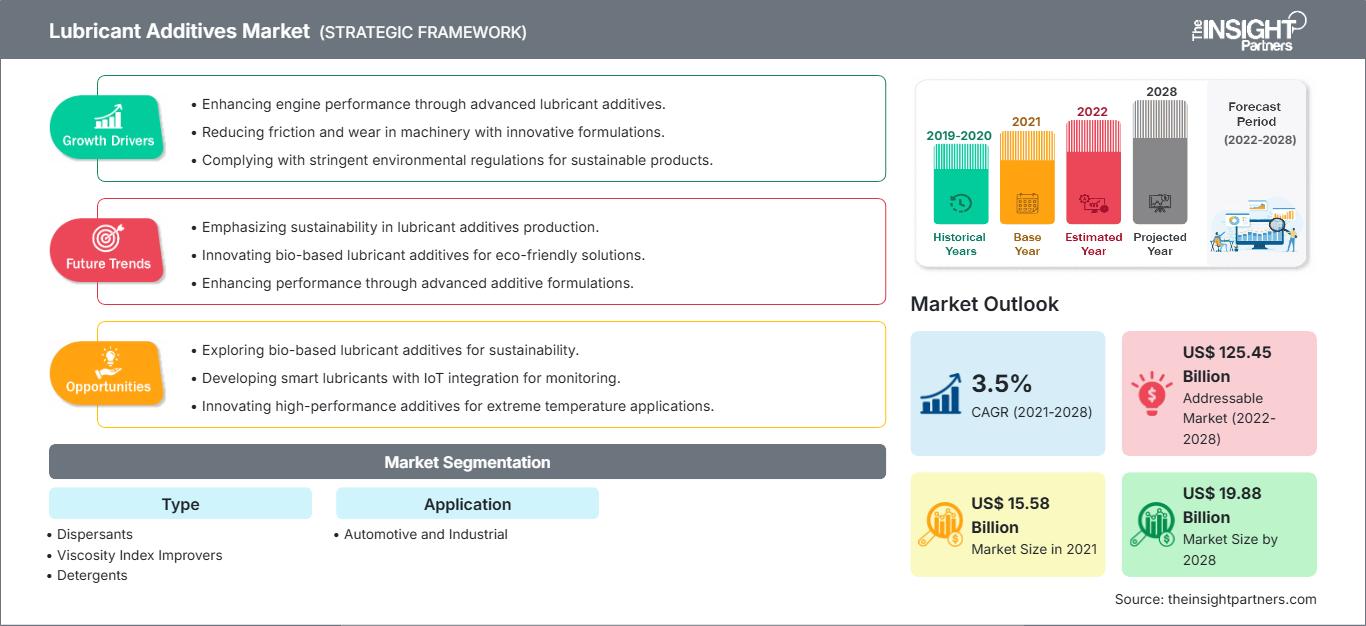

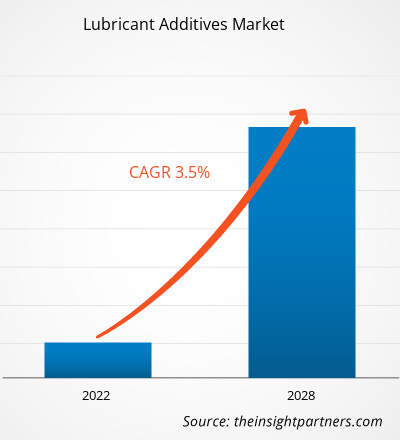

2021年,润滑油添加剂市场价值为155.849亿美元,预计到2028年将达到198.8012亿美元;预计2021年至2028年的复合年增长率为3.5%。

润滑油添加剂用于加工合成润滑油,合成润滑油因其优于天然矿物油的特性,常用于工业和汽车领域。因此,工业和汽车行业的蓬勃发展推动了对合成润滑油的需求。发动机油是汽车和工业领域最常用的润滑油。它具有优异的物理和化学性能,包括更高的粘度指数、更低的挥发性、倾点和更高的热稳定性。在润滑油中添加粘度改进剂和倾点下降剂等添加剂可以改善其物理和化学性能。因此,润滑油在各行各业的广泛应用是推动润滑油添加剂市场发展的关键因素,因为润滑油与添加剂的混合可以提高其性能和使用寿命。

2020年,亚太地区占据了全球润滑油添加剂市场的最大份额。推动该地区市场增长的主要因素是汽车和其他制造业对润滑油添加剂的需求不断增长。随着汽车产量的增长,该地区汽车零部件的不断发展,再加上汽车燃料制造商的不断创新,为润滑油市场创造了丰厚的利润,进而推动了市场的增长。此外,尤其是在中国和印度,建筑活动的蓬勃发展可能会吸引全球市场参与者在亚太地区开展业务。重型商用车在中国被广泛使用,因为消费者更喜欢它们,因为它们具有高承载能力和强大的悬挂系统。因此,它们在运输活动中非常有用。重型商用车,例如卡车,由于其高承载能力,广泛应用于物流、建筑和农业。它们主要用于在任何地形条件下将碎屑和物料从一个地方运输到另一个地方。所有这些因素都将推动润滑油添加剂的市场需求。

