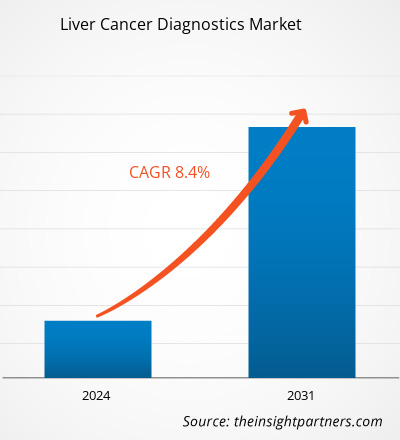

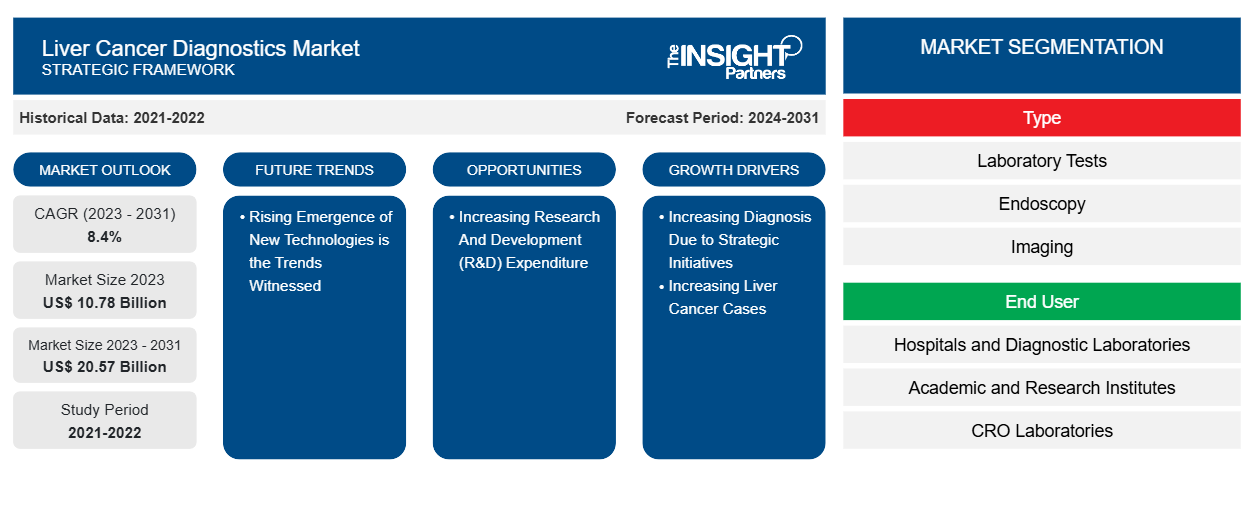

Le marché du diagnostic du cancer du foie devrait atteindre 20,57 milliards USD d'ici 2031, contre 10,78 milliards USD en 2023. Le marché devrait enregistrer un TCAC de 8,4 % au cours de la période 2023-2031. L'émergence croissante de nouvelles technologies devrait rester une tendance clé du marché.

Analyse du marché du diagnostic du cancer du foie

Selon le CDC, chaque année aux États-Unis, environ 24 500 hommes et 10 000 femmes développent un cancer du foie, dont 18 600 hommes et 9 000 femmes meurent de la maladie. Les cas d'Américains atteints de cancer du foie sont en augmentation depuis plusieurs décennies. Le carcinome hépatocellulaire (CHC) est le cancer du foie le plus courant aux États-Unis. De plus, selon le gouvernement canadien, environ 1 adulte canadien sur 4 (26,6 %) souffre actuellement d'obésité. Les cas d'obésité sont également en augmentation et, avec l'augmentation du nombre de cas, le risque de certains problèmes de santé tels que les lésions hépatiques, le diabète, l'hypertension artérielle et les maladies cardiaques augmente également.

