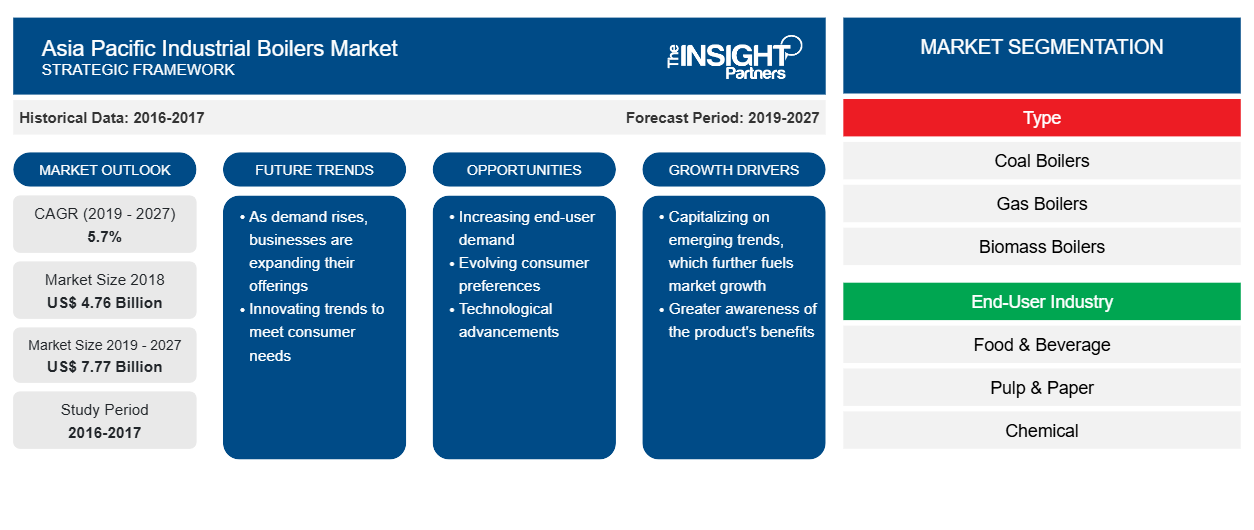

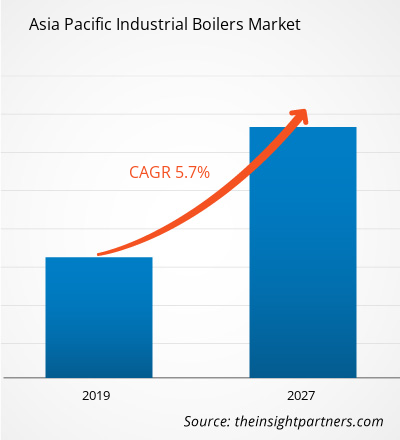

The Asia Pacific industrial boilers market is estimated to account US$ 4.76 Bn in 2018 and is expected to grow at a CAGR of 5.7% during the forecast period 2019 – 2027, to account to US$ 7.77 Bn by 2027.

APAC is among the fastest-growing regions due to the presence of countries such as India, China, and Japan. The growing economies of the region are fueling the growth in an array of sectors, such as the general industry, chemicals, and oil & gas. The region consists of many developing countries that are witnessing high growth in their industrial sectors. The region has become a global manufacturing hub with the presence of diverse manufacturing and processing industries. Alongside China’s evolution into a high-skilled manufacturing hub, other developing countries such as India, South Korea, Taiwan, and Vietnam are attracting several businesses that are in a quest to relocate their low- to medium-skilled manufacturing facilities to the countries offering lower labor costs. The Asia Pacific industrial boilers market for metals & mining is expeted to witness an CAGR growth rate of 2.6% from 2019 to 2027.

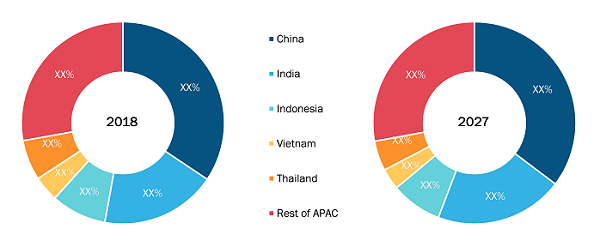

Asia Pacific Industrial Boilers Market – By Countries

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Asia Pacific Industrial Boilers Market Insights

Increasing government initiatives towards environment pollution control

Boilers play a key role in determining the efficiency of industrial operations. The rising concerns towards the environmental pollution and stringent emission norms are driving the growth of Asia Pacific industrial boilers market. For instance, in 2013, Beijing has launched a program i.e., “war on air pollution.” It was primarily focused on reducing the use of coal. China is the world’s largest user of coal, and China’s energy mix is dominated by coal, accounting for about 60% of the total energy in 2016. Another example is Hebei Province, as per the initial government plan of switching from coal to gas, around 1.8 million households and around 4,500 steam tons equivalent of coal-fired boilers would be covered. Thus, driving the growth of the Asia Pacific industrial boilers market during the coming years.