自定义此报告以满足您的要求

您将免费获得任何报告的定制,包括本报告的部分内容,或国家级分析、Excel 数据包,以及为初创企业和大学提供超值优惠和折扣

润滑油添加剂市场: 战略洞察

-

获取本报告的主要市场趋势。这个免费样本将包括数据分析,从市场趋势到估计和预测。

新冠疫情对润滑油添加剂市场的影响

2020 年,新冠疫情严重冲击了全球市场,原因是润滑油添加剂生产原材料供应链中断。随着多个国家放松封锁措施,许多行业恢复运营,润滑油添加剂需求从 2021 年开始复苏。此外,新冠疫苗接种计划的快速推进也支持了润滑油添加剂市场的增长。

市场洞察

快速的工业增长有利于润滑油添加剂市场的增长

润滑油是工业领域使用的关键部件之一,因为它们有助于设备高效、可靠地运行。矿物和合成润滑剂、油脂、压缩机油和切削液是几种类型的润滑剂,它们被用作汽车、石油和天然气、纺织、玻璃、发电、造纸和纸浆、化学品和石化产品、农业、制造业、食品和饮料以及制药行业等的添加剂。这些行业在世界各地发展,导致对润滑剂以及润滑剂添加剂的需求巨大。纺织品整理行业,尤其是亚太地区的纺织行业,对工业润滑剂的需求很高。亚太地区的纺织行业对工业润滑剂的需求很高。因此,润滑剂在各个行业的广泛应用以及工业领域的快速增长是推动润滑剂添加剂市场的关键因素。

应用洞察

根据应用,市场细分为汽车市场和工业市场。汽车领域在 2020 年占据了更大的市场份额。润滑油添加剂用于发动机油和机油中,以防止运行时油中无机物质的絮凝。多级发动机油、齿轮油、自动变速箱油、动力转向液、润滑脂和一些液压油对润滑油添加剂的需求很高,以保持高温下的粘度。许多汽车制造商正在投资提高汽车的燃油效率,这可能会在未来几年进一步促进市场增长。

润滑油添加剂市场的一些主要市场参与者包括赢创工业股份公司、路博润公司、朗盛、诺力昂、Mol-lub Kft.、都佛化学公司、禾大国际公司、雪佛龙公司、巴斯夫欧洲公司和埃克森美孚公司。这些公司为润滑油添加剂市场提供了广泛的产品组合。这些公司在发展中地区都有业务,这为润滑油添加剂提供了有利可图的机会。这些市场参与者高度专注于开发高质量和创新产品,以满足客户的需求。

报告重点

- 润滑油添加剂市场不断发展的行业趋势,帮助参与者制定有效的长期战略

- 发达市场和发展中市场采用的业务增长战略

- 2019 年至 2028 年润滑油添加剂市场的定量分析

- 全球润滑油添加剂需求估算

- 波特五力分析,阐明买家和供应商在润滑油添加剂市场中的效力

- 了解市场竞争格局的最新发展

- 市场趋势和前景以及推动和抑制润滑油添加剂市场增长的因素

- 通过强调支撑商业利益的市场战略来协助决策过程

- 润滑油添加剂市场在各个节点的规模

- 详细概述和细分市场以及润滑油添加剂行业动态

- 各地区润滑油添加剂市场规模及增长潜力

润滑油添加剂市场区域洞察

The Insight Partners 的分析师已详尽阐述了预测期内影响润滑油添加剂市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的润滑油添加剂市场细分和地域分布。

润滑油添加剂市场报告范围

| 报告属性 | 细节 |

|---|---|

| 市场规模 2021 | US$ 15.58 Billion |

| 市场规模 2028 | US$ 19.88 Billion |

| 全球复合年增长率 (2021 - 2028) | 3.5% |

| 历史数据 | 2019-2020 |

| 预测期 | 2022-2028 |

| 涵盖的领域 |

By 类型

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

润滑油添加剂市场参与者密度:了解其对业务动态的影响

润滑油添加剂市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求的驱动因素包括消费者偏好的不断变化、技术进步以及对产品优势的认知度不断提高。随着需求的增长,企业正在扩展产品线,不断创新以满足消费者需求,并抓住新兴趋势,从而进一步推动市场增长。

- 获取 润滑油添加剂市场 主要参与者概述

润滑油添加剂市场

-

类型

- 分散剂

- 粘度指数改进剂

- 清洁剂

- 抗磨剂

- 乳化剂

- 其他

-

应用

-

- 汽车

- 工业

公司简介

- 赢创工业股份公司

- 路博润公司

- 朗盛

- 诺力昂

- Mol-lub Kft.

- 都佛化学公司

- 禾大国际公司

- 雪佛龙公司

- 巴斯夫SE

- 埃克森美孚公司

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

相关报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 润滑油添加剂市场

获取免费样品 - 润滑油添加剂市场