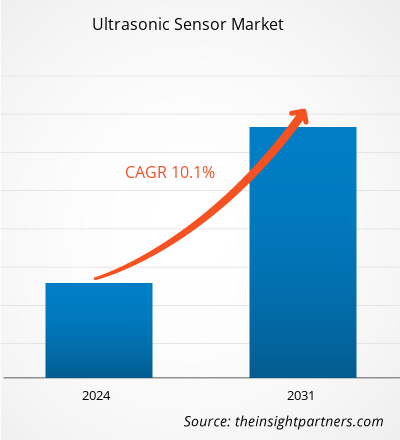

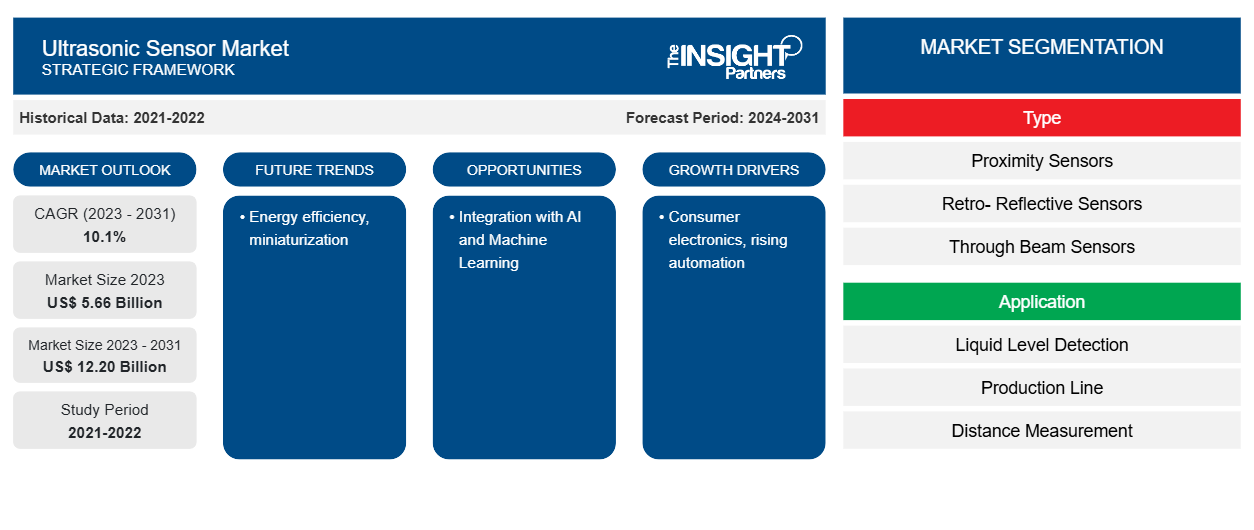

Se proyecta que el tamaño del mercado de sensores ultrasónicos alcance los 12.200 millones de dólares en 2031, frente a los 5.660 millones de dólares en 2023. Se espera que el mercado registre una CAGR del 10,1 % entre 2023 y 2031. Es probable que la eficiencia energética y la miniaturización sigan siendo tendencias clave en el mercado de sensores ultrasónicos.

Análisis del mercado de sensores ultrasónicos

Los sensores ultrasónicos se utilizan para una variedad de aplicaciones en todo el mundo, tanto en interiores como en exteriores, en entornos difíciles. Los sensores ultrasónicos se pueden utilizar en el proceso de fabricación para automatizar el control de procesos en la planta de producción, y también son una herramienta esencial para que las empresas maximicen la productividad mediante una medición y un control precisos. Los sensores ultrasónicos pueden estimar la distancia a una variedad de objetos, independientemente de la forma, el color o la textura de la superficie. También pueden medir un objeto cuando se acerca o se aleja. Para aplicaciones similares, los sensores ultrasónicos se están utilizando en las principales industrias, como la automotriz, la fabricación y la atención médica , entre otras. Esto está impulsando el crecimiento del mercado.

