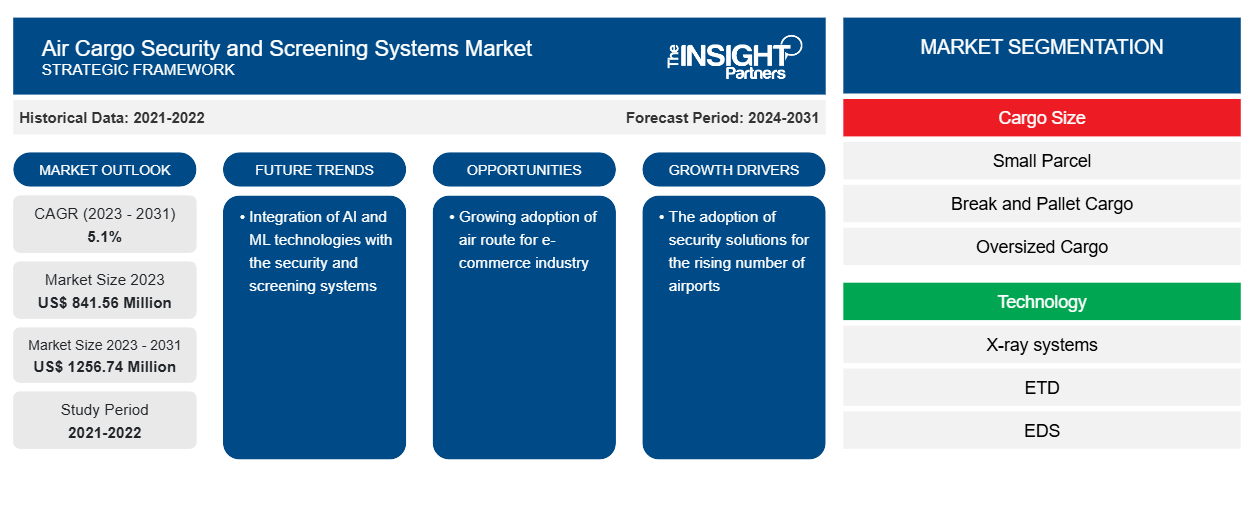

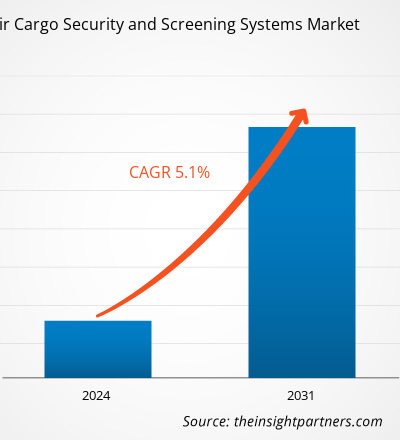

The air cargo security and screening systems market size is projected to reach US$ 1256.74 million by 2031 from US$ 841.56 million in 2023. The market is expected to register a CAGR of 5.1% during 2023–2031. The adoption of security solutions for the rising number of airports and the growing e-commerce industry are likely to remain key trends in the market.

Air Cargo Security and Screening Systems Market Analysis

The growing e-commerce industry is fuelling the market growth. The rising number of airports generates the demand for airport security solutions, which further drives market growth. The rising terrorist attacks and drug trafficking in the world generate the demand for airport security and screening systems. The risk management approach of the airports drives the need for security solutions.

Air Cargo Security and Screening Systems Market Overview

Air cargo security and screening systems play a crucial role in ensuring the security and safety of the people at airports. These systems provide detection technology to the airport operators with which they can detect any explosive object, narcotics, metal and contraband. To avoid terrorist attacks and drug trafficking, these systems are required at the airports

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Air Cargo Security and Screening Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Air Cargo Security and Screening Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Air Cargo Security and Screening Systems Market Drivers and Opportunities

Growing adoption of air routes for the e-commerce industry

The e-commerce industry is experiencing growth at a rapid phase. To deliver the products faster to the customers, the shipping industry is shifting towards the air route. The speed factor plays a crucial role in retail shipments through air routes. The air carriers sometimes carry cargo in the passenger flights and cargo flights. This factor has generated the demand for air cargo security and screening systems.

Rising Consumer Electronics Market

The government's focus on ensuring air cargo security drives the demand for air cargo security and screening systems. For example, the Department of Homeland Security's (DHS) Transportation Security Administration (TSA) and US Customs and Border Protection (CBP) address US-bound air cargo security through distinct programs and they have taken steps to measure their effectiveness. TSA conducts an inspection program to ensure that air carriers are comply with specific cargo-related security requirements, such as requirements related to control and custody, cargo acceptance, and screening procedures.

Air Cargo Security and Screening Systems Market Report Segmentation Analysis

Key segments that contributed to the derivation of air cargo security and screening systems market analysis are the cargo size, technology, and application.

- Based on the cargo size, the air cargo security and screening systems market is divided into small parcel, break and pallet cargo, and oversized cargo. The oversized cargo segment is expected to grow with the highest CAGR.

- By technology, the market is segmented into X-ray systems, ETD (explosives trace detection), EDS (explosive detection system), and others. The X-ray systems segment held a significant share of the market in 2023.

- By application, the market is segmented into narcotics detection, explosive detection, metal and contraband detection, and others. The metal and contraband detection segment held a significant share of the market in 2023.

