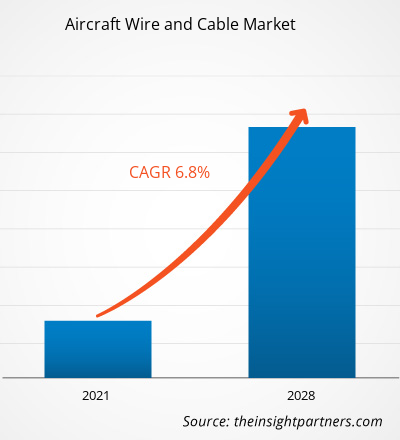

[Rapporto di ricerca]Il mercato globale dei cavi e fili per aeromobili è stato valutato a 716,63 milioni di dollari nel 2020 e si prevede che raggiungerà i 1.153,64 milioni di dollari entro il 2028; si prevede una crescita a un CAGR del 6,8% nel periodo di previsione dal 2021 al 2028.

Il mercato dei cavi e fili per aeromobili è ampiamente segmentato in cinque regioni principali: Nord America, Europa, APAC, MEA e SAM. In termini di quota di mercato, la regione del Nord America ha dominato il mercato dei cavi e fili per aeromobili nel 2020. La regione del Nord America registra la presenza di aziende multinazionali impegnate nella fornitura di cavi e fili per aeromobili, il che la rende una regione leader e dominante nel settore dei cavi e fili per aeromobili. Mercato dei cavi nel 2020. Fattori quali la disponibilità di capacità tecnologiche, il supporto infrastrutturale, la ricerca e sviluppo e la professionalità tecnica, tra gli altri, hanno contribuito al significativo consolidamento della quota di mercato dei cavi e dei fili per aeromobili in Nord America.

Impatto della pandemia di COVID-19 sul mercato dei cavi e dei fili per aeromobili

Secondo l'ultimo rapporto sulla situazione dell'Organizzazione Mondiale della Sanità (OMS), Stati Uniti, India, Brasile, Russia, Regno Unito, Francia, Spagna e Italia sono tra i paesi più colpiti dall'epidemia di COVID-19. L'epidemia è iniziata a Wuhan (Cina) nel dicembre 2019 e da allora si è diffusa rapidamente in tutto il mondo. La crisi del COVID-19 colpisce le industrie di tutto il mondo e l'economia globale ha subito ripercussioni negative nel 2020 e probabilmente nel 2021. La pandemia ha colpito le aziende e i fornitori di cavi e fili per aeromobili in tutto il mondo. Gli operatori del mercato hanno subito interruzioni delle loro attività e le conseguenze probabilmente si protrarranno fino alla metà del 2021. Fino allo scoppio del COVID-19, l'industria aerospaziale stava registrando una crescita sostanziale in termini di produzione e servizi, nonostante gli enormi arretrati da parte dei produttori di aeromobili; l'industria aeronautica globale ha assistito a un aumento significativo del numero di passeggeri, a un incremento degli acquisti di aeromobili (sia commerciali che militari), nonché a una crescita delle attività di manutenzione, riparazione e revisione (MRO).

Personalizza questo rapporto in base alle tue esigenze

Potrai personalizzare gratuitamente qualsiasi rapporto, comprese parti di questo rapporto, o analisi a livello di paese, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

Mercato dei cavi e dei fili per aeromobili: Approfondimenti strategici

-

Ottieni le principali tendenze chiave del mercato di questo rapporto.Questo campione GRATUITO includerà l'analisi dei dati, che vanno dalle tendenze di mercato alle stime e alle previsioni.

La rapida espansione del settore aeronautico a livello globale e la crescente adozione di tecnologie avanzate per il corretto funzionamento degli aeromobili contribuiscono in modo significativo alla crescita del mercato. Inoltre, la presenza di solidi produttori di aeromobili, come Boeing e Airbus, e l'aumento del reddito disponibile nei paesi in via di sviluppo sono tra i fattori che determinano la domanda di questi cavi e fili per aeromobili.

Si prevede che la crescente spesa per la difesa in economie importanti, come Stati Uniti, Cina, India, Russia e Arabia Saudita, guiderà il mercato dei cavi e dei fili per aeromobili nei prossimi anni. Inoltre, i crescenti sviluppi tecnologici, i crescenti investimenti in ricerca e sviluppo (R&S) da parte dei produttori di apparecchiature originali (OEM) per aeromobili e la crescente domanda di trasporto aereo stanno stimolando la crescita del settore aerospaziale e della difesa, che a sua volta sta trainando il mercato dei cavi e dei fili per aeromobili. Crescita del mercato dei cavi.

Approfondimenti sul segmento di tipologia

In base alla tipologia, il segmento dei cavi è il più esigente sul mercato e si prevede che lo stesso segmento dominerà il mercato in termini di quota di mercato. Tuttavia, con l'aumento dell'adozione di cavi per varie funzioni, si prevede che il segmento dei cavi sarà il segmento in più rapida crescita nel mercato dei cavi e dei fili per aeromobili.

