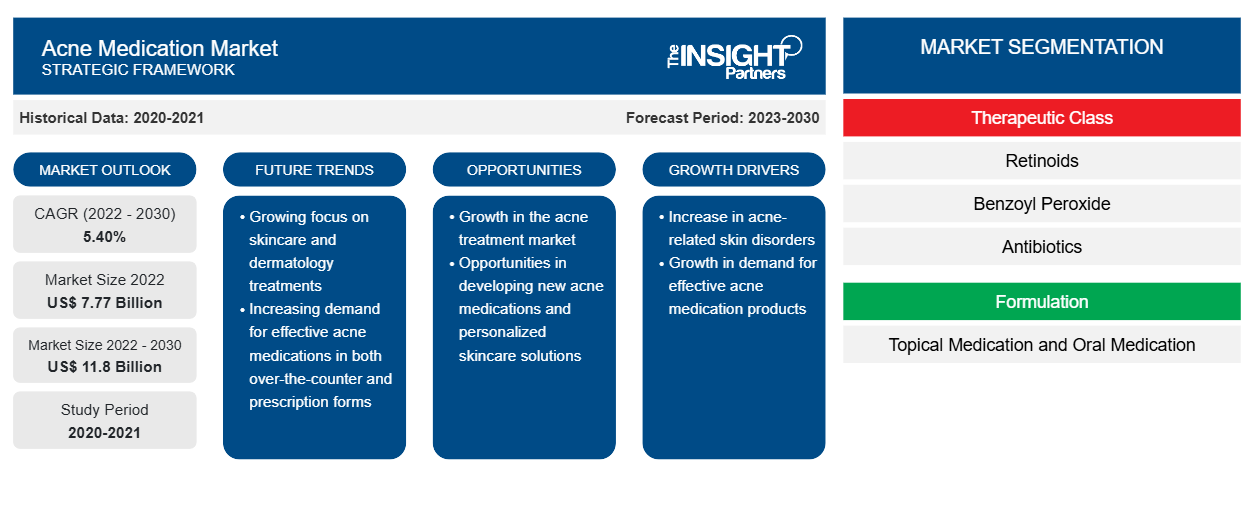

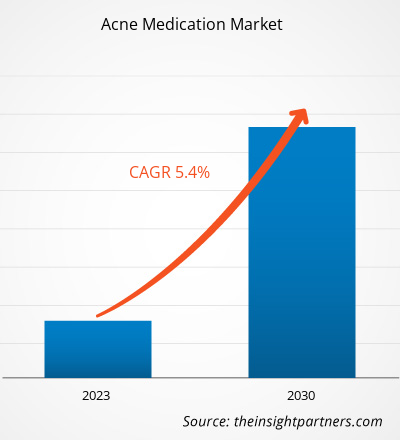

[Research Report] Acne medication market value is projected to grow from US$ 7,774.56 million in 2022 to US$ 11,802.29 million by 2030. The market is further anticipated to record a CAGR of 5.40% from 2022 to 2030.

Market Insights and Analyst View:

The acne medication market forecast presented in this report can help stakeholders in this marketplace plan their growth strategies. Acne is a common skin condition characterized by the presence of comedones (blackheads and whiteheads), papules, pustules, nodules, and cysts on the skin. It typically occurs on the face, neck, chest, back, and shoulders. It is primarily caused by factors such as excess oil production, clogged hair follicles, bacteria, and inflammation. Acne can vary in severity, ranging from mild occasional breakouts to severe, persistent conditions that can lead to scarring and psychological distress. Various medications and treatments are available to manage acne effectively. However, side effects associated with acne medication hinder the market growth. Moreover, the acne medication market trends include an upsurge in the need for organic and natural treatments.

