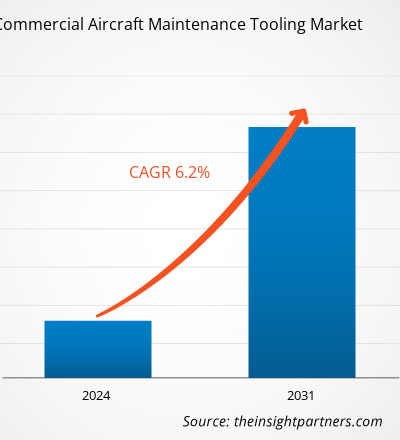

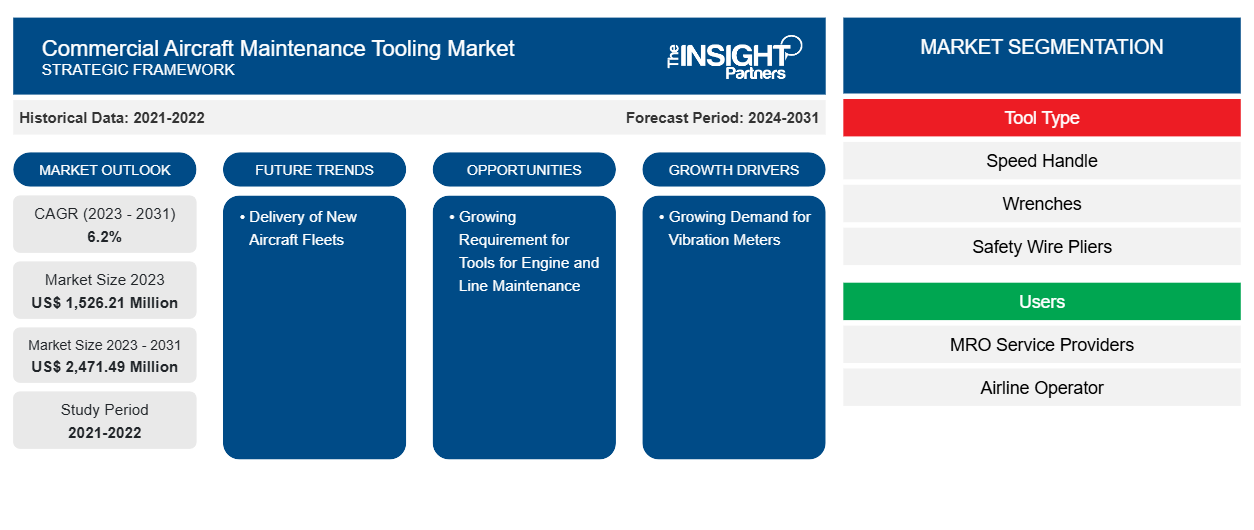

Se proyecta que el tamaño del mercado de herramientas de mantenimiento de aeronaves comerciales alcance los 2.471,49 millones de dólares estadounidenses en 2031, frente a los 1.526,21 millones de dólares estadounidenses en 2023. Se espera que el mercado registre una CAGR del 6,2 % durante el período 2023-2031. Es probable que la creciente entrega de nuevas flotas de aeronaves siga siendo una tendencia clave en el mercado.

Análisis del mercado de herramientas de mantenimiento de aeronaves comerciales

Entre los fabricantes líderes en el mercado de herramientas de mantenimiento de aeronaves comerciales se encuentran empresas como Red Box Tools, Hydro Systems KG, Shanghai kaviation Technology Co. Ltd., Stanley Black & Decker, Stahlwille Eduard Wille GmbH & Co. KG, Field International Group Limited, Henchman Products, Dedienne Aerospace, FRANKE-Aerotech GmbH, German Gulf Aviation Services, Tronair y Snap-On Tools. Estas empresas se dedican al diseño, fabricación y venta de una amplia gama de herramientas de mantenimiento de aeronaves a distribuidores que luego las suministran a los usuarios finales, como aerolíneas, empresas de MRO, fabricantes de equipos originales de aviación y fabricantes de componentes de aeronaves, respectivamente.

