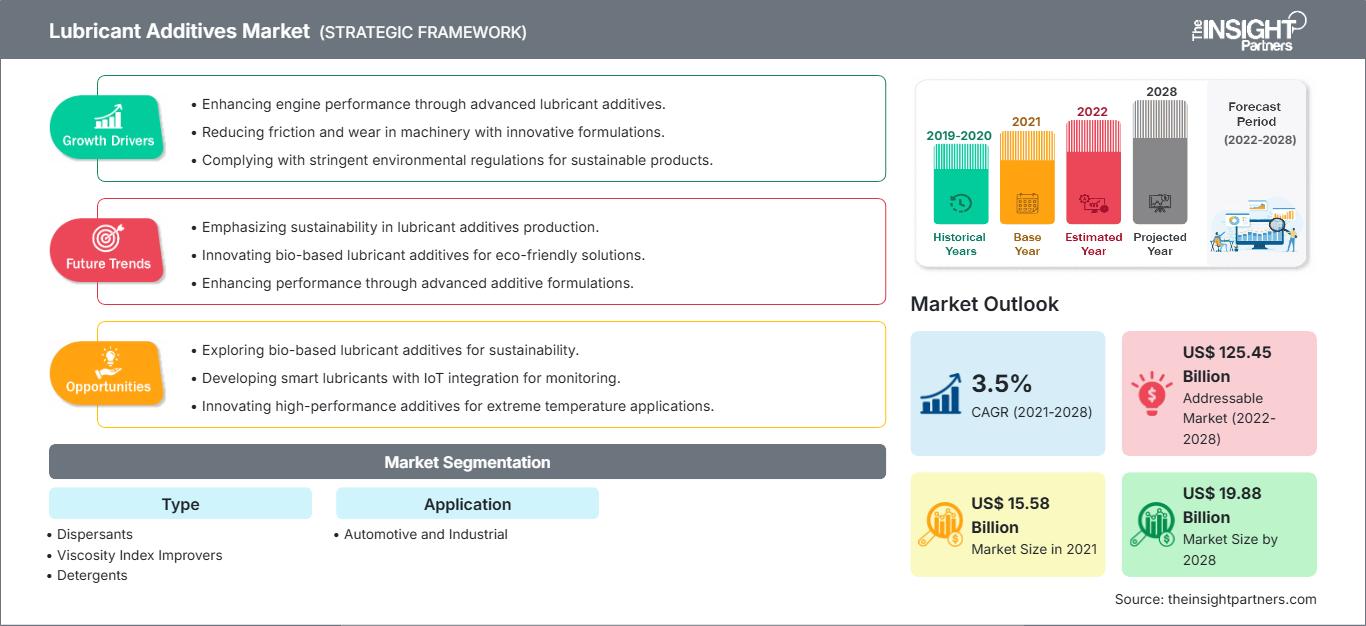

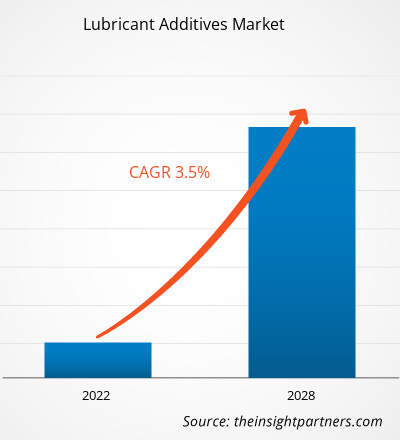

Il mercato degli additivi per lubrificanti è stato valutato a 15.584,9 milioni di dollari nel 2021 e si prevede che raggiungerà i 19.880,12 milioni di dollari entro il 2028; si prevede che registrerà un CAGR del 3,5% dal 2021 al 2028.

Gli additivi per lubrificanti vengono utilizzati nella lavorazione dei lubrificanti sintetici, comunemente utilizzati nei settori industriale e automobilistico grazie alle loro caratteristiche superiori all'olio minerale naturale. Pertanto, la crescita dei settori industriale e automobilistico aumenta la domanda di lubrificanti sintetici. L'olio motore è il lubrificante più comunemente utilizzato nei settori automobilistico e industriale. Presenta eccellenti proprietà fisiche e chimiche, tra cui un indice di viscosità più elevato, una minore volatilità, un punto di scorrimento più elevato e una maggiore stabilità termica. L'aggiunta di additivi come modificatori di viscosità e abbassatori del punto di scorrimento nei lubrificanti ne migliora le proprietà fisiche e chimiche. Pertanto, l'ampia applicazione dei lubrificanti in vari settori è il fattore chiave che guida il mercato degli additivi per lubrificanti, poiché la miscelazione di lubrificanti con additivi ne migliora le prestazioni e la durata.

