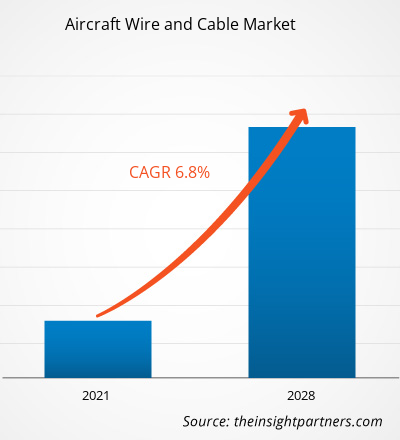

[Rapport de recherche] Le marché mondial des fils et câbles pour avions était évalué à 716,63 millions de dollars américains en 2020 et devrait atteindre 1 153,64 millions de dollars américains d'ici 2028 ; il devrait croître à un TCAC de 6,8 % au cours de la période de prévision de 2021 à 2028.

Le marché des fils et câbles pour avions est largement segmenté en cinq grandes régions : l'Amérique du Nord, l'Europe, l'APAC, le MEA et la SAM. En termes de part de marché, la région Amérique du Nord a dominé le marché des fils et câbles pour avions en 2020. La région Amérique du Nord connaît la présence de sociétés multinationales engagées dans la fourniture de fils et câbles pour avions, ce qui en fait une région leader et dominante du marché des fils et câbles pour avions. Marché des câbles en 2020. Des facteurs tels que la disponibilité des capacités technologiques, le soutien des infrastructures, la R&D et les professionnels techniques, entre autres, ont contribué à la consolidation significative de la part de marché des fils et câbles aéronautiques en Amérique du Nord.

Impact de la pandémie de COVID-19 sur le marché des fils et câbles aéronautiques

Selon le dernier rapport de situation de l'Organisation mondiale de la santé (OMS), les États-Unis, l'Inde, le Brésil, la Russie, le Royaume-Uni, la France, l'Espagne et l'Italie figurent parmi les pays les plus touchés par l'épidémie de COVID-19. L'épidémie a débuté à Wuhan (Chine) en décembre 2019 et s'est depuis propagée rapidement à travers le monde. La crise de la COVID-19 affecte les industries du monde entier et l'économie mondiale a été affectée négativement en 2020 et probablement en 2021. La pandémie a perturbé les entreprises et les fournisseurs de fils et câbles aéronautiques du monde entier. Les acteurs du marché ont subi des perturbations dans leurs activités, et cela devrait avoir des conséquences jusqu'à la mi-2021. Jusqu'à l'apparition de la COVID-19, l'industrie aérospatiale connaissait une croissance substantielle en termes de production et de services, malgré d'énormes retards de la part des constructeurs aéronautiques ; l'industrie aéronautique mondiale a connu une augmentation significative du nombre de passagers, une augmentation des achats d'avions (tant commerciaux que militaires), ainsi qu'une croissance accrue des activités MRO.

Vous bénéficierez d’une personnalisation sur n’importe quel rapport - gratuitement - y compris des parties de ce rapport, ou une analyse au niveau du pays, un pack de données Excel, ainsi que de profiter d’offres exceptionnelles et de réductions pour les start-ups et les universités

Marché des fils et câbles pour avions: Perspectives stratégiques

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

L'expansion rapide du secteur aéronautique à l'échelle mondiale et l'adoption croissante de technologies de pointe pour le bon fonctionnement des avions contribuent considérablement à la croissance du marché. De plus, la présence de constructeurs aéronautiques robustes, tels que Boeing et Airbus, et la croissance des revenus disponibles dans les pays en développement comptent parmi les facteurs qui stimulent la demande de ces fils et câbles pour avions.

L'augmentation des dépenses de défense dans des économies importantes, telles que les États-Unis, la Chine, l'Inde, la Russie et l'Arabie saoudite, devrait stimuler le marché des fils et câbles pour avions dans les années à venir. De plus, les développements technologiques croissants, les investissements croissants en recherche et développement (R&D) par les fabricants d'équipements d'origine (OEM) pour l'aéronautique et la demande croissante de transport aérien propulsent la croissance du secteur aérospatial et de la défense, qui stimule par conséquent le marché des fils et câbles pour avions. Croissance du marché des câbles.

Informations sur les segments de type

Selon le type, le segment des câbles est le plus exigeant du marché et devrait dominer le marché en termes de parts de marché. Cependant, avec l'adoption croissante des câbles pour diverses fonctions, le segment des câbles devrait être le segment à la croissance la plus rapide sur le marché des câbles et fils aéronautiques.

Informations sur les segments de type d'avion

Selon les types d'avion, le marché mondial des câbles et fils aéronautiques est segmenté en commercial et militaire. En raison de la croissance remarquable du nombre de livraisons d'avions commerciaux, le type d'avion commercial devrait dominer le marché en termes de parts de marché au cours de la période de prévision.

Informations sur les segments de type d'ajustement

Selon le type d'ajustement, le marché mondial des câbles et fils aéronautiques est dominé par le segment de l'ajustement en ligne, qui détenait la majorité des parts de marché en 2020 et devrait maintenir sa domination au cours de la période de prévision sur le marché mondial des câbles et fils aéronautiques. marché des câbles.

Aperçu des segments d'application

Sur la base des applications, le marché des fils et câbles pour avions est dominé par le segment du transfert d'énergie, qui détenait la plus grande part de marché en 2020 et devrait poursuivre sa domination au cours de la période de prévision sur le marché mondial des fils et câbles pour avions. Marché des câbles.

Les acteurs du marché se concentrent sur les innovations et les développements de nouveaux produits en intégrant des technologies et des fonctionnalités avancées dans leurs produits pour concurrencer la concurrence.

- En 2020, Harbour Industries LLC a déclaré avoir approuvé le fabricant de plusieurs câbles coaxiaux à faible perte et de données à haut débit utilisés sur l'avion de chasse F-35 Lighting II de 5e génération de Lockheed Martin.

- En 2020, TE Connectivity (TE) a présenté son nouveau système Ethernet à paire unique Mini-ETH pour les avions commerciaux.

- En 2019, Carlisle Companies Incorporated a acquis 100 % des actions de Draka Fileca SAS auprès de Prysmian SpA

.

Aperçu régional du marché des fils et câbles pour avions

Les tendances régionales et les facteurs influençant le marché des fils et câbles aéronautiques tout au long de la période de prévision ont été analysés en détail par les analystes de The Insight Partners. Cette section aborde également les segments et la géographie du marché des fils et câbles aéronautiques en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu'en Amérique du Sud et en Amérique centrale.

Portée du rapport sur le marché des fils et câbles pour avions

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2020 | US$ 716.63 Million |

| Taille du marché par 2028 | US$ 1,153.64 Million |

| TCAC mondial (2020 - 2028) | 6.8% |

| Données historiques | 2018-2019 |

| Période de prévision | 2021-2028 |

| Segments couverts |

By Type

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché des fils et câbles aéronautiques : comprendre son impact sur la dynamique commerciale

Le marché des fils et câbles aéronautiques connaît une croissance rapide, portée par une demande croissante des utilisateurs finaux, due à des facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une meilleure connaissance des avantages du produit. Face à cette demande croissante, les entreprises élargissent leur offre, innovent pour répondre aux besoins des consommateurs et capitalisent sur les nouvelles tendances, ce qui alimente la croissance du marché.

- Obtenez le Marché des fils et câbles pour avions Aperçu des principaux acteurs clés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Rapports connexes

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché des fils et câbles pour avions

Obtenez un échantillon gratuit pour - Marché des fils et câbles pour avions