Aperçu du marché du diagnostic du cancer du foie

En 2020, l'Organisation mondiale de la santé (OMS) a déclaré que plus de 10 millions de décès sont survenus dans le monde, dont un décès sur six est dû au cancer. De plus, en 2020, le cancer du foie est l'un des types de cancer les plus courants, représentant environ 4,7 % de tous les nouveaux cas de cancer et 8,3 % de tous les décès par cancer. Sur tous les cas de cancer du foie diagnostiqués, 75 à 90 % sont des carcinomes hépatocellulaires (CHC), qui ont un impact plus important sur les décès liés au cancer. Selon l'article publié dans CCO (Chinese Clinical Oncology), le cancer hépatocellulaire (CHC) est l'une des principales causes de décès par cancer dans le monde. Les procédures les plus souvent utilisées pour le dépistage du HCC sont le test d'alpha-fœtoprotéine sérique (AFP) et l'échographie hépatique. Cependant, en termes de sensibilité, le test AFP a une sensibilité de 25 à 65 %, et l'échographie a une sensibilité de plus de 60 %. Le cancer du foie est un cancer plus courant et les cas sont en augmentation. Au Royaume-Uni, par exemple, les taux de mortalité dus au CHC devraient augmenter de 14 % d’ici 2025, ce qui représente la plus forte augmentation pour tous les cancers.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Facteurs moteurs et opportunités du marché du diagnostic du cancer du foie

Augmentation du nombre de diagnostics grâce à des initiatives stratégiques visant à favoriser le marché

En juin 2020, les scientifiques du NCI ont développé un nouveau test de dépistage du carcinome hépatocellulaire (CHC), la forme la plus courante de cancer du foie. Ce dépistage implique une analyse sanguine pour rechercher l'exposition antérieure du patient à certains virus. Ce dépistage conduit à une détection et un diagnostic précoces, principalement parce que les cancers à un stade tardif ou avancé sont détectés et, à ce stade, ils sont souvent incurables. En outre, le NCI a également lancé le programme CCR Liver Cancer pour développer de nouvelles méthodes de détection, de diagnostic et de traitement précoces, dans le but d'améliorer les résultats des patients atteints de HCC. En outre, les National Institutes of Health (NIH) ont lancé leur réseau d'essais cliniques pour évaluer les aides et les problèmes possibles des nouvelles technologies prometteuses de dépistage du cancer et pour régir les méthodes efficaces d'intégration de ces innovations dans les protocoles de soins standard.

Augmentation des dépenses en recherche et développement (R&D)

En 2021, les dépenses de recherche et développement (R&D) d'Elecsys GALAD se sont élevées à 14,65 milliards USD et en 2020, elles étaient de 13,17 milliards USD. Elles ont augmenté de 14 % sur une base de base. En outre, la R&D de F. Hoffmann-La Roche Ltd a augmenté principalement pour les investissements de stade avancé en oncologie, en ophtalmologie et en soins de santé personnalisés. De plus, en juin 2020, des scientifiques des National Institutes of Health (NIH) ont lancé des tests sanguins pour améliorer le dépistage du cancer du foie, qui sont gérés par des chercheurs du National Cancer Institute (NCI). Par conséquent, les investissements croissants en R&D et le développement de tests de diagnostic pour le cancer du foie stimulent le marché du diagnostic du cancer du foie.

Analyse de segmentation du rapport sur le marché du diagnostic du cancer du foie

Les segments clés qui ont contribué à l’élaboration de l’analyse du marché du diagnostic du cancer du foie sont le type et l’utilisateur final.

- En fonction du type, le marché est divisé en tests de laboratoire, endoscopie , imagerie, biopsie et autres. Le segment des tests de laboratoire détenait une part de marché plus importante en 2023.

- En fonction de l'utilisateur final, le marché est divisé en hôpitaux et laboratoires de diagnostic, instituts universitaires et de recherche et laboratoires CRO. Le segment des hôpitaux et des laboratoires de diagnostic détenait une part de marché plus importante en 2023.

Analyse des parts de marché du diagnostic du cancer du foie par géographie

La portée géographique du rapport sur le marché du diagnostic du cancer du foie est principalement divisée en cinq régions : Amérique du Nord, Asie-Pacifique, Europe, Moyen-Orient et Afrique, et Amérique du Sud et centrale.

