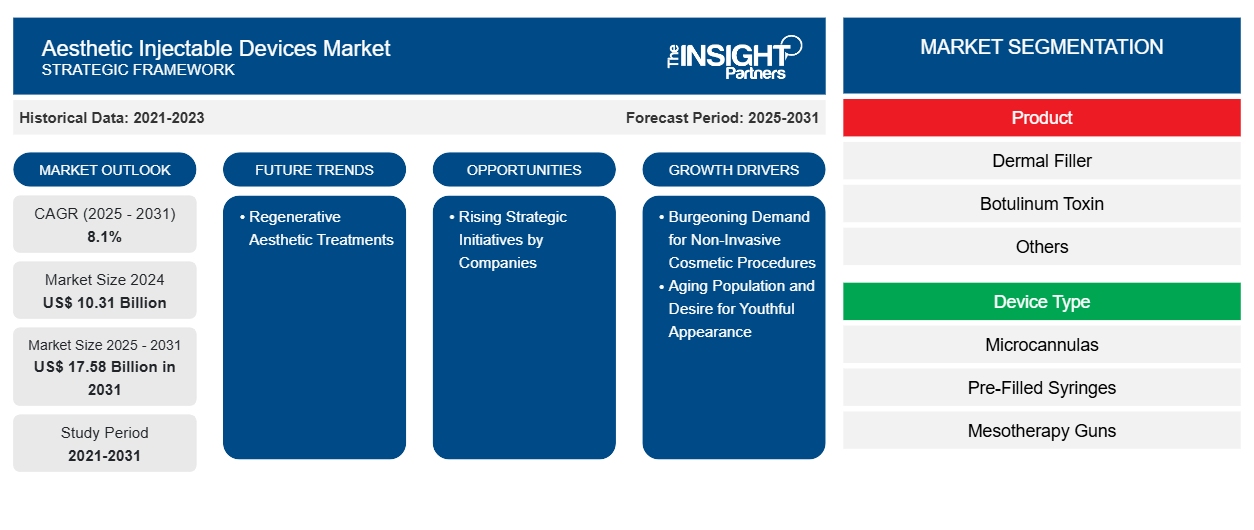

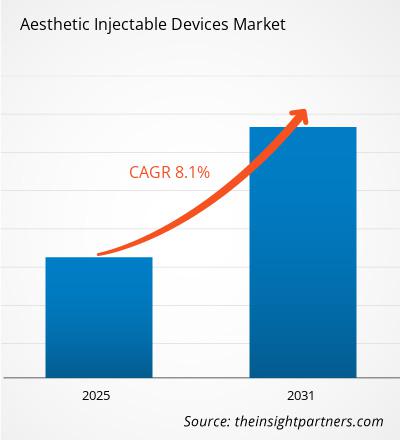

The aesthetic injectable devices market size is projected to reach US$ 17.58 billion by 2031 from US$ 10.31 billion in 2024. The market is expected to register a CAGR of 8.1% during 2025–2031. The regenerative aesthetic treatments are likely to bring in new market trends during the forecast period.

Aesthetic Injectable Devices Market Analysis

Major aesthetic injectable devices consist of botulinum toxin (e.g., Botox), dermal fillers (e.g., hyaluronic acid-based), and collagen stimulators. The market growth is driven by rising applications across wrinkle reduction, lip enhancement, facial contouring, and scar correction. Advances in formulation and delivery technology, as well as better safety profiles, have supported greater patient acceptance. Expansion is strongest in Asia-Pacific, Europe, and North America. Emerging markets in South and Central America and the Middle East and Africa have highly potential. Medical tourism, influencer-driven aesthetic trends, and the increasing number of well-trained aesthetic practitioners accelerate product demand. However, regulatory challenges, cost barriers, and risks of adverse effects limit adoption in some segments. Overall, the market is poised for steady growth, supported by innovation, consumer demand, and expanding clinical indications.

Aesthetic Injectable Devices Market Overview

The aesthetic injectable devices market is rapidly expanding due to the burgeoning demand for minimally invasive cosmetic procedures, soaring aging population, and desire for a youthful appearance. Prominent players operating in the market are focusing on innovations and collaborative efforts for enhanced product availability and reach. However, the high cost of treatments with recurring needs hinders market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aesthetic Injectable Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aesthetic Injectable Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aesthetic Injectable Devices Market Drivers and Opportunities

Aging Population and Desire for Youthful Appearance Fuel Market Growth

As per the data published by World Health Organization's (WHO) in October 2022, one in six people globally will be aged 60 or over by 2030. The number of individuals aged 60 and above will increase from 1 billion in 2020 to 1.4 billion by 2030 and to 2.1 billion by 2050. It is estimated that the population of those aged 80 or older will triple between 2020 and 2050, reaching 426 million. As collagen and elastin depletion accelerates with age, non-surgical options such as injectables become appealing to individuals seeking quick rejuvenation with minimal downtime. The age-related changes, including wrinkles, fine lines, volume loss, and skin laxity, fuel the demand for minimally invasive treatments such as botulinum toxin (e.g., Botox, Dysport, Xeomin) and hyaluronic acid fillers.

