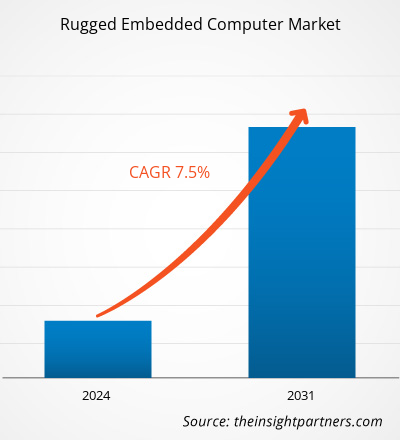

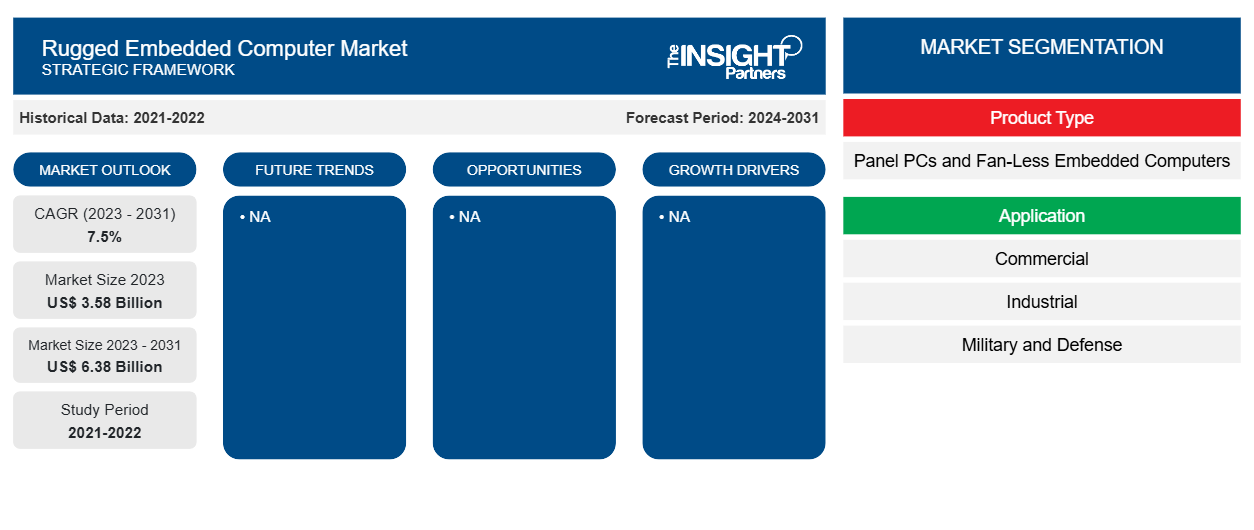

Si prevede che la dimensione del mercato dei computer embedded rugged raggiungerà i 6,38 miliardi di dollari entro il 2031, rispetto ai 3,58 miliardi di dollari del 2023. Si prevede che il mercato registrerà un CAGR del 7,5% nel 2023-2031. La crescita nel settore petrolifero e del gas e la domanda da parte dei settori militare e della difesa rimarranno probabilmente le principali tendenze del mercato dei computer embedded rugged.

Analisi del mercato dei computer embedded robusti

L'aumento dell'adozione dell'automazione nel settore manifatturiero genera la domanda di computer embedded robusti per l'analisi dei dati e i sistemi di controllo del movimento. Vari governi in tutto il mondo stanno supportando l' automazione della produzione , portando alla crescita del mercato dei computer embedded robusti. Poiché il petrolio e il gas operano a temperature estreme e in ambienti difficili e difficili, richiedono un'elettronica robusta che porta a un'ulteriore crescita del mercato. Per soddisfare questa domanda, gli operatori di mercato stanno lanciando soluzioni che promuovono la crescita del mercato in tutto il mondo. Ad esempio, a giugno 2021, Cincoze ha lanciato la prima famiglia di computer embedded robusti basati su Intel Xeon/Core di decima generazione. La serie DS-1300 presenta tre modelli con un numero variabile di slot di espansione PCIe ed è ideale per applicazioni in ambienti difficili che richiedono un'elevata potenza di elaborazione, come sistemi senza pilota e robotica.

