Antibody Testing Market Share, Growth & Key Opportunities by 2034

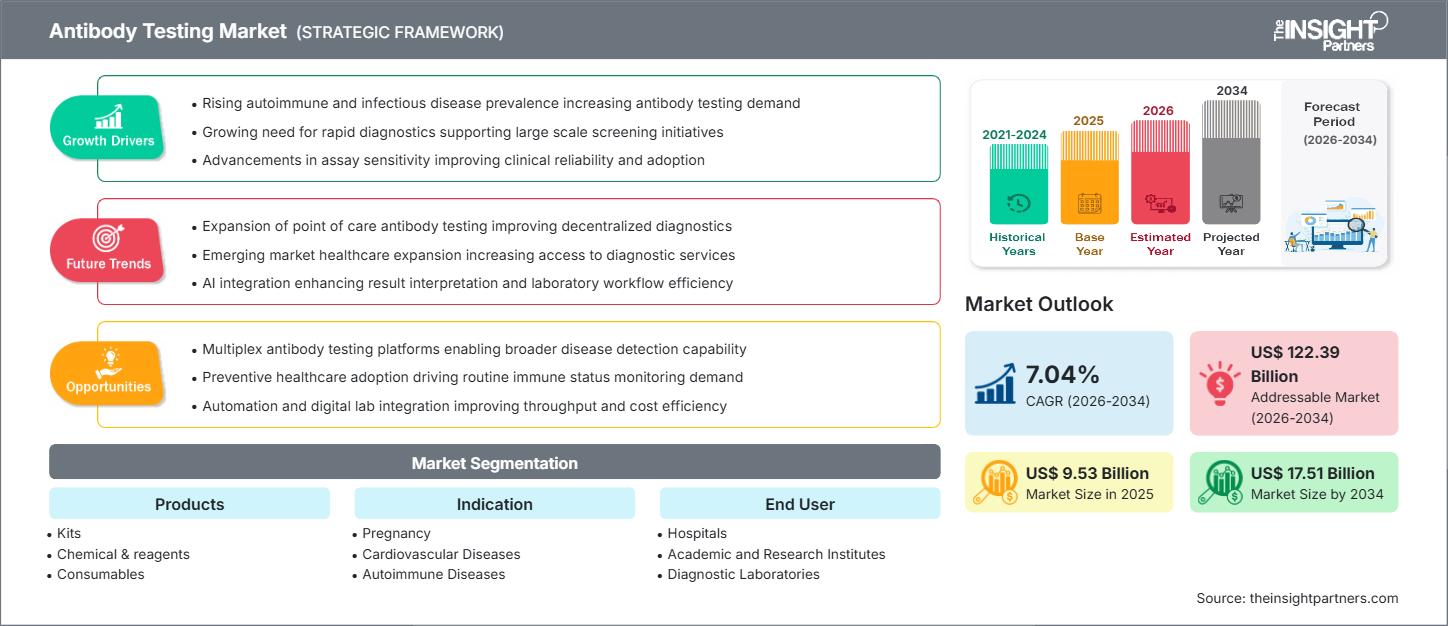

Antibody Testing Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Products (Kits, Chemical & reagents, and Consumables), Indication (Pregnancy, Cardiovascular Diseases, Autoimmune Diseases, Infectious Diseases, Oncology, Endocrine Diseases, and Others), End User (Hospitals, Academic and Research Institutes, Diagnostic Laboratories, and Biopharmaceutical Companies)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Status : Data Released

- Report Code : TIPRE00016492

- Category : Life Sciences

- No. of Pages : 150

- Available Report Formats :

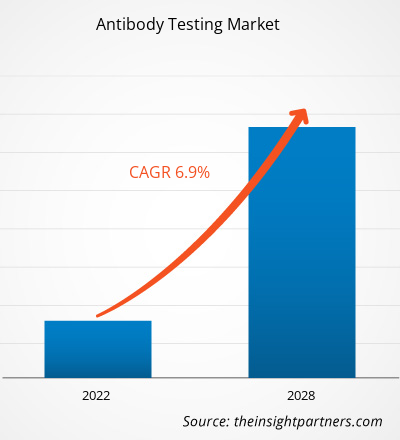

The antibody testing market size is expected to reach US$ 17.51 billion by 2034 from US$ 9.53 billion in 2025. The market is anticipated to register a CAGR of 7.04% during 2026–2034.

Antibody Testing Market Analysis

The antibody testing market forecast indicates robust growth, driven by the rising prevalence of infectious and autoimmune diseases, increasing demand for accurate diagnostic solutions, and advancements in immunoassay technologies. Market expansion is supported by growing applications in oncology, endocrine disorders, and vaccine efficacy monitoring. Additionally, the integration of automation, AI-driven interpretation, and point-of-care (POC) testing platforms further accelerates adoption. Strategic collaborations between diagnostic companies and healthcare providers, coupled with the development of multiplex assays, are expected to create significant opportunities for market players.

