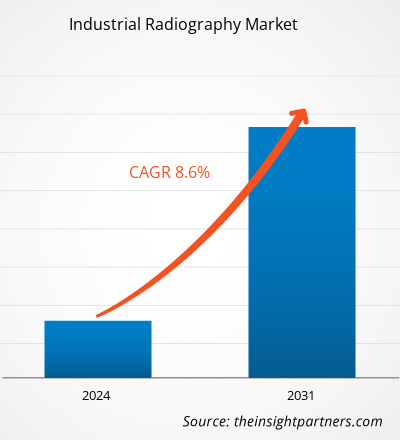

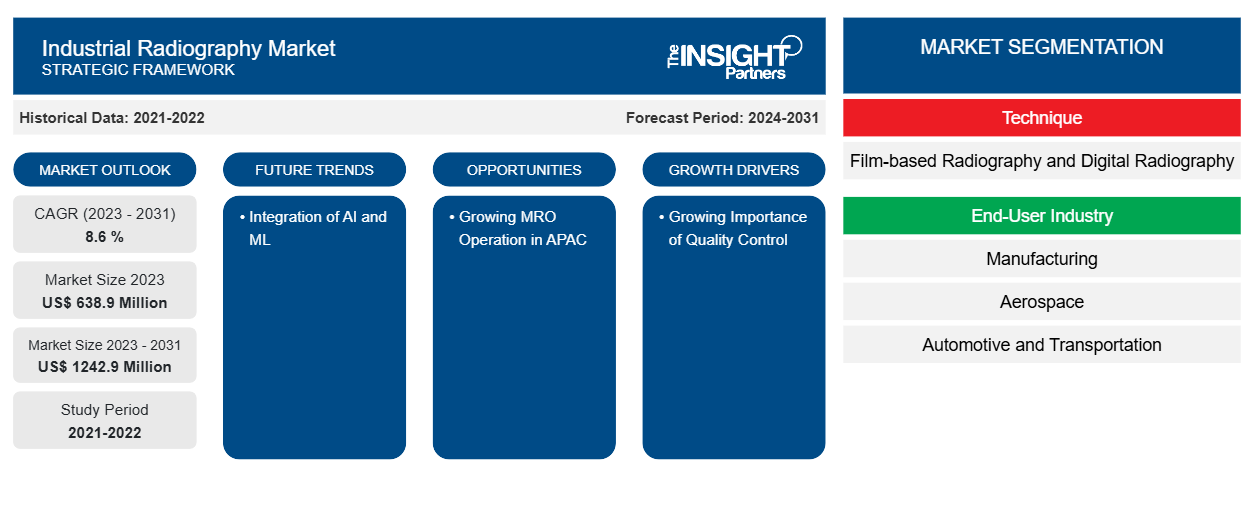

Se proyecta que el tamaño del mercado de radiografía industrial alcance los 1242,9 millones de dólares estadounidenses en 2031, frente a los 638,9 millones de dólares estadounidenses en 2023. Se espera que el mercado registre una CAGR del 8,6 % durante el período 2023-2031. Es probable que la integración de IA y ML siga siendo una tendencia clave en el mercado.

Análisis del mercado de la radiografía industrial

En la radiografía industrial, los inspectores analizan la estructura interna de los materiales y componentes mediante radiación ionizante, como rayos X o rayos gamma. Esto permite descubrir defectos ocultos, medir el espesor y comprobar la integridad de diversas construcciones sin causar daños. Además, el aumento del mantenimiento, las reparaciones y las operaciones están impulsando el crecimiento del mercado.

Descripción general del mercado de radiografía industrial

La radiografía industrial es una modalidad de prueba no destructiva que utiliza radiación ionizante para inspeccionar materiales y componentes con el fin de detectar y medir fallas y degradación en las cualidades del material que podrían causar la rotura de estructuras de ingeniería. Los fabricantes utilizan la radiografía industrial para detectar fracturas o fallas en los materiales. La radiografía industrial emplea principalmente rayos X y radiación gamma para revelar fallas que no se pueden notar a simple vista. La radiografía industrial es un tipo de prueba física no destructiva. Esta forma de radiografía emplea radiación ionizante emitida desde una fuente radiactiva en condiciones reguladas para detectar o determinar la estructura interna de un objeto sin causar ningún daño a su morfología externa. Como resultado, se puede utilizar para obtener una comprensión clara de los constituyentes o componentes de la cosa o producto en estudio.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Factores impulsores y oportunidades del mercado de la radiografía industrial

Creciente importancia del control de calidad para favorecer el mercado

Los inspectores de control de calidad de radiografía industrial evalúan la calidad general de las imágenes radiográficas y los métodos de inspección. Garantizan que las inspecciones cumplan con los estándares de la industria y que el equipo funcione correctamente. La radiografía industrial se utiliza principalmente para detectar fallas internas en materiales y estructuras, como grietas, huecos, inclusiones y discontinuidades. Garantiza la integridad estructural y la seguridad de numerosos componentes del sistema. La radiografía industrial se utiliza para evaluar materiales como metales, polímeros , compuestos y cerámicas. Las soldaduras, las tuberías, las piezas fundidas, las piezas forjadas, los componentes de aviación y otros elementos se inspeccionan comúnmente.