Panoramica del mercato dei computer embedded robusti

Le aziende di vari settori, come industriale, commerciale, militare e della difesa, adottano soluzioni di edge computing per migliorare l'efficienza, analizzare rapidamente i dati e supportare attività critiche nel loro ambiente di lavoro. I computer embedded rugged sono ampiamente utilizzati in questi settori in quanto resistono a condizioni difficili, rendendoli ideali per ambienti difficili e difficili. Questi computer sono costruiti con involucri rinforzati e costruzione a stato solido, che li proteggono da polvere, detriti e altre piccole particelle che possono intasare i computer con ventola e danneggiare i componenti interni. Possono funzionare in condizioni meteorologiche intense e difficili e in ambienti difficili che in genere distruggerebbero l'hardware dei computer non rugged. I sistemi informatici embedded rugged sono altamente adatti per il monitoraggio e il controllo da remoto.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

-

Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Driver e opportunità del mercato dei computer embedded robusti

Domanda da parte di militari e difesa per favorire il mercato

Secondo lo Stockholm International Peace Research Institute (SIPRI), la spesa militare globale è aumentata del 3,7% in termini reali nel 2022 rispetto al 2021, raggiungendo un nuovo massimo di 2240 miliardi di dollari. La spesa supporta i moderni sistemi di guerra e l'inclusione di tecnologie avanzate. Questa spesa supporta anche la tecnologia per l'integrazione di sistemi di elaborazione embedded che forniscono funzionalità mission-critical. Questi sistemi embedded robusti devono essere in grado di tollerare vibrazioni e urti derivanti dall'impatto di spari, acqua e polvere, temperature estreme e interferenze elettromagnetiche (EMI). I sistemi embedded robusti sono progettati secondo uno standard molto elevato per resistere nell'ambiente militare duro e impegnativo, il che porta alla sua richiesta da parte del settore militare e della difesa di applicazioni di edge computing .SIPRI), global military expenditure increased by 3.7% in real terms in 2022 compared to 2021 to reach a new high of US$ 2240 billion. The expenditure supports modern warfare systems and the inclusion of advanced technology. This expenditure also supports the technology for the integration of embedded computing systems that provide mission-critical functionality. These rugged embedded systems must be able to tolerate vibration and shock from the impact of gunfire, water, and dust, extremes of temperature, and electromagnetic interference (EMI). The rugged embedded systems are designed to a very high standard to sustain in the harsh and challenging military environment, which leads to its demand from the military and defense sector for edge

Automazione della produzione nelle economie in via di sviluppo: un'opportunità nel mercato dei computer embedded robusti

L'Industria 4.0 sta trasformando il modo in cui le aziende producono, elaborano e distribuiscono i loro prodotti e si concentrano sul miglioramento della qualità del prodotto riducendo al minimo l'errore umano e velocizzando il processo di produzione. Grazie all'aumento dell'Industria 4.0, i governi dei paesi in via di sviluppo stanno investendo per potenziare ulteriormente il loro settore manifatturiero. Ad esempio, a marzo 2023, secondo il "State of Smart Manufacturing Report" di Rockwell Automation, l'India aveva il numero più alto di organizzazioni manifatturiere che investevano in tecnologia. Le economie in via di sviluppo stanno abbracciando la trasformazione digitale che sta portando all'adozione di elettronica in grado di resistere ad ambienti difficili e impegnativi, il che porta ulteriormente alla domanda di computer embedded robusti.

Analisi della segmentazione del rapporto di mercato dei computer embedded robusti

I segmenti chiave che hanno contribuito alla derivazione dell'analisi di mercato dei computer embedded rugged sono il tipo di prodotto e l'applicazione.

- In base al tipo di prodotto, il mercato dei computer embedded rugged è diviso in panel PC e computer embedded senza ventola. Il segmento dei computer embedded senza ventola ha detenuto una quota di mercato maggiore nel 2023.

- Per applicazione, il mercato è segmentato in commerciale, industriale, militare e difesa. Il segmento industriale ha detenuto la quota maggiore del mercato nel 2023.

Analisi della quota di mercato dei computer embedded robusti per area geografica

L'ambito geografico del rapporto sul mercato dei computer embedded rugged è suddiviso principalmente in cinque regioni: Nord America, Asia Pacifico, Europa, Medio Oriente e Africa e Sud America/Sud e Centro America.

