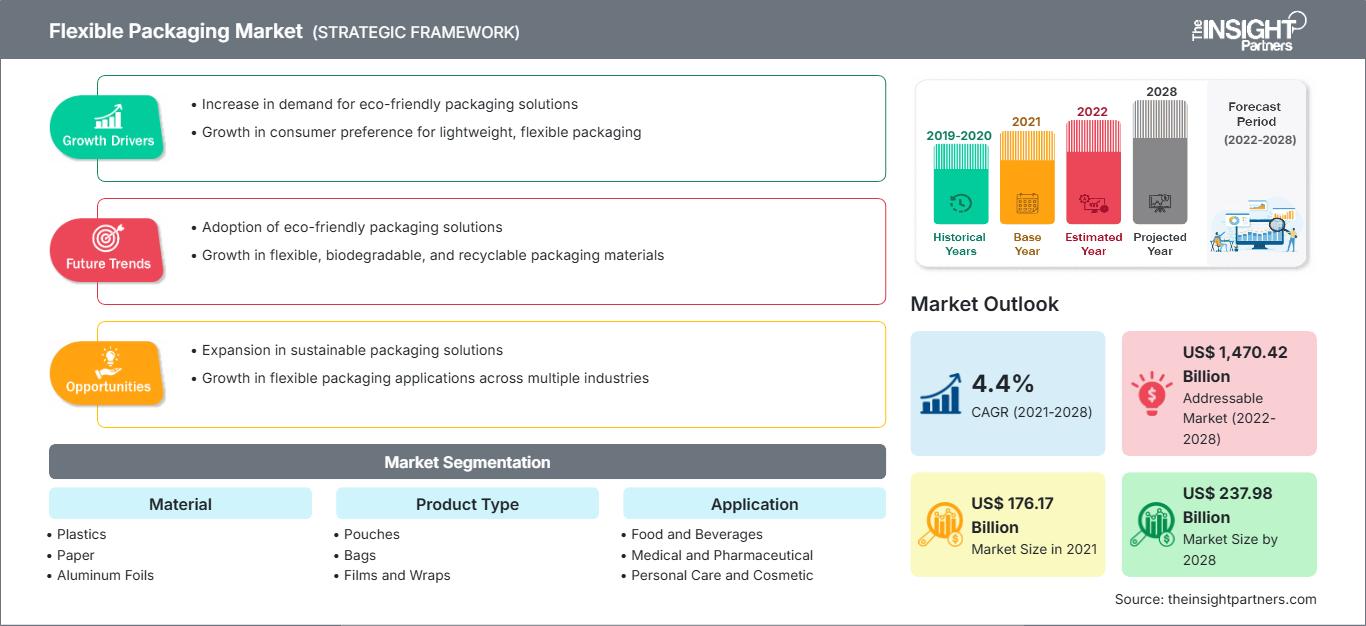

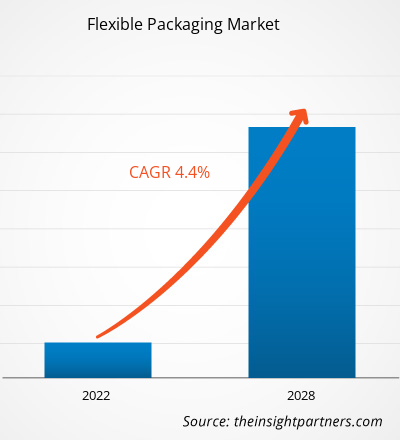

Le marché de l'emballage flexible devrait atteindre 237 975,67 millions de dollars américains d'ici 2028, contre 176 173,61 millions de dollars américains en 2021 ; sa croissance devrait atteindre un TCAC de 4,4 % entre 2021 et 2028.

Les emballages flexibles comprennent les doublures, les sachets, les joints, les sachets d'échantillons et les sacs. Ils peuvent être composés de film, de plastique, de papier, de feuille, etc. Ils sont utilisés pour divers produits alimentaires et boissons, produits de consommation, CD de musique, produits pharmaceutiques, logiciels et nutraceutiques. La durabilité offerte par les emballages flexibles permet aux fabricants d'imprimer des designs personnalisés accrocheurs et de haute qualité, ce qui augmente la visibilité des produits dans un environnement de vente au détail.

En 2020, l'Asie-Pacifique détenait la plus grande part de revenus du marché mondial de l'emballage flexible. Selon la Coopération économique Asie-Pacifique, l'Australie est l'un des pays développés de la région APAC. Le secteur agroalimentaire est le plus important secteur manufacturier d'Australie, représentant 32 % du chiffre d'affaires manufacturier total du pays. Selon le rapport 2019 sur l'état du secteur de l'alimentation et des boissons de l'Australian Food and Grocery Council, le secteur de l'alimentation, des boissons, de l'épicerie et des produits frais représente 85,32 milliards de dollars américains. Il regroupe 15 000 entreprises de toutes tailles qui emploient plus de 273 000 personnes. La croissance du secteur agroalimentaire stimule le marché de l'emballage souple.

