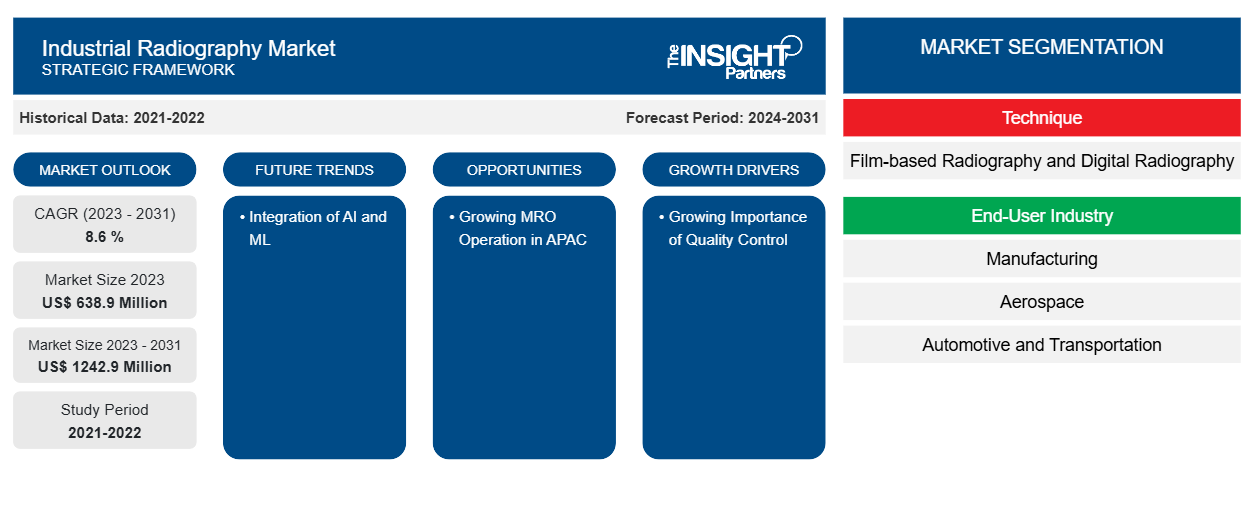

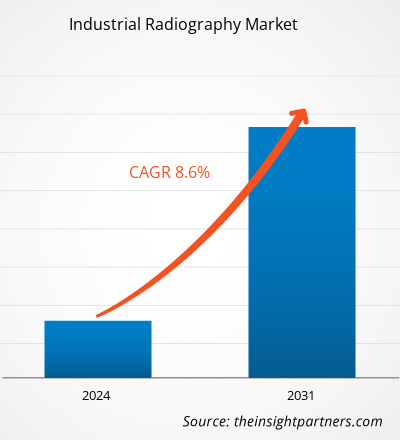

Si prevede che la dimensione del mercato della radiografia industriale raggiungerà 1242,9 milioni di dollari entro il 2031, rispetto ai 638,9 milioni di dollari del 2023. Si prevede che il mercato registrerà un CAGR dell'8,6% nel periodo 2023-2031. È probabile che l'integrazione di AI e ML rimanga una tendenza chiave nel mercato.

Analisi del mercato della radiografia industriale

Nella radiografia industriale, gli ispettori analizzano la struttura interna di materiali e componenti utilizzando radiazioni ionizzanti come raggi X o raggi gamma. Ciò consente di rivelare difetti nascosti, misurare lo spessore e controllare l'integrità di varie costruzioni senza causare danni. Inoltre, l'aumento della manutenzione, delle riparazioni e delle operazioni sta guidando la crescita del mercato.

Panoramica del mercato della radiografia industriale

La radiografia industriale è una modalità di test non distruttivo che utilizza radiazioni ionizzanti per ispezionare materiali e componenti allo scopo di rilevare e misurare difetti e degradazione delle qualità dei materiali che potrebbero causare la rottura di strutture ingegneristiche. I produttori utilizzano la radiografia industriale per rilevare fratture o difetti nei materiali. La radiografia industriale impiega principalmente raggi X e radiazioni gamma per rivelare difetti che non possono essere notati a occhio nudo. La radiografia industriale è un tipo di test fisico non distruttivo. Questa forma di radiografia impiega radiazioni ionizzanti emesse da una sorgente radioattiva in condizioni regolate per rilevare o determinare la struttura interna di un oggetto senza causare alcun danno alla sua morfologia esterna. Di conseguenza, può essere utilizzata per ottenere una chiara comprensione dei costituenti o dei componenti della cosa o del prodotto in esame.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

