The EV powertrain market in Asia-Pacific is expected to grow from US$ 20.27 Bn in 2018 to US$ 59.10 Bn by the year 2027. This represents a CAGR of 12.8% from the year 2019 to 2027.

The EV powertrain market outlook is positive, as the electric vehicles are gaining popularity among the end-users. Increasing the adoption of these vehicles would enable the manufacturers to increase their production lines, thereby requiring an increased quantity of EV powertrains. This factor is expected to drive the EV powertrain market. Additionally, the presence of a large number of well-established and automotive industry recognized players in the market is allowing the end-users to technologically enhanced powertrain products, which is also a key driving force of the EV powertrain market. The volume of EV powertrain procurement is at a constant rise in the current scenario, owing to the fact that the OEMs are increasingly procuring the powertrains in large quantities to cater to the needs of the manufacturing of existing vehicle models and to test respective newer models practically.

The governments of various countries are undertaking initiatives for reducing custom duty and taxes on various EV components. For instance, in 2019, the Indian government reduced the custom duty on EV components by 5%. This led to a reduction in tax collected through electric vehicles by 5%. Thus, the support from the government and increasing awareness among the consumers about the ill effects of the emissions are creating an opportunity for ICE vehicle manufacturers to invest in electric vehicle production.

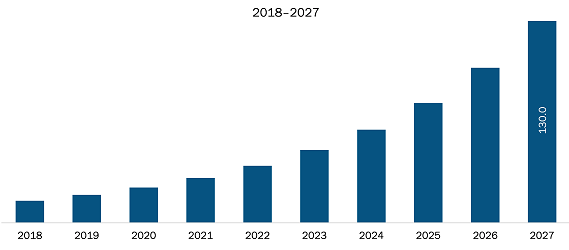

Currently, China is dominating the EV powertrain market in terms of installation, which in turn boosts the demand for the EV powertrain market in the region. China has been the largest automotive market globally over the years. The growth in the automotive sector in China has been achieved mainly through the establishment of various joint ventures with car manufacturers such as Volkswagen, General Motors, and others. According to The International Council on Clean Transportation, China produced around 1,078,000 electric vehicles (passenger cars and light commercial vehicles) in 2018. Also, according to the China Association of Automobile Manufacturers (CAAM) in 2019, battery electric vehicle (BEV) production reached around 1.02 million units, with 3.4% of growth. Whereas, the plug-in hybrid vehicle (PHV) production reached up to 220,000 units. The figure given below highlights the revenue share of India in the Asia-Pacific EV powertrain market in the forecast period:

India EV Powertrain Market Revenue and Forecasts to 2027 (US$ Mn)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Asia-Pacific EV Powertrain Market - Segmentation

Asia-Pacific EV Powertrain Market – By Product Type

- Series Hybrid Powertrain

- Battery Electric Vehicle Powertrain

- Series-Parallel Hybrid Powertrain

- Mild Hybrid Powertrain

- Parallel Hybrid Powertrain

Asia-Pacific EV Powertrain Market – By Application

- Passenger Cars

- Commercial Vehicles

Asia-Pacific EV Powertrain Market – By Country

- China

- Japan

- India

- South Korea

Asia-Pacific EV Powertrain Market -Companies Mentioned

- Continental AG

- Cummins Inc.

- Dana Limited

- Magna International

- Mahle GmbH

- Maxim Integrated

- Robert Bosch GmbH

- Tata Elxsi

- Valeo SA

- ZF Friedrichshafen AG

Asia-Pacific EV Powertrain Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 20.27 Billion |

| Market Size by 2027 | US$ 59.10 Billion |

| CAGR (2019 - 2027) | 12.8% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For