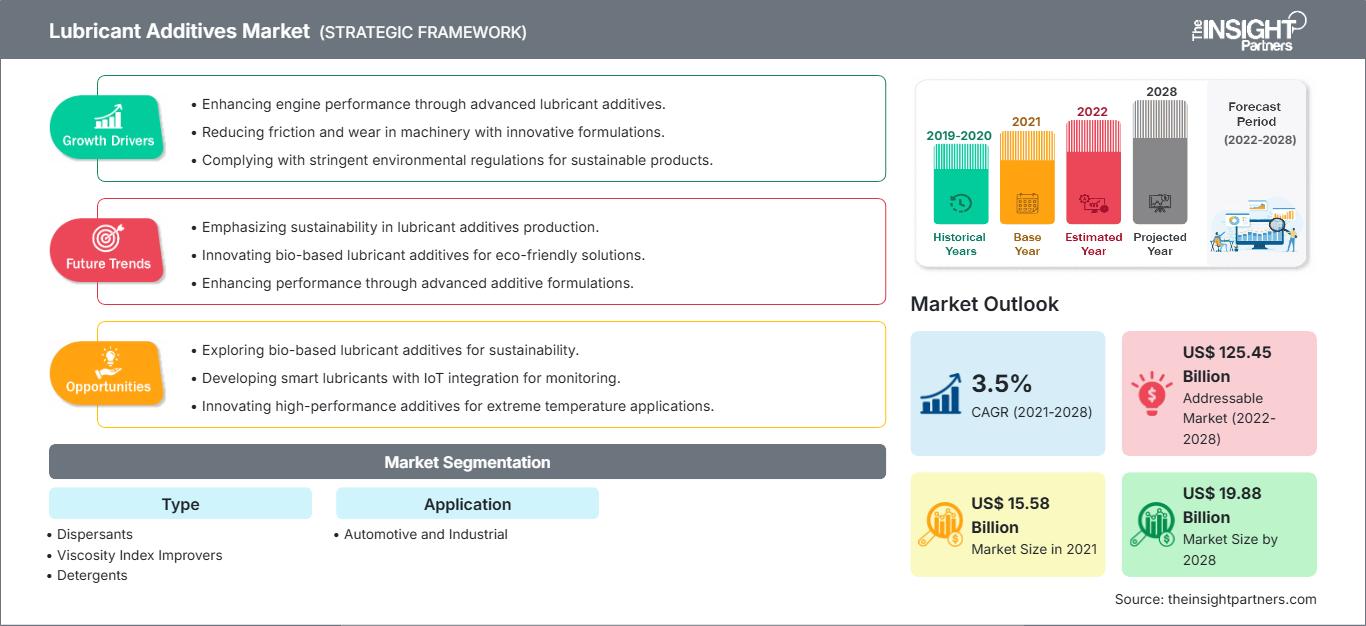

El mercado de aditivos para lubricantes se valoró en US$ 15.584,9 millones en 2021 y se proyecta que alcance los US$ 19.880,12 millones para 2028; se espera que registre una CAGR de 3,5% de 2021 a 2028.

Los aditivos lubricantes se utilizan en el procesamiento de lubricantes sintéticos, comúnmente utilizados en los sectores industrial y automotriz debido a sus características superiores a las del aceite mineral natural. Por lo tanto, el auge de los sectores industrial y automotriz impulsa la demanda de lubricantes sintéticos. El aceite de motor es el lubricante más utilizado en los sectores automotriz e industrial. Posee excelentes propiedades físicas y químicas, incluyendo un mayor índice de viscosidad, menor volatilidad, menor punto de fluidez y mayor estabilidad térmica. La adición de aditivos como modificadores de viscosidad y depresores del punto de fluidez a los lubricantes mejora sus propiedades físicas y químicas. Por lo tanto, la amplia aplicación de lubricantes en diversas industrias es el factor clave que impulsa el mercado de aditivos para lubricantes, ya que la mezcla de lubricantes con aditivos mejora su rendimiento y vida útil.

En 2020, Asia Pacífico ocupó la mayor participación en el mercado mundial de aditivos para lubricantes. El principal factor que contribuyó al crecimiento del mercado en esta región fue la creciente demanda de aditivos para lubricantes por parte de la industria automotriz y otras industrias manufactureras. El creciente desarrollo de piezas y componentes automotrices en la región, junto con el aumento de la producción de vehículos, junto con las continuas innovaciones de los fabricantes de combustibles para automóviles, generó oportunidades lucrativas para el mercado de lubricantes, lo que, a su vez, impulsó su crecimiento. Además, es probable que el crecimiento de la construcción, especialmente en China e India, atraiga a actores del mercado global a establecer sus negocios en Asia Pacífico. Los vehículos comerciales pesados se utilizan ampliamente en China, ya que los consumidores los prefieren debido a su alta capacidad de carga y sus robustos sistemas de suspensión. Por lo tanto, son útiles en las actividades de transporte. Los vehículos comerciales pesados, como los camiones, se utilizan ampliamente en logística, construcción y agricultura debido a su gran capacidad de carga. Se utilizan principalmente para transportar escombros y materiales de un lugar a otro en cualquier terreno. Todos estos factores impulsarán la demanda de aditivos para lubricantes en el mercado.

Recibirá personalización de cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, y además aprovechará grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado de aditivos para lubricantes: Perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impacto de la pandemia de COVID-19 en el mercado de aditivos para lubricantes

La pandemia de COVID-19 impactó gravemente el mercado global en 2020 debido a la interrupción de las cadenas de suministro de materias primas utilizadas en la producción de aditivos para lubricantes. La flexibilización de las medidas de confinamiento en varios países y la reanudación de la actividad en muchas industrias contribuyeron a la reactivación de la demanda de aditivos para lubricantes a partir de 2021. Además, el rápido ritmo de los programas de vacunación contra la COVID-19 ha impulsado el crecimiento del mercado de aditivos para lubricantes.