L'Amérique du Nord domine le marché et l'Asie-Pacifique devrait connaître le TCAC le plus élevé dans les années à venir. La croissance du marché de l'Asie-Pacifique est due à l'augmentation de la population âgée et à l'élargissement des options de traitement du cancer du foie. En raison de la mise en œuvre de procédures de diagnostic améliorées pour le cancer du foie dans des pays comme l'Inde et la Chine, la région APAC devrait avoir le TCAC le plus élevé. À mesure que la rentabilité des solutions de diagnostic s'améliore, la demande de diagnostics du cancer du foie dans les laboratoires de diagnostic indépendants de l'APAC devrait augmenter. Les facteurs ci-dessus propulseront le marché du diagnostic du cancer du foie.

Aperçu régional du marché du diagnostic du cancer du foie

Les tendances et facteurs régionaux influençant le marché du diagnostic du cancer du foie tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché du diagnostic du cancer du foie en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché du diagnostic du cancer du foie

Portée du rapport sur le marché du diagnostic du cancer du foie

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | 10,78 milliards de dollars américains |

| Taille du marché d'ici 2031 | 20,57 milliards de dollars américains |

| Taux de croissance annuel composé mondial (2023-2031) | 8,4% |

| Données historiques | 2021-2022 |

| Période de prévision | 2024-2031 |

| Segments couverts |

Par type

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché du diagnostic du cancer du foie : comprendre son impact sur la dynamique commerciale

Le marché du diagnostic du cancer du foie connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché du diagnostic du cancer du foie sont :

- Abbé,

- BioMérieux SA,

- F. HOFFMANN-LA ROCHE LTÉE,

- Illumina, Inc.,

- Royal Philips NV,

- QIAGEN,

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché du diagnostic du cancer du foie

Actualités et développements récents du marché du diagnostic du cancer du foie

Le marché du diagnostic du cancer du foie est évalué en collectant des données qualitatives et quantitatives après des recherches primaires et secondaires, qui comprennent d'importantes publications d'entreprise, des données d'association et des bases de données. Quelques-uns des développements sur le marché du diagnostic du cancer du foie sont énumérés ci-dessous :

- Illumina, Inc. a lancé le test oncologique TruSight pour évaluer plusieurs gènes tumoraux et biomarqueurs. Le test TruSight sera bientôt lancé à l'échelle mondiale en Europe. Il évalue les gènes tumoraux et les biomarqueurs pour découvrir le profil moléculaire spécifique du cancer d'un patient, contribuant ainsi à éclairer les décisions en matière de médecine de précision. (Source : Illumina, Inc., communiqué de presse, mars 2022)

- Perspectum a conclu un partenariat avec HepQuant pour fournir la technologie d'évaluation de la fonction hépatique de HepQuant via les services d'organisation de recherche sous contrat (CRO) de Perspectum. Cette collaboration a permis aux sociétés pharmaceutiques soutenant des essais cliniques sur les maladies du foie, notamment la cirrhose du foie, la stéatohépatite non alcoolique (NASH), les maladies hépatiques auto-immunes et le cancer du foie, de bénéficier des connaissances en matière d'imagerie et de tests fonctionnels de la part de Pharma Solutions de Perspectum. (Source : Perspectum, communiqué de presse, novembre 2021)

Rapport sur le marché du diagnostic du cancer du foie : couverture et livrables

Le rapport « Taille et prévisions du marché du diagnostic du cancer du foie (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille et prévisions du marché du diagnostic du cancer du foie aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le champ d'application

- Tendances du marché du diagnostic du cancer du foie, ainsi que la dynamique du marché, comme les facteurs moteurs, les contraintes et les opportunités clés

- Analyse détaillée des cinq forces de PEST/Porter et SWOT

- Analyse du marché du diagnostic du cancer du foie couvrant les principales tendances du marché, le cadre mondial et régional, les principaux acteurs, les réglementations et les développements récents du marché3

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents sur le marché du diagnostic du cancer du foie

- Profils d'entreprise détaillés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Rapports connexes

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché du diagnostic du cancer du foie

Obtenez un échantillon gratuit pour - Marché du diagnostic du cancer du foie