Nel 2020, l'Asia-Pacifico deteneva la quota maggiore del mercato globale degli additivi per lubrificanti. Il fattore principale che contribuisce alla crescita del mercato in questa regione è la crescente domanda di additivi per lubrificanti da parte dell'industria automobilistica e di altre industrie manifatturiere. Il crescente sviluppo di componenti e componenti per autoveicoli nella regione, con l'aumento della produzione di veicoli, unito alle continue innovazioni dei produttori di carburanti per autotrazione, crea opportunità redditizie per il mercato dei lubrificanti, che a sua volta ne stimola la crescita. Inoltre, la crescita delle attività di costruzione, soprattutto in Cina e India, probabilmente attirerà gli operatori del mercato globale a stabilire le loro attività nell'area Asia-Pacifico. I veicoli commerciali pesanti sono ampiamente utilizzati in Cina, poiché i consumatori li preferiscono per la loro elevata capacità di carico e i robusti sistemi di sospensioni. Pertanto, sono utili nelle attività di trasporto. I veicoli commerciali pesanti, ad esempio i camion, sono ampiamente utilizzati nella logistica, nell'edilizia e nell'agricoltura grazie alla loro elevata capacità di carico. Vengono utilizzati principalmente per il trasporto di detriti e materiali da un luogo all'altro su qualsiasi terreno. Tutti questi fattori alimenteranno la domanda di additivi lubrificanti sul mercato.

Personalizza questo rapporto in base alle tue esigenze

Potrai personalizzare gratuitamente qualsiasi rapporto, comprese parti di questo rapporto, o analisi a livello di paese, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

Mercato degli additivi lubrificanti: Approfondimenti strategici

-

Ottieni le principali tendenze chiave del mercato di questo rapporto.Questo campione GRATUITO includerà l'analisi dei dati, che vanno dalle tendenze di mercato alle stime e alle previsioni.

Impatto della pandemia di COVID-19 sul mercato degli additivi lubrificanti

La pandemia di COVID-19 ha avuto un impatto significativo sul mercato globale nel 2020 a causa dell'interruzione delle catene di approvvigionamento delle materie prime utilizzate nella produzione di additivi lubrificanti. L'allentamento delle misure di lockdown in diversi paesi e la ripresa delle attività operative in molti settori hanno contribuito alla ripresa della domanda di additivi lubrificanti a partire dal 2021. Inoltre, il rapido ritmo dei programmi di vaccinazione contro il COVID-19 ha sostenuto la crescita del mercato degli additivi lubrificanti.

Approfondimenti di mercato

La rapida crescita industriale favorisce la crescita del mercato degli additivi lubrificanti

I lubrificanti sono tra i componenti chiave utilizzati nel settore industriale, poiché aiutano le apparecchiature a funzionare con elevata efficienza e massima affidabilità. Lubrificanti minerali e sintetici, grassi, oli per compressori e fluidi da taglio sono diversi tipi di lubrificanti utilizzati come additivi nei settori automobilistico, petrolifero e del gas, tessile, del vetro, della produzione di energia, della carta e della cellulosa, chimico e petrolchimico, agricolo, manifatturiero, alimentare e delle bevande e farmaceutico, tra gli altri. La crescita di questi settori in tutto il mondo si traduce in un'enorme domanda di lubrificanti e additivi per lubrificanti. Le industrie di finitura tessile, in particolare nell'area Asia-Pacifico, generano un'elevata domanda di lubrificanti industriali. L'industria tessile dell'area Asia-Pacifico registra un'elevata domanda di lubrificanti industriali. Pertanto, l'ampio utilizzo di lubrificanti in vari settori e la rapida crescita del settore industriale sono i fattori chiave che guidano il mercato degli additivi per lubrificanti.

