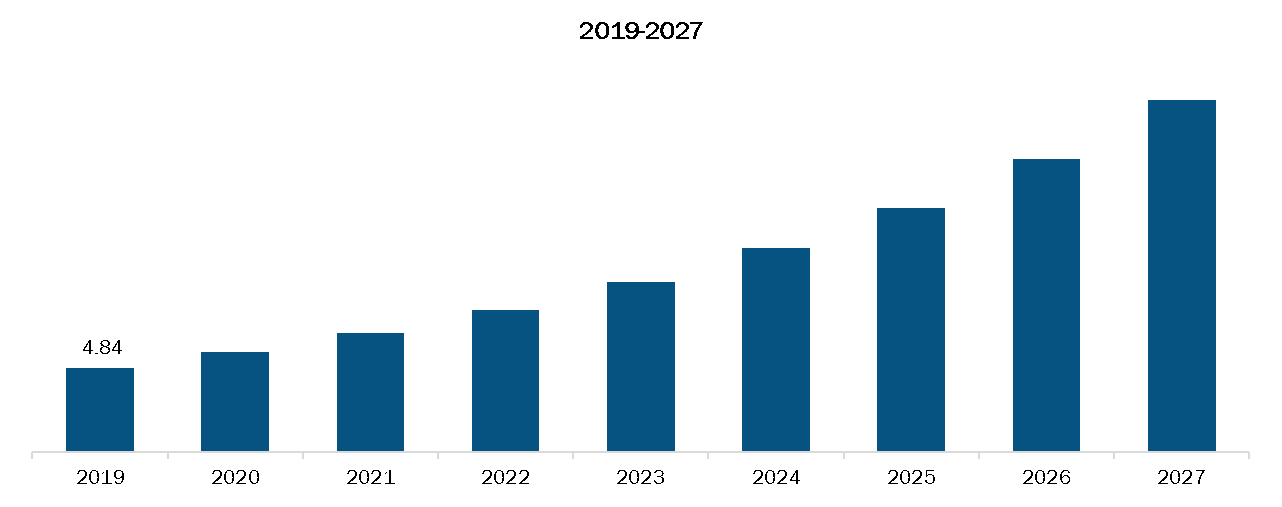

The Asia Pacific closed systems drug transfer devices market is expected to reach US$ 345.83 million by 2027 from US$ 75.23 million in 2019; it is estimated to grow at a CAGR of 21.1% from 2019 to 2027.

Driving factors include growing adoption of chemotherapy and closed system drug transfer devices. However, the lack of regulatory guidelines regarding health workers’ safety in emerging countries may restrain the market growth.

The closed system drug transfer devices provide protection against hazardous drugs or vapors during drug preparation and administration. It comprises components which enables filtering of dangerous vapors out of the system. Closed system drug transfer devices play a major role in protection of healthcare professionals from antineoplastic as well as other harmful medications. Growing emphasis on implementation of occupational health and safety standards by government authorities are offering lucrative opportunity for growth of the market.

Several hazardous drugs, such as antineoplastics, monoclonal antibodies, and antibiotics, are used during patient treatment protocols. Pharmacists, physicians, nurses, and other healthcare workers are at significant risk of exposure to hazardous drugs. Cancer is the leading cause of death in China. The cancer treatment comprises the utilization of antineoplastic drugs that can cause several health implications if ingested. The antineoplastic can have a severe impact during pregnancies, and the exposure can lead to chromosomal abnormalities. The surface contamination of chemotherapy treatment can impact healthcare professionals and the patient and their families. An increasing number of cancer cases are anticipated to drive the adoption of chemotherapies. According to the Globocan Cancer Statistics 2018, an estimated 4.3 million new cancer cases and 2.9 million new cancer deaths occurred in China in 2018. China is undergoing the cancer transition stage where the cancer spectrum is changing, with a rapid increase in cancer burden of colorectal, prostate, and female breast cancers and a high occurrence of infection-related and digestive cancers. Thus, the consequent surge in adopting chemotherapies would eventually drive the demand for closed systems drug transfer devices in the coming years.

A few studies have proven the effectiveness of closed-system drug transfer devices to prevent surface contamination in oncology settings. These devices prohibit the escape of harmful drug or vapor concentrations outside the system; they also prevent environmental contaminants' entry into the system. Many government organizations recommend using closed-system drug transfer devices to avoid any exposure to potentially hazardous drugs. Such effectiveness of closed-system drug transfer devices, coupled with the growing adoption of chemotherapies, drives the growth of the closed system drug transfer device market.

Considering the geographic and economic operations between Asian countries and China, the countries are expected to witness challenge of COVID-19. With its aging population having chronic diseases and the growing burden of cancer, Asia is facing the dual challenge of controlling the spread of COVID-19 and at the same time providing and maintaining cancer care. There is also the potential for negative impacts of both a medium- and longer-term nature on R&D and manufacturing activities, and delay on projects. These factors are affecting the growth of the Closed System Drug Transfer Device (CSTD) market in the region.

Rest of Asia Pacific Closed Systems Drug Transfer Devices Market, Revenue and Forecast to 2027 (US$ Mn)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

ASIA PACIFIC CLOSED SYSTEMS DRUG TRANSFER DEVICES MARKET SEGMENTATION

By Closing Mechanism

- Push-to-turn Systems

- Luer-lock Systems

- Color-to-color Alignment Systems

- Click-to-lock Systems

By Type

- Membrane-to-membrane Systems

- Needleless Systems

By Technology

- Diaphragm-based Devices

- Compartmentalized Devices

- Air Cleaning/Filtration Devices

By Component

- Vial Access Devices

- Syringe Safety Devices

- Bag/Line Access Devices

- Accessories

By End User

- Hospitals and Clinics

- Oncology Centers

- Others

By Country

- China

- Japan

- India

- South Korea

- Australia

Company Profiles

- JMS CO., LTD

- Caragen Ltd.

- BD

- B. Braun Medical Inc

- ICU MEDICAL INC

Asia Pacific Closed Systems Drug Transfer Devices Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 75.23 Million |

| Market Size by 2027 | US$ 345.83 Million |

| CAGR (2019 - 2027) | 21.1% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Closing Mechanism

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For