Page Updated:

Oct 2021

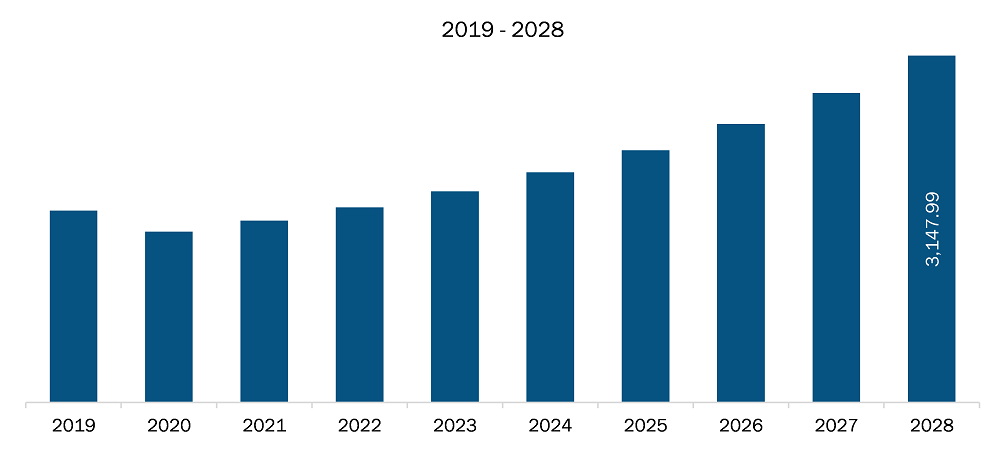

The aircraft wheels and brakes market in Asia Pacific is expected to grow from US$ 1,650.72 million in 2021 to US$ 3,147.99 million by 2028; it is estimated to grow at a CAGR of 9.7% from 2021 to 2028.

China, India, and Japan are major economies in Asia Pacific. Electric brakes and fiber-reinforced plastic wheels is the major factor driving the growth of the Asia Pacific aircraft wheels and brakes market. Electric brakes have emerged as an attractive alternative to conventional aircraft brake systems due to their benefits such as reduction in fuel consumption and CO2 emissions due to optimized weight of aircraft. These brake systems come with easy installation procedures and maintenance requirements, which simplifies the process of retrofitting for aircraft MRO services players. The electric brake systems integrate smart features such as real-time assessment of carbon disk wear and quick data transmission to the cockpit to bring greater convenience in aircraft operations. The anti-oxidation coating on brakes increases their service life and provides better protection against de-icing products. Electric brakes are predominantly used in several military aircraft models; on the other hand, B787 Dreamliner is the only commercial aircraft model that uses electric brakes. Advanced features such as real-time assessment reporting and data transmission make it popular among aircraft manufacturers. With these benefits, electric brake systems are anticipated to become a prominent trend in the aircraft wheels and brakes market in the coming years. In the aircraft wheel manufacturing segment, many conceptual developments are underway as several manufacturers are concentrating on the development of fiber-reinforced plastics wheels. Since wheels bear the maximum dynamic and thermal loads during aircraft take-off and landing, several stakeholders are engaged in exploring different advanced raw materials as suitable and better replacements for aluminum or magnesium in wheel production. Thus, a carbon-fiber-reinforced plastic wheel is another trend emerging in the aircraft wheels and brakes market, which is further anticipated to drive the market in Asia Pacific.The COVID-19 pandemic has disrupted the economy of APAC and its aerospace market, along with changing the customer attitude toward the sector. The region has witnessed a significant decline in the air transportation. As per IATA estimates Asia-Pacific airlines recorded a year-on-year revenue decline of US$ 113 billion in 2020. The reduction in air travel demand, and border restrictions have resulted in the grounding of aircraft at an unprecedented scale. ~18,000 aircraft, including the Boeing 747 and Airbus A380, were shelved in 2020 due to the collapse in passenger demand and bankruptcies. China is one of the leading aerospace manufacturing countries in the region and has been one of APAC's most affected countries by the pandemic during Q1 and Q2 of 2020. Airbus and Boeing manufacturing facilities in China were shut down for a long period, which resulted in substantially low demand for various components and systems, including wheels and brakes. Similarly, OMAC, an indigenous aircraft manufacturer in China, also halted its production of C919 during Q1.However, the aviation authorities, airlines, and aircraft manufacturers foresee a strong growth in APAC aviation industry. Owing to this, several airlines and military forces are ordering and taking deliveries of newer aircraft models. This is expected to drive the demand for aircraft wheels, brakes, and braking systems among commercial and military MRO facilities and aircraft manufacturers.With the decline in COVID-19 cases, many manufacturing plants and facilities are starting to open up in various countries in APAC, and employees are also returning to work. Countries such as Japan, South Korea, and Australia have made better progress in recent weeks, having ramped up their vaccination programs. In contrast, Singapore has been the leader among the APAC economies, with a first-dose vaccination rate as a share of total population that is amongst the highest in the world, on a par with the UK and Canada.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Asia Pacific Aircraft Wheels and Brakes Market Segmentation

Asia Pacific Aircraft Wheels and Brakes Market – By Component

- Braking System

- Wheels

- Brakes

Asia Pacific Aircraft Wheels and Brakes Market – By Fit Type

- Line Fit

- Retro Fit

Asia Pacific Aircraft Wheels and Brakes Market – By End User

- Defense

- Commercial

Asia Pacific Aircraft Wheels and Brakes Market – By Country

- Australia

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

Asia Pacific Aircraft Wheels and Brakes Market – Companies Mentioned

- Collins Aerospace

- Crane Aerospace & Electronics

- Honeywell International Inc.

- Meggitt PLC

- Parker Hannifin Corporation

- Safran

Asia Pacific Aircraft Wheels and Brakes Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1,650.72 Million |

| Market Size by 2028 | US$ 3,147.99 Million |

| CAGR (2021 - 2028) | 9.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Our Clients

Sales Assistance

US: +1-646-491-9876

UK: +44-20-8125-4005

Email: sales@theinsightpartners.com

Chat with us

87-673-9708

ISO 9001:2015

Get Free Sample For

Get Free Sample For