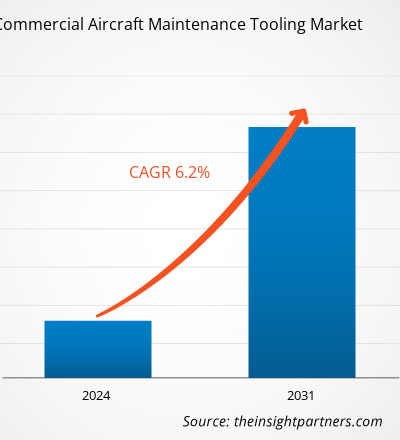

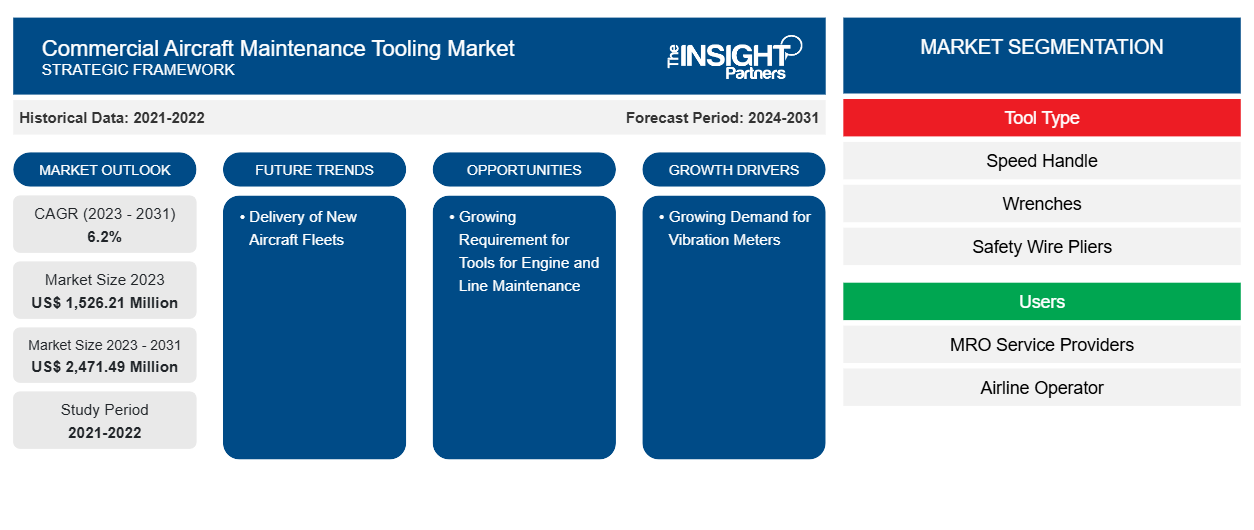

Le marché des outils de maintenance des avions commerciaux devrait atteindre 2 471,49 millions USD d'ici 2031, contre 1 526,21 millions USD en 2023. Le marché devrait enregistrer un TCAC de 6,2 % au cours de la période 2023-2031. La livraison croissante de nouvelles flottes d'avions devrait rester une tendance clé du marché.

Analyse du marché des outils de maintenance des avions commerciaux

Des entreprises telles que Red Box Tools, Hydro Systems KG, Shanghai kaviation Technology Co. Ltd., Stanley Black & Decker, Stahlwille Eduard Wille GmbH & Co. KG, Field International Group Limited, Henchman Products, Dedienne Aerospace, FRANKE-Aerotech GmbH, German Gulf Aviation Services, Tronair et Snap-On Tools comptent parmi les principaux fabricants sur le marché des outils de maintenance des avions commerciaux. Ces entreprises conçoivent, fabriquent et vendent une large gamme d' outils de maintenance d'avions à des distributeurs qui les fournissent ensuite aux utilisateurs finaux, tels que les compagnies aériennes, les sociétés de MRO, les équipementiers aéronautiques et les fabricants de composants d'avions.