In termini di fatturato, il Nord America ha rappresentato la quota di mercato più grande per i computer embedded rugged. Stati Uniti, Canada e Messico sono tra i paesi chiave del Nord America. La regione è una delle prime ad adottare soluzioni tecnologicamente avanzate, che è uno dei fattori chiave che guidano la crescita del mercato. I computer embedded rugged sono costruiti per resistere ad ambienti difficili in cui l'hardware dei computer non rugged può guastarsi. La regione adotta ampiamente i computer embedded rugged per applicazioni industriali, commerciali, militari e di difesa, in quanto sono più robusti delle sue alternative. Inoltre, le crescenti attività manifatturiere e le operazioni di petrolio e gas nella regione richiedono elettronica rugged, il che porta ulteriormente alla domanda di computer embedded rugged.

Approfondimenti regionali sul mercato dei computer embedded robusti

Le tendenze regionali e i fattori che influenzano il mercato dei computer embedded rugged durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del mercato dei computer embedded rugged in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e America centrale e meridionale.

- Ottieni i dati specifici regionali per il mercato dei computer embedded robusti

Ambito del rapporto di mercato sui computer embedded robusti

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2023 | 3,58 miliardi di dollari USA |

| Dimensioni del mercato entro il 2031 | 6,38 miliardi di dollari USA |

| CAGR globale (2023-2031) | 7,5% |

| Dati storici | 2021-2022 |

| Periodo di previsione | 2024-2031 |

| Segmenti coperti |

Per tipo di prodotto

|

| Regioni e Paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità dei giocatori del mercato dei computer embedded robusti: comprendere il suo impatto sulle dinamiche aziendali

Il mercato dei computer embedded rugged sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato dei computer embedded robusti sono:

- SISTEMI INTEGRATI ACURA IN

- CORPO TECNOLOGIA ARBOR

- Società anonima Cincoze Co., Ltd.

- Gruppo Crystal, Inc.

- Dell Inc.

- TECNOLOGIA MICROMAX

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato dei computer embedded robusti

Notizie e sviluppi recenti sul mercato dei computer embedded robusti

Il mercato dei computer embedded rugged viene valutato raccogliendo dati qualitativi e quantitativi dopo la ricerca primaria e secondaria, che includono importanti pubblicazioni aziendali, dati associativi e database. Di seguito è riportato un elenco degli sviluppi nel mercato:

- A marzo 2024, Cincoze ha lanciato due nuovi computer embedded compatti nella linea di prodotti rugged computing—DIAMOND. Il DA-1200 è un dispositivo delle dimensioni di un palmo, adatto alle applicazioni di base della maggior parte dei settori e a un prezzo che lo ha reso una scelta popolare tra i clienti per molti anni. Con questo ultimo aumento delle prestazioni, probabilmente rimarrà la scelta migliore. Il DV-1100 supporta le ultime CPU Intel Core di 13a/12a generazione, offrendo prestazioni potenti in una configurazione semplificata e massimizzando il rapporto costi-efficacia. È consigliato per siti industriali con esigenze di elaborazione ad alte prestazioni ma spazio di installazione limitato, come produzione intelligente, visione artificiale e elaborazione ferroviaria. (Fonte: Cincoze, comunicato stampa, 2024)

- Nell'ottobre 2023, Neousys Technology, fornitore leader del settore di sistemi embedded robusti, ha annunciato la serie POC-700, uno dei primi computer embedded ultracompatti senza ventola del settore a utilizzare un processore Intel Core I, offrendo prestazioni eccezionali e capacità di espansione versatili per un'ampia gamma di applicazioni industriali. (Fonte: Neousys Technology, comunicato stampa, 2023)

Copertura e risultati del rapporto sul mercato dei computer embedded robusti

Il rapporto "Dimensioni e previsioni del mercato dei computer embedded robusti (2021-2031)" fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni e previsioni del mercato a livello globale, regionale e nazionale per tutti i segmenti di mercato chiave coperti dall'ambito

- Dinamiche di mercato come fattori trainanti, vincoli e opportunità chiave

- Principali tendenze future

- Analisi dettagliata delle cinque forze PEST/Porter e SWOT

- Analisi di mercato globale e regionale che copre le principali tendenze di mercato, i principali attori, le normative e gli sviluppi recenti del mercato

- Analisi del panorama industriale e della concorrenza che copre la concentrazione del mercato, l'analisi della mappa di calore, i principali attori e gli sviluppi recenti

- Profili aziendali dettagliati

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Rapporti correlati

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato dei computer embedded robusti

Ottieni un campione gratuito per - Mercato dei computer embedded robusti