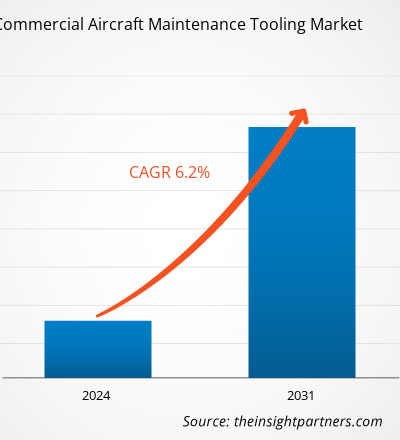

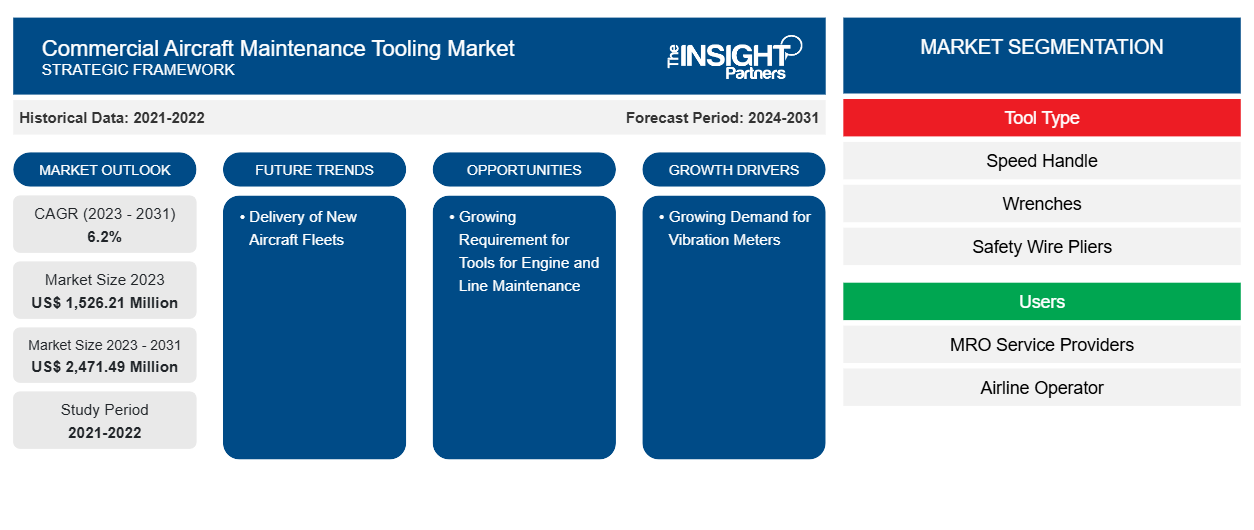

Si prevede che la dimensione del mercato degli utensili per la manutenzione degli aeromobili commerciali raggiungerà i 2.471,49 milioni di dollari entro il 2031, rispetto ai 1.526,21 milioni di dollari del 2023. Si prevede che il mercato registrerà un CAGR del 6,2% nel periodo 2023-2031. È probabile che la crescente consegna di nuove flotte di aeromobili rimanga una tendenza chiave nel mercato.

Analisi del mercato degli utensili per la manutenzione degli aeromobili commerciali

Aziende come Red Box Tools, Hydro Systems KG, Shanghai kaviation Technology Co. Ltd., Stanley Black & Decker, Stahlwille Eduard Wille GmbH & Co. KG, Field International Group Limited, Henchman Products, Dedienne Aerospace, FRANKE-Aerotech GmbH, German Gulf Aviation Services, Tronair e Snap-On Tools sono tra i principali produttori nel mercato degli utensili per la manutenzione degli aeromobili commerciali. Queste aziende sono impegnate nella progettazione, produzione e vendita di un'ampia gamma di utensili per la manutenzione degli aeromobili a distributori che poi li forniscono agli utenti finali, come rispettivamente compagnie aeree, aziende MRO, OEM aeronautici e produttori di componenti per aeromobili.