Growth Drivers and Restraints:

Severe acne, often characterized by painful cysts, nodules, and persistent inflammation, presents a considerable challenge that can significantly impact people’s quality of life. As per the 2022 GBD research, acne has a prevalence rate of 9.4%, ranking it eighth among the most common diseases in the world. Acne vulgaris affects over 85% of young individuals from the age group of 12–25. Such a high prevalence has led to an upsurge in the demand for effective acne medications tailored to address moderate to severe forms of the condition. As individuals seek ways to mitigate the physical and emotional burden associated with severe acne, there is a corresponding increase in the demand for advanced and more effective prescription and over-the-counter treatments. This trend prompts pharmaceutical companies to focus on developing innovative formulations, including topical retinoids, oral antibiotics, hormonal therapies, and advanced topical treatments, to address the complex needs of individuals with severe acne. The Journal of Drugs in Dermatology (JDD) estimates that acne treatments incur over US$ 1 billion as direct annual costs to the US economy, with over-the-counter acne drugs accounting for nearly 10% of this cost. JDD also estimates that billions of dollars would be spent on acne treatment in the coming years. Thus, the increasing prevalence of severe acne and an upsurge in associated costs to economies bolster the acne medication market size.

On the other hand, many traditional and systemic acne treatments, including oral antibiotics, retinoids, and hormonal therapies, are associated with a range of potential adverse effects, including skin dryness, irritation, photosensitivity, gastrointestinal discomfort, and, in rare cases, more severe systemic side effects. These potential adverse reactions have raised concerns among patients and healthcare providers, leading to reluctance in the adoption of certain acne medications, particularly for long-term use. Side effects also result in the lack of treatment adherence, as individuals may opt to discontinue or avoid specific medications due to intolerable or undesirable side effects. Consequently, consumers show an inclination toward advanced formulations and treatment modalities that prioritize efficacy while minimizing adverse reactions, introducing a constant need for novel, more tolerable, and better-tolerated acne medications. Thus, side effects associated with acne medication limit the acne medication market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Acne Medication Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Acne Medication Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Trends:

As people are becoming more conscious of the potentially harmful effects of synthetic ingredients and chemicals used in traditional skincare products, the demand for natural and organic alternatives that are deemed to be safer, gentler, and more environmentally friendly is on the rise across the world. Consumers are increasingly seeking products free from harsh chemicals, artificial fragrances, and potentially irritating substances, opting for formulations that harness the power of plant-based ingredients, botanical extracts, essential oils, and other natural compounds known for their skincare benefits. In response to this trend, many skincare brands and manufacturers are developing a wide range of natural and organic acne treatment products that cater to the needs of health-conscious consumers. These products often feature ingredients such as tea tree oil, witch hazel, aloe vera, green tea extract, and salicylic acid derived from natural sources, offering a more holistic and sustainable approach to treating acne without compromising efficacy. In July 2022, MÁDARA, an organic skincare business, introduced two new and natural everyday skincare products—a microbiome-balancing moisturizer and a non-drying face cleanser. The company claims that these products were developed by blending science and nature, and were specifically formulated to offer gentle treatment for people of different complexions, who are prone to acne. Both products are made with natural, organic, and vegan ingredients—Northern Juniper Stem Cells, fermented polysaccharides, and lichen and Maté tea extracts—which deal specifically with imperfections, keeping the skin unharmed. Adults and teenagers can both utilize this product. Thus, the increasing preference for natural and organic acne treatment options is expected to continue shaping the future of the acne medication market in the coming years.

Report Segmentation and Scope:

The acne medication market analysis has been carried out by considering the following segments: therapeutic class, formulation, type, acne type, and distribution channel. Based on therapeutic class, the market is segmented into retinoids, benzoyl peroxide, antibiotics, salicylic acid, and others. In terms of formulation, the market is differentiated into topical medication and oral medication. The acne medication market, by usage, is divided into prescription medicine and over-the-counter medicine. Based on acne type, the acne medication market is bifurcated into non-inflammatory acne and inflammatory acne. Based on distribution channel, the market is classified into pharmacies and drug stores, retail stores, and e-commerce. In terms of geography, the acne medication market is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

The retinoid segment held the largest acne medication market share, based on therapeutic class, in 2022. The same segment is anticipated to register a significant CAGR in the market during 2022–2030. Retinoids, which can be only bought with a doctor's prescription, contain vitamin A as a primary ingredient; their action mechanism is similar to retinol but they exhibit higher potency and better outcomes in treating acne than the latter. Retinoids are available as oral capsules and topical therapies. Tretinoin, adapalene, and isotretinoin are well-known retinoids; the oral formulation of isotretinoin is sometimes referred to as Roaccutane. Retinoids are frequently prescribed in dosages of 0.1–1% for topical applications and 0.5–1 mg for oral applications per kilogram of patient weight.

