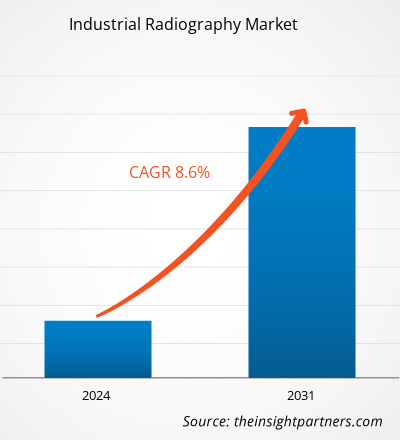

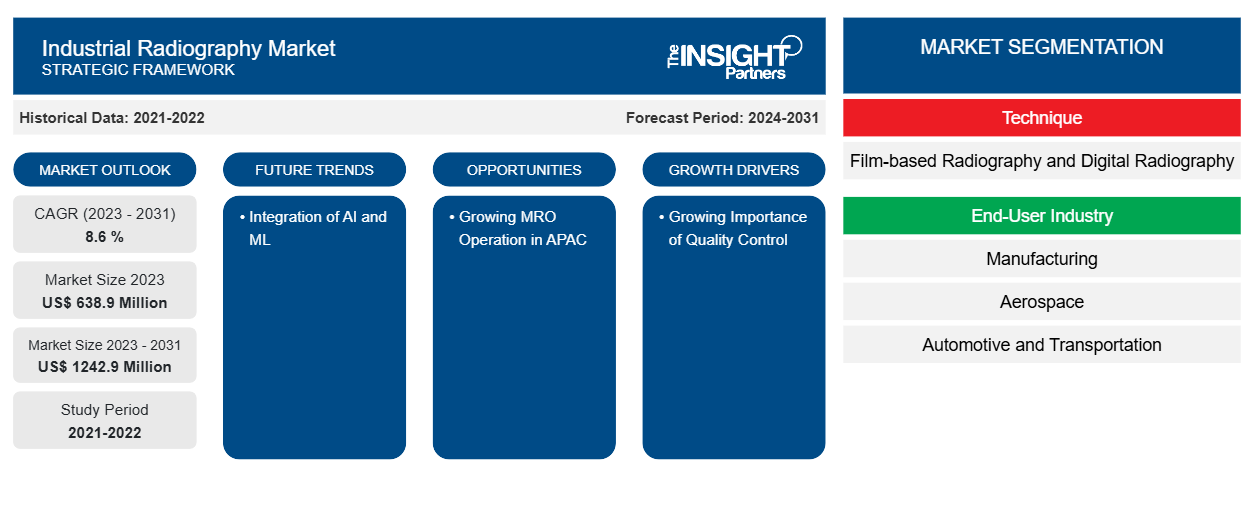

La taille du marché de la radiographie industrielle devrait atteindre 1 242,9 millions USD d'ici 2031, contre 638,9 millions USD en 2023. Le marché devrait enregistrer un TCAC de 8,6 % au cours de la période 2023-2031. L'intégration de l'IA et du ML devrait rester une tendance clé du marché.

Analyse du marché de la radiographie industrielle

En radiographie industrielle, les inspecteurs analysent la structure interne des matériaux et des composants à l'aide de rayonnements ionisants tels que les rayons X ou les rayons gamma. Cela permet de révéler des défauts cachés, de mesurer l'épaisseur et de vérifier l'intégrité de diverses constructions sans causer de dommages. De plus, l'augmentation des opérations de maintenance, de réparation et d'exploitation stimule la croissance du marché.

Aperçu du marché de la radiographie industrielle

La radiographie industrielle est une modalité de contrôle non destructif qui utilise des rayonnements ionisants pour inspecter les matériaux et les composants dans le but de détecter et de mesurer les défauts et la dégradation des qualités des matériaux qui pourraient entraîner la rupture des structures d'ingénierie. Les fabricants utilisent la radiographie industrielle pour détecter les fractures ou les défauts des matériaux. La radiographie industrielle utilise principalement les rayons X et gamma pour révéler les défauts qui ne peuvent pas être remarqués à l'œil nu. La radiographie industrielle est un type de test physique non destructif. Cette forme de radiographie utilise un rayonnement ionisant émis par une source radioactive dans des conditions réglementées pour détecter ou déterminer la structure intérieure d'un objet sans endommager sa morphologie extérieure. Par conséquent, elle peut être utilisée pour obtenir une compréhension claire des constituants ou des composants de la chose ou du produit étudié.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que d'offres et de remises exceptionnelles pour les start-ups et les universités.

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Facteurs moteurs et opportunités du marché de la radiographie industrielle

Importance croissante du contrôle qualité pour favoriser le marché

Les inspecteurs du contrôle qualité de la radiographie industrielle évaluent la qualité globale des images radiographiques et des méthodes d'inspection. Ils garantissent que les inspections répondent aux normes de l'industrie et que l'équipement fonctionne correctement. La radiographie industrielle est principalement utilisée pour détecter les défauts internes des matériaux et des structures, tels que les fissures, les vides, les inclusions et les discontinuités. Elle garantit l'intégrité structurelle et la sécurité de nombreux composants du système. La radiographie industrielle est utilisée pour évaluer des matériaux tels que les métaux, les polymères , les composites et les céramiques. Les soudures, les pipelines, les pièces moulées, les pièces forgées, les composants de l'aviation et d'autres éléments sont tous couramment inspectés.

