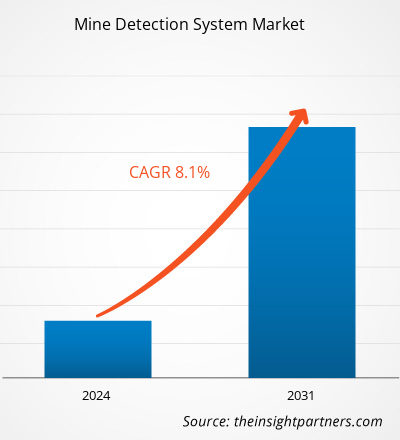

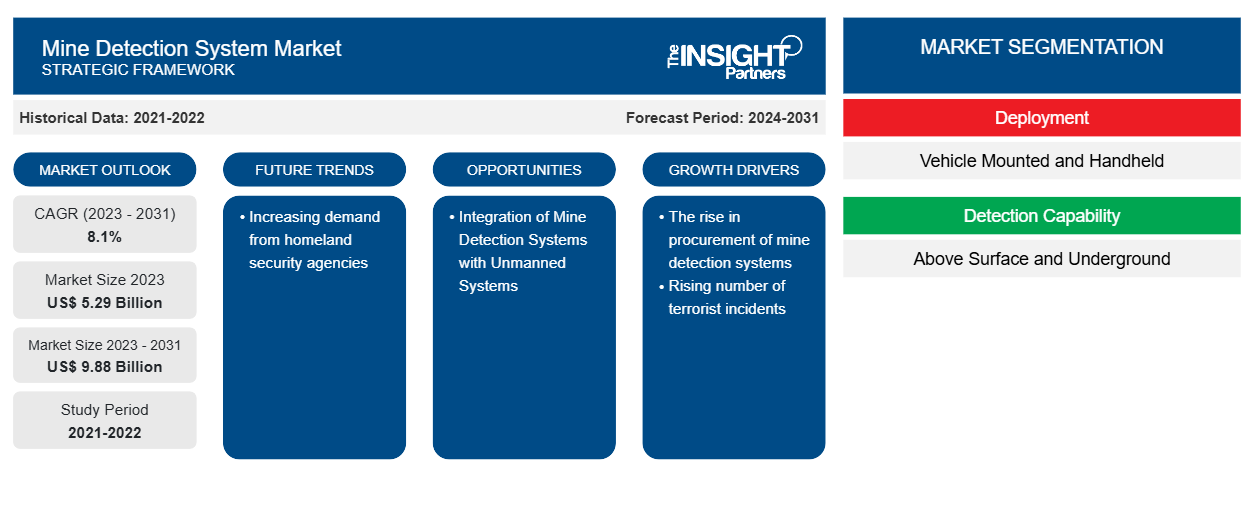

Se proyecta que el tamaño del mercado de sistemas de detección de minas alcance los 9.880 millones de dólares en 2031, frente a los 5.290 millones de dólares en 2023. Se espera que el mercado registre una CAGR del 8,1 % durante el período 2023-2031. Es probable que la creciente demanda de las agencias de seguridad nacional siga siendo una tendencia clave en el mercado.

Análisis del mercado de sistemas de detección de minas

Los sistemas de detección de minas se encuentran entre los productos más demandados en las fuerzas de defensa y seguridad nacional. Esto se debe a la importancia de los sistemas para la seguridad de una nación. Las fuerzas de defensa dependen en gran medida de los actores del mercado de sistemas de detección de minas bien establecidos. La mayor dependencia de los principales contratistas de defensa refleja un mayor número de contratos adjudicados a los contratistas. Debido a esto, la entrada al mercado de actores del mercado de sistemas de detección de minas más pequeños o regionales está restringida. Este factor se ha analizado para comprender la amenaza para los nuevos participantes en el sistema de detección de minas.

Descripción general del mercado de sistemas de detección de minas

Los principales actores en el ecosistema del mercado global de sistemas de detección de minas incluyen componentes, fabricantes de sistemas de detección de minas y usuarios finales. Los proveedores de componentes de sistemas de detección de minas proporcionan productos como sensores electromagnéticos, radares, sensores ópticos y sistemas de detección térmica. Cualquier interrupción en el suministro de los componentes afecta negativamente la producción del producto final. Por lo tanto, los fabricantes de componentes desempeñan un papel crucial en el ecosistema del mercado de sistemas de detección de minas.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Factores impulsores y oportunidades del mercado de sistemas de detección de minas

Aumento de la adquisición de sistemas de detección de minas

La frecuencia de los conflictos armados entre países está aumentando a un ritmo alarmante, lo que genera una mayor necesidad de que las fuerzas de defensa de los países refuercen sus medidas de seguridad. Además, tanto los países desarrollados como los países en desarrollo han experimentado un aumento significativo del gasto militar a lo largo de los años. Por ejemplo, según los datos publicados por el Instituto Internacional de Investigación para la Paz de Estocolmo (SIPRI), en 2022, el gasto militar mundial experimentó un aumento del 8,4% en comparación con 2019. Una parte sustancial de la asignación presupuestaria se define para la adquisición de tecnologías de contramedidas, incluidos sistemas de detección de minas en diferentes fuerzas armadas y agencias de aplicación de la ley.

