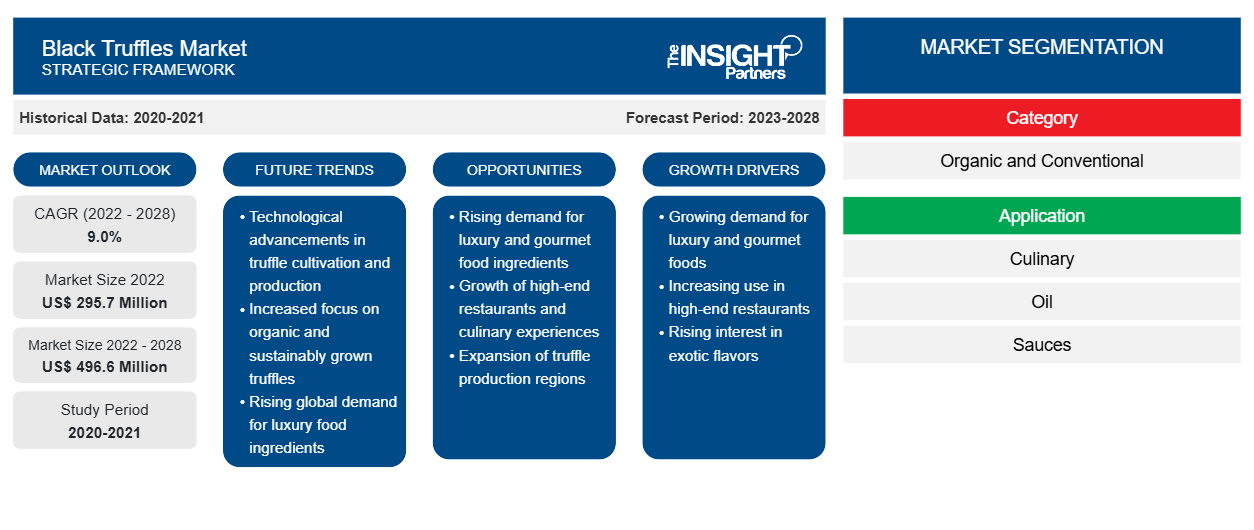

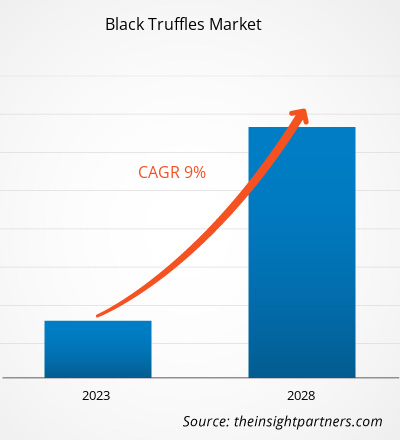

Si prevede che il mercato del tartufo nero crescerà da 295,7 milioni di dollari nel 2022 a 496,6 milioni di dollari entro il 2028; si prevede una crescita a un CAGR del 9,0% dal 2022 al 2028.

Il tartufo nero (Tuber melanosporum), noto anche come tartufo del Perigord o tartufo nero invernale, si trova allo stato selvatico in tutta Europa da novembre a febbraio, anche se la stagione può variare leggermente. Di recente, il tartufo nero invernale è stato coltivato con successo in Australia e Nuova Zelanda. Il tartufo nero è un fungo ectomicorrizico, quindi di solito si trova in stretta associazione con le radici degli alberi. Il tartufo nero è utilizzato principalmente nella cucina italiana e francese. Il tartufo nero ha sapori e aromi unici. Il sapore del tartufo nero ha note terrose con un pizzico di menta, pepe e nocciola. Il tartufo nero è preferito da molti gourmet per il suo profilo aromatico unico. Spesso, gli chef chiamano il tartufo nero il "Diamante della cucina".

