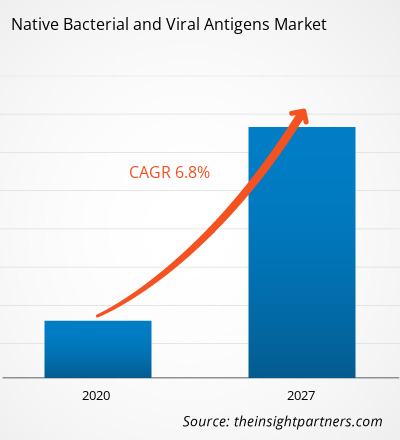

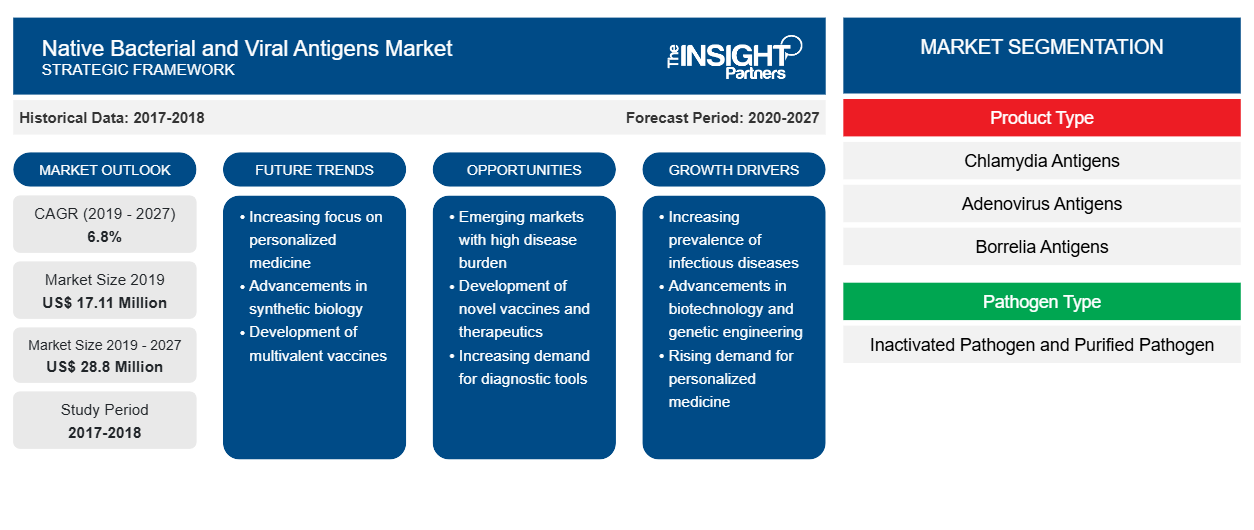

Se espera que el mercado de antígenos bacterianos y virales nativos alcance los US$ 28.801,15 mil para 2027 desde los US$ 17.105,05 mil en 2019; se estima que crecerá a una CAGR del 6,8% entre 2020 y 2027.

Los antígenos nativos se extraen en su forma natural de las fuentes respectivas. A medida que experimentan modificaciones habituales in vivo , al aislarlos, exhiben una gran semejanza con la compleja estructura tridimensional que exhiben en el huésped. En el caso de los antígenos proteicos, estas modificaciones pueden incluir alteraciones postraduccionales como la escisión de proteínas precursoras, la formación de enlaces disulfuro y la adición de grupos de bajo peso molecular a través de procesos como la glicosilación o la fosforilación. El mercado mundial de antígenos bacterianos y virales nativos está impulsado por factores como el uso creciente de antígenos microbianos nativos en diagnósticos y terapias, y la creciente prevalencia de enfermedades infecciosas. Sin embargo, las limitaciones asociadas con los antígenos nativos, como el alto costo, los bajos niveles de producción de antígenos y las dificultades de ampliación, obstaculizan el crecimiento del mercado. Sin embargo , los mercados emergentes están creando oportunidades de crecimiento para los actores del mercado.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Perspectivas del mercado

Uso creciente de antígenos microbianos nativos en diagnósticos y terapias

Los antígenos son biomoléculas capaces de desencadenar una respuesta inmunitaria en el organismo del huésped mediante la activación de los linfocitos. Los antígenos bacterianos se utilizan en el desarrollo de diversos tipos de anticuerpos en los laboratorios de investigación para mejorar el sistema inmunitario. Además, los antígenos bacterianos también se utilizan ampliamente en ensayos de inmunodiagnóstico como el ELISA.

La selección de bibliotecas de antígenos nativos ha llevado al desarrollo de potentes anticuerpos neutralizantes contra diversas infecciones bacterianas y víricas. Los antígenos nativos se extraen en su forma natural de una fuente correspondiente. Existe una gran demanda de una gran cantidad de antígenos nativos, especialmente en el diagnóstico in vitro y la investigación de vacunas. Según varios estudios científicos, los antígenos recombinantes presentan problemas de solubilidad y agregación. Además, la asociación de antígenos recombinantes con entidades no proteicas también es diferente y, a veces, deficiente en términos de rendimiento en comparación con los antígenos nativos.

Con el reciente brote de COVID-19, las empresas están desarrollando antígenos comerciales del SARS-CoV-2 para respaldar la formulación de la vacuna y la investigación y el desarrollo para fortalecer el diagnóstico y la terapia de la enfermedad. En febrero de 2020, Native Antigen Company se convirtió en la primera empresa en ofrecer comercialmente los nuevos antígenos del coronavirus, utilizando el sistema de expresión VirtuE (HEK293) patentado por la empresa. Por lo tanto, el creciente uso de antígenos nativos, que respaldan eficazmente el diagnóstico y la terapia de diversas afecciones médicas, impulsa el crecimiento del mercado de antígenos y anticuerpos bacterianos nativos.