Panoramica del mercato degli utensili per la manutenzione degli aeromobili commerciali

L'ecosistema del mercato degli utensili per la manutenzione degli aeromobili commerciali è diversificato e in continua evoluzione. I suoi stakeholder sono fornitori di materie prime, produttori di componenti di utensili MRO e cassette degli attrezzi, distributori e utenti finali. I principali attori occupano posizioni nei vari nodi dell'ecosistema di mercato. I fornitori di materie prime forniscono materie prime come acciaio, gomma e alluminio ai produttori di utensili che poi le utilizzano per produrre e progettare i prodotti finali degli utensili. Il prodotto finale viene poi distribuito agli utenti finali tramite diversi mezzi, come vendite dirette tramite distributori aziendali o vendite a terzi tramite distributori terzi.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

-

Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Driver e opportunità del mercato degli utensili per la manutenzione degli aeromobili commerciali

La crescente domanda di misuratori di vibrazioni favorisce il mercato

A causa di un continuo aumento della domanda, i produttori di misuratori di vibrazioni avanzati si concentrano sullo sviluppo di analizzatori di vibrazioni robusti. MTI Instruments ha sviluppato un analizzatore/sistema di bilanciamento delle vibrazioni delle turbine denominato PBS-4100R+, adatto per motori a reazione. Il sistema è utilizzato da diversi produttori di aeromobili e strutture MRO che operano nel settore dell'aviazione commerciale. La disponibilità di diversi analizzatori/misuratori di vibrazioni per aeromobili commerciali consente ai fornitori di MRO di procurarsi facilmente il prodotto desiderato. Questo fattore ha aiutato il mercato degli utensili per la manutenzione degli aeromobili commerciali a crescere nel corso degli anni. La crescente inclinazione verso l'adozione di misuratori di vibrazioni avanzati da parte dei fornitori di servizi MRO e degli operatori aerei con strutture MRO interne sta guidando il mercato degli utensili per la manutenzione degli aeromobili commerciali fino al 2031.

Crescente richiesta di utensili per la manutenzione di motori e linee

le attività di manutenzione di linea svolgono un ruolo cruciale nelle operazioni quotidiane fluide delle flotte di aeromobili commerciali. L'importanza della manutenzione di linea è sempre più alta tra gli operatori di aeromobili. Il personale addetto alla manutenzione di linea utilizza strumenti quali chiavi dinamometriche, strumenti avionici e strumenti di manutenzione di ruote e freni. Si prevede che la domanda di tali strumenti aumenterà tra i team di manutenzione di linea con il crescente numero di flotte di aeromobili in tutto il mondo. I fornitori di servizi di manutenzione di linea di aeromobili commerciali insieme alle società di servizi di manutenzione dei motori si concentrano sull'ordinazione di attrezzature e strumenti di manutenzione di fascia alta per eseguire i loro compiti in modo competente. Sia la manutenzione di linea che la manutenzione dei motori sono di fondamentale importanza per qualsiasi operatore di aeromobili, che si prevede guideranno l'evoluzione del mercato degli strumenti di manutenzione degli aeromobili commerciali nel periodo di previsione.

Analisi della segmentazione del rapporto di mercato degli utensili per la manutenzione degli aeromobili commerciali

I segmenti chiave che hanno contribuito alla derivazione dell'analisi del mercato degli utensili per la manutenzione degli aeromobili commerciali sono il tipo di utensile, gli utenti e l'applicazione.

- In base al tipo di strumento, il mercato degli utensili per la manutenzione degli aeromobili commerciali è suddiviso in speed handle, chiavi inglesi, pinze per fili di sicurezza, misuratori di vibrazioni, utensili per la lavorazione dei metalli, utensili NDT e altri. Il segmento speed handle ha detenuto una quota di mercato maggiore nel 2023.

- In base agli utenti, il mercato degli utensili per la manutenzione degli aeromobili commerciali è suddiviso in fornitori di servizi MRO e operatori di compagnie aeree. Il segmento dei fornitori di servizi MRO ha detenuto una quota di mercato maggiore nel 2023.

- In base all'applicazione, il mercato degli utensili per la manutenzione degli aeromobili commerciali è suddiviso in motore, cellula, carrello di atterraggio, manutenzione della linea e altri. Il segmento della cellula ha detenuto una quota di mercato maggiore nel 2023.

Analisi della quota di mercato degli utensili per la manutenzione degli aeromobili commerciali per area geografica

L'ambito geografico del rapporto sul mercato degli utensili per la manutenzione degli aeromobili commerciali è suddiviso principalmente in cinque regioni: Nord America, Asia Pacifico, Europa, Medio Oriente e Africa, e Sud e Centro America.

