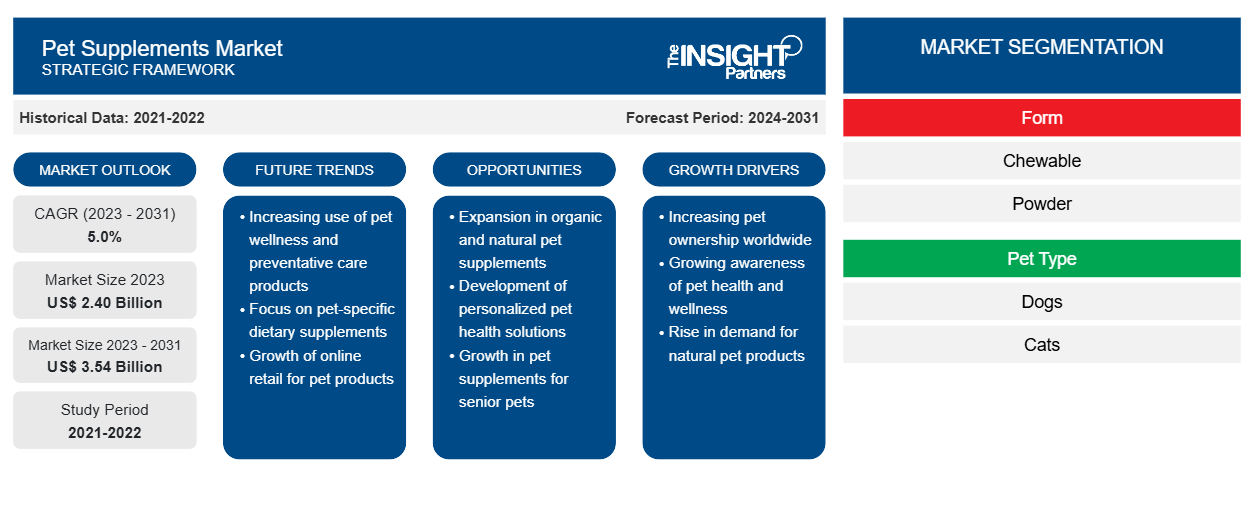

Si prevede che il mercato degli integratori per animali domestici raggiungerà i 3,54 miliardi di dollari entro il 2031, rispetto ai 2,40 miliardi di dollari del 2023. Si prevede che il mercato registrerà un CAGR del 5,0% nel 2023-2031. La crescente preferenza dei consumatori verso gli ingredienti naturali negli integratori per animali domestici sarà probabilmente una tendenza chiave nel mercato globale degli integratori per animali domestici. Oggigiorno, i genitori di animali domestici controllano i nutrienti e gli additivi inclusi negli integratori per animali domestici per garantire che i loro animali ricevano le cure più appropriate e benefiche. Pertanto, la crescente consapevolezza tra i genitori di animali domestici riguardo ai benefici degli ingredienti naturali ha alimentato la domanda di integratori naturali per animali domestici a livello globale.

Analisi di mercato degli integratori per animali domestici

Uno dei principali fattori che guidano la crescita del mercato degli integratori per animali domestici sono le iniziative strategiche dei principali attori del mercato. La crescente domanda di prodotti per animali domestici ricchi di nutrienti, premium e personalizzati ha aumentato le innovazioni di prodotto da parte dei produttori di integratori per animali domestici. Si stanno concentrando sullo sviluppo di integratori per animali domestici innovativi, sicuri e di qualità premium. Inoltre, stanno diversificando i loro portafogli di prodotti lanciando una varietà di prodotti per integratori per animali domestici con diverse forme e benefici per la salute. Ad esempio, a giugno 2024, ADM ha annunciato il lancio europeo di sette formule di prodotti per animali domestici chiavi in mano progettate per un mercato che dà sempre più priorità alla salute olistica degli animali domestici. Offerte in formati di masticativi morbidi e bustine di polvere di integratori, queste formule funzionali presentano affermazioni di benessere molto ricercate, supportate dalla scienza e conformi alle normative europee, offrendo ai consumatori opzioni affidabili per supportare il percorso di benessere dei loro animali domestici.