Surging adoption of energy efficient solution

In the future, the energy-efficient solutions would most likely to witness high demand. Energy-Efficient boilers are required to reduce future operating costs, capital investment, and utility systems costs. The performance of industrial boilers is a key element in the efforts of commercial facilities to hold down utility costs. For maintenance and engineering procedures in various industries, businesses trying to provide efficient boiler performance, the efficiency of the boiler is decided by the proportion of heat output to the amount of fuel utilized. According to the U.S Department of energy, traditional heating systems generally run between 56% to 70% efficiency, which is a substantial loss in energy savings. However, modern boilers and water heaters run around 80% efficiency, which provides significant energy savings when used in a number of industries.

Asia Pacific Industrial Boilers Market – Type Insights

The industrial boilers market in Asia Pacific region is segmented based on the type as coal boilers, gas boilers, biomass boilers, solid waste boilers, fluidized bed boilers, and others. The others segment consists of boilers such as chemical recovery boilers and packaging boilers The fluidized bed boilers segment is further segmented as bubbling fluidized bed boilers and circulating fluidized bed boilers. The coal boilers are the most prominent industrial boilers as these boilers are used in various industries including electricity generation industry, food & beverage industry, and pulp & paper industry. The demand for coal boilers is maximum in the recent years, however, due to increasing concerns related to environmental pollution, and emission of harmful gases, the segment is expected to witness slower growth during the forecast period.

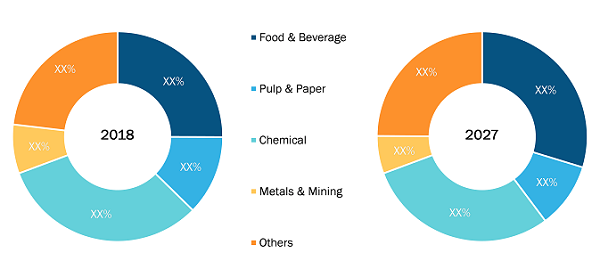

Asia Pacific Industrial Boilers Market – End-user Industry Insights

The Asia Pacific industrial boilers market is analyzed based on the end-user industry as the food & beverage industry, pulp & paper industry, chemical industry, metals & mining industry, and others. The other industry segment comprises of power generation industry, manufacturing industry, and refining industry. The demand for industrial boilers is maximum in the chemical industry as the number of boilers required for smooth operation in the chemical industry is much higher as compared to other sectors. This has facilitated the industry to dominate the Asia Pacific industrial boilers market.

Asia Pacific Industrial Boilers Market for by End-user Industry

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Asia Pacific Industrial Boilers Market -

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAsia Pacific Industrial Boilers Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Some of the market initiatives were observed to be most adopted strategy in the Asia Pacific industrial boilers market. Few of the recent market initiatives adopted by the market players operating in the Asia Pacific industrial boilers market are listed below:

2019:

B&W has signed a strategic collaboration agreement with JZHC to pair JZHC’s Coen burners with B&W’s water-tube package boilers and enables the companies to offer the combined burner as well as boiler solution to their customers.2019:

B&W received a contract for around US$ 3 Mn to design and supply three package boilers for the district energy provider for the City of Akron, Ohio, Akron Energy Systems.2019:

B&W announced that it has succesfully turned over a waste-fired boiler for a combined heat and power plant to its customer, Bodens Energi AB, a municipally owned producer of electricity and heat in Boden, Sweden.ASIA PACIFIC INDUSTRIAL BOILERS SEGMENTATION

Asia Pacific Industrial Boilers Market – By Type

- Coal Boilers

- Gas Boilers

- Biomass Boilers

- Solid Waste Boilers

- Fluidized Bed Boilers

- Others

Asia Pacific Industrial Boilers Market – By End-user Industry

- Food & Beverage

- Pulp & Paper

- Chemical

- Metals & Mining

- Others

Asia Pacific Industrial Boilers Market – By Country

-

Asia Pacific (APAC)

- China

- India

- Indonesia

- Vietnam

- Thailand

- Rest of Asia Pacific

Asia Pacific Industrial Boilers Market - Company Profiles

- AC Boilers S.p.A.

- Babcock & Wilcox Enterprises, Inc.

- Bharat Heavy Electrical Limited

- Siemens AG

- Dongfang Electric Corporation Limited

- General Electric Company

- Harbin Electric Company Limited

- IHI Corporation

- Thermax

- Wood Group PLC

Asia Pacific Industrial Boilers Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 4.76 Billion |

| Market Size by 2027 | US$ 7.77 Billion |

| CAGR (2019 - 2027) | 5.7% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

Asia Pacific Industrial Boilers Market Players Density: Understanding Its Impact on Business Dynamics

The Asia Pacific Industrial Boilers Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Asia Pacific Industrial Boilers Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For