Antibody Testing Market Overview

Antibody testing refers to diagnostic procedures that detect antibodies (IgG, IgM, IgA) in blood samples, indicating an immune response to infections, autoimmune conditions, or vaccines. These tests employ technologies such as ELISA, chemiluminescence immunoassays, lateral flow assays, and immunofluorescence. Antibody testing plays a critical role in disease surveillance, clinical diagnostics, and therapeutic monitoring. The market benefits from increasing healthcare access, rising chronic disease burden, and technological innovations in rapid and high-throughput testing. Emerging economies in the Asia Pacific and Latin America present strong growth potential due to expanding diagnostic infrastructure and affordability initiatives.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAntibody Testing Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Antibody Testing Market Drivers and Opportunities

Market Drivers:

- Rising Prevalence of Infectious and Autoimmune Diseases: The global burden of infectious diseases such as HIV, hepatitis, and emerging viral infections, along with autoimmune conditions like rheumatoid arthritis and lupus, is significantly increasing. According to the WHO, autoimmune disorders affect millions worldwide, and infectious diseases remain a leading cause of morbidity. This surge in disease prevalence drives the demand for accurate antibody-based diagnostics for early detection, monitoring, and treatment planning.

- Technological Advancements in Immunoassays: Continuous innovation in diagnostic technologies, such as ELISA, chemiluminescence immunoassays, and multiplex platforms, has improved sensitivity, specificity, and turnaround time. These advancements enable high-throughput testing and integration with automated laboratory systems, reducing manual errors and enhancing efficiency. The development of AI-driven interpretation tools further strengthens diagnostic accuracy and clinical decision-making.

- Growing Adoption of Point-of-Care and Automated Solutions: Healthcare systems are increasingly shifting toward decentralized testing models to improve accessibility and reduce diagnostic delays. Point-of-care (POC) antibody tests allow rapid screening in clinics, remote areas, and emergency settings. Simultaneously, automated platforms in centralized labs streamline workflows, handle large sample volumes, and support multiplex testing, meeting the rising demand for faster and more reliable diagnostics.

Market Opportunities:

- Development of Multiplex and AI-Enhanced Assays: Multiplex assays capable of detecting multiple antibodies in a single test are gaining traction for their efficiency and cost-effectiveness. Coupled with AI-based analytics, these solutions provide comprehensive diagnostic insights, reduce interpretation errors, and support personalized treatment strategies. This innovation opens avenues for premium product segments and differentiation in a competitive market.

- Expansion in Emerging Markets: Emerging economies in the Asia Pacific, Latin America, and Africa present significant growth potential due to improving healthcare infrastructure, rising awareness of preventive diagnostics, and government-led screening programs. Affordable, portable antibody testing kits tailored for infectious disease surveillance can address unmet needs in these regions, creating opportunities for market penetration and revenue growth.

- Strategic Collaborations and Partnerships: Collaborations between diagnostic companies, biopharmaceutical firms, and public health organizations are increasing to support vaccine trials, epidemiological studies, and population-level screening initiatives. These partnerships enable companies to expand their product portfolios, access new markets, and leverage shared resources for innovation, regulatory approvals, and large-scale deployment.

Antibody Testing Market Report Segmentation Analysis

By Product:

- Kits: Comprehensive diagnostic kits for detecting specific antibodies (IgG, IgM) across multiple indications.

- Chemical & Reagents: Essential components such as enzymes, buffers, and substrates for assay performance.

- Consumables: Plates, cartridges, and pipette tips supporting high-throughput and POC testing workflows.

By Indication:

- Pregnancy: Detection of antibodies related to prenatal health and maternal immunity.

- Cardiovascular Diseases: Identification of cardiac-specific antibodies for early diagnosis.

- Autoimmune Diseases: Tests for ANA, anti-MCV, and other autoantibodies are critical for conditions like RA and lupus.

- Infectious Diseases: COVID-19, HIV, hepatitis, and other infections remain primary drivers of antibody testing.

- Oncology: Tumor-associated antibodies aid in cancer detection and monitoring.

- Endocrine Diseases: Autoantibodies linked to thyroid and other endocrine disorders.

- Others: Includes drug hypersensitivity and transplant monitoring.

By End User:

- Hospitals: Centralized labs and POC units for large-scale patient diagnostics.

- Academic and Research Institutes: Focused on assay development and validation.

- Diagnostic Laboratories: High-volume testing centers offering specialized antibody panels.