Crecimiento de las operaciones MRO en APAC

Se espera que la demanda de MRO de la India se expanda más rápido que el promedio mundial, creando oportunidades para inversores nacionales y extranjeros, OEM y MRO de primer nivel. Los inversores, tanto nacionales como extranjeros, podrían participar. Además, el hogar de la mayor base de MRO en Asia, la alta concentración de la industria aeroespacial, la presencia de grandes actores de la industria como Rolls Royce y Airbus son las razones para el crecimiento de las operaciones de MRO en Asia. MRO es un componente vital de muchas industrias. Las siguientes industrias hacen un uso intensivo de las prácticas de MRO: Las empresas manufactureras dependen en gran medida de las actividades de mantenimiento y reparación para equipos de fabricación, maquinaria y herramientas. Esto abarca automóviles, aviones, productos electrónicos, bienes de consumo y otras industrias. El negocio del transporte, que incluye aerolíneas, trenes, envíos y logística, depende de las técnicas de MRO para mantener sus flotas de automóviles, aviones, locomotoras y contenedores de envío.

Análisis de segmentación del informe de mercado de radiografía industrial

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de radiografía industrial son la industria técnica y del usuario final.

- Según la técnica, el mercado de radiografía industrial se segmenta en radiografía basada en película y radiografía digital.

- Según la industria del usuario final, el mercado de radiografía industrial está segmentado en manufactura, aeroespacial, automotriz y transporte, generación de energía, petroquímica y gas, y otros.

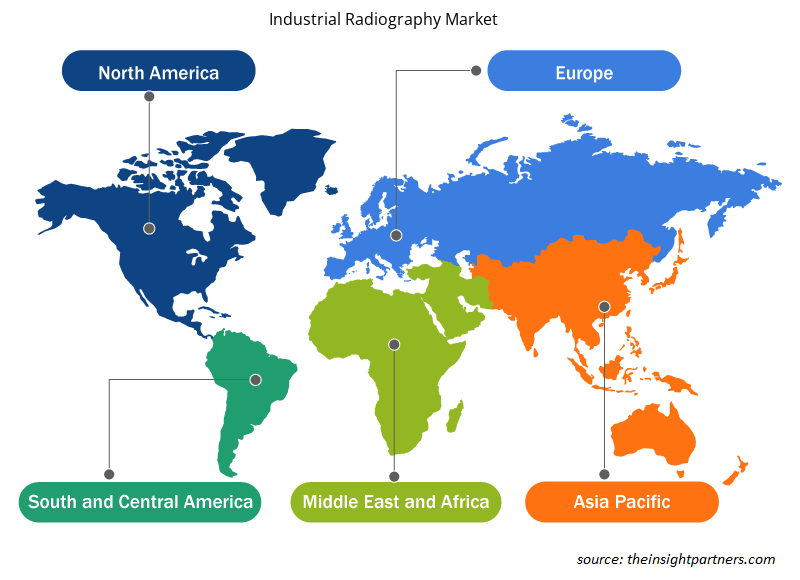

Análisis de la cuota de mercado de la radiografía industrial por geografía

El alcance geográfico del informe de mercado de radiografía industrial se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Oriente Medio y África, y América del Sur y Central. El mercado de radiografía industrial en América del Norte está segmentado en Estados Unidos, Canadá y México. América del Norte ha desarrollado la producción de vehículos automotrices de meteorología de la industria aeroespacial y de defensa. La región tiene varios fabricantes automotrices de renombre como Ford, Hona, Toyota, Tesla y otros. El objetivo principal de la radiografía industrial es detectar defectos internos en materiales y estructuras como grietas, huecos, inclusiones y discontinuidades. Los fabricantes lo utilizan para detectar grietas o fallas en los productos.

Perspectivas regionales del mercado de radiografía industrial

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de radiografía industrial durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de radiografía industrial en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de radiografía industrial

Alcance del informe de mercado de radiografía industrial

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 638,9 millones |

| Tamaño del mercado en 2031 | US$ 1242,9 millones |

| CAGR global (2023 - 2031) | 8,6 % |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por técnica

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado: comprensión de su impacto en la dinámica empresarial

El mercado de la radiografía industrial está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de radiografía industrial son:

- Rayos X 3D

- Anritsu

- Grupo de cometas

- Corporación Fujifilm

- ELECTRICIDAD GENERAL

- METTLER TOLEDO

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de radiografía industrial

Noticias y desarrollos recientes del mercado de radiografía industrial

El mercado de la radiografía industrial se evalúa mediante la recopilación de datos cualitativos y cuantitativos a partir de investigaciones primarias y secundarias, que incluyen publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se enumeran algunos de los avances en el mercado de la radiografía industrial:

- La Real Fuerza Aérea Británica ha adjudicado a 3DX-Ray un contrato para suministrar tres sistemas portátiles de escaneo por rayos X ThreatScan-LSC (RAF). Los ThreatScan-LSC reemplazarán a los sistemas existentes y este es el primer contrato de Ray con la RAF.

(Fuente: 3DX-RAY, enero de 2021)

- Teledyne Industrial X-Ray Solutions, un proveedor de imágenes por rayos X de alto rendimiento, presentó una nueva línea de productos de detectores dinámicos industriales de alta velocidad y alto rendimiento basados en nuestra innovadora tecnología de sensores IGZO resistentes a la radiación. Los detectores Rad-Xcam 1717, 1723 y 3030 están diseñados para abordar las exigentes necesidades de las aplicaciones de inspección industrial, biomédica y científica, y brindan atractivas ventajas en cuanto a costos de integración. (Fuente: Teledyne, julio de 2023)

Cobertura y resultados del informe de mercado de radiografía industrial

El informe “Tamaño y pronóstico del mercado de radiografía industrial (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado de radiografía industrial y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de radiografía industrial, así como dinámicas del mercado, como impulsores, restricciones y oportunidades clave

- Análisis detallado de las cinco fuerzas de Porter y PEST y FODA

- Análisis del mercado de radiografía industrial que abarca las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes en el mercado de radiografía industrial

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de radiografía industrial

Obtenga una muestra gratuita para - Mercado de radiografía industrial