Based on formulation, the acne medication market is classified into topical medication and oral medication. The topical medication segment held a larger share of the acne medication market in 2022. The same segment is further anticipated to record a significant CAGR in the market from 2022 to 2030. Topical formulations play a vital role in managing and treating acne, offering targeted delivery of active ingredients directly to the affected skin areas. Various types of topical acne medication include gel, cream, lotion, foam, and solution, each tailored to address specific acne concerns and skin types. These formulations commonly contain ingredients such as retinoids, benzoyl peroxide, salicylic acid, and antibiotics, each serving distinct roles in combating acne breakouts.

Based on type, the market is classified into prescription medicines and over-the-counter medicines. The prescription medicines segment held a larger acne medication market share in 2022. Dermatologists or healthcare providers typically prescribe medications after a thorough assessment of the individual's acne type, severity, and responsiveness to previous treatments. Prescription acne medications encompass a range of options, including topical treatments, oral medications, combination therapies, and specialized formulations tailored to address specific acne concerns. Prescription medications are meant to offer targeted and potent solutions for individuals with moderate to severe forms of the condition.

The acne medication market, by distribution channel, is segmented into retail stores, pharmacies and drug stores, and others based on mode. In 2022, the pharmacies and drug stores segment held the largest market share. With their accessibility, privacy, and affordability (compared to private physicians), pharmacies and drug stores are vital sources of health services, supplies, and knowledge. Pharmacies and drug stores have gained recognition in numerous nations in recent years for their ability to enhance health by aiding in the management of a broad range of illnesses and medical conditions. Pharmacies and drug stores often have knowledgeable staff to guide customers on selecting the right acne medication based on individual skin types and concerns.

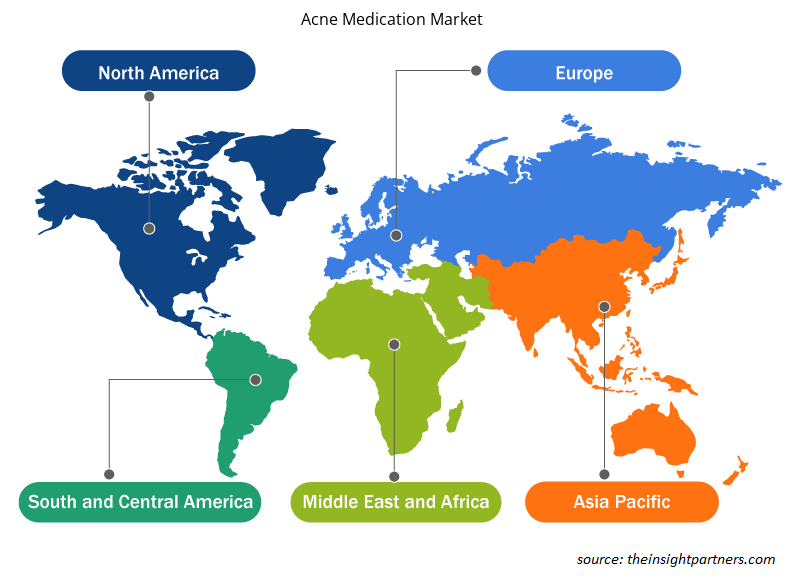

Regional Analysis:

The geographic scope of the acne medication market report encompasses North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. In 2022, North America held the largest share of the global acne medication market.

