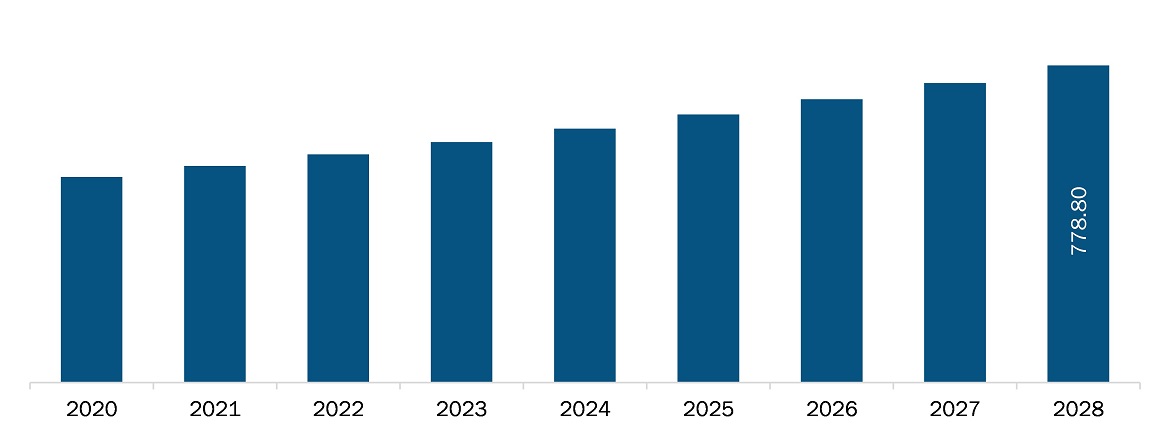

The Asia Pacific cosmetic bioactive ingredients market is expected to reach US$ 778.8 million by 2028 from US$ 531.9 million in 2021. The market is estimated to grow at a CAGR of 5.6% from 2021–2028.

Increasing consumer demand for natural products is fueling the research related to bioactive substances that can be used in cosmetics. Asia Pacific is home to a few of the biggest bioactive ingredient manufacturers and personal care brands such as BASF, and DSM. The launch of bioactive ingredients for the personal care industry is driving the growth of the market. In June 2019, BASF Care Creations launched three new active ingredients for the beauty market, which use rambutan trees that provide skin hydration and rejuvenation. Similarly, in April 2019, Lonza launched the H2OBioEV bioactive ingredient, which is a unique combination of naturally sourced ingredients—Aphanothece Sacrum polysaccharides and Galactoarabinan—with water and glycerin. The ingredient confers moisturization abilities by replenishing essential humectants, which facilitates optimal environment for the formation and maintenance of a strong epidermal protein barrier.

The COVID-19 pandemic has hit people because they want to change their current consumption to make life more convenient and safer. Consumers are also looking for “holistic, resilient and more conscious consumption” of dressings, food, and cosmetics. The effects of the COVID-19 outbreak will change significantly and permanently; the demand for color cosmetics is expected to slow down, and skincare is expected to increase. There are also new opportunities for personal care companies to offer additional related benefits that should be considered. Because of the social isolation and distancing, it also takes more "me time" and self-care. Thus, the need for cosmetic products with bioactive ingredients that have a medical benefit will increase enormously. The market for cosmetic bioactive ingredients received immense impulses from the COVID-19 pandemic with increasing research and development activities. Several studies have shown the antiviral properties of bioactive ingredients against COVID-19.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the cosmetic bioactive ingredients market. The Asia Pacific cosmetic bioactive ingredients market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Asia Pacific Cardiovascular Needle Market Segmentation

By Ingredient Type

- Probiotics and Prebiotics

- Omega-3 Fatty Acids

- Vitamins

- Carotenoids and Antioxidants

- Plant Extracts

- Minerals

- Amino Acids

- Proteins and Peptides

- Others

By Sources

- Plant

- Animal

- Microbial

By Country

- Asia Pacific

-

-

-

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

-

-

Companies Mentioned

- BASF SE

- DuPont de Nemours, Inc.

- FMC CORPORATION

- Cargill, Incorporated

- Sensient Technologies Corporation

- DSM

- Ajinomoto Co. Inc.

- Roquette Frères

- ADM

- Vytrus Biotech

Asia Pacific Cosmetic Bioactive Ingredients Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 531.9 Million |

| Market Size by 2028 | US$ 778.8 Million |

| CAGR (2021 - 2028) | 5.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Ingredient Type

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For