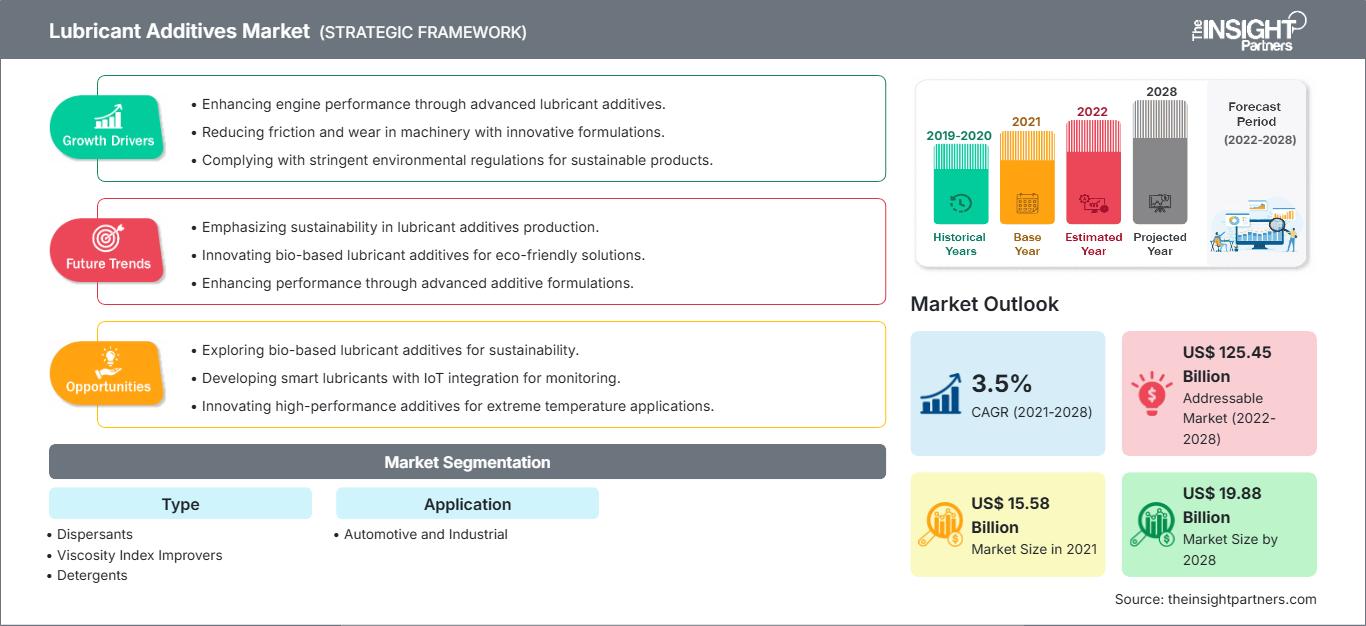

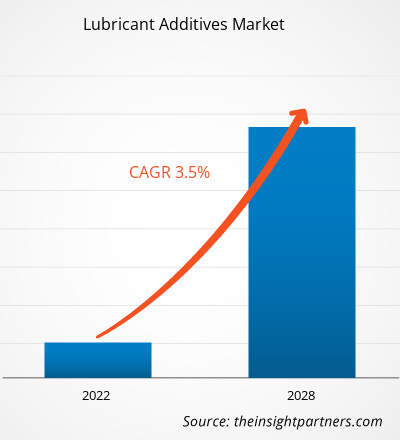

潤滑油添加剤市場は2021年に155億8,490万米ドルと評価され、2028年には198億8,012万米ドルに達すると予測されています。また、2021年から2028年にかけて3.5%のCAGR(年平均成長率)を記録すると見込まれています。