Impatto della pandemia di COVID-19 sul mercato del tartufo nero

Nel 2020, vari settori hanno dovuto rallentare le proprie attività a causa di interruzioni nelle catene di valore e di fornitura causate dalla chiusura dei confini nazionali e internazionali. La pandemia di COVID-19 ha avuto un impatto negativo sulle economie e sui settori a causa di blocchi, divieti di viaggio e chiusure aziendali. Le interruzioni nelle catene di fornitura di materie prime chiave e le irregolarità nei processi di produzione dovute alle restrizioni imposte dalle autorità governative hanno avuto un impatto diretto sul settore alimentare e delle bevande. Questi fattori hanno avuto un impatto negativo sul mercato del tartufo nero durante la pandemia di COVID-19. Tuttavia, nel 2021, il mercato ha assistito a una ripresa positiva poiché i governi hanno annunciato l'allentamento delle restrizioni precedentemente imposte. Ai produttori è stato consentito di lavorare a piena capacità, sfruttando la loro redditività. Si prevede che questo fattore guiderà il mercato nei prossimi anni.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

Mercato del tartufo nero: approfondimenti strategici

-

Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Approfondimenti di mercato

Iniziative di innovazione di prodotto da parte degli utenti finali

I produttori di tartufo nero stanno investendo in modo significativo in ricerca e sviluppo, partnership e collaborazioni per lanciare prodotti innovativi per attrarre un'ampia base di consumatori. I venditori di cibo e bevande stanno lanciando nuovi prodotti a base di tartufo, come salse e oli, che portano al consumo di tartufo nero nel mercato globale. Nel 2018, deRosario, il produttore con sede negli Stati Uniti, ha lanciato una gamma di condimenti al tartufo realizzati con tartufi, tra cui olio al tartufo nero e olio extravergine di oliva. Nel 2020, PS Gourmet Pe ha lanciato il suo olio al tartufo nero a Singapore. Nel novembre 2022, TRUFF, un produttore con sede in Australia, è entrato nel settore dei condimenti con "TRUFF Black Truffle Salt". L'opzione del condimento presenta un mix di sale marino fine e grosso con una quantità mirata di tartufo nero. Tali lanci di prodotti aiutano le aziende a stabilire relazioni a lungo termine con i consumatori finali.

Tipo Informazioni

In base alla categoria, il mercato del tartufo nero è segmentato in biologico e convenzionale. Si prevede che il segmento biologico registrerà un CAGR più elevato durante il periodo di previsione. Il tartufo nero biologico viene coltivato in terreni privi di fertilizzanti chimici (come azoto sintetico, fosfato e potassio) e ingredienti geneticamente modificati. Anche erbicidi e pesticidi sintetici vengono evitati nella coltivazione biologica del tartufo nero. Invece, i coltivatori utilizzano stimolatori della crescita biologici per coltivare tartufi neri biologici. In genere, i tartufi neri biologici sono più costosi dei tartufi convenzionali a causa della loro qualità superiore. Le aziende si stanno concentrando sul conseguimento di certificazioni biologiche per soddisfare la crescente domanda di tartufi neri biologici sul mercato.

Approfondimenti sulle applicazioni

In base all'applicazione, il mercato del tartufo nero è segmentato in culinario; olio; salse, creme spalmabili e burro; e altri. Il segmento culinario ha detenuto la quota maggiore del mercato nel 2021. I tartufi neri vengono grattugiati in salse a base di vino o panna o grattugiati su pasta cotta, uova strapazzate o piatti di patate. I tartufi neri vengono aggiunti come guarnizioni a vari prodotti alimentari per migliorarne il sapore e conferire loro un aspetto più opulento. Inoltre, i tartufi neri vengono aggiunti come ingredienti di guarnizione ai pasti a base di carne e per conferire un sapore forte al cibo. Vengono anche utilizzati per produrre sale al tartufo e miele al tartufo. Anche alcuni tipi di formaggi speciali contengono tartufi neri. Questi fattori stanno alimentando la domanda di tartufi neri nelle applicazioni culinarie.

I principali attori che operano nel mercato del tartufo nero includono Trufo, TRUFFUS SAS, L'Aragonais Food Supplies SL, SABATINO NA LLC, LAUMONT TRUFFLES SLU, Arotz SA, Les Freres Jaumard SaRL, Perigord Truffles of Tasmania Pty Ltd, Great Southern Truffles Pty Ltd e Old World Truffles. Questi attori si concentrano sulla fornitura di prodotti di alta qualità per soddisfare le richieste dei clienti. Si concentrano anche su strategie come investimenti in attività di ricerca e sviluppo e lanci di nuovi prodotti.