- Biopharmaceutical Companies: Use antibody testing for clinical trials and therapeutic monitoring.

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Antibody Testing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 9.53 Billion |

| Market Size by 2034 | US$ 17.51 Billion |

| Global CAGR (2026 - 2034) | 7.04% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Products

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Antibody Testing Market Players Density: Understanding Its Impact on Business Dynamics

The Antibody Testing Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Antibody Testing Market Share Analysis by Geography

North America

- Market Share: Holds the largest share due to advanced healthcare infrastructure and high adoption of automated immunoassay platforms.

- Key Drivers:

- High prevalence of autoimmune diseases and chronic conditions requiring routine antibody testing.

- Strong investment in diagnostic R&D and rapid adoption of AI-integrated platforms.

- Favorable reimbursement policies and well-established laboratory networks.

- Trends: Increasing demand for multiplex assays and integration of antibody testing in personalized medicine programs.

Europe

- Market Share: Significant share driven by government-backed preventive healthcare initiatives and strong regulatory frameworks.

- Key Drivers:

- Rising incidence of autoimmune disorders and infectious diseases across major economies.

- Supportive reimbursement systems for advanced diagnostic tests.

- Growing focus on early disease detection and population-level screening programs.

- Trends: Adoption of point-of-care antibody tests and harmonization of CE-certified diagnostic standards.

Asia Pacific

- Market Share: Fastest-growing region due to expanding healthcare infrastructure and affordability initiatives.

- Key Drivers:

- Increasing burden of infectious diseases such as hepatitis and dengue.

- Rapid growth of diagnostic laboratories and hospital networks in China and India.

- Government-led programs promoting preventive diagnostics and vaccination monitoring.

- Trends: Surge in demand for portable antibody kits and regional manufacturing partnerships for cost-effective solutions.

Central & South America

- Market Share: Emerging region with rising diagnostic awareness and healthcare investments.

- Key Drivers:

- Expansion of private diagnostic centers and hospital-based laboratories.

- Government initiatives for HIV and hepatitis screening programs.

- Growing affordability and availability of rapid antibody testing kits.

- Trends: Increased adoption of point-of-care solutions and mobile testing units for rural areas.

Middle East & Africa

- Market Share: Developing market with growing healthcare infrastructure and international aid support.

- Key Drivers:

- Rising investment in diagnostic facilities and laboratory automation.

- High demand for infectious disease surveillance and outbreak preparedness.

- Support from global health organizations for population-level screening and vaccination programs.

- Trends: Deployment of mobile diagnostic units and donor-funded antibody testing initiatives.

Antibody Testing Market Players Density: Understanding Its Impact on Business Dynamics

The antibody testing market is highly competitive, characterized by global players focusing on innovation and strategic partnerships. Differentiation strategies include:

- Development of multiplex and AI-integrated platforms.

- Enhanced assay sensitivity and specificity.

- Expansion into emerging markets with cost-effective solutions.

Opportunities and Strategic Moves:

- Collaborations with biopharma for vaccine trials and therapeutic monitoring.

- Investment in POC and automated testing systems.

- Launch of advanced immunoassay kits for oncology and autoimmune diagnostics.

Major Companies Operating in the Antibody Testing Market Are:

- Abbott Laboratories

- Roche Diagnostics

- Thermo Fisher Scientific

- Bio-Rad Laboratories

- Siemens Healthineers

- Agilent Technologies

- Danaher Corporation

- PerkinElmer Inc.

- DiaSorin S.p.A.

- Merck KGaA

Disclaimer: The companies listed above are not ranked in any particular order

Antibody Testing Market News and Recent Developments

- In November 2025, Thermo Fisher Scientific Inc., the world leader in serving science, announced that it had received 510(k) clearance for the EXENT® Analyser and Immunoglobulin Isotypes (GAM) Assay, a first-of-its-kind automated MALDI-ToF mass spectrometry platform for clinical laboratories. The EXENT System combined enhanced sensitivity and automation to deliver accurate Antibody Testing results, helping clinicians make faster diagnoses for patients with multiple myeloma and related disorders.

- In June 2025, DiaSorin (FTSE MIB: DIA) announced that it had received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for the LIAISON PLEX® Gram-Positive Blood Culture Assay, the final syndromic blood culture panel for the microbiological diagnosis of bloodstream infections on the LIAISON PLEX® platform. This advancement strengthened DiaSorin's Antibody Testing capabilities by enabling comprehensive detection and diagnostic accuracy for bloodstream infections.

Antibody Testing Market Report Coverage and Deliverables

The "Antibody Testing Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- Antibody Testing Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Antibody Testing Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Antibody Testing Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Antibody Testing Market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For