Croissance des opérations de MRO en Asie-Pacifique

Français La demande MRO de l'Inde devrait croître plus rapidement que la moyenne mondiale, créant des opportunités pour les investisseurs nationaux et étrangers, les OEM et les meilleurs MRO. Les investisseurs, tant nationaux qu'étrangers, pourraient participer. En outre, le fait d'abriter la plus grande base MRO d'Asie et la forte concentration de l'industrie aérospatiale, présence de grands acteurs de l'industrie tels que Rolls Royce et Airbus, expliquent la croissance des opérations MRO en Asie. Le MRO est un élément vital de nombreuses industries. Les industries suivantes ont largement recours aux pratiques MRO : Les entreprises manufacturières dépendent largement des activités de maintenance et de réparation des équipements, des machines et des outils de fabrication. Cela englobe les automobiles, les avions, l'électronique, les biens de consommation et d'autres industries. Le secteur des transports, qui comprend les compagnies aériennes, les trains, le transport maritime et la logistique, s'appuie sur les techniques MRO pour entretenir ses flottes de voitures, d'avions, de locomotives et de conteneurs d'expédition.

Analyse de segmentation du rapport sur le marché de la radiographie industrielle

Les segments clés qui ont contribué à l’élaboration de l’analyse du marché de la radiographie industrielle sont la technique et l’industrie des utilisateurs finaux.

- En fonction de la technique, le marché de la radiographie industrielle est segmenté en radiographie sur film et radiographie numérique.

- En fonction de l'industrie de l'utilisateur final, le marché de la radiographie industrielle est segmenté en fabrication, aérospatiale, automobile et transport, production d'électricité, pétrochimie et gaz, et autres.

Analyse des parts de marché de la radiographie industrielle par zone géographique

La portée géographique du rapport sur le marché de la radiographie industrielle est principalement divisée en cinq régions : Amérique du Nord, Asie-Pacifique, Europe, Moyen-Orient et Afrique, et Amérique du Sud et centrale. Le marché de la radiographie industrielle en Amérique du Nord est segmenté entre les États-Unis, le Canada et le Mexique. L'Amérique du Nord a développé la production de véhicules automobiles de météorologie de l'industrie aérospatiale et de la défense. La région compte divers constructeurs automobiles renommés tels que Ford, Hona, Toyota, Tesla et d'autres. L'objectif principal de la radiographie industrielle est de détecter les défauts internes des matériaux et des structures tels que les fissures, les vides, les inclusions et les discontinuités. Les fabricants l'utilisent pour détecter les fissures ou les défauts des produits.

Aperçu régional du marché de la radiographie industrielle

Les tendances régionales et les facteurs influençant le marché de la radiographie industrielle tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché de la radiographie industrielle en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché de la radiographie industrielle

Portée du rapport sur le marché de la radiographie industrielle

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | 638,9 millions de dollars américains |

| Taille du marché d'ici 2031 | 1 242,9 millions de dollars américains |

| Taux de croissance annuel composé mondial (2023-2031) | 8,6 % |

| Données historiques | 2021-2022 |

| Période de prévision | 2024-2031 |

| Segments couverts |

Par Technique

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché : comprendre son impact sur la dynamique des entreprises

Le marché de la radiographie industrielle connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché de la radiographie industrielle sont :

- RAYONS 3DX

- Anritsu

- Groupe Comet

- Société Fujifilm

- ÉLECTRICITÉ GÉNÉRALE

- METTLER TOLEDO

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché de la radiographie industrielle

Actualités et développements récents du marché de la radiographie industrielle

Le marché de la radiographie industrielle est évalué en collectant des données qualitatives et quantitatives après des recherches primaires et secondaires, qui comprennent d'importantes publications d'entreprise, des données d'association et des bases de données. Quelques-uns des développements du marché de la radiographie industrielle sont énumérés ci-dessous :

- La Royal Air Force a attribué à 3DX-Ray un contrat pour la fourniture de trois systèmes portables de balayage à rayons X ThreatScan-LSC (RAF). Les ThreatScan-LSC remplaceront les systèmes existants et il s'agit du premier contrat de 3DX-Ray avec la RAF.

(Source : 3DX-RAY, janvier 2021)

- Teledyne Industrial X-Ray Solutions, fournisseur d'imagerie à rayons X haute performance, a lancé une nouvelle gamme de détecteurs dynamiques industriels haute vitesse et hautes performances basés sur notre technologie innovante de capteurs IGZO résistants aux radiations. Les détecteurs Rad-Xcam 1717, 1723 et 3030 sont conçus pour répondre aux besoins exigeants des applications d'inspection industrielle, biomédicales et scientifiques, offrant des avantages convaincants en termes de coûts d'intégration. (Source : Teledyne., juillet 2023)

Rapport sur le marché de la radiographie industrielle : couverture et livrables

Le rapport « Taille et prévisions du marché de la radiographie industrielle (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille et prévisions du marché de la radiographie industrielle aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le champ d'application

- Tendances du marché de la radiographie industrielle, ainsi que la dynamique du marché, comme les facteurs moteurs, les contraintes et les opportunités clés

- Analyse détaillée des cinq forces de PEST/Porter et SWOT

- Analyse du marché de la radiographie industrielle couvrant les principales tendances du marché, le cadre mondial et régional, les principaux acteurs, les réglementations et les développements récents du marché

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents sur le marché de la radiographie industrielle

- Profils d'entreprise détaillés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché de la radiographie industrielle

Obtenez un échantillon gratuit pour - Marché de la radiographie industrielle