Descripción general del mercado de herramientas de mantenimiento de aeronaves comerciales

El ecosistema del mercado de herramientas de mantenimiento de aeronaves comerciales es diverso y está en constante evolución. Sus partes interesadas son los proveedores de materias primas, los fabricantes de componentes y cajas de herramientas para MRO, los distribuidores y los usuarios finales. Los principales actores ocupan lugares en los distintos nodos del ecosistema del mercado. Los proveedores de materias primas suministran materias primas como acero, caucho y aluminio a los fabricantes de herramientas, quienes luego las utilizan para fabricar y diseñar los productos de herramientas finales. El producto final luego se distribuye a los usuarios finales a través de diferentes medios, como ventas directas a través de distribuidores de la empresa o ventas a terceros a través de distribuidores externos.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de herramientas de mantenimiento de aeronaves comerciales

La creciente demanda de medidores de vibraciones favorecerá el mercado

Debido al continuo aumento de la demanda, los fabricantes de medidores de vibraciones avanzados se centran en el desarrollo de analizadores de vibraciones robustos. MTI Instruments ha desarrollado un sistema de equilibrado/analizador de vibraciones de turbinas llamado PBS-4100R+ que es adecuado para motores a reacción. El sistema lo utilizan varios fabricantes de aeronaves e instalaciones de MRO que operan en el sector de la aviación comercial. La disponibilidad de varios analizadores/medidores de vibraciones para aeronaves comerciales permite a los proveedores de MRO adquirir el producto deseado fácilmente. Este factor ha ayudado al mercado de herramientas de mantenimiento de aeronaves comerciales a impulsarse a lo largo de los años. La creciente inclinación hacia la adopción de medidores de vibraciones avanzados por parte de los proveedores de servicios de MRO y los operadores de aerolíneas con instalaciones de MRO internas está impulsando el mercado de herramientas de mantenimiento de aeronaves comerciales hasta 2031.

Necesidad creciente de herramientas para el mantenimiento de motores y líneas

Las actividades de mantenimiento de línea desempeñan un papel crucial en el buen funcionamiento diario de las flotas de aviones comerciales. La importancia del mantenimiento de línea es máxima entre los operadores de aeronaves. El personal de mantenimiento de línea utiliza herramientas como llaves dinamométricas, herramientas de aviónica y herramientas de mantenimiento de ruedas y frenos. Se espera que la demanda de dichas herramientas aumente entre los equipos de mantenimiento de línea con el creciente número de flotas de aeronaves en todo el mundo. Los proveedores de servicios de mantenimiento de línea de aeronaves comerciales, junto con las empresas de servicios de mantenimiento de motores, se centran en el pedido de equipos y herramientas de mantenimiento de alta gama para ejecutar sus tareas de manera competente. Tanto el mantenimiento de línea como el mantenimiento de motores son de suma importancia para cualquier operador de aeronaves, lo que se prevé que dirija la evolución del mercado de herramientas de mantenimiento de aeronaves comerciales durante el período de pronóstico.

Análisis de segmentación del informe de mercado de herramientas de mantenimiento de aeronaves comerciales

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de herramientas de mantenimiento de aeronaves comerciales son el tipo de herramienta, los usuarios y la aplicación.

- Según el tipo de herramienta, el mercado de herramientas de mantenimiento de aeronaves comerciales se divide en mangos de velocidad, llaves, alicates para cables de seguridad, medidores de vibraciones, herramientas para trabajar metales, herramientas para END y otros. El segmento de mangos de velocidad tuvo una mayor participación de mercado en 2023.

- En función de los usuarios, el mercado de herramientas de mantenimiento de aeronaves comerciales se divide en proveedores de servicios MRO y operadores de aerolíneas. El segmento de proveedores de servicios MRO tuvo una mayor participación de mercado en 2023.

- Según la aplicación, el mercado de herramientas de mantenimiento de aeronaves comerciales se divide en motores, fuselaje, tren de aterrizaje, mantenimiento de línea y otros. El segmento de fuselaje tuvo una mayor participación de mercado en 2023.

