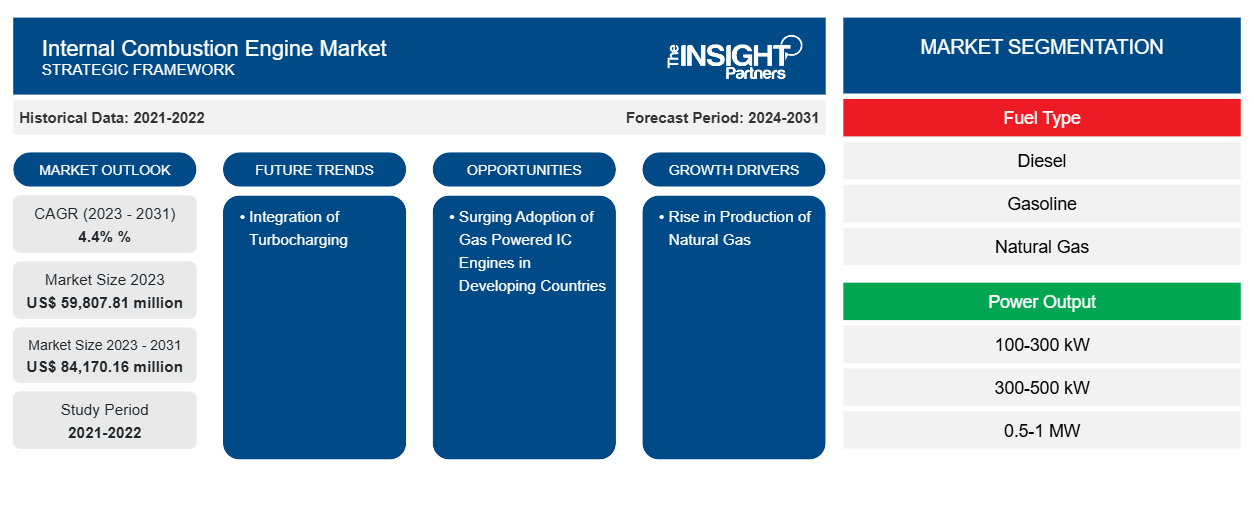

Si prevede che la dimensione del mercato dei motori a combustione interna raggiungerà gli 84.170,16 milioni di dollari entro il 2031, rispetto ai 59.807,81 milioni di dollari del 2023. Si prevede che il mercato registrerà un CAGR del 4,4% nel 2023-2031. È probabile che l'accettazione del gas naturale per la produzione di energia nei settori industriale e commerciale rimanga una delle principali tendenze del mercato dei motori a combustione interna.

Analisi di mercato dei motori a combustione interna

L'aumento della domanda di motori alimentati a gas naturale in applicazioni in industrie pesanti come metallurgia, lavorazione alimentare e prodotti chimici sta guidando significativamente il mercato. Inoltre, le crescenti preoccupazioni in merito alle emissioni e il miglioramento degli standard normativi stanno aiutando la crescita del mercato nel settore automobilistico. Nel mercato dei motori a combustione interna, automotive, mid-stream oil and gas, remote, industrie pesanti, produzione leggera, servizi di pubblica utilità, off-road, data center, MUSH e commerciale sono utenti finali.

Panoramica del mercato dei motori a combustione interna

Il crescente riscaldamento globale è una delle principali preoccupazioni ambientali in tutto il mondo. I governi di varie nazioni stanno imponendo alcune restrizioni per controllare le emissioni dei motori diesel e a benzina ; pertanto, la crescente enfasi sulle alternative ecocompatibili sta costringendo i produttori di motori a sviluppare tecnologie per rendere i motori a combustione interna più efficaci e produrre meno emissioni. Produttori e clienti stanno ora spostando la loro attenzione verso l'applicazione di carburanti alternativi nei motori a combustione interna. Ad esempio, i motori a combustione interna alimentati a gas naturale emettono meno emissioni per produrre una quantità necessaria di energia con elevata efficienza. Le agenzie di monitoraggio delle emissioni e di regolamentazione di varie nazioni stanno applicando rigide normative sull'uso di motori diesel e generatori. Per soddisfare questi standard normativi, diverse industrie stanno implementando motori a gas e generatori per la produzione di energia.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

-

Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Driver e opportunità del mercato dei motori a combustione interna

Aumento della produzione di gas naturale per favorire il mercato dei motori a combustione interna

The demand for gas engines is increasing in the power generation sector with new emission control policies. The industrial sector, including metals, chemicals, and manufacturing industries, is a major contributor to the escalating demand for gas engines. The generation of natural gas, which is one type of fuel required for internal combustion engines, is growing at a significant rate. The industrial sector, including metals, chemicals, and manufacturing industries, is a major contributor to the accelerating demand for internal combustion engines. The generation of natural gas, which is necessary for operating internal combustion engines, is rising at a substantial rate. Major applications such as electricity generation, heating, and vehicle functioning are strengthening the requirement for natural gas internal combustion engines. Hence, to offer a resolution for sudden power outages, utility service companies are utilizing gas generators to manage peak loads. Thus, the constant surge in demand from developing countries is one of the key factors driving the internal combustion engine market growth.