The desire for youthfulness spans generations. Even younger demographics are using injectables as a preventive measure, and a surge in the “preventative Botox” trend has been witnessed. With the rise of social media platforms and the prevalence of celebrity culture, people are constantly exposed to images of flawless skin, perfect features, and idealized beauty standards. This exposure has created a desire among individuals to achieve similar aesthetic goals and maintain a youthful appearance. The American Academy of Facial Plastic and Reconstructive Surgery has observed that social media users are transitioning from aesthetic treatments to achieve the static 'Instagram face' to seeking the more dynamic 'TikTok face.' They observed that 79% of facial plastic surgeons report a growing consumer demand for procedures that enhance selfie appearance, preserve the effects of previous treatments, and minimize visible signs of aging.

Given Botox’s advantages, it is no surprise that people from various age groups, genders, and backgrounds praise its effectiveness. In 2022, individuals between the ages of 35 and 50 accounted for nearly half of all Botox procedures, making them the most active demographic in the market. This age group seeks to combat visible signs of aging—something that the skin’s declining elasticity can't address on its own. As people age, the skin naturally loses collagen and elastin, leading to more noticeable wrinkles and sagging, driving the demand for Botox to manage or reverse these changes. Following this group, 4.4 million treatments were performed on the younger millennials, and Gen Z accounted for 2.2 million procedures. This age group, ranging from 18 to 34 years old, focuses on proactively preventing fine lines rather than waiting for them to develop into deep wrinkles. Thus, the rising demand for aesthetic injectables is driven by aging populations and social pressure for youthful, non-invasive beauty solutions.

Rising Strategic Initiatives by Companies to Create Lucrative Opportunities in the Market

Companies operating in the aesthetic injectable devices market are focusing on strategic developments. They are adopting strategies such as geographic expansions, new product developments, and technological advancements to boost their revenues. These strategies help them increase their sales, expand their geographic area, and enhance their capacity to cater to a larger customer base than their existing customer base. Strategic initiatives by companies significantly fuel market growth by fostering innovation, expanding market reach, and enhancing consumer engagement. The noteworthy developments in the aesthetic injectable devices market are mentioned below:

- In May 2025, Prollenium, a global leader in medical aesthetic technology, introduced Renew+ to its Revanesse line of dermal fillers in Canada. Revanesse Renew+ is a skin-boosting injection. It blends low and high-molecular-weight hyaluronic acid to deeply hydrate and revitalize the skin, enhancing texture and promoting a smoother, more radiant appearance.

- In February 2025, Evolus, Inc. announced that the US Food and Drug Administration (FDA) had approved Evolysse Form and Evolysse Smooth—injectable hyaluronic acid gels that are the first offerings in the Evolysse product line. These approvals signify Evolus’ official entry into the US market. Developed by Symatese, Evolysse Form and Evolysse Smooth feature innovative Cold-X technology, which helps maintain the natural structure of the hyaluronic acid molecule, aiming to deliver longer-lasting, natural-looking results.

- In October 2024, Allergan Aesthetics, a division of AbbVie, received the US FDA approval for BOTOX Cosmetic for the temporary improvement in the appearance of moderate to severe vertical neck bands (platysma bands) in adults. This approval makes BOTOX Cosmetic the first and only product with four aesthetic treatment areas. These areas include forehead lines, frown lines, crow’s feet, and now platysma bands, thus marking it as the first product of its kind to go beyond facial applications.

- In July 2024, Merz Aesthetics received US FDA approval for XEOMIN (incobotulinumtoxinA) as the first and only neurotoxin for the treatment of upper facial lines.

- In May 2024, Galderma launched its hyaluronic acid injectable filler, Restylane VOLYME, in China. Alongside this filler, the company is introducing its Shape Up Holistic Individualized Treatment (HIT), designed to address age-related concerns stemming from the loss of structural support in the mid-face. These tailored solutions for mid-face rejuvenation reflect Galderma’s ongoing commitment to supporting patients’ needs in China.