Análisis de la cuota de mercado de herramientas de mantenimiento de aeronaves comerciales por geografía

El alcance geográfico del informe de mercado de herramientas de mantenimiento de aeronaves comerciales se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Medio Oriente y África, y América del Sur y Central.

El alcance del informe de mercado de herramientas de mantenimiento de aeronaves comerciales abarca América del Norte (EE. UU., Canadá y México), Europa (Rusia, Reino Unido, Francia, Alemania, Italia y el resto de Europa), Asia Pacífico (Corea del Sur, India, Australia, Japón, China y el resto de Asia Pacífico), Oriente Medio y África (Arabia Saudita, Sudáfrica, Emiratos Árabes Unidos y el resto de Oriente Medio y África) y América del Sur y Central (Argentina, Brasil y el resto de América del Sur y Central). En términos de ingresos, América del Norte dominó la participación de mercado de herramientas de mantenimiento de aeronaves comerciales en 2023. Europa es el segundo mayor contribuyente al mercado mundial de herramientas de mantenimiento de aeronaves comerciales, seguida de Asia Pacífico.

Perspectivas regionales del mercado de herramientas de mantenimiento de aeronaves comerciales

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de herramientas de mantenimiento de aeronaves comerciales durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de herramientas de mantenimiento de aeronaves comerciales en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de herramientas de mantenimiento de aeronaves comerciales

Alcance del informe de mercado de herramientas de mantenimiento de aeronaves comerciales

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 1.526,21 millones |

| Tamaño del mercado en 2031 | US$ 2.471,49 millones |

| CAGR global (2023 - 2031) | 6,2% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por tipo de herramienta

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de herramientas de mantenimiento de aeronaves comerciales: comprensión de su impacto en la dinámica empresarial

El mercado de herramientas de mantenimiento de aeronaves comerciales está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de herramientas de mantenimiento de aeronaves comerciales son:

- Sistemas Aero RH

- Herramientas de caja roja

- Stanley Black & Decker

- Compañía Tecnológica Shangai Kaviation Co. Ltd.

- Stahlwille Eduard Wille GmbH & Co. KG

- Grupo Internacional Field Limited

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de herramientas de mantenimiento de aeronaves comerciales

Noticias y desarrollos recientes del mercado de herramientas de mantenimiento de aeronaves comerciales

El mercado de herramientas de mantenimiento de aeronaves comerciales se evalúa mediante la recopilación de datos cualitativos y cuantitativos posteriores a la investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se enumeran algunos de los desarrollos en el mercado de herramientas de mantenimiento de aeronaves comerciales:

- Rhinestahl Corporation adquirió Hydro Systems KG para convertirse en el líder indiscutible de la industria en el mercado de equipos y servicios de apoyo a la aviación. (Fuente: Rhinestahl Corporation, comunicado de prensa, abril de 2024)

- Field International Group ha anunciado la expansión de su negocio en India, Field International Pvt Ltd., que se convertirá en una planta de fabricación que prestará servicios a los mercados locales de India e internacionales proporcionando herramientas y soluciones de fabricación de aeronaves. (Fuente: Field International Group Limited, comunicado de prensa, mayo de 2021)

Informe sobre el mercado de herramientas de mantenimiento de aeronaves comerciales: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de herramientas de mantenimiento de aeronaves comerciales (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado de herramientas de mantenimiento de aeronaves comerciales y pronóstico a nivel mundial, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de herramientas de mantenimiento de aeronaves comerciales, así como dinámicas del mercado, como impulsores, restricciones y oportunidades clave

- Análisis PEST y FODA detallados

- Análisis del mercado de herramientas de mantenimiento de aeronaves comerciales que abarca las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes para el mercado de herramientas de mantenimiento de aeronaves comerciales

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de herramientas para el mantenimiento de aeronaves comerciales

Obtenga una muestra gratuita para - Mercado de herramientas para el mantenimiento de aeronaves comerciales