Acne is a skin condition brought on by debris, oil, sebum, and dead skin cells clogging hair follicles. According to the American Academy of Dermatology, acne is the most prevalent illness in the US, up to 50 million Americans suffer from acne each year, making it the most common skin ailment in the country. The acne medication market in this country is projected to expand due to the increased incidence of acne in Americans and the subsequent launch of various innovative acne medications. Additionally, the growing focus on personal grooming, skin health, and external appearance fuels the demand for acne medications. Technological advancements and research have led to the development of innovative acne treatment products with improved efficacy and minimal side effects, contributing further to the acne medication market growth in the US, as people in this country are more willing to invest in high-quality products that deliver desired results.

Asia Pacific is estimated to register the highest CAGR in the acne medication market during 2022–2030. China is the largest market for acne medication in this region. The acne medication market in China is propelled by various factors. Notably, the widespread adoption of AI-enabled telemedicine has revolutionized dermatological care, improving access to treatments and providing better personalization in the same. AIDERMA is China's first all-inclusive platform for AI-assisted diagnosis and therapy of skin conditions. Consultation, education, and diagnosis and therapy support are the prime offerings of AIDERMA. More than 90 types of common skin illnesses are provided for assisted diagnosis and treatment. This claims to be a straightforward procedure that offers a diagnostic and potential course of action. More than 7,000 clinicians have registered for AIDDA, an application that allows doctors in China to diagnose psoriasis, eczema, and atopic dermatitis.

Acne Medication Market Regional Insights

The regional trends and factors influencing the Acne Medication Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Acne Medication Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Acne Medication Market

Acne Medication Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 7.77 Billion |

| Market Size by 2030 | US$ 11.8 Billion |

| Global CAGR (2022 - 2030) | 5.40% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Therapeutic Class

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

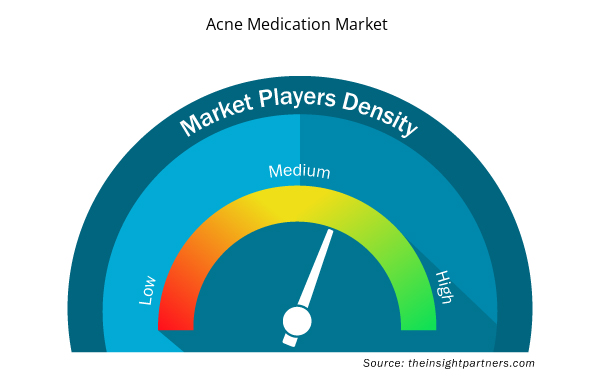

Acne Medication Market Players Density: Understanding Its Impact on Business Dynamics

The Acne Medication Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Acne Medication Market are:

- Teva Pharmaceutical Industries Ltd

- Mayne Pharma Group Ltd

- Almirall SA

- Johnson & Johnson

- Sun Pharmaceutical Industries Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Acne Medication Market top key players overview

Industry Developments and Future Opportunities:

Different initiatives by prominent players in the global acne medication market, as per company press releases, are listed below:

- In September 2023, Cosmo Pharmaceuticals NV (Ireland) and Glenmark Specialty SA, a subsidiary of Glenmark Pharmaceuticals (Mumbai), announced signing distribution and licensing arrangements for the distribution of Winlevi (1% clascoterone cream) in South Africa and Europe. The agreements state that Glenmark will get sole rights to market Winlevi in 15 EU nations (Sapin, Bulgaria, the Czech Republic, Denmark, Finland, France, Hungary, Iceland, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, and Sweden), as well as in South Africa and the UK, via Cassiopea, a Cosmo subsidiary.

- In October 2023, Crown Therapeutics, a branch of Crown Laboratories, added two new PanOxyl products—PanOxyl Clarifying Exfoliant with 2% salicylic acid and PanOxyl Adapalene 0.1% gel—to its dermatologist-endorsed and award-winning PanOxyl range. In September 2023, Sun Pharma Canada Inc., a wholly owned subsidiary of Sun Pharmaceutical Industries Limited, announced the accessibility of WINLEVI (clascoterone cream, 1% w/w) in Canada. For patients 12 years of age and older, WINLEVI is the first and only androgen receptor inhibitor recommended for the topical treatment of acne vulgaris, or acne.