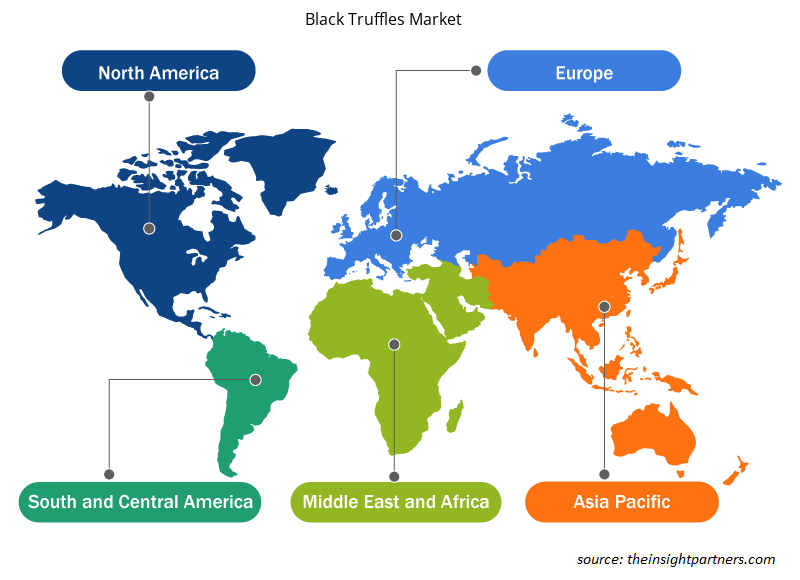

Approfondimenti regionali sul mercato del tartufo nero

Le tendenze regionali e i fattori che influenzano il mercato dei tartufi neri durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del mercato dei tartufi neri in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa, e Sud e Centro America.

- Ottieni i dati specifici regionali per il mercato del tartufo nero

Scopo del rapporto sul mercato dei tartufi neri

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2022 | 295,7 milioni di dollari USA |

| Dimensioni del mercato entro il 2028 | 496,6 milioni di dollari USA |

| CAGR globale (2022 - 2028) | 9,0% |

| Dati storici | 2020-2021 |

| Periodo di previsione | 2023-2028 |

| Segmenti coperti |

Per categoria

|

| Regioni e Paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli attori del mercato del tartufo nero: comprendere il suo impatto sulle dinamiche aziendali

Il mercato del tartufo nero sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei benefici del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato del Tartufo Nero sono:

- Trufo, Truffus SAS

- L'aragonais Food Supplies SL

- Sabatino Na LLC

- Tartufi Laumont SLU

- Arotz SA

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato del tartufo nero

Segnala i riflettori

- Tendenze progressive del settore nel mercato del tartufo nero per aiutare gli operatori a sviluppare strategie efficaci a lungo termine

- Strategie di crescita aziendale adottate dalle aziende per garantire la crescita nei mercati sviluppati e in via di sviluppo

- Analisi quantitativa del mercato del tartufo nero dal 2019 al 2028

- Stima della domanda mondiale di tartufo nero

- Analisi delle cinque forze di Porter per illustrare l'efficacia di acquirenti e fornitori di tartufi neri

- Sviluppi recenti per comprendere lo scenario competitivo del mercato

- Tendenze e prospettive del mercato, insieme ai fattori che guidano e frenano la crescita del mercato del tartufo nero

- Assistenza nel processo decisionale evidenziando le strategie di mercato che sostengono l'interesse commerciale

- La dimensione del mercato del tartufo nero nei vari nodi

- Panoramica dettagliata e segmentazione del mercato, nonché dinamiche del settore alimentare e delle bevande

- Dimensioni del mercato del tartufo nero in diverse regioni con promettenti opportunità di crescita

Profili aziendali

- Vero

- TRUFFO SAS

- Forniture alimentari L'Aragonais SL

- SABATINO NA LLC

- TARTUFI LAUMONT SLU

- Arotz SA

- I Fratelli Jaumard SaRL

- Tartufi Perigord della Tasmania Pty Ltd

- Tartufi della Grande Southern Pty Ltd

- Tartufi del Vecchio Mondo

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato del Tartufo Nero

Ottieni un campione gratuito per - Mercato del Tartufo Nero