Integración de sistemas de detección de minas con sistemas no tripulados

Las contramedidas contra minas están sufriendo una importante transformación, debido a la evolución de tecnologías disruptivas, desde la tradicional búsqueda de minas con cazaminas de buques grises hasta la utilización de vehículos autónomos no tripulados para la misma. Los sistemas no tripulados y autónomos que operan sobre y bajo el agua han progresado de forma constante durante la última década, alcanzando grados de madurez que ahora son capaces de ser utilizados como detectores de minas. Garantizar la seguridad del personal naval y evitar que sufra bajas son los aspectos más críticos de las contramedidas contra minas. El uso de tecnologías no tripuladas y autónomas es un gran paso adelante en este ámbito. Esto ha influido en empresas como el grupo Thales para ofrecer productos de detección de minas que se pueden integrar fácilmente con vehículos autónomos no tripulados.

Análisis de segmentación del informe de mercado del sistema de detección de minas

Los segmentos clave que contribuyeron a la derivación del análisis del mercado del sistema de detección de minas son la implementación, la capacidad de detección y el usuario final.

- Según la implementación, el mercado de sistemas de detección de minas se divide en sistemas montados en vehículos y portátiles. El segmento portátil tuvo una mayor participación de mercado en 2023.

- Según la capacidad de detección, el mercado de sistemas de detección de minas se divide en superficial y subterráneo. El segmento subterráneo tuvo una mayor participación de mercado en 2023.

- Según el usuario final, el mercado de sistemas de detección de minas se segmenta en defensa y seguridad nacional. El segmento de defensa tuvo una mayor participación de mercado en 2023.

Análisis de la cuota de mercado de los sistemas de detección de minas por geografía

El alcance geográfico del informe de mercado del sistema de detección de minas se divide principalmente en cinco regiones: América del Norte, Europa, Asia Pacífico, Medio Oriente y África, y América del Sur.

En 2023, América del Norte dominó el mercado, seguida de Europa y la región de Asia Pacífico. Además, es probable que Asia Pacífico también experimente la CAGR más alta en los próximos años. Estados Unidos dominó el mercado de sistemas de detección de minas de América del Norte en 2023. Estados Unidos tiene el mayor presupuesto de defensa del mundo y destina una cantidad significativa de presupuesto a la adquisición y actualización de varios sistemas de armas. Esto demuestra la demanda de adquisición de nuevos sistemas de detección de minas, lo que pone de relieve el crecimiento del mercado. Un número cada vez mayor de armas en los servicios militares estadounidenses es un factor de apoyo importante para el crecimiento del mercado, ya que las empresas están desarrollando sistemas de armas avanzados para prevenir ataques terrestres, submarinos y aéreos. Además, la creciente mejora del sistema de armas de la marina con una mayor penetración del sistema de detección de minas es un factor clave que aumenta el crecimiento del mercado.

Perspectivas regionales del mercado de sistemas de detección de minas

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de sistemas de detección de minas durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de sistemas de detección de minas en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de sistemas de detección de minas

Alcance del informe de mercado del sistema de detección de minas

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | 5.29 mil millones de dólares estadounidenses |

| Tamaño del mercado en 2031 | US$ 9.88 mil millones |

| CAGR global (2023 - 2031) | 8,1% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por implementación

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado: comprensión de su impacto en la dinámica empresarial

El mercado de sistemas de detección de minas está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de sistemas de detección de minas son:

- MBDA

- Sistemas BAE

- Grupo Chemring PLC

- Compañía: DCD Ltd.

- Industrias Aeroespaciales de Israel Ltd.

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de sistemas de detección de minas

Noticias y desarrollos recientes del mercado de sistemas de detección de minas

El mercado de sistemas de detección de minas se evalúa mediante la recopilación de datos cualitativos y cuantitativos a partir de una investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se enumeran algunos de los avances en el mercado de sistemas de detección de minas:

- Northrop Grumman Corporation (NYSE: NOC) ha obtenido un contrato de Korea Aerospace Industries, Ltd. (KAI) para proporcionar soluciones de sistemas de detección de minas por láser aerotransportados (ALMDS) y soporte técnico para la fase de ingeniería, fabricación y diseño (EMD) del programa de helicópteros coreanos de contramedidas contra minas (KMCH) de la República de Corea. Se espera que la fase EMD se complete en 2027. (Fuente: Northrop Grumman Corporation, comunicado de prensa, octubre de 2023)

- Raytheon Missiles & Defense demostró el sistema de detección de minas con sonar AN/AQS-20C en un ejercicio en la bahía de Narragansett en Rhode Island para el Reino Unido y otros posibles clientes internacionales. (Fuente: Raytheon Technologies Corporation, comunicado de prensa, 2021)

Informe de mercado sobre sistemas de detección de minas: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de sistemas de detección de minas (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado de sistemas de detección de minas y pronóstico a nivel mundial, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de sistemas de detección de minas, así como dinámica del mercado, como impulsores, restricciones y oportunidades clave

- Análisis detallado de las cinco fuerzas de Porter

- Análisis del mercado de sistemas de detección de minas que abarca las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes del mercado de sistemas de detección de minas

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de sistemas de detección de minas

Obtenga una muestra gratuita para - Mercado de sistemas de detección de minas