Aperçu du marché des outils de maintenance des avions commerciaux

L'écosystème du marché de l'outillage de maintenance des avions commerciaux est diversifié et en constante évolution. Ses parties prenantes sont les fournisseurs de matières premières, les fabricants de composants d'outils et de boîtes à outils MRO, les distributeurs et les utilisateurs finaux. Les principaux acteurs occupent des places dans les différents nœuds de l'écosystème du marché. Les fournisseurs de matières premières fournissent des matières premières telles que l'acier, le caoutchouc et l'aluminium aux fabricants d'outils qui les utilisent ensuite pour fabriquer et concevoir les produits d'outillage finaux. Le produit final est ensuite distribué aux utilisateurs finaux par différents moyens, tels que la vente directe par l'intermédiaire de distributeurs de l'entreprise ou la vente à des tiers par l'intermédiaire de distributeurs tiers.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Moteurs et opportunités du marché des outils de maintenance des avions commerciaux

La demande croissante de vibromètres favorise le marché

En raison d'une demande en constante augmentation, les fabricants de vibromètres avancés se concentrent sur le développement d'analyseurs de vibrations robustes. MTI Instruments a développé un analyseur/système d'équilibrage des vibrations de turbine appelé PBS-4100R+ qui convient aux moteurs à réaction. Le système est utilisé par plusieurs constructeurs d'avions et installations MRO opérant dans le secteur de l'aviation commerciale. La disponibilité de plusieurs analyseurs/compteurs de vibrations pour avions commerciaux permet aux fournisseurs MRO de se procurer facilement le produit souhaité. Ce facteur a contribué à propulser le marché de l'outillage de maintenance des avions commerciaux au fil des ans. La tendance croissante à l'adoption de vibromètres avancés par les fournisseurs de services MRO et les exploitants de compagnies aériennes disposant d'installations MRO internes stimule le marché de l'outillage de maintenance des avions commerciaux jusqu'en 2031.

Besoin croissant d'outils pour la maintenance des moteurs et des lignes

Les activités de maintenance en ligne jouent un rôle crucial dans le bon fonctionnement quotidien des flottes d'avions commerciaux. L'importance de la maintenance en ligne est de plus en plus élevée parmi les exploitants d'aéronefs. Le personnel de maintenance en ligne utilise des outils tels que des clés dynamométriques, des outils avioniques et des outils de maintenance des roues et des freins. La demande pour de tels outils devrait augmenter parmi les équipes de maintenance en ligne avec le nombre croissant de flottes d'avions à travers le monde. Les prestataires de services de maintenance en ligne d'avions commerciaux ainsi que les sociétés de services de maintenance de moteurs se concentrent sur la commande d'équipements et d'outils de maintenance haut de gamme pour exécuter leurs tâches avec compétence. La maintenance en ligne et la maintenance des moteurs sont toutes deux de la plus haute importance pour tout exploitant d'aéronefs, qui devrait orienter l'évolution du marché des outils de maintenance des avions commerciaux au cours de la période de prévision.

Analyse de segmentation du rapport sur le marché des outils de maintenance des avions commerciaux

Les segments clés qui ont contribué à l’élaboration de l’analyse du marché de l’outillage de maintenance des avions commerciaux sont le type d’outil, les utilisateurs et l’application.

- En fonction du type d'outil, le marché de l'outillage de maintenance des avions commerciaux est divisé en poignées rapides, clés, pinces à fil de sécurité, vibromètres, outils de travail des métaux, outils CND et autres. Le segment des poignées rapides détenait une part de marché plus importante en 2023.

- En fonction des utilisateurs, le marché des outils de maintenance des avions commerciaux est divisé en prestataires de services MRO et exploitants de compagnies aériennes. Le segment des prestataires de services MRO détenait une part de marché plus importante en 2023.

- En fonction de l'application, le marché des outils de maintenance des avions commerciaux est divisé en moteurs, cellules, trains d'atterrissage, maintenance en ligne et autres. Le segment des cellules détenait une part de marché plus importante en 2023.