- In February 2024, Croma-Pharma announced that its partner, Korean toxin manufacturer Hugel, had received US FDA approval for Letybo (letibotulinumtoxinA), the company’s botulinum toxin product. With this approval, Letybo became the sixth botulinum toxin product to achieve this milestone globally. This milestone enhances the product’s credibility and reinforces trust among healthcare professionals. Hugel now stands as one of only three global companies holding licenses in the largest aesthetic markets: the US, Europe, and China.

Thus, new product developments and marketing approvals are anticipated to create lucrative growth opportunities in the aesthetic injectable devices market in the upcoming years.

Aesthetic Injectable Devices Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Aesthetic Injectable Devices market analysis are product, device type, application, age group, gender, and end user.

- Based on product, the aesthetic injectable devices market is segmented into dermal fillers, botulinum toxin, and others. The dermal fillers segment is classified into calcium hydroxylapatite, hyaluronic acid, collagen, poly-l-lactic acid, polmethylmethacrylate, fat fillers, and others. The botulinum toxin segment held the largest share of the market in 2024.

- By device type, the aesthetic injectable devices market is divided into microcannulas, pre‑filled syringes, mesotherapy guns, and others. The pre‑filled syringes segment dominated the market in 2024.

- Based on application, the aesthetic injectable devices market is segmented into facial line correction, face lift, lip treatment, anti-ageing and wrinkle treatment, acne and scar treatment, stretch marks, and others. The facial line correction segment held the largest share of the market in 2024.

- Per age group, the aesthetic injectable devices market is categorized into Up to 30, 31-40, 41-50, 51-60, and More Than 60. The 31-40 segment dominated the market in 2024.

- By gender, the aesthetic injectable devices market is bifurcated into female and male. The female segment dominated the market in 2024.

- As per end user, the aesthetic injectable devices market is categorized into medical spas, dermatology clinics, hospitals, and others. The dermatology clinics segment dominated the market in 2024.

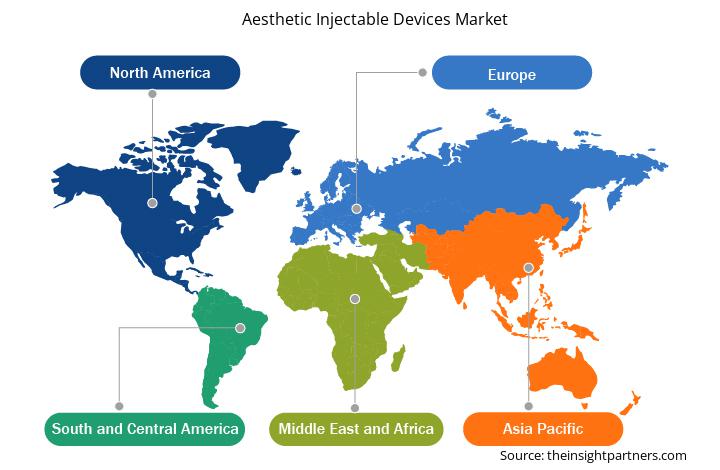

Aesthetic Injectable Devices Market Share Analysis by Geography

The geographic scope of the aesthetic injectable devices market report mainly focuses on five regions: North America, Asia Pacific, Europe, South & Central America, and the Middle East & Africa. In terms of revenue, North America dominated the market in 2024. It is expected to continue its dominance in the global market during the forecast period. The US is the largest market for aesthetic injectable devices in the world. A rise in the development of noninvasive and minimally invasive aesthetic devices, and an upsurge in nonsurgical aesthetic procedures, fuel the growth of the aesthetic injectable devices market in the US. According to the 2023 Global Survey by the International Society of Aesthetic Plastic Surgery (ISAPS), ~6.19 million aesthetic procedures were performed in the US. Of these, nearly 4.4 million were nonsurgical procedures, with injectable treatments making up the majority. Botulinum toxin procedures accounted for ~2.5 million, while hyaluronic acid procedures comprised ~0.71 million. Consumers increasingly prefer minimally invasive procedures that yield natural results that do not appear overly done. As a result, the spending on aesthetic procedures has also grown significantly in the country.