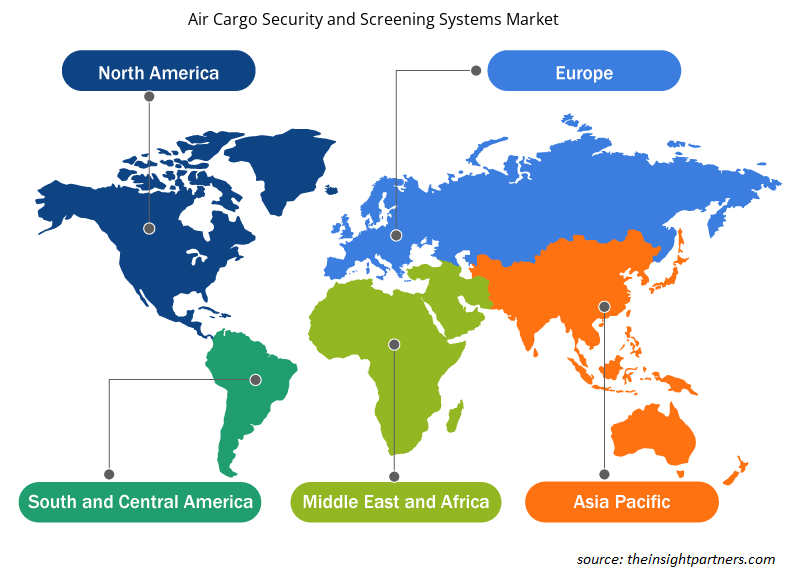

Air Cargo Security and Screening Systems Market Share Analysis by Geography

The geographic scope of the air cargo security and screening systems market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America holds a significant global market share in 2023. The rising concerns over security at the airports drive the market growth in the region. The growing e-commerce industry in the region is generating demand for air cargo security solutions. The government investment in improving airport security further fosters market growth in the region.

Air Cargo Security and Screening Systems Market Regional Insights

The regional trends and factors influencing the Air Cargo Security and Screening Systems Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Air Cargo Security and Screening Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Air Cargo Security and Screening Systems Market

Air Cargo Security and Screening Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 841.56 Million |

| Market Size by 2031 | US$ 1256.74 Million |

| Global CAGR (2023 - 2031) | 5.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Cargo Size

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

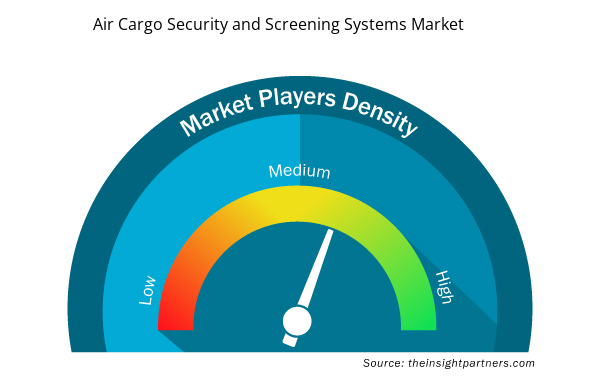

Air Cargo Security and Screening Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Air Cargo Security and Screening Systems Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Air Cargo Security and Screening Systems Market are:

- Astrophysics Inc

- Dhonaadhi Hitec Innovations

- Krystalvision Image Systems Pvt Ltd

- Nuctech Company Limited

- Rapiscan Systems, Inc

- Safran S.A

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Air Cargo Security and Screening Systems Market top key players overview

Air Cargo Security and Screening Systems Market News and Recent Developments

The air cargo security and screening systems market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the air cargo security and screening systems market are listed below:

- Under the CAPITAL INVESTMENT PLAN for the FY24-FY28. The country is focused on the Air Cargo Security Program that collaborates with industry to develop requirements and to qualify technologies to address identified capability gaps in air cargo screening security. (Source: US Department of Homeland Security, Press Release, August 2023)

Air Cargo Security and Screening Systems Market Report Coverage and Deliverables

The "Air Cargo Security and Screening Systems Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Air cargo security and screening systems market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Air cargo security and screening systems market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Air cargo security and screening systems market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the air cargo security and screening systems market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Grant Management Software Market

- Hydrocephalus Shunts Market

- Greens Powder Market

- Surgical Gowns Market

- Excimer & Femtosecond Ophthalmic Lasers Market

- Transdermal Drug Delivery System Market

- Integrated Platform Management System Market

- Artificial Intelligence in Healthcare Diagnosis Market

- Power Bank Market

- Redistribution Layer Material Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Cargo Size, Technology, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Brazil, Canada, Chile, China, France, Germany, India, Indonesia, Italy, Japan, Malaysia, Mexico, RoAPAC, Russian Federation, Singapore, South Korea, Thailand, United Arab Emirates, United Kingdom, United States, Vietnam

Frequently Asked Questions

What are the driving factors impacting the air cargo security and screening systems market?

The adoption of security solutions for the rising number of airports and the growing e-commerce industry are the key driving factors impacting the air cargo security and screening systems market.

Which are the leading players operating in the air cargo security and screening systems market?

Astrophysics Inc; Dhonaadhi Hitec Innovations; Krystalvision Image Systems Pvt Ltd; Nuctech Company Limited; Rapiscan Systems, Inc; Safran S.A.; EAS Envimet Analytical Systems Ges.m.b.H.; Safeway Inspection System Limited; Smith's Detection Group Ltd. (Smiths Group plc); and OSI Systems are some of the key players operating in the air cargo security and screening systems market.

What would be the estimated value of the air cargo security and screening systems market by 2031?

The estimated value of the air cargo security and screening systems market will be US$ 1256.74 million by 2031.

What is the future trend of the air cargo security and screening systems market?

Integration of AI and ML technologies with the security and screening systems is a key trend in the air cargo security and screening systems market.

What is the expected CAGR of the air cargo security and screening systems market?

The global air cargo security and screening systems market is estimated to register a CAGR of 5.1% during the forecast period 2023–2031.

Get Free Sample For

Get Free Sample For