Vous bénéficierez d’une personnalisation sur n’importe quel rapport - gratuitement - y compris des parties de ce rapport, ou une analyse au niveau du pays, un pack de données Excel, ainsi que de profiter d’offres exceptionnelles et de réductions pour les start-ups et les universités

Marché de l'emballage flexible: Perspectives stratégiques

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Impact de la pandémie de COVID-19 sur le marché de l'emballage flexible

La fermeture des unités de production, les difficultés d'approvisionnement en matières premières et les restrictions logistiques ont eu un impact négatif sur le marché de l'emballage flexible. Cependant, la COVID-19 a provoqué une augmentation massive des livraisons de produits d'épicerie en ligne. De plus, les industries des aliments et des boissons emballés connaissent une forte hausse de la demande d'aliments et de boissons de longue conservation, y compris les produits laitiers, alors que les consommateurs se précipitent pour remplir leurs garde-manger. Des millions de ménages ont commencé à acheter des produits d'épicerie en ligne pour les emporter ou les livrer à domicile, et beaucoup continueront d'utiliser les options de commerce électronique une fois la crise passée. De plus, la demande croissante de produits alimentaires transformés, tels que les aliments pratiques qui utilisent généralement des matériaux d'emballage de qualité supérieure à haute barrière pour une durée de conservation plus longue, est sur le point d'encourager le besoin d'emballages flexibles.

Analyses du marché

Consommation accrue d'aliments et de boissons transformés Boissons

Selon le rapport d'Anu Food Brazil, le chiffre d'affaires total du secteur brésilien de la vente au détail de produits alimentaires s'élevait à 96 milliards de dollars américains en 2019. L'industrie brésilienne des aliments et des boissons a enregistré une croissance de 6,7 % en 2019 et de 12,8 % en 2020. Le marché des aliments surgelés est florissant au Brésil. Le marché des aliments surgelés est florissant au Brésil en raison de l'expansion de la classe moyenne, de l'augmentation du pouvoir d'achat et de l'augmentation du nombre de personnes travaillant à temps plein. Par conséquent, la préférence croissante des consommateurs pour les aliments prêts à consommer stimule le marché de l'emballage flexible.

Aperçu de l'industrie des matériaux

En fonction du matériau, le marché mondial de l'emballage flexible est segmenté en plastiques, papier, feuilles d'aluminium, etc. Le segment des plastiques détenait la plus grande part du marché mondial de l'emballage flexible en 2020. L'emballage plastique flexible comprend différents types de matières plastiques utilisées pour l'emballage de différents produits. Le type de matériau utilisé dans l'emballage dépend de l'application et du type de produit à emballer. Généralement, les emballages plastiques souples sont fabriqués à partir de matières plastiques telles que le polyéthylène, le polypropylène, le polystyrène et le polychlorure de vinyle. L'emballage souple est considéré comme le moyen le plus pratique et le plus économique de conserver, distribuer et emballer les aliments, les boissons, les produits pharmaceutiques et divers produits de consommation.

Parmi les principaux acteurs du marché mondial de l'emballage souple, on trouve Amcor plc, Huhtamaki, Mondi, Berry Global Inc., Sealed Air, Sonoco Products Company, Coveris, Constantia Flexibles, Flexpak Services et Transcontinental Inc. Ces acteurs se concentrent sur le développement de produits innovants et de haute qualité pour répondre aux exigences des clients.

Emballage souple

Aperçu régional du marché de l'emballage flexible

Les tendances régionales et les facteurs influençant le marché de l'emballage flexible tout au long de la période de prévision ont été analysés en détail par les analystes de The Insight Partners. Cette section aborde également les segments et la géographie du marché de l'emballage flexible en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu'en Amérique du Sud et en Amérique centrale.

Portée du rapport sur le marché des emballages flexibles

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2021 | US$ 176.17 Billion |

| Taille du marché par 2028 | US$ 237.98 Billion |

| TCAC mondial (2021 - 2028) | 4.4% |

| Données historiques | 2019-2020 |

| Période de prévision | 2022-2028 |

| Segments couverts |

By Matériau

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché de l'emballage flexible : comprendre son impact sur la dynamique commerciale

Le marché de l'emballage flexible connaît une croissance rapide, portée par une demande croissante des utilisateurs finaux, due à des facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une meilleure connaissance des avantages du produit. Face à cette demande croissante, les entreprises élargissent leur offre, innovent pour répondre aux besoins des consommateurs et capitalisent sur les nouvelles tendances, ce qui alimente la croissance du marché.

- Obtenez le Marché de l'emballage flexible Aperçu des principaux acteurs clés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché de l'emballage flexible

Obtenez un échantillon gratuit pour - Marché de l'emballage flexible