潤滑油添加剤は、天然鉱油よりも優れた特性を持つ合成潤滑油の製造に使用されます。そのため、工業および自動車部門の繁栄により、合成潤滑油の需要が高まっています。エンジンオイルは、自動車および工業部門で最も一般的に使用されている潤滑油です。エンジンオイルは、粘度指数が高く、揮発性が低く、流動点が高く、熱安定性に優れているなど、優れた物理的・化学的特性を備えています。潤滑油に粘度調整剤や流動点降下剤などの添加剤を加えることで、潤滑油の物理的・化学的特性が向上します。したがって、様々な産業における潤滑剤の広範な応用は、潤滑剤添加剤市場を牽引する重要な要因です。潤滑剤と添加剤を混合することで、潤滑剤の性能と耐用年数が向上するためです。

2020年、アジア太平洋地域は世界の潤滑剤添加剤市場で最大のシェアを占めました。この地域における市場成長の主因は、自動車産業をはじめとする製造業からの潤滑剤添加剤の需要増加です。この地域における自動車部品の開発と車両生産の増加、そして自動車燃料メーカーによる継続的なイノベーションは、潤滑剤市場に大きな利益をもたらす機会を生み出し、それが市場の成長を牽引しています。さらに、特に中国とインドにおける建設活動の活発化は、世界の市場プレーヤーがアジア太平洋地域に事業を展開するきっかけとなるでしょう。大型商用車は、高い積載量と強力なサスペンションシステムにより消費者に好まれ、中国で広く使用されています。そのため、輸送活動に役立ちます。トラックなどの大型商用車は、その高い積載量から、物流、建設、農業などで広く使用されています。潤滑油添加剤は主に、あらゆる地形において、瓦礫や資材をある場所から別の場所へ輸送するために使用されます。これらすべての要因が、潤滑油添加剤の市場需要を押し上げるでしょう。

要件に合わせてレポートをカスタマイズ

レポートの一部、国レベルの分析、Excelデータパックなどを含め、スタートアップ&大学向けに特別オファーや割引もご利用いただけます(無償)

潤滑油添加剤市場: 戦略的洞察

-

このレポートの主要な市場動向を入手してください。この無料サンプルには、市場動向から見積もりや予測に至るまでのデータ分析が含まれます。

COVID-19パンデミックによる潤滑油添加剤市場への影響

COVID-19パンデミックは、潤滑油添加剤の製造に使用される原材料のサプライチェーンの混乱により、2020年に世界市場に深刻な影響を与えました。いくつかの国でロックダウン措置が緩和され、多くの業界で操業が再開されたことで、2021年からの潤滑油添加剤の需要が回復しました。さらに、COVID-19ワクチン接種プログラムの急速なペースも、潤滑油添加剤市場の成長を支えています。

市場洞察

急速な産業成長が潤滑油添加剤市場の成長を後押し

潤滑剤は、機器が高効率かつ最大限の信頼性で動作するために必要なため、産業部門で使用される重要なコンポーネントの1つです。鉱物油や合成潤滑油、グリース、コンプレッサーオイル、切削液など、自動車、石油・ガス、繊維、ガラス、発電、製紙・パルプ、化学・石油化学、農業、製造、食品・飲料、医薬品などの業界で添加剤として使用されている潤滑剤には、さまざまな種類があります。これらの産業が世界中で成長しているため、潤滑剤だけでなく潤滑剤添加剤にも大きな需要があります。特にアジア太平洋地域の繊維仕上げ産業では、工業用潤滑剤の需要が高くなっています。アジア太平洋地域の繊維産業では、工業用潤滑剤の需要が高くなっています。そのため、さまざまな業界での潤滑剤の広範な用途と産業部門の急速な成長が、潤滑剤添加剤市場を牽引する主な要因となっています。

アプリケーションの洞察

アプリケーションに基づいて、市場は自動車用と工業用に分割されています。 2020年には自動車部門が大きな市場シェアを占めました。潤滑油添加剤は、エンジンオイルやモーターオイルに使用され、運転時にオイル内の無機物質の凝集を防ぎます。マルチグレードエンジンオイル、ギアオイル、オートマチックトランスミッションフルード、パワーステアリングフルード、グリース、一部の油圧作動油では、高温での粘度維持のために潤滑油添加剤の需要が高くなっています。多くの自動車メーカーが車両の燃費向上に投資しており、今後数年間で市場の成長にさらに貢献する可能性があります。