L'ambito del rapporto di mercato sugli utensili per la manutenzione degli aeromobili commerciali comprende Nord America (Stati Uniti, Canada e Messico), Europa (Russia, Regno Unito, Francia, Germania, Italia e resto d'Europa), Asia Pacifico (Corea del Sud, India, Australia, Giappone, Cina e resto dell'Asia Pacifico), Medio Oriente e Africa (Arabia Saudita, Sudafrica, Emirati Arabi Uniti e resto del Medio Oriente e Africa) e Sud e Centro America (Argentina, Brasile e resto del Sud e Centro America). In termini di fatturato, il Nord America ha dominato la quota di mercato degli utensili per la manutenzione degli aeromobili commerciali nel 2023. L'Europa è il secondo maggiore contributore al mercato globale degli utensili per la manutenzione degli aeromobili commerciali, seguita dall'Asia Pacifico.

Approfondimenti regionali sul mercato degli utensili per la manutenzione degli aeromobili commerciali

Le tendenze regionali e i fattori che influenzano il mercato degli utensili per la manutenzione di aeromobili commerciali durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del mercato degli utensili per la manutenzione di aeromobili commerciali in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e America centrale e meridionale.

- Ottieni i dati specifici regionali per il mercato degli utensili per la manutenzione degli aeromobili commerciali

Ambito del rapporto di mercato sugli utensili per la manutenzione degli aeromobili commerciali

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2023 | 1.526,21 milioni di dollari USA |

| Dimensioni del mercato entro il 2031 | 2.471,49 milioni di dollari USA |

| CAGR globale (2023-2031) | 6,2% |

| Dati storici | 2021-2022 |

| Periodo di previsione | 2024-2031 |

| Segmenti coperti |

Per tipo di strumento

|

| Regioni e Paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli operatori del mercato degli utensili per la manutenzione degli aeromobili commerciali: comprendere il suo impatto sulle dinamiche aziendali

Il mercato degli utensili per la manutenzione di aeromobili commerciali sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato degli utensili per la manutenzione degli aeromobili commerciali sono:

- Sistemi aerodinamici RH

- Strumenti della scatola rossa

- Stanley Black & Decker

- Società per azioni Shanghai Kaviation Technology Co. Ltd.

- Stahlwille Eduard Wille GmbH & Co. KG

- Gruppo internazionale di campo limitato

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato degli utensili per la manutenzione degli aeromobili commerciali

Notizie e sviluppi recenti sul mercato degli utensili per la manutenzione degli aeromobili commerciali

Il mercato degli utensili per la manutenzione degli aeromobili commerciali viene valutato raccogliendo dati qualitativi e quantitativi dopo la ricerca primaria e secondaria, che include importanti pubblicazioni aziendali, dati associativi e database. Di seguito sono elencati alcuni degli sviluppi nel mercato degli utensili per la manutenzione degli aeromobili commerciali:

- Rhinestahl Corporation ha acquisito Hydro Systems KG per formare il leader indiscusso del settore nel mercato delle attrezzature e dei servizi di supporto all'aviazione. (Fonte: Rhinestahl Corporation, comunicato stampa, aprile 2024)

- Field International Group ha annunciato l'espansione della sua attività in India, Field International Pvt Ltd., che si svilupperà in uno stabilimento di produzione, al servizio dei mercati locali indiano e internazionale, fornendo soluzioni di produzione e utensili per aeromobili. (Fonte Field International Group Limited, comunicato stampa, maggio 2021)

Copertura e risultati del rapporto sul mercato degli utensili per la manutenzione degli aeromobili commerciali

Il rapporto "Dimensioni e previsioni del mercato degli utensili per la manutenzione degli aeromobili commerciali (2021-2031)" fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni e previsioni del mercato degli utensili per la manutenzione degli aeromobili commerciali a livello globale, regionale e nazionale per tutti i principali segmenti di mercato coperti dall'ambito

- Tendenze del mercato degli strumenti per la manutenzione degli aeromobili commerciali e dinamiche di mercato come driver, vincoli e opportunità chiave

- Analisi PEST e SWOT dettagliate

- Analisi di mercato degli utensili per la manutenzione degli aeromobili commerciali che copre le principali tendenze di mercato, il quadro globale e regionale, i principali attori, le normative e i recenti sviluppi del mercato

- Analisi del panorama industriale e della concorrenza che copre la concentrazione del mercato, l'analisi della mappa di calore, i principali attori e gli sviluppi recenti per il mercato degli utensili per la manutenzione degli aeromobili commerciali

- Profili aziendali dettagliati

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato degli utensili per la manutenzione degli aeromobili commerciali

Ottieni un campione gratuito per - Mercato degli utensili per la manutenzione degli aeromobili commerciali