Competitive Landscape and Key Companies:

Teva Pharmaceutical Industries Ltd, Mayne Pharma Group Ltd, Almirall SA, Johnson & Johnson, Sun Pharmaceutical Industries Ltd, Bausch Health Companies Inc, Centro Internacional de Cosmiatria SA de CV, Galderma SA, Pfizer Inc., GSK Plc, Viatris Inc, Somar Sapi De CV, Carnot Technologies, and Italmex SA are a few key companies profiled in the acne medication market report. These companies focus on the development and adoption of new technologies, advancements in existing products, and expansion of their geographic presence to meet the growing consumer demand worldwide.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Grant Management Software Market

- Electronic Toll Collection System Market

- Social Employee Recognition System Market

- Vertical Farming Crops Market

- Sleep Apnea Diagnostics Market

- UV Curing System Market

- Advanced Planning and Scheduling Software Market

- Embolization Devices Market

- Quantitative Structure-Activity Relationship (QSAR) Market

- Radiopharmaceuticals Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Therapeutic Class, Formulation, Type, Acne Type, Distribution Channel, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

What is acne medication?

Acne is a common skin condition characterized by the presence of comedones (blackheads and whiteheads), papules, pustules, nodules, and cysts on the skin, typically occurring on the face, neck, chest, back, and shoulders. It is primarily caused by factors such as excess oil production, clogged hair follicles, bacteria, and inflammation. Acne can vary in severity, ranging from mild occasional breakouts to severe, persistent conditions that can lead to scarring and psychological distress. Various medications and treatments are available to manage acne effectively.

What factors drive the acne medication market?

Key factors driving the market growth are increasing prevalence of severe acne problems and launch of novel drugs.

What are the growth estimates for the acne medication market till 2030?

The acne medication market is expected to be valued at US$ 11,802.29 million in 2030.

Who are the major players in the acne medication market?

The acne medication market majorly consists of the players, including Teva Pharmaceutical Industries Ltd, Mayne Pharma Group Ltd, Almirall SA, Johnson & Johnson, Sun Pharmaceutical Industries Ltd, Bausch Health Companies Inc, Centro Internacional de Cosmiatria SA de CV, Galderma SA, Pfizer Inc., GSK Plc, Viatris Inc, Somar Sapi De CV, Carnot Technologies, and Italmex SA.

What was the estimated acne medication market size in 2022?

The acne medication market was valued at US$ 7,774.56 million in 2022.

Which therapeutic class segment dominates the acne medication market?

Retinoids, which can be only bought with a doctor's prescription, contain vitamin A as a primary ingredient; they function similarly to retinol but they are far more potent and more successful in treating acne. Retinoids are available as oral capsules and topical therapies. Tretinoin, adapalene, and isotretinoin are well-known retinoids; the oral formulation of isotretinoin is sometimes referred to as Roaccutane. Retinoids are frequently prescribed in dosages of 0.1–1% for topical applications and 0.5–1 mg for oral applications per kilogram of patient weight.

Which distribution channel segment dominates the acne medication market?

The acne medication market is segmented into retail stores, pharmacies and drug stores, and others based on mode. In 2022, the pharmacies and drug stores segment held a larger market share. With their accessibility, privacy, and affordability (compared to private physicians), pharmacies and drug stores are vital sources of health services, supplies, and knowledge.

Which usage type segment dominates the acne medication market?

Based on type, the global acne medication market is classified into prescription medicines and over-the-counter medicines. The prescription medicines segment held a largest acne medication market share in 2022.

Which formulation segment dominates the acne medication market?

The topical medication segment held the largest share of the acne medication market in 2022. The same segment is further anticipated to record a significant CAGR in the market from 2022 to 2030.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Acne Medication Market

- Teva Pharmaceutical Industries Ltd

- Mayne Pharma Group Ltd

- Almirall SA

- Johnson & Johnson

- Sun Pharmaceutical Industries Ltd

- Bausch Health Companies Inc

- Centro Internacional de Cosmiatria SA de CV

- Galderma SA, Pfizer Inc.

- GSK Plc, Viatris Inc

- Somar Sapi De CV

- Carnot Technologies

- Italmex SA

Get Free Sample For

Get Free Sample For