Market players are launching new products alongside receiving approvals from the corresponding regulatory bodies. In March 2023, Galderma introduced FACE, an aesthetic visualization tool powered by augmented reality. This tool enables aesthetic professionals and patients to preview potential injectable treatment outcomes during the planning phase, before the procedure is performed. In April 2023, the company announced that the US FDA approved Sculptra (injectable poly-L-lactic acid, or PLLA-SCA) for treating fine lines and wrinkles in the cheek area. In May 2023, Allergan Aesthetics, an AbbVie company, received FDA approval for SKINVIVE by Juvéderm. It is the first and only hyaluronic acid intradermal microdroplet injection in the US designed to enhance cheek skin smoothness in adults over 21 years of age. Clinical results show effects lasting up to six months with optimal treatment. In June 2023, Galderma secured FDA approval for Restylane Eyelight, a hyaluronic acid dermal filler developed to address undereye hollows or dark shadows in adults over 21. It is the first and only product in the US formulated with NASHA Technology for this purpose, delivering natural-looking results by restoring volume under the eyes. In July 2024, Merz Aesthetics announced FDA approval of XEOMIN (incobotulinumtoxin A) as the first and only neurotoxin approved for simultaneous treatment of forehead lines, frown lines, and crow’s feet. In October 2024, Allergan Aesthetics announced FDA approval of BOTOX Cosmetic for the temporary improvement in the appearance of moderate to severe vertical platysma bands (connecting the jaw and neck) in adults. That same month, Allergan Aesthetics announced the nationwide launch of JUVÉDERM VOLUMA XC for treating temple hollowing. Following its FDA approval in March 2024, JUVÉDERM VOLUMA XC remains the first and only hyaluronic acid filler approved for moderate to severe temple hollowing in adults aged more than 21. In February 2025, Evolus, Inc. received FDA approval for Evolysse Form and Evolysse Smooth, injectable hyaluronic acid gels. Developed using Symatese’s proprietary Cold-X technology, these products are designed to preserve the hyaluronic acid molecule’s natural structure, offering long-lasting, natural-looking results.

Aesthetic Injectable Devices Market Regional Insights

The regional trends and factors influencing the Aesthetic Injectable Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Aesthetic Injectable Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Aesthetic Injectable Devices Market

Aesthetic Injectable Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 10.31 Billion |

| Market Size by | US$ 17.58 Billion in 2031 |

| Global CAGR (2025 - 2031) | 8.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Aesthetic Injectable Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Aesthetic Injectable Devices Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Aesthetic Injectable Devices Market are:

- Merz Pharma GmbH & Co KGaA

- AbbVie Inc

- Hugel Inc

- Galderma SA

- Medytox Inc

- Sinclair Pharma Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Aesthetic Injectable Devices Market top key players overview

Aesthetic Injectable Devices Market News and Recent Developments

The aesthetic injectable devices market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. Key developments witnessed in the aesthetic injectable devices market are as follows:

- Evolus Announces FDA Approval of Evolysse Form and Evolysse Smooth Injectable Hyaluronic Acid Gels. (Source: Evolus, Inc., Company News, February 2025)

- Allergan Aesthetics Launches BOTOX Cosmetic (onabotulinumtoxinA) for Masseter Muscle Prominence (MMP) in Adults in China. (Source: AbbVie Inc., Press Release, September 2024)

Aesthetic Injectable Devices Market Report Coverage and Deliverables

The "Aesthetic Injectable Devices Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Aesthetic injectable devices market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Aesthetic injectable devices market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Aesthetic injectable devices market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the aesthetic injectable devices market

- Detailed company profiles

Frequently Asked Questions

What are the factors driving the aesthetic injectable devices market growth?

The burgeoning demand for minimally invasive cosmetic procedures, soaring aging population, and desire for youthful appearance are among the significant factors fueling the market growth.

Which region dominated the aesthetic injectable devices market in 2024?

North America dominated the market in 2024.

Which are the leading players operating in the aesthetic injectable devices market?

Merz Pharma GmbH & Co KGaA, AbbVie Inc, Hugel Inc, Galderma SA, Medytox Inc, Sinclair Pharma Ltd, Revance Therapeutics Inc, Evolus Inc, Ipsen SA, Mesoestetic E-Commerce SL, Sinopharm Group Co Ltd, Laboratoires Vivacy, S.A.S. are among the key players operating in the market.

What are the future trends in the aesthetic injectable devices market?

The regenerative aesthetic treatments are likely to emerge as a new growth trend in the market in the coming years.

What is the expected CAGR of the aesthetic injectable devices market?

The market is expected to register a CAGR of 8.1% during 2025–2031.

What would be the estimated value of the aesthetic injectable devices market by 2031?

The market value is expected to reach US$ 17.58 billion by 2031.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Aesthetic Injectable Devices Market

- Merz Pharma GmbH & Co KGaA

- AbbVie Inc

- Hugel Inc

- Galderma SA

- Medytox Inc

- Sinclair Pharma Ltd

- Revance Therapeutics Inc

- Evolus Inc

- Ipsen SA

- Mesoestetic E-Commerce SL

- Sinopharm Group Co Ltd

- Laboratoires Vivacy, S.A.S.

Get Free Sample For

Get Free Sample For