Approfondimenti sul segmento di tipologia di aeromobile

In base alla tipologia di aeromobile, il mercato globale dei cavi e dei fili per aeromobili è segmentato in commerciale e militare. A causa della notevole crescita del numero di consegne di aeromobili commerciali, si prevede che il tipo di aeromobile commerciale dominerà il mercato in termini di quota di mercato durante il periodo di previsione.

Approfondimenti sul segmento di tipologia di adattamento

In base alla tipologia di adattamento, il mercato globale dei cavi e dei fili per aeromobili è dominato dal segmento di adattamento in linea, che ha detenuto la maggior parte della quota di mercato nel 2020 e si prevede che manterrà il suo predominio durante il periodo di previsione nel mercato globale dei cavi e dei fili per aeromobili. mercato dei cavi.

Approfondimenti sui segmenti applicativi

In base all'applicazione, il mercato dei cavi e dei fili per aeromobili è dominato dal segmento del trasferimento di potenza, che ha detenuto la quota di mercato maggiore nel 2020 e si prevede che continuerà a dominare durante il periodo di previsione nel mercato globale dei cavi e dei fili per aeromobili. Mercato dei cavi.

Gli operatori del mercato si concentrano su innovazioni e sviluppi di nuovi prodotti integrando tecnologie e funzionalità avanzate nei loro prodotti per competere con i concorrenti.

- Nel 2020, Harbour Industries LLC ha dichiarato di aver approvato la produzione di diversi cavi coassiali a bassa perdita e cavi dati ad alta velocità utilizzati sul caccia F-35 Lighting II di quinta generazione di Lockheed Martin.

- Nel 2020, TE Connectivity (TE) ha introdotto il suo nuovo sistema Ethernet a coppia singola Mini-ETH per aerei commerciali.

- Nel 2019, Carlisle Companies Incorporated ha acquisito il 100% delle azioni di Draka Fileca SAS da Prysmian SpA

.

Approfondimenti regionali sul mercato dei cavi e fili per aeromobili

Le tendenze regionali e i fattori che influenzano il mercato dei cavi e dei fili per aeromobili durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di The Insight Partners. Questa sezione illustra anche i segmenti e la geografia del mercato dei cavi e dei fili per aeromobili in Nord America, Europa, Asia-Pacifico, Medio Oriente e Africa, America Meridionale e Centrale.

Ambito del rapporto sul mercato dei cavi e fili per aeromobili

| Attributo del rapporto | Dettagli |

|---|---|

| Dimensioni del mercato in 2020 | US$ 716.63 Million |

| Dimensioni del mercato per 2028 | US$ 1,153.64 Million |

| CAGR globale (2020 - 2028) | 6.8% |

| Dati storici | 2018-2019 |

| Periodo di previsione | 2021-2028 |

| Segmenti coperti |

By Tipo

|

| Regioni e paesi coperti |

Nord America

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli operatori del mercato dei cavi e dei fili per aeromobili: comprendere il suo impatto sulle dinamiche aziendali

Il mercato dei cavi e dei fili per aeromobili è in rapida crescita, trainato dalla crescente domanda degli utenti finali, dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando la propria offerta, innovando per soddisfare le esigenze dei consumatori e sfruttando le tendenze emergenti, alimentando ulteriormente la crescita del mercato.

- Ottieni il Mercato dei cavi e dei fili per aeromobili Panoramica dei principali attori chiave

- Cavo

- Filo

- Cablaggio

Mercato dei cavi e dei fili per aeromobili - Per tipo di aeromobile

- Commerciale

- Militare

Mercato dei cavi e dei fili per aeromobili - Per tipo di adattamento

- Adattamento di linea

- Retrofit

Mercato dei cavi e dei fili per aeromobili - Per applicazione

- Trasferimento di potenza

- Trasferimento dati

- Sistema di controllo di volo

- Avionica

- Illuminazione

Mercato dei cavi e dei fili per aeromobili Mercato dei cavi: per regione

-

Nord America

- Stati Uniti

- Canada

- Messico

-

Europa

- Francia

- Germania

- Italia

- Regno Unito

- Russia

- Resto d'Europa

-

Asia Pacifico (APAC)

- Cina

- India

- Corea del Sud

- Giappone

- Australia

- Resto dell'APAC

-

Medio Oriente e Africa (MEA)

- Sudafrica

- Arabia Saudita

- EAU

- Resto del MEA

-

Sudamerica (SAM)

- Brasile

- Argentina

- Resto del SAM

Cavi e amp; Mercato dei cavi: Profili aziendali

- Axon Enterprise, Inc.

- Harbour Industries, LLC

- Draka

- Glenair, Inc.

- HUBER+SUHNER

- AE Petsche Company

- AMETEK Inc.

- Amphenol Corporation

- Carlisle Companies Incorporated

- Collins Aerospace, a Raytheon Technologies Corporation Azienda

- TE Connectivity Ltd.

- WL Gore and Associates, Inc.

- PIC Wire & Cavo

- Nexans

- Radiall

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Rapporti correlati

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato dei cavi e dei fili per aeromobili

Ottieni un campione gratuito per - Mercato dei cavi e dei fili per aeromobili