Approfondimenti sulle applicazioni

In base all'applicazione, il mercato è segmentato in automobilistico e industriale. Il segmento automobilistico ha detenuto una quota di mercato maggiore nel 2020. Gli additivi lubrificanti vengono utilizzati nell'olio motore per prevenire la flocculazione di sostanze inorganiche nell'olio durante il funzionamento. Vi è un'elevata domanda di additivi lubrificanti negli oli motore multigrado, negli oli per ingranaggi, nei fluidi per trasmissioni automatiche, nei fluidi per servosterzo, nei grassi e in alcuni fluidi idraulici per mantenere la viscosità ad alte temperature. Molte case automobilistiche stanno investendo nel miglioramento dell'efficienza dei consumi di carburante dei veicoli, il che probabilmente contribuirà ulteriormente alla crescita del mercato nei prossimi anni.

Alcuni dei principali attori del mercato degli additivi lubrificanti sono Evonik Industries AG; The Lubrizol Corporation; LANXESS, Nouryon; Mol-lub Kft.; Dover Chemical Corporation; Croda International plc; Chevron Corporation; BASF SE; ed EXXON MOBIL CORPORATION. Queste aziende offrono un'ampia gamma di prodotti per il mercato degli additivi lubrificanti. Queste aziende sono presenti nelle regioni in via di sviluppo, il che offre un'opportunità redditizia per gli additivi lubrificanti. Questi operatori di mercato sono fortemente concentrati sullo sviluppo di prodotti innovativi e di alta qualità per soddisfare le esigenze del cliente.

In evidenza nel rapporto

- Tendenze progressive del settore nel mercato degli additivi per lubrificanti per aiutare gli operatori a sviluppare strategie efficaci a lungo termine

- Strategie di crescita aziendale adottate dai mercati sviluppati e in via di sviluppo

- Analisi quantitativa del mercato degli additivi per lubrificanti dal 2019 al 2028

- Stima della domanda globale di additivi per lubrificanti

- Analisi delle cinque forze di Porter per illustrare l'efficacia di acquirenti e fornitori nel mercato degli additivi per lubrificanti

- Sviluppi recenti per comprendere lo scenario competitivo del mercato

- Tendenze e prospettive di mercato, nonché fattori che guidano e frenano la crescita del mercato degli additivi per lubrificanti

- Assistenza nel processo decisionale evidenziando le strategie di mercato che sostengono l'interesse commerciale

- Le dimensioni del mercato degli additivi per lubrificanti in vari nodi

- Panoramica dettagliata e segmentazione del mercato, nonché dinamiche del settore degli additivi lubrificanti

- Dimensioni del mercato degli additivi lubrificanti in varie regioni con promettenti opportunità di crescita

Approfondimenti regionali sul mercato degli additivi lubrificanti

Le tendenze regionali e i fattori che influenzano il mercato degli additivi lubrificanti durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di The Insight Partners. Questa sezione illustra anche i segmenti e la geografia del mercato degli additivi lubrificanti in Nord America, Europa, Asia-Pacifico, Medio Oriente e Africa, America meridionale e centrale.

Ambito del rapporto di mercato sugli additivi lubrificanti

| Attributo del rapporto | Dettagli |

|---|---|

| Dimensioni del mercato in 2021 | US$ 15.58 Billion |

| Dimensioni del mercato per 2028 | US$ 19.88 Billion |

| CAGR globale (2021 - 2028) | 3.5% |

| Dati storici | 2019-2020 |

| Periodo di previsione | 2022-2028 |

| Segmenti coperti |

By Tipo

|

| Regioni e paesi coperti |

Nord America

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli operatori del mercato degli additivi lubrificanti: comprendere il suo impatto sulle dinamiche aziendali

Il mercato degli additivi lubrificanti è in rapida crescita, trainato dalla crescente domanda degli utenti finali, dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei benefici del prodotto. Con l'aumento della domanda, le aziende stanno ampliando la propria offerta, innovando per soddisfare le esigenze dei consumatori e sfruttando le tendenze emergenti, alimentando ulteriormente la crescita del mercato.

- Ottieni il Mercato degli additivi lubrificanti Panoramica dei principali attori chiave

Mercato degli additivi lubrificanti

-

Tipo

- Disperdenti

- Miglioratori dell'indice di viscosità

- Detergenti

- Agente antiusura

- Emulsionanti

- Altri

-

Applicazione

-

- Automotive

- Industriale

Profili aziendali

- Evonik Industries AG

- The Lubrizol Corporation

- LANXESS

- Nouryon

- Mol-lub Kft.

- Dover Chemical Corporation

- Croda International plc

- Chevron Corporation

- BASF SE

- EXXON MOBIL CORPORATION

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Rapporti correlati

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato degli additivi lubrificanti

Ottieni un campione gratuito per - Mercato degli additivi lubrificanti