Panoramica del mercato degli integratori per animali domestici

Gli integratori per animali domestici sono prodotti che offrono nutrienti aggiuntivi come vitamine, oligoelementi, minerali o una combinazione di questi in diverse forme. Gli integratori per animali domestici aiutano a migliorare il sistema immunitario e a ridurre il rischio di infiammazione, cancro, malattie cardiache , diabete e altri. Inoltre, gli integratori per animali domestici aiutano anche a migliorare la capacità di combattere problemi come infezioni batteriche, prurito alla pelle e allergie ambientali e a migliorare la salute della pelle. Il mercato degli integratori per animali domestici è guidato da fattori come l'aumento dell'adozione di animali domestici e le crescenti preoccupazioni sul benessere degli animali. Il mercato globale degli integratori per animali domestici è segmentato in base alla forma, al tipo di animale domestico e al canale di distribuzione. In base alla forma, il mercato è segmentato in masticabili, in polvere e altri. Il segmento masticabile ha detenuto la quota maggiore del mercato degli integratori per animali domestici nel 2023.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

Mercato degli integratori per animali domestici: approfondimenti strategici

-

Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Driver e opportunità del mercato degli integratori per animali domestici

L'aumento del numero di proprietari di animali domestici favorisce la crescita del mercato

Negli ultimi anni, il crescente reddito disponibile delle persone e il crescente interesse delle persone nell'adozione di animali domestici hanno sostenuto la cultura degli animali domestici in molti paesi in tutto il mondo. La crescente proprietà di animali domestici in vari paesi sta guidando la crescita del mercato degli integratori per animali domestici. Inoltre, a causa dell'insorgenza della pandemia di COVID-19, molte persone lavoravano da casa e si autoisolavano; questo cambiamento nello stile di vita ha ispirato molte famiglie ad avere animali domestici. Molte persone si sono sentite al sicuro con un compagno animale che ha fornito supporto emotivo e mentale durante la pandemia.

Preferenze dei consumatori per la piattaforma di e-commerce: un'opportunità

Negli ultimi anni, l'uso di piattaforme di e-commerce è aumentato in tutto il mondo. Alcuni dei fattori chiave che guidano le vendite di vari prodotti, tra cui gli integratori per animali domestici, tramite piattaforme di e-commerce sono un aumento della penetrazione di smartphone e Internet, un aumento del potere d'acquisto dei consumatori e comode esperienze di acquisto offerte da queste piattaforme di vendita al dettaglio online. Molte persone preferiscono le piattaforme di vendita al dettaglio online per acquistare integratori per animali domestici a causa della disponibilità di vari prodotti di diversi marchi, descrizioni dettagliate dei prodotti, valutazioni e recensioni dei consumatori, sconti, offerte e servizi di consegna a domicilio. Durante l'epidemia di COVID-19, la propensione dei consumatori verso lo shopping online è aumentata. Con la crescente preferenza dei consumatori per le piattaforme di e-commerce, i produttori di integratori per animali domestici stanno migliorando la loro presenza online vendendo i loro prodotti tramite piattaforme di e-commerce, come Walmart, Amazon e Lidl. Pertanto, la crescente preferenza dei consumatori per le piattaforme di e-commerce offre un'enorme opportunità per i produttori di integratori per animali domestici di fornire i loro prodotti tramite piattaforme di e-commerce e aumentare la loro base di clienti e i margini di profitto.

Analisi della segmentazione del rapporto di mercato degli integratori per animali domestici

I segmenti chiave che hanno contribuito alla derivazione dell'analisi di mercato degli integratori per animali domestici sono la forma, il tipo di animale domestico e il canale di distribuzione.

- In base alla forma, il mercato degli integratori per animali domestici è suddiviso in masticabili, in polvere e altri. Il segmento masticabile ha detenuto una quota di mercato maggiore nel 2023.

- In base al tipo di animale domestico, il mercato è segmentato in cani, gatti e altri. Il segmento dei cani ha detenuto la quota maggiore del mercato nel 2023.

- In termini di canale di distribuzione, il mercato è diviso in online e offline. Il segmento offline ha dominato il mercato nel 2023.

Analisi della quota di mercato degli integratori per animali domestici per area geografica