Información basada en el tipo de producto

El mercado de antígenos bacterianos y virales nativos, según el tipo de producto, está segmentado en antígenos de clamidia, antígenos de adenovirus , antígenos de borrelia , antígenos de clostridium , antígenos del virus chikungunya y antígenos del virus del dengue. El segmento de antígenos de clamidia tuvo la mayor participación del mercado en 2019, y se anticipa que el mercado para el mismo crezca a la CAGR más alta durante el período de pronóstico. El crecimiento del mercado para este segmento se atribuye a la fácil disponibilidad de estos antígenos, y la mayoría de los actores del mercado ofrecen comercialmente estos antígenos en las formas nativas. Además, se espera que el uso de antígenos de clamidia en institutos de investigación y laboratorios para el desarrollo de vacunas y pruebas de diagnóstico in vitro ( IVD ) impulse aún más el crecimiento del mercado para este segmento.

Perspectivas basadas en el tipo de patógeno

Según el tipo de patógeno, el mercado de antígenos virales y bacterianos nativos se segmenta en patógenos inactivados y patógenos purificados. El segmento de patógenos inactivados tuvo una mayor participación en el mercado en 2019 y se estima que registrará una CAGR más alta durante el período de pronóstico.

Perspectivas basadas en aplicaciones

Según la aplicación, el mercado de antígenos bacterianos y virales nativos se segmenta en ELISA, inmunoensayo, SDS-PAGE, hemaglutinación y pruebas de aglutinación. El segmento ELISA tuvo la mayor participación del mercado en 2019 y se estima que registrará la CAGR más alta durante 2020-2027.

Información basada en el usuario final

Según el usuario final, el mercado de antígenos bacterianos y virales nativos se segmenta en laboratorios y centros de diagnóstico e institutos académicos y de investigación. El segmento de laboratorios y centros de diagnóstico tuvo la mayor participación del mercado en 2019, y se estima que registrará la CAGR más alta entre 2020 y 2027.

Los lanzamientos y aprobaciones de productos son estrategias que las empresas suelen adoptar para ampliar su presencia global y sus carteras de productos; estas estrategias les ayudan a satisfacer la creciente demanda de los consumidores. La colaboración es una de las principales estrategias adoptadas por las empresas que operan en el mercado de antígenos bacterianos y virales nativos para ampliar su base de clientes en todo el mundo, lo que también les permite mantener su marca a nivel mundial.

Perspectivas regionales del mercado de antígenos virales y bacterianos nativos

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de antígenos virales y bacterianos nativos durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de antígenos virales y bacterianos nativos en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de antígenos virales y bacterianos nativos

Alcance del informe de mercado de antígenos virales y bacterianos nativos

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2019 | US$ 17,11 millones |

| Tamaño del mercado en 2027 | US$ 28,8 millones |

| CAGR global (2019-2027) | 6,8% |

| Datos históricos | 2017-2018 |

| Período de pronóstico | 2020-2027 |

| Segmentos cubiertos |

Por tipo de producto

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de antígenos virales y bacterianos nativos: comprensión de su impacto en la dinámica empresarial

El mercado de antígenos virales y bacterianos nativos está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de antígenos virales y bacterianos nativos son:

- LABORATORIOS BIO-RAD INC.

- Biosistemas Microbix

- Inmunología SERION

- Reactivos Aalto Bio Ltd.

- Ciencias de la vida enzo inc.

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de antígenos virales y bacterianos nativos

Mercado de antígenos virales y bacterianos nativos: por tipo de producto

- Antígenos de clamidia

- Antígenos de adenovirus

- Antígenos de Borrelia

- Antígenos del virus chikungunya

- Antígenos de Clostridium

- Antígenos del virus del dengue

Mercado de antígenos virales y bacterianos nativos: por tipo de patógeno

- Patógeno inactivado

- Patógeno purificado

Mercado de antígenos virales y bacterianos nativos: por aplicación

- Prueba ELISA

- Inmunoensayo

- Hoja de datos de seguridad (SDS)

- Hemaglutinación

- Prueba de aglutinación

Mercado de antígenos virales y bacterianos nativos – por EndUser

- Laboratorios y centros de diagnóstico

- Institutos académicos y de investigación

Mercado de antígenos virales y bacterianos nativos por geografía

-

América del norte

- A NOSOTROS

- Canadá

- México

-

Europa

- Francia

- Alemania

- Italia

- Reino Unido

- España

- Resto de Europa

-

Asia Pacífico (APAC)

- Porcelana

- India

- Corea del Sur

- Japón

- Australia

- Resto de Asia Pacífico

-

Oriente Medio y África (MEA)

- Sudáfrica

- Arabia Saudita

- Emiratos Árabes Unidos

- Resto de Oriente Medio y África

-

América del Sur y Central

- Brasil

- Argentina

- Resto de Sudamérica

Perfiles de empresas

- LABORATORIOS BIO-RAD INC.

- Biosistemas Microbix

- Inmunología SERION

- Reactivos Aalto Bio Ltd.

- Ciencias de la vida enzo inc.

- Jena Bioscience GmbH

- LABORATORIOS ROSS SUR

- La compañía Native Antigen

- Diagnóstico creativo

- TRINA BIORREACTIVOS AG

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de antígenos bacterianos y virales nativos

Obtenga una muestra gratuita para - Mercado de antígenos bacterianos y virales nativos