Rising Adoption of Gas Engines in Developing Nations– An Opportunity in the Gas Engine Market

The increase in population and the lack of supporting infrastructure for electric technologies are the major factors supporting the internal combustion engine market. Electric devices, electric motors, solar plants, and wind projects are more costly than gas engines, which is compelling the preference of various nations toward gas engines as an environment-friendly alternative. Further, developments in the emission standards for diesel engines for which various end-use industries are shifting to gas engines for low emissions. Emerging nations are effectively inclining towards adopting natural gas for power generation. Thus, the growing popularity of natural gas is anticipated to offer lucrative opportunities for the internal combustion engine market.

Internal Combustion Engine Market Report Segmentation Analysis

Key segments that contributed to the derivation of the internal combustion engine market analysis are fuel type, power output, and end-user.

- Based on the fuel type, the internal combustion engine market has been divided into diesel, gasoline, and natural gas. The gasoline segment held a larger market share in 2023.

- In terms of power output, the market has been segmented into 100-300 kW, 300-500 kW, 0.5-1 MW, 1-5 MW, 5-15 MW, 15-25 MW, and 25 MW and above. The 100-300 kW segment dominated the market in 2023.

- In terms of end-user, the market has been segmented into industrial, marine, power generation, aerospace, and defense, automotive, off-road, and others. The automotive segment dominated the market in 2023.

- In terms of cylinders, the market has been segmented into 1, 2, 3, and 4. The 4 cylinders segment dominated the market in 2023.

Internal Combustion Engine Market Share Analysis by Geography

The geographic scope of the Internal Combustion Engine Market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

The internal combustion engine market in the Asia Pacific is segmented into India, Japan, Australia, China, South Korea, and the Rest of Asia Pacific. China is one of the leading internal combustion engine manufacturing countries in this region, while India and Japan are also considered substantial contributors to regional growth. Due to the increasing population in developing nations like India and China, there is an increasing demand for electricity; thus, end users such as power generating plants, remote plants and manufacturing industries are utilizing internal combustion engines for power generation. The rising number of manufacturing companies in India and China is characterized by the mass production of internal combustion engines for automobile and power generation, owing to the substantial availability of skilled human resources. Due to the high cost of electric energy engines and the lack of supporting infrastructure, there is a rise in the adoption of conventional internal combustion engines, which has supplemented the market growth. Moreover, governments of various nations in the region are majorly promoting natural gas application in internal combustion engines for low emissions.

Internal Combustion Engine Market Regional Insights

The regional trends and factors influencing the Internal Combustion Engine Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Internal Combustion Engine Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Internal Combustion Engine Market

Internal Combustion Engine Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 59,807.81 million |

| Market Size by 2031 | US$ 84,170.16 million |

| Global CAGR (2023 - 2031) | 4.4% % |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Fuel Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Densità degli attori del mercato: comprendere il suo impatto sulle dinamiche aziendali

Il mercato dei motori a combustione interna sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato dei motori a combustione interna sono:

- INNIO Jenbacher GmbH & Co OG

- Caterpillar Inc.

- Società per azioni Cummins Inc.

- Società a responsabilità limitata Fairbanks Morse

- Azienda

- Liebherr

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato dei motori a combustione interna

Notizie e sviluppi recenti sul mercato dei motori a combustione interna

Il mercato dei motori a combustione interna viene valutato raccogliendo dati qualitativi e quantitativi dopo la ricerca primaria e secondaria, che include importanti pubblicazioni aziendali, dati associativi e database. Di seguito è riportato un elenco degli sviluppi nel mercato per innovazioni, espansione aziendale e strategie:

- Nel maggio 2022, Caterpillar Inc. ha annunciato un progetto triennale con District Energy St. Paul, con sede in Minnesota, per dimostrare un sistema di cogenerazione di calore ed energia elettrica alimentato a idrogeno. (Fonte: Caterpillar Inc., comunicato stampa/sito Web aziendale/newsletter)

- Nel maggio 2024, Cummins Inc. ha annunciato l'avvio della produzione dei suoi motori a combustione interna a idrogeno per Tata Motors a Jamshedpur, in India. (Fonte: Cummins Inc., comunicato stampa/sito Web aziendale/newsletter)

Copertura e risultati del rapporto sul mercato dei motori a combustione interna

Il rapporto "Dimensioni e previsioni del mercato dei motori a combustione interna (2021-2031)" fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni del mercato dei motori a combustione interna e previsioni a livello globale, regionale e nazionale per tutti i segmenti di mercato chiave coperti dall'ambito

- Dinamiche di mercato come fattori trainanti, vincoli e opportunità chiave

- Tendenze del mercato dei motori a combustione interna

- Analisi PEST e SWOT dettagliate

- Analisi di mercato dei motori a combustione interna che copre le principali tendenze del mercato, il quadro globale e regionale, i principali attori, le normative e i recenti sviluppi del mercato

- Analisi del settore, del panorama e della concorrenza dei motori a combustione interna, che copre la concentrazione del mercato, l'analisi della mappa di calore, i principali attori e gli sviluppi recenti

- Profili aziendali dettagliati

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato dei motori a combustione interna

Ottieni un campione gratuito per - Mercato dei motori a combustione interna