Mercato della radiografia industriale: approfondimenti strategici

-

Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Driver e opportunità del mercato della radiografia industriale

Crescente importanza del controllo di qualità per favorire il mercato

Controllo qualità Gli ispettori della radiografia industriale valutano la qualità complessiva delle immagini radiografiche e dei metodi di ispezione. Garantiscono che le ispezioni soddisfino gli standard del settore e che le apparecchiature funzionino correttamente. La radiografia industriale è utilizzata principalmente per rilevare difetti interni in materiali e strutture, come crepe, vuoti, inclusioni e discontinuità. Garantisce l'integrità strutturale e la sicurezza di numerosi componenti del sistema. La radiografia industriale è utilizzata per valutare materiali come metalli, polimeri , compositi e ceramiche. Saldature, condutture, fusioni, forgiature, componenti aeronautici e altri articoli sono tutti comunemente ispezionati.

Crescita delle operazioni MRO nell'area APAC

Si prevede che la domanda MRO dell'India si espanderà più rapidamente della media globale, creando opportunità per investitori nazionali ed esteri, OEM e principali MRO. Gli investitori, sia nazionali che esteri, potrebbero partecipare. Inoltre, la sede della più grande base MRO in Asia, l'elevata concentrazione dell'industria aerospaziale e la presenza di grandi attori del settore come Rolls Royce e Airbus sono le ragioni per la crescita delle operazioni MRO in Asia. MRO è una componente essenziale di molti settori. I seguenti settori fanno ampio uso di pratiche MRO: le aziende manifatturiere si affidano ampiamente ad attività di manutenzione e riparazione per attrezzature di produzione, macchinari e utensili. Ciò comprende automobili, aeroplani, elettronica, beni di consumo e altri settori. Il settore dei trasporti, che comprende compagnie aeree, treni, spedizioni e logistica, si affida alle tecniche MRO per mantenere le proprie flotte di auto, aeroplani, locomotive e container.

Analisi della segmentazione del rapporto di mercato della radiografia industriale

I segmenti chiave che hanno contribuito alla derivazione dell'analisi del mercato della radiografia industriale sono la tecnica e il settore dell'utente finale.

- In base alla tecnica, il mercato della radiografia industriale è suddiviso in radiografia su pellicola e radiografia digitale.

- In base al settore dell'utente finale, il mercato della radiografia industriale è segmentato in produzione, aerospaziale, automobilistico e trasporti, produzione di energia, petrolchimico e del gas e altri.

