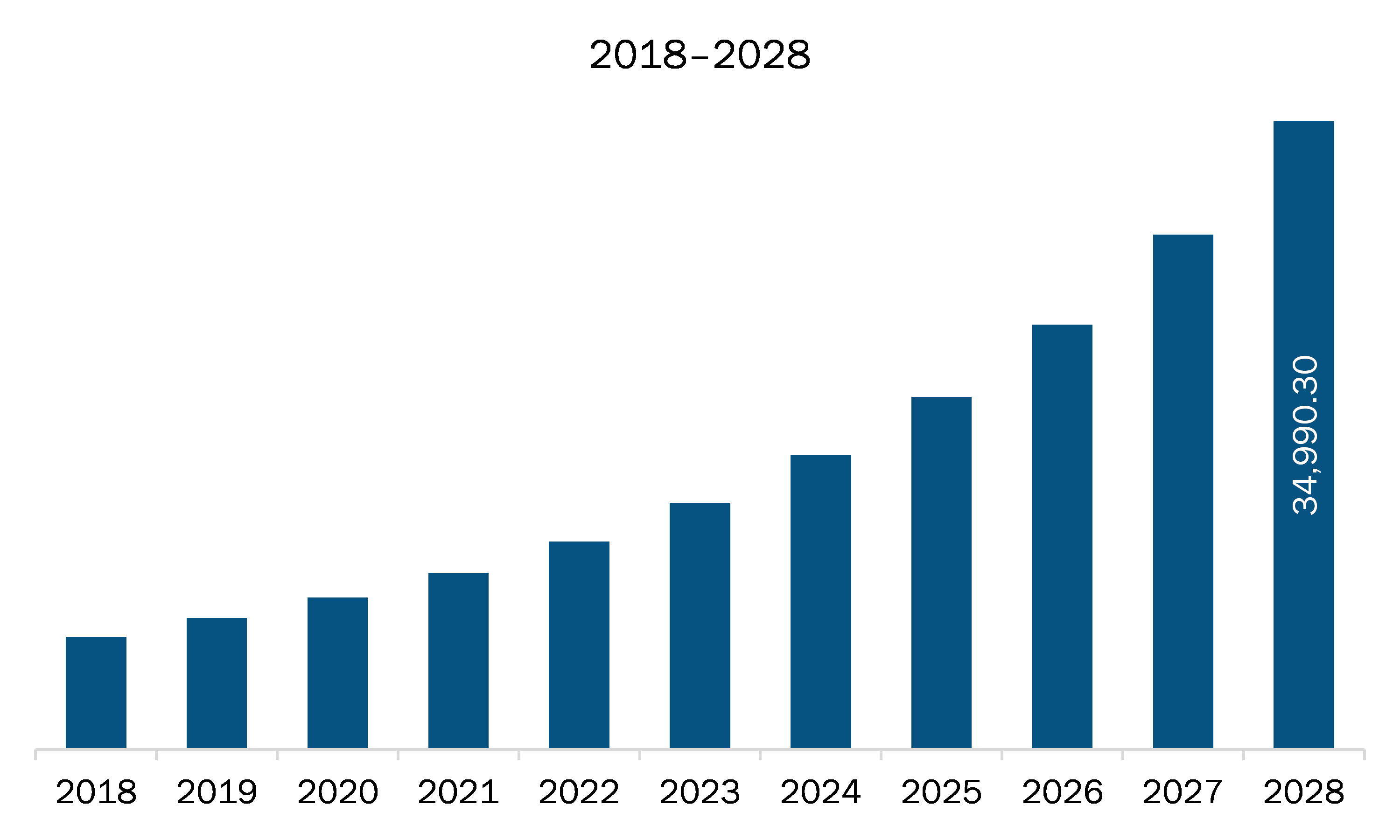

The B2B food marketplace platforms market in APAC is expected to grow from US$ 9846.03 million in 2021 to US$ 34990.30 million by 2028; it is estimated to grow at a CAGR of 19.9% from 2021 to 2028.

China, Japan, India, Australia, Indonesia, Malaysia, and Thailand are major economies in APAC. Companies are concentrating their efforts on enhancing their production capacity, go-to-market processes, and digital activities such as expanding their e-commerce presence and scale. COVID-19 has provided every other firm an incentive to make changes in their marketing strategy post normalcy. Every organization, big or small, has been concentrating on developing new business models to meet the market's changing needs. For example, PepsiCo Inc. has launched its direct-to-consumer (DTC) websites Snacks.com and PantryShop.com in response to the increased demand caused by the COVID-19 pandemic. Both websites are aimed to gain profit from the growing trend of people using e-commerce to satisfy their food and beverage demands amidst the current health crisis. PepsiCo is promoting its Pepsi, Frito-Lay, Gatorade, Quaker Oats, and other well-known brands on these sites. This type of initiative aids other businesses in innovating their online marketplaces based on demand. As a whole, these variables are anticipated to contribute to the B2B food marketplace platform's growth.

The COVID-19 pandemic has severely impacted APAC due to wide disease spread; countries in this region are among the highly populated, which leads to the greater risk infection spread. According to the Organization for Economic Co-operation and Development (OECD), the pandemic has affected major economies such as China, India, Australia, and Japan, which are experiencing inflation. India is the worst-hit country by the pandemic in this region. The limitations imposed by governments to control the spread of COVID-19 has adversely impacted the food & beverage industry of Asian countries. Closure of hotels, restaurants, and caterers’ business has negatively impacted the adoption of B2B food marketplace in Asian economy.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the B2B food marketplace platforms market. The APAC B2B food marketplace platforms market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

APAC B2B Food Marketplace Platforms Market Segmentation

APAC B2B Food Marketplace Platforms Market – By Enterprise Size

- SMEs

- Large Enterprises

APAC B2B Food Marketplace Platforms Market – By Food Category

- Chilled and Dairy

- Grocery

- Beverages

- Water

- Others

- Others

APAC B2B Food Marketplace Platforms Market- By Country

- China

- Japan

- India

- Australia

- Indonesia

- Malaysia

- Thailand

- Rest of APAC

APAC B2B Food Marketplace Platforms Market-Companies Mentioned

- Agorara

- eFoodChoice.com

- FoodsTrade

- Jumbotail Technologies Pvt. Ltd.

- Mindcurv GmbH

- Telio Vietnam Co., Ltd

- Ukrainian Food Platform

Asia Pacific B2B Food Marketplace Platforms Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 9846.03 Million |

| Market Size by 2028 | US$ 34990.30 Million |

| CAGR (2021 - 2028) | 19.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Enterprise Size

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For