潤滑油添加剤市場の主要な市場プレーヤーには、Evonik Industries AG、The Lubrizol Corporation、LANXESS、Nouryon、Mol-lub Kft.、Dover Chemical Corporation、Croda International plc、Chevron Corporation、BASF SE、EXXON MOBIL CORPORATIONなどがあります。これらの企業は発展途上地域に拠点を置いており、潤滑剤添加剤にとって有利な機会を提供しています。これらの市場プレーヤーは、顧客の要件を満たす高品質で革新的な製品の開発に重点を置いています。

レポートのスポットライト

- 潤滑剤添加剤市場における進歩的な業界動向。プレーヤーが効果的な長期戦略を策定するのに役立ちます

- 先進国と発展途上国市場で採用されているビジネス成長戦略

- 2019年から2028年までの潤滑剤添加剤市場の定量分析

- 潤滑剤添加剤の世界的需要の推定

- 潤滑剤添加剤市場における買い手とサプライヤーの有効性を示すポーターのファイブフォース分析

- 競争の激しい市場シナリオを理解するための最近の動向

- 潤滑剤添加剤市場の成長を促進する要因と抑制する要因、および市場動向と展望

- 商業的関心を支える市場戦略を強調することで意思決定プロセスを支援

- 潤滑剤添加剤市場の規模さまざまなノードで

- 市場の詳細な概要とセグメンテーション、および潤滑油添加剤業界のダイナミクス

- 有望な成長機会のあるさまざまな地域における潤滑油添加剤市場の規模

潤滑油添加剤市場の地域別分析

予測期間を通じて潤滑油添加剤市場に影響を与える地域的な傾向と要因は、The Insight Partnersのアナリストによって詳細に説明されています。このセクションでは、北米、ヨーロッパ、アジア太平洋、中東・アフリカ、中南米における潤滑油添加剤市場のセグメントと地域についても説明します。

潤滑油添加剤市場レポートの範囲

| レポート属性 | 詳細 |

|---|---|

| の市場規模 2021 | US$ 15.58 Billion |

| 市場規模別 2028 | US$ 19.88 Billion |

| 世界的なCAGR (2021 - 2028) | 3.5% |

| 過去データ | 2019-2020 |

| 予測期間 | 2022-2028 |

| 対象セグメント |

By タイプ

|

| 対象地域と国 |

北米

|

| 市場リーダーと主要企業の概要 |

|

潤滑油添加剤市場のプレーヤー密度:ビジネスダイナミクスへの影響を理解する

潤滑油添加剤市場は、消費者の嗜好の変化、技術の進歩、製品の利点に対する認知度の高まりといった要因によるエンドユーザーの需要増加に牽引され、急速に成長しています。需要の増加に伴い、企業は製品ラインナップの拡充、消費者ニーズへの対応のための革新、そして新たなトレンドの活用を進めており、これが市場の成長をさらに加速させています。

- 入手 潤滑油添加剤市場 主要プレーヤーの概要

潤滑油添加剤市場

-

タイプ

- 分散剤

- 粘度指数向上剤

- 洗浄剤

- 耐摩耗剤

- 乳化剤

- その他

-

用途

-

- 自動車

- 工業用

企業プロファイル

- Evonik Industries AG

- The Lubrizol Corporation

- LANXESS

- Nouryon

- Mol-lub Kft.

- Dover Chemical Corporation

- Croda International plc

- Chevron Corporation

- BASF SE

- エクソンモービル株式会社

- 過去2年間の分析、基準年、CAGRによる予測(7年間)

- PEST分析とSWOT分析

- 市場規模価値/数量 - 世界、地域、国

- 業界と競争環境

- Excel データセット

最新レポート

関連レポート

お客様の声

購入理由

- 情報に基づいた意思決定

- 市場動向の理解

- 競合分析

- 顧客インサイト

- 市場予測

- リスク軽減

- 戦略計画

- 投資の正当性

- 新興市場の特定

- マーケティング戦略の強化

- 業務効率の向上

- 規制動向への対応

無料サンプルを入手 - 潤滑油添加剤市場

無料サンプルを入手 - 潤滑油添加剤市場