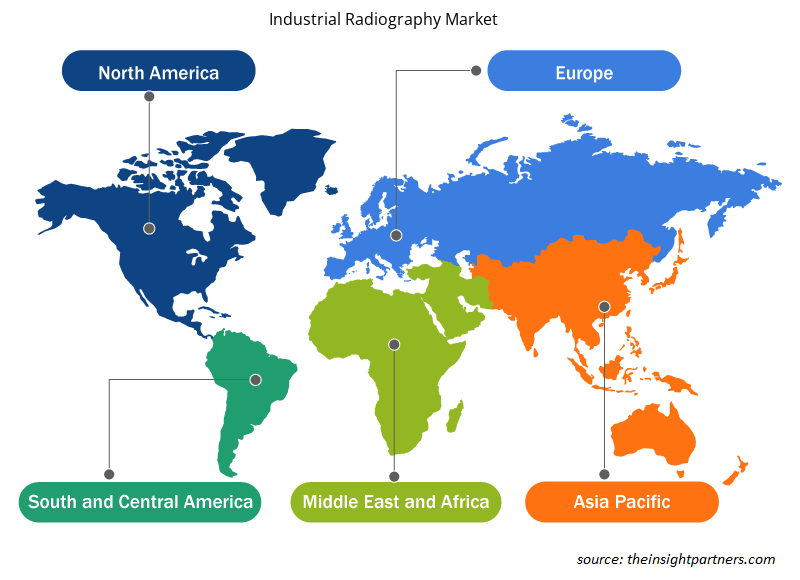

Analisi della quota di mercato della radiografia industriale per area geografica

L'ambito geografico del rapporto di mercato sulla radiografia industriale è principalmente suddiviso in cinque regioni: Nord America, Asia Pacifico, Europa, Medio Oriente e Africa e Sud e Centro America. Il mercato della radiografia industriale in Nord America è segmentato in Stati Uniti, Canada e Messico. Il Nord America ha sviluppato l'industria aerospaziale e della difesa, la meteorologia e la produzione di veicoli automobilistici. La regione ha vari produttori automobilistici rinomati come Ford, Hona, Toyota, Tesla e altri. L'obiettivo principale della radiografia industriale è rilevare difetti interni in materiali e strutture come crepe, vuoti, inclusioni e discontinuità. I produttori lo utilizzano per rilevare prodotti per crepe o guasti.

Approfondimenti regionali sul mercato della radiografia industriale

Le tendenze regionali e i fattori che influenzano il mercato della radiografia industriale durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del mercato della radiografia industriale in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e America meridionale e centrale.

- Ottieni i dati specifici regionali per il mercato della radiografia industriale

Ambito del rapporto sul mercato della radiografia industriale

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2023 | 638,9 milioni di dollari USA |

| Dimensioni del mercato entro il 2031 | 1242,9 milioni di dollari USA |

| CAGR globale (2023-2031) | 8,6% |

| Dati storici | 2021-2022 |

| Periodo di previsione | 2024-2031 |

| Segmenti coperti |

Per tecnica

|

| Regioni e Paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli attori del mercato: comprendere il suo impatto sulle dinamiche aziendali

Il mercato della radiografia industriale sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato della radiografia industriale sono:

- RAGGI X 3D

- Anritsu

- Gruppo Cometa

- Società Fujifilm

- ELETTRICA GENERALE

- METTLER TOLEDO

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato della radiografia industriale

Notizie e sviluppi recenti sul mercato della radiografia industriale

Il mercato della radiografia industriale viene valutato raccogliendo dati qualitativi e quantitativi dopo la ricerca primaria e secondaria, che include importanti pubblicazioni aziendali, dati associativi e database. Di seguito sono elencati alcuni degli sviluppi nel mercato della radiografia industriale:

- La Royal Air Force ha assegnato a 3DX-Ray un contratto per la fornitura di tre sistemi portatili di scansione a raggi X (RAF) ThreatScan-LSC. I ThreatScan-LSC sostituiranno i sistemi esistenti e questo è il primo contratto di 3DX-Ray con la RAF.

(Fonte: 3DX-RAY, gennaio 2021)

- Teledyne Industrial X-Ray Solutions, fornitore di imaging a raggi X ad alte prestazioni, ha introdotto una nuova linea di prodotti di rilevatori dinamici industriali ad alta velocità e alte prestazioni basati sulla nostra innovativa tecnologia di sensori IGZO resistenti alle radiazioni. I rilevatori Rad-Xcam 1717, 1723 e 3030 sono progettati per soddisfare le esigenti esigenze delle applicazioni di ispezione industriale, biomediche e scientifiche, offrendo interessanti vantaggi in termini di costi di integrazione. (Fonte: Teledyne., luglio 2023)

Copertura e risultati del rapporto sul mercato della radiografia industriale

Il rapporto "Dimensioni e previsioni del mercato della radiografia industriale (2021-2031)" fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni e previsioni del mercato della radiografia industriale a livello globale, regionale e nazionale per tutti i principali segmenti di mercato coperti dall'ambito

- Tendenze del mercato della radiografia industriale, nonché dinamiche di mercato quali driver, vincoli e opportunità chiave

- Analisi dettagliata delle cinque forze PEST/Porter e SWOT

- Analisi del mercato della radiografia industriale che copre le principali tendenze del mercato, il quadro globale e regionale, i principali attori, le normative e i recenti sviluppi del mercato

- Analisi del panorama industriale e della concorrenza che copre la concentrazione del mercato, l'analisi della mappa termica, i principali attori e gli sviluppi recenti nel mercato della radiografia industriale

- Profili aziendali dettagliati

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato della radiografia industriale

Ottieni un campione gratuito per - Mercato della radiografia industriale