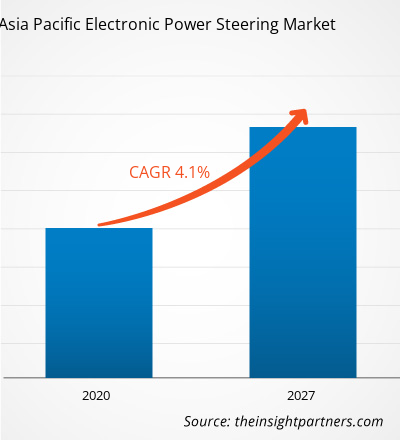

The electronic power steering market in APAC is expected to grow from US$ 26,704.59 million in 2019 to US$ 28,933.30 million by 2027; it is estimated to grow at a CAGR of 4.1% from 2020 to 2027.

China, India, Japan, and South Korea are major economies in APAC. Rising interests for electrification of vehicles is driving the APAC electronic power steering market in a positive way. Several countries are highly focused on building green transportation. For instance, in May 2019, the Ministry of Transport in China and various other ministries mutually issued the Green Travel Action Plan for 2019–2022 that would promote application of green vehicles. The country would also continue to enhance public transportation facilities and information systems that are supporting green transportation. The governments across different countries are taking several initiatives to boost the adoption of electric vehicles in their public transportation—such as e-trucks and e-buses—so as to reduce CO2 emissions by offering tax rebates and incentives. Some of the electric vehicle models are the BYD K9, Mercedes Benz electric truck, and Tata Starbus Hybrid e-buses. Recently, some of the commercial vehicle manufacturers have announced electric buses and some OEMs have announced the plans for migrating full-size trucks or pickup trucks to battery EV platforms. All these factors are expected to create huge opportunities for the growth and the acceleration of new technology implementations, such as EPS, across APAC.APAC is severely affected by the COVID-19 pandemic. The region comprises a large number of developing countries, positive economic outlook, high industrial presence, huge population, and rise in disposable income. All these factors make APAC a major growth driving region for various markets, electronic power steering market. Increasing online shoppers and growing e-commerce sector in this region offer lucrative opportunities for the growth of the APAC electronic power steering market. The consequence and impact of the COVID-19 pandemic can be even worse and totally depend on the spread of the virus. The government of countries in APAC is taking possible steps to reduce the effects of the outbreak by announcing lockdown, which negatively impacts the revenue generated by the market. India is one of the leading manufacturing sectors in the region, and the most affected country in APAC. Several markets in the region have witnessed negative growth in the past three months. The lockdown is hindering the automotive sector in India. Japan and South Korea are still combating the novel coronavirus, which is a critical factor toward the slowdown in the growth of the electronic power steering market. However, China has been able to stabilize the spread of COVID-19, and industries are up and running. This embarks a positive sign toward the stabilization of the electronic power steering market.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the APAC electronic power steering market. The APAC electronic power steering market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

APAC Electronic power steering Market Segmentation

APAC Electronic power steering Market – By Type

- Column Assisted Electronic Power Steering(C-EPS)

- Pinion Assisted Electronic Power Steering (P-EPS)

- Rack Assisted Power Steering System (R-EPS)

- Electronic Hydraulic Power Steering (EHPS)

APAC Electronic power steering Market – By Application

- Light Commercial Vehicles (LCV)

- Passenger Cars

- Heavy Commercial Vehicles (HCV)

APAC Electronic power steering Market, by Country

- China

- India

- Japan

- South Korea

- Rest of APAC

APAC Electronic power steering Market - Companies Mentioned

- HYUNDAI MOBIS

- JTEKT Corporation

- Mando Corporation

- Mitsubishi Electric Corporation

- Nexteer Automotive

- NSK Ltd.

- Robert Bosch GmbH

- SHOWA CORPORATION

- thyssenkrupp AG

- ZF Friedrichshafen AG

Asia Pacific Electronic Power Steering Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 26,704.59 Million |

| Market Size by 2027 | US$ 28,933.30 Million |

| Global CAGR (2020 - 2027) | 4.1% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Nitrogenous Fertilizer Market

- Flexible Garden Hoses Market

- Helicopters Market

- Pharmacovigilance and Drug Safety Software Market

- Portable Power Station Market

- Sexual Wellness Market

- Carbon Fiber Market

- Visualization and 3D Rendering Software Market

- Nuclear Waste Management System Market

- Architecture Software Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, China, Japan, South Korea

Trends and growth analysis reports related to Automotive and Transportation : READ MORE..

Some of the leading companies are:

- HYUNDAI MOBIS

- JTEKT Corporation

- Mando Corporation

- Mitsubishi Electric Corporation

- Nexteer Automotive

- NSK Ltd.

- Robert Bosch GmbH

- SHOWA CORPORATION

- thyssenkrupp AG

- ZF Friedrichshafen AG

Get Free Sample For

Get Free Sample For