Analyse des parts de marché des outils de maintenance des avions commerciaux par zone géographique

La portée géographique du rapport sur le marché des outils de maintenance des avions commerciaux est principalement divisée en cinq régions : Amérique du Nord, Asie-Pacifique, Europe, Moyen-Orient et Afrique, et Amérique du Sud et centrale.

Français Le rapport sur le marché des outils de maintenance des avions commerciaux couvre l'Amérique du Nord (États-Unis, Canada et Mexique), l'Europe (Russie, Royaume-Uni, France, Allemagne, Italie et reste de l'Europe), l'Asie-Pacifique (Corée du Sud, Inde, Australie, Japon, Chine et reste de l'Asie-Pacifique), le Moyen-Orient et l'Afrique (Arabie saoudite, Afrique du Sud, Émirats arabes unis et reste du Moyen-Orient et de l'Afrique) et l'Amérique du Sud et centrale (Argentine, Brésil et reste de l'Amérique du Sud et centrale). En termes de chiffre d'affaires, l'Amérique du Nord a dominé la part de marché des outils de maintenance des avions commerciaux en 2023. L'Europe est le deuxième contributeur au marché mondial des outils de maintenance des avions commerciaux, suivie de l'Asie-Pacifique.

Aperçu régional du marché des outils de maintenance des avions commerciaux

Les tendances et facteurs régionaux influençant le marché de l’outillage de maintenance des avions commerciaux tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché de l’outillage de maintenance des avions commerciaux en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des outils de maintenance des avions commerciaux

Portée du rapport sur le marché des outils de maintenance des avions commerciaux

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | 1 526,21 millions de dollars américains |

| Taille du marché d'ici 2031 | 2 471,49 millions de dollars américains |

| Taux de croissance annuel composé mondial (2023-2031) | 6,2% |

| Données historiques | 2021-2022 |

| Période de prévision | 2024-2031 |

| Segments couverts |

Par type d'outil

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché des outils de maintenance des avions commerciaux : comprendre son impact sur la dynamique commerciale

Le marché des outils de maintenance des avions commerciaux connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des outils de maintenance des avions commerciaux sont :

- Systèmes Aéro RH

- Outils de la boîte rouge

- Stanley Black & Decker

- Shanghai kaviation Technology Co. Ltd.

- Stahlwille Eduard Wille GmbH & Co. KG

- Groupe Field International Limitée

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché des outils de maintenance des avions commerciaux

Actualités et développements récents du marché des outils de maintenance des avions commerciaux

Le marché des outils de maintenance des avions commerciaux est évalué en collectant des données qualitatives et quantitatives après des recherches primaires et secondaires, qui comprennent d'importantes publications d'entreprise, des données d'association et des bases de données. Quelques-uns des développements sur le marché des outils de maintenance des avions commerciaux sont énumérés ci-dessous :

- Rhinestahl Corporation a acquis Hydro Systems KG pour former le leader incontesté du marché des équipements et services de soutien à l'aviation. (Source : Rhinestahl Corporation, communiqué de presse, avril 2024)

- Field International Group a annoncé l'expansion de ses activités en Inde, Field International Pvt Ltd. et deviendra une usine de fabrication, au service des marchés locaux indiens et internationaux en fournissant des solutions d'outillage et de fabrication d'avions. (Source Field International Group Limited, communiqué de presse, mai 2021)

Rapport sur le marché des outils de maintenance des avions commerciaux

Le rapport « Taille et prévisions du marché des outils de maintenance des avions commerciaux (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille et prévisions du marché des outils de maintenance des avions commerciaux aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le périmètre

- Tendances du marché des outils de maintenance des avions commerciaux ainsi que la dynamique du marché, comme les facteurs déterminants, les contraintes et les opportunités clés

- Analyse PEST et SWOT détaillée

- Analyse du marché des outils de maintenance des avions commerciaux couvrant les principales tendances du marché, le cadre mondial et régional, les principaux acteurs, les réglementations et les développements récents du marché

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents pour le marché des outils de maintenance des avions commerciaux

- Profils d'entreprise détaillés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché des outils de maintenance des avions commerciaux

Obtenez un échantillon gratuit pour - Marché des outils de maintenance des avions commerciaux