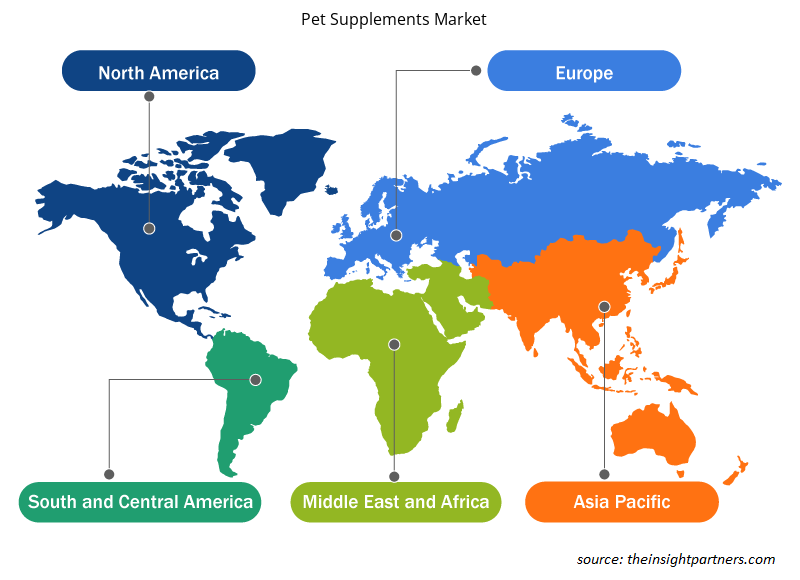

L'ambito geografico del rapporto sul mercato degli integratori per animali domestici è suddiviso principalmente in cinque regioni: Nord America, Asia Pacifico, Europa, Medio Oriente e Africa, Sud e Centro America.

Il Nord America ha dominato il mercato degli integratori per animali domestici nel 2023. Il mercato degli integratori per animali domestici del Nord America sta crescendo in modo significativo a causa della crescente umanizzazione degli animali domestici, che sta aumentando la domanda di dolcetti, cibo e integratori per animali domestici. Inoltre, la crescente consapevolezza degli elevati benefici nutrizionali degli integratori per animali domestici sta influenzando le decisioni di acquisto dei consumatori. Inoltre, la crescente consapevolezza tra i genitori di animali domestici riguardo ai benefici degli ingredienti naturali sta aumentando la domanda di integratori naturali per animali domestici nel Nord America.

Approfondimenti regionali sul mercato degli integratori per animali domestici

Le tendenze regionali e i fattori che influenzano il mercato degli integratori per animali domestici durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del mercato degli integratori per animali domestici in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e Sud e Centro America.

- Ottieni i dati specifici regionali per il mercato degli integratori per animali domestici

Ambito del rapporto di mercato sugli integratori per animali domestici

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2023 | 2,40 miliardi di dollari USA |

| Dimensioni del mercato entro il 2031 | 3,54 miliardi di dollari USA |

| CAGR globale (2023-2031) | 5,0% |

| Dati storici | 2021-2022 |

| Periodo di previsione | 2024-2031 |

| Segmenti coperti |

Per modulo

|

| Regioni e Paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli attori del mercato degli integratori per animali domestici: comprendere il suo impatto sulle dinamiche aziendali

Il mercato degli integratori per animali domestici sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei benefici del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato degli integratori per animali domestici sono:

- Zampa Zesty LLC

- Comfort Click Ltd

- Prodotti Naturali Arrowleaf Ltd

- Quattro zampe Inc.

- Assistenza clienti Nutramax Laboratories Inc

- Scienza alimentare LLC

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato degli integratori per animali domestici

Notizie e sviluppi recenti sul mercato degli integratori per animali domestici

Il mercato degli integratori per animali domestici viene valutato raccogliendo dati qualitativi e quantitativi dopo la ricerca primaria e secondaria, che include importanti pubblicazioni aziendali, dati associativi e database. Di seguito è riportato un elenco degli sviluppi nel mercato degli integratori per animali domestici e delle strategie:

Mars Petcare entra nella categoria degli integratori introducendo Pedigree Multivitamins. Questa nuova linea di prodotti è composta da tre tipi di masticativi morbidi specificamente progettati per soddisfare le esigenze essenziali degli animali domestici. I Pedigree Multivitamins mirano a supportare l'immunità, promuovere una sana digestione e fornire cure articolari per gli animali domestici. (Fonte: Mars Petcare/Comunicato stampa, 2023)

- Native Pet ha lanciato The Daily, un nuovo integratore tutto in uno per cani sviluppato negli ultimi due anni. (Nutraceuticals World, Sito Web aziendale/Notizie/2023)

Copertura e risultati del rapporto sul mercato degli integratori per animali domestici

Il rapporto "Dimensioni e previsioni del mercato degli integratori per animali domestici (2021-2031)" fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni e previsioni del mercato a livello globale, regionale e nazionale per tutti i segmenti di mercato chiave coperti dall'ambito

- Dinamiche di mercato come fattori trainanti, vincoli e opportunità chiave

- Principali tendenze future

- Analisi dettagliata delle cinque forze di Porter e SWOT

- Analisi di mercato globale e regionale che copre le principali tendenze di mercato, i principali attori, le normative e gli sviluppi recenti del mercato

- Analisi del panorama industriale e della concorrenza che copre la concentrazione del mercato, l'analisi della mappa di calore, i principali attori e gli sviluppi recenti

- Profili aziendali dettagliati

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Rapporti correlati

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato degli integratori per animali domestici

Ottieni un campione gratuito per - Mercato degli integratori per animali domestici