Descripción general del mercado de sensores ultrasónicos

El panorama industrial actual, con la integración masiva de IoT, y la automatización industrial han creado un espacio impresionante para la expansión de aplicaciones para el uso de sensores ultrasónicos. La creciente complejidad de la automatización en el entorno industrial está impulsando la demanda en el mercado. Los actores del mercado participan activamente en la introducción de productos nuevos e innovadores. Por ejemplo, en agosto de 2022, Toposens presentó el primer sensor anticolisión ultrasónico 3D del mundo para su uso en aplicaciones industriales con el fin de mejorar la productividad y la seguridad mediante el uso de equipos automatizados.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de sensores ultrasónicos

El aumento de la automatización industrial favorecerá al mercado

Los sensores ultrasónicos son sensores versátiles en el campo de la automatización industrial, con varias variedades disponibles, cada una adaptada a una aplicación única. Los sensores ultrasónicos en líneas de producción automatizadas garantizan que los brazos robóticos y la maquinaria funcionen correctamente. Ayudan con tareas como alinear componentes y garantizar que las piezas estén correctamente posicionadas para el ensamblaje o el procesamiento.

Integración con IA y aprendizaje automático: una oportunidad en el campo de los sensores ultrasónicos

Los sensores ultrasónicos se están integrando cada vez más con la inteligencia artificial (IA) y los algoritmos de aprendizaje automático. Esta integración permitirá un procesamiento de datos más inteligente, lo que permitirá que los sensores respondan a condiciones cambiantes y realicen predicciones más precisas. Esta mejora es muy prometedora para aplicaciones complejas como el mantenimiento predictivo y el control de calidad.

Análisis de segmentación del informe de mercado de sensores ultrasónicos

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de sensores ultrasónicos son el tipo, la aplicación y la vertical de la industria.

- Según el tipo, el mercado de sensores ultrasónicos se divide en sensores de proximidad, sensores retrorreflectivos, sensores de barrera y otros. El segmento de sensores de barrera tuvo la mayor participación del mercado en 2023.

- Según la aplicación, el mercado de sensores ultrasónicos se divide en detección de nivel de líquido, línea de producción, medición de distancia y otros.

- Según la vertical de la industria, el mercado está segmentado en automotriz, alimentos y bebidas, médico, petróleo y gas, industrial y otros.

Análisis de la cuota de mercado de sensores ultrasónicos por geografía

El alcance geográfico del informe del mercado de sensores ultrasónicos se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Medio Oriente y África, y América del Sur / América del Sur y Central.

Europa ha dominado elMercado de sensores ultrasónicos. La creciente automatización y la Industria 4.0 en los países europeos están impulsando la demanda de sensores ultrasónicos en la región. El mercado de sensores ultrasónicos está experimentando un desarrollo sustancial en América del Norte, que se puede atribuir al desarrollo de los sectores de la automoción y el transporte.

Perspectivas regionales del mercado de sensores ultrasónicos

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de sensores ultrasónicos durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de sensores ultrasónicos en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de sensores ultrasónicos

Alcance del informe de mercado de sensores ultrasónicos

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | 5.660 millones de dólares estadounidenses |

| Tamaño del mercado en 2031 | US$ 12,20 mil millones |

| CAGR global (2023 - 2031) | 10,1% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de sensores ultrasónicos: comprensión de su impacto en la dinámica empresarial

El mercado de sensores ultrasónicos está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de sensores ultrasónicos son:

- Toposens

- Baumer

- Automatización Rockwell

- Siemens

- Honeywell Internacional Inc.

- Pepperl+Fuchs Pvt. Limitada.

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de sensores ultrasónicos

Noticias y desarrollos recientes del mercado de sensores ultrasónicos

El mercado de sensores ultrasónicos se evalúa mediante la recopilación de datos cualitativos y cuantitativos posteriores a la investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se incluye una lista de los avances en el mercado de sensores ultrasónicos y las estrategias:

- Murata, el fabricante líder de productos electrónicos, anunció la introducción de un nuevo dispositivo sensor ultrasónico destinado a su implementación en aplicaciones automotrices. Con alta sensibilidad y rápida capacidad de respuesta, el MA48CF15-7N está alojado en un paquete herméticamente sellado para protegerlo contra la entrada de líquidos. (Fuente: Murata Manufacturing Co., Ltd., comunicado de prensa, 2023)

Informe de mercado de sensores ultrasónicos: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de sensores ultrasónicos (2023-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Dinámica del mercado, como impulsores, restricciones y oportunidades clave

- Principales tendencias futuras

- Análisis detallado de las cinco fuerzas de Porter y PEST y FODA

- Análisis del mercado global y regional que cubre las tendencias clave del mercado, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de sensores ultrasónicos

Obtenga una muestra gratuita para - Mercado de sensores ultrasónicos