Perspectivas del mercado

El rápido crecimiento industrial favorece el crecimiento del mercado de aditivos para lubricantes.

Los lubricantes se encuentran entre los componentes clave utilizados en el sector industrial, ya que ayudan a los equipos a operar con alta eficiencia y máxima confiabilidad. Los lubricantes minerales y sintéticos, las grasas, los aceites para compresores y los fluidos de corte son varios tipos de lubricantes que se utilizan como aditivos en las industrias automotriz, de petróleo y gas, textil, del vidrio, de generación de energía, de papel y pulpa, química y petroquímica, agrícola, manufacturera, de alimentos y bebidas, y farmacéutica, entre otras. El crecimiento de estas industrias en todo el mundo genera una enorme demanda de lubricantes, así como de aditivos para lubricantes. Las industrias de acabado textil, especialmente en Asia Pacífico, generan una alta demanda de lubricantes industriales. Existe una alta demanda de lubricantes industriales en las industrias textiles de Asia Pacífico. Por lo tanto, la amplia aplicación de lubricantes en diversas industrias y el rápido crecimiento del sector industrial son los factores clave que impulsan el mercado de aditivos para lubricantes.

Perspectivas de la aplicación

Según la aplicación, el mercado se segmenta en automoción e industria. El segmento automotor tuvo una mayor cuota de mercado en 2020. Los aditivos lubricantes se utilizan en aceites de motor para evitar la floculación de sustancias inorgánicas durante el funcionamiento. Existe una gran demanda de aditivos lubricantes en aceites de motor multigrado, aceites para engranajes, fluidos para transmisiones automáticas, fluidos para dirección asistida, grasas y algunos fluidos hidráulicos para mantener la viscosidad a altas temperaturas. Muchos fabricantes de automóviles están invirtiendo en la mejora de la eficiencia de combustible de sus vehículos, lo que probablemente contribuirá aún más al crecimiento del mercado en los próximos años.

Algunos de los principales actores del mercado de aditivos para lubricantes son Evonik Industries AG; The Lubrizol Corporation; LANXESS, Nouryon; Mol-lub Kft.; Dover Chemical Corporation; Croda International plc; Chevron Corporation; BASF SE; y EXXON MOBIL CORPORATION. Estas empresas ofrecen una amplia gama de productos para el mercado de aditivos para lubricantes. Su presencia en las regiones en desarrollo representa una oportunidad lucrativa para este sector. Estos actores del mercado están altamente enfocados en el desarrollo de productos innovadores y de alta calidad para satisfacer las necesidades de los clientes.

Informe destacado

- Tendencias progresivas de la industria en el mercado de aditivos para lubricantes para ayudar a los actores a desarrollar estrategias efectivas a largo plazo.

- Estrategias de crecimiento empresarial adoptadas por los mercados desarrollados y en desarrollo

- Análisis cuantitativo del mercado de aditivos para lubricantes de 2019 a 2028

- Estimación de la demanda mundial de aditivos para lubricantes

- Análisis de las cinco fuerzas de Porter para ilustrar la eficacia de los compradores y proveedores en el mercado de aditivos para lubricantes

- Desarrollos recientes para comprender el escenario del mercado competitivo

- Tendencias y perspectivas del mercado, así como factores que impulsan y restringen el crecimiento del mercado de aditivos para lubricantes.

- Asistencia en el proceso de toma de decisiones destacando las estrategias de mercado que sustentan el interés comercial

- El tamaño del mercado de aditivos para lubricantes en varios nodos

- Descripción detallada y segmentación del mercado, así como la dinámica de la industria de aditivos para lubricantes.

- Tamaño del mercado de aditivos para lubricantes en diversas regiones con prometedoras oportunidades de crecimiento

Perspectivas regionales del mercado de aditivos para lubricantes

Los analistas de The Insight Partners han explicado detalladamente las tendencias regionales y los factores que influyen en el mercado de aditivos para lubricantes durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de aditivos para lubricantes en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

Alcance del informe de mercado de aditivos para lubricantes

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2021 | US$ 15.58 mil millones |

| Tamaño del mercado en 2028 | US$ 19.88 mil millones |

| CAGR global (2021-2028) | 3,5% |

| Datos históricos | 2019-2020 |

| Período de pronóstico | 2022-2028 |

| Segmentos cubiertos |

Por tipo

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de aditivos para lubricantes: comprensión de su impacto en la dinámica empresarial

El mercado de aditivos para lubricantes está creciendo rápidamente, impulsado por la creciente demanda del usuario final debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y un mayor conocimiento de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una descripción general de los principales actores clave del mercado de aditivos para lubricantes

Mercado de aditivos para lubricantes

-

Tipo

- Dispersantes

- Mejoradores del índice de viscosidad

- Detergentes

- Agente antidesgaste

- Emulsionantes

- Otros

- Solicitud

-

- Automotor

- Industrial

Perfiles de empresas

- Evonik Industries AG

- La Corporación Lubrizol

- LANXESS

- Nourion

- Mol-lub Kft.

- Corporación química Dover

- Croda International plc

- Corporación Chevron

- BASF SE

- CORPORACIÓN EXXON MOBIL

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de aditivos para lubricantes

Obtenga una muestra gratuita para - Mercado de aditivos para lubricantes