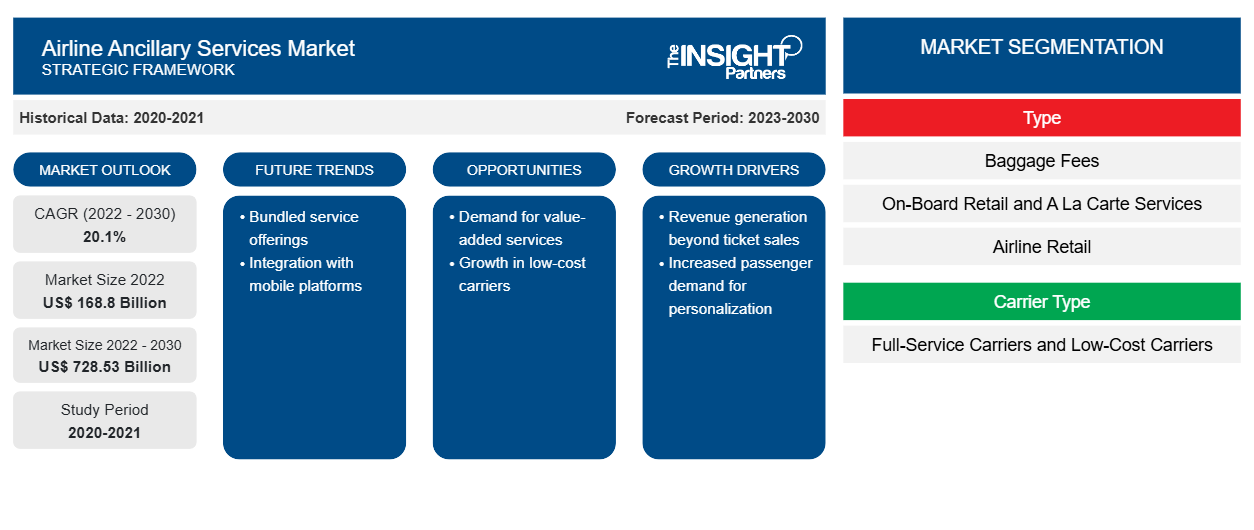

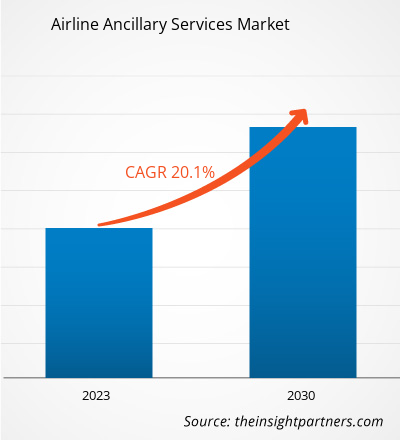

The airline ancillary services market size is projected to reach US$ 728.53 billion by 2030 from US$ 168.80 billion in 2022; the market is expected to record a CAGR of 20.1% from 2022 to 2030.

Analyst Perspective:

The key players operating in the airline ancillary services market are witnessing increased demand for services such as entertainment, Wi-Fi, and catering. The growing number of aviation passengers across the world significantly drives the airline ancillary services market. Ancillary revenues are critical to the airline business model; for instance, in developed markets such as North America and Europe, airline companies including Ryanair, Spirit, and Allegiance have recognized ancillary revenues contributing significantly to their total revenues. The trend was soon adopted by rapidly developing economies in Asia Pacific, where carriers such as Air Asia experienced that one-fifth of their revenue comes from ancillary services. Thus, this trend is anticipated to significantly influence airline carrier revenues, particularly in developing economies, which would further contribute to the airline ancillary services market growth.Airline Ancillary Services Market Overview:

The airline ancillary services market is benefitted from the willingness of the passengers to pay for services that add value to their experience. Seat upgrades, pre-booking of seats, and baggage are a few of the popular ancillary services in demand. Several startups are entering the market to cater to these evolving needs. Further, low-cost carriers are gaining immense importance in the global aviation industry. The robust business models for ticketing, airport services, onboard services, and others facilitate low-cost carriers to attract passengers from all classes of society. The rising demand from passengers for additional services such as inflight food and beverages service, Wi-Fi, and retail is expected to offer several opportunities to startups. Apart from the aforementioned ancillary services, the in-flight entertainment (IFE) service is expected to impact the airline ancillary service industry substantially. As digitally cultured customers, particularly business travelers, anticipate their carriers to facilitate in-flight connectivity options. It was also found that most passengers on a short-haul route demand web access while onboarding to access their digital devices. Thus, the rising demand for IFE is expected to enhance ancillary revenues, positively influencing the airline ancillary services market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Airline Ancillary Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Airline Ancillary Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Airline Ancillary Services Market Driver:

Rising Preference for Air Travel by Middle-Income Passengers

According to the International Air Transport Association (IATA), global air passenger traffic is projected to reach approximately 7.8 billion by 2036, driven primarily by strong demand in emerging economies. As per IATA's press release published in January 2025, international full-year air traffic rose by 13.6% compared to 2023, while the air passenger capacity rose by 12.8%. Asia Pacific airlines recorded a 26.0% rise in full-year international 2024 traffic compared to 2023, demonstrating the strongest year-over-year growth among all major regions. The expanding middle-income population, particularly in China, India, and Southeast Asian countries, is a key enabler of this growth. As disposable incomes rise and urbanization accelerates, more individuals in these regions are prioritizing air travel for both business and leisure purposes. This shift is contributing to a notable surge in global flight activity and, in turn, the demand for airline ancillary services. Post-COVID-19 pandemic, collaborations between the United Nations World Tourism Organization (UNWTO) and the International Civil Aviation Organization (ICAO), both of which are globally recognized organizations, emphasized the importance of restoring public confidence in international travel. The Memorandum of Understanding signed between UNWTO and IATA in October 2020 aimed to accelerate the recovery of global tourism through joint efforts to streamline travel protocols and enhance safety standards. With increasing air traffic, airlines are intensifying their focus on non-ticket revenue streams. Ancillary services such as in-flight Wi-Fi, seat selection, baggage upgrades, onboard food and beverages, and retail purchases are becoming pivotal to their profitability. According to the IATA, ancillary revenues accounted for more than US$ 100 billion globally in 2023, underscoring their growing importance in overall airline business models. Further, the shift in passenger expectations has prompted airlines to invest in personalized offerings and digital platforms, improving the overall travel experience. For instance, low-cost carriers (LCCs) are increasingly adopting unbundled pricing strategies, allowing middle-income travelers to customize services according to budget and preferences. This approach not only improves customer satisfaction but also enhances ancillary revenue potential.

Thus, a rise in middle-class air travelers is encouraging innovation in customer engagement strategies, in addition to reshaping airline pricing and service models. As airlines aim to differentiate themselves in a competitive market, tailored ancillary services are becoming critical in achieving passenger loyalty and sustaining long-term profitability.

Airline Ancillary Services Market Segmental Analysis:

The airline ancillary services market, by type, is segmented into baggage fees, on-board retail & a la carte, airline retail, FFP mile sale, and others. The baggage fees segment held the largest market share in 2022. Baggage fees are additional charges imposed by airlines for checking in luggage or carrying extra baggage on a flight. These fees are separate from the base ticket price and vary based on factors such as the airline, destination, and baggage weight or size. Baggage fees have become a common practice in the airline industry, allowing airlines to generate extra revenue and offer more flexible fare options to passengers. Travelers can choose to pay for checked baggage or opt for lower base fares if they travel with only carry-on luggage. The implementation of baggage fees has been a significant aspect of the airline ancillary services market, providing airlines with a means to increase profitability and offering passengers choices in their travel experience.Airline Ancillary Services Market Regional Analysis:

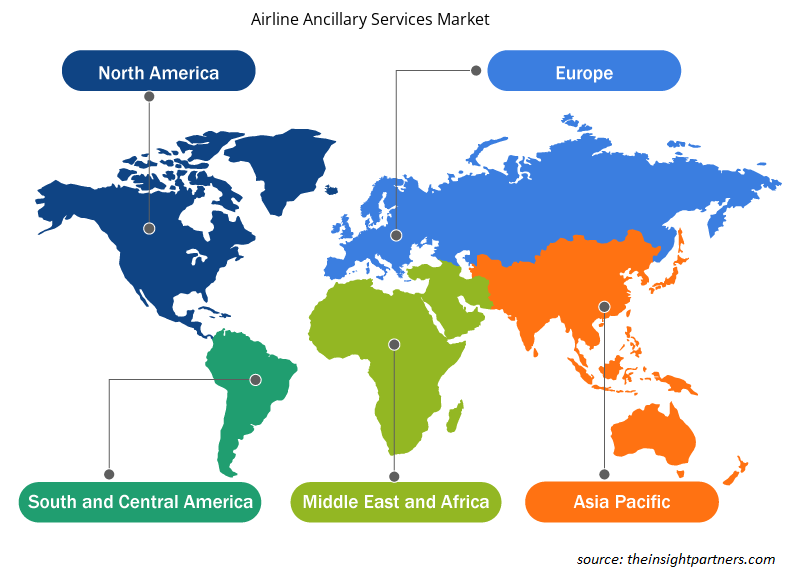

The North America airline ancillary services size was US$ 64.70 million in 2022; the market is expected to register a CAGR of 20.6% during 2023–2030, reaching a value of US$ 289.34 million by 2030. The North America airline ancillary services market is segmented into the US, Canada, and Mexico. The US held the largest share of the North American airline ancillary services market in 2022. According to the data of the Bureau of Economic Analysis, the GDP of the US in the fourth quarter of FY2022 increased by ~2.6%; this growth in the GDP was primarily driven by strong business investment and consumer spending. The airline industry contributes significantly to the overall US economic growth. The rising consumer spending and business investment in the civil airline sector are expected to encourage the airline ancillary services market growth.Airline Ancillary Services Market Key Player Analysis:

United Airlines Holdings Inc, American Airlines Group Inc, Delta Air Lines Inc, EasyJet Plc, Deutsche Lufthansa AG, Qantas Airways Ltd, Ryanair Holdings Plc, Southwest Airlines Co, The Emirates, and Air France KLM SA are among the major players in the airline ancillary services market.Airline Ancillary Services Market Regional Insights

The regional trends and factors influencing the Airline Ancillary Services Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Airline Ancillary Services Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Airline Ancillary Services Market

Airline Ancillary Services Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 168.8 Billion |

| Market Size by 2030 | US$ 728.53 Billion |

| Global CAGR (2022 - 2030) | 20.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Airline Ancillary Services Market Players Density: Understanding Its Impact on Business Dynamics

The Airline Ancillary Services Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Airline Ancillary Services Market are:

- United Airlines Holdings Inc

- American Airlines Group Inc

- Delta Air Lines Inc

- EasyJet Plc

- Deutsche Lufthansa AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Airline Ancillary Services Market top key players overview

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the airline ancillary services market. A few recent key airline ancillary services market developments are listed below:- In February 2023, United Airlines recently announced its decision to allow families with small children to select adjacent seats at no additional cost. This customer-friendly move acknowledges the importance of providing families a seamless and comfortable travel experience, highlighting United's commitment to enhancing its ancillary offerings.

- In January 2023, Delta Air Lines' announced free Wi-Fi for passengers in the US, made possible through a partnership with T-Mobile. Starting February 1, the frequent flier program members of SkyMiles would enjoy complimentary Wi-Fi. This move, made as a significant step toward enhancing ancillary service offerings, demonstrates Delta's commitment to improving the inflight experience and adding value to its loyal customers.

- In July 2022, EasyJet took steps to improve the customer experience with a series of initiatives for the summer travel season. These include a dedicated customer hotline for families, extended customer service hours, "Helping Hands" at key airports, and the reintroduction of the Twilight Bag Drop service. The airline aims to provide additional support and convenience to passengers, showcasing its commitment to enhancing ancillary services.

Frequently Asked Questions

What is the incremental growth of the Global Airline Ancillary Services Market during the forecast period?

The incremental growth expected to be recorded for the Global Airline Ancillary Services Market during the forecast period is US$ 559.73 billion.

Which are the key players holding the major market share of the Global Airline Ancillary Services Market?

The key players holding majority shares in the Global Airline Ancillary Services Market are United Airlines Holdings Inc, American Airlines Group Inc, Delta Air Lines Inc, EasyJet Plc, and Deutsche Lufthansa AG.

What are the future trends of the Global Airline Ancillary Services Market?

Increasing deployment of in-flight wi-fi are impacting the Global Airline Ancillary Services, which is anticipated to play a significant role in the Global Airline Ancillary Services Market in the coming years.

What are the driving factors impacting the Global Airline Ancillary Services Market?

The rising preference for air travel by middle-income passengers, benefits of frequent flyer programs, and in-flight retail partnerships are the major factors that propel the Global Airline Ancillary Services Market.

What is the estimated market size for the Global Airline Ancillary Services Market in 2022?

The Global Airline Ancillary Services Market was estimated to be US$ 168.80 billion in 2022 and is expected to grow at a CAGR of 20.1% during the forecast period 2023 - 2030.

What will be the market size for the Global Airline Ancillary Services Market by 2030?

The Global Airline Ancillary Services Market is expected to reach US$ 728.53 billion by 2030.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Aircraft MRO Market

- Helicopter Hoists Winches and Hooks Market

- Fixed-Base Operator Market

- Aerospace Fasteners Market

- Aerospace Stainless Steel And Superalloy Fasteners Market

- Aircraft Floor Panel Market

- Military Optronics Surveillance and Sighting Systems Market

- Smoke Grenade Market

- Airport Runway FOD Detection Systems Market

- Artillery Systems Market

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Airline Ancillary Services Market

- United Airlines Holdings Inc

- American Airlines Group Inc

- Delta Air Lines Inc

- EasyJet Plc

- Deutsche Lufthansa AG

- Qantas Airways Ltd

- Ryanair Holdings Plc

- Southwest Airlines Co

- The Emirates

- Air France KLM SA

Get Free Sample For

Get Free Sample For