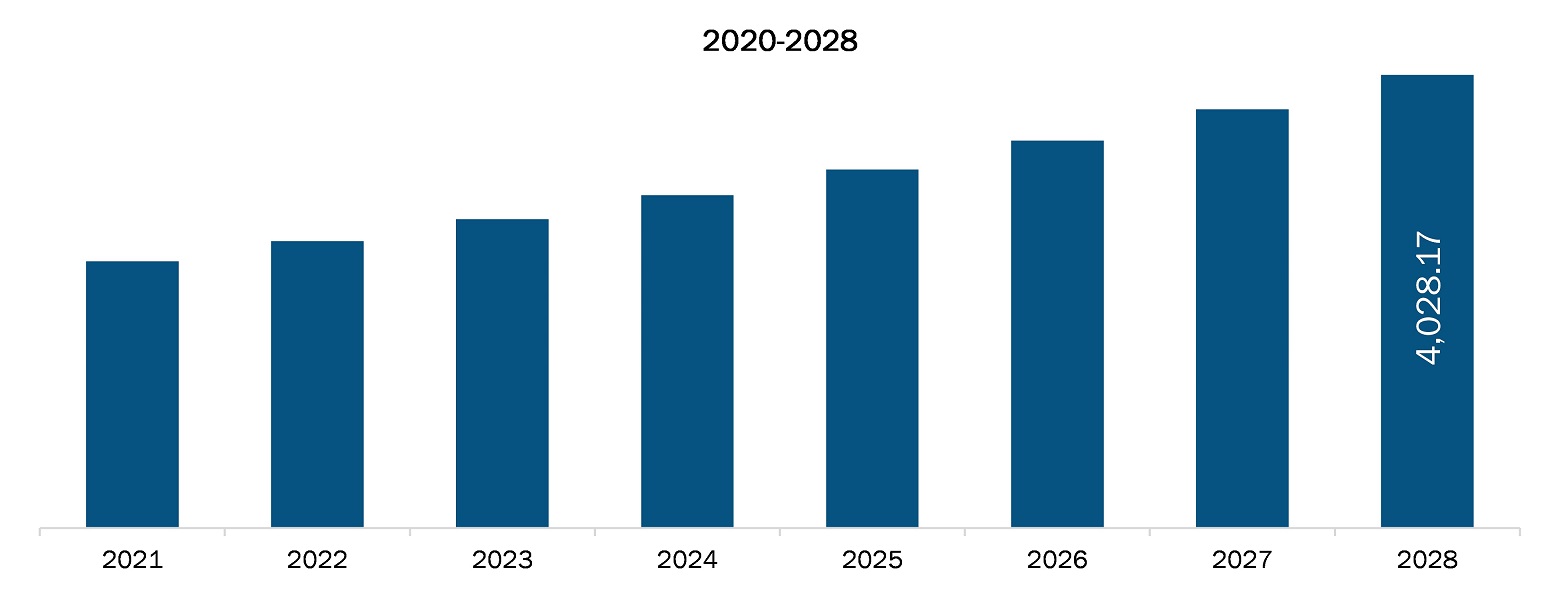

The Asia Pacific laboratory developed test market is projected to reach US$ 4,028.17 million by 2028 from US$ 2,372.68 million in 2021; it is estimated to grow at a CAGR of 7.9% from 2021 to 2028.

The key factors attributing to the market’s growth are the increasing incidence of cancer and genetic disorders and the rising automation of laboratory processes across the globe. However, the changing regulatory landscape is hampering the growth of the Asia Pacific laboratory development test market.

Automation is emerging as an approach to minimize human involvement in laboratory processes. The automation of routine laboratory procedures with the help of dedicated workstations and system software helps increase efficiency and reduce human errors. Laboratories are increasingly adopting laboratory information management systems (LIMS) and other automation tools to maintain stringent regulatory compliance, increase efficiency and productivity, and enhance data security and integrity. As per the study published in the Journal of Lab Automation, the error frequencies in fully automated, semiautomated, and manual operations are 1–5%, 1–10%, and 10–30%, respectively. Moreover, high volumes of data generated by laboratory systems are triggering the demand for effective data processing, analysis, and sharing methods, thereby highlighting the need for efficient and cost-effective solutions such as the LIMS. The automation of LDTs can significantly boost productivity and simplify compliance procedures. Clinical laboratories are under enormous pressure to manage increasing test volumes and conduct more complex diagnostic assays, further underlining the need for flexible automation systems. Many MedTech companies are offering automation solutions to help streamline clinical laboratory processes. For instance, Roche Cobas Omni–Utility Channel is beneficial for both IVD assays and high-volume LDTs. It is designed to meet the growing need for efficient workflows in laboratories, as it can assist in different stages ranging from sample processing to quick data interpretation. It can run up to 96 results in 3 hours and up to 864 results in 8 hours, thereby enhancing the efficiency of laboratories. Also, the rising incidence of cancer and growing awareness regarding the importance of early diagnostics are boosting the adoption of LDTs.

The COVID-19 outbreak has pushed diagnostics to the forefront of healthcare and increased awareness about quality testing worldwide. Many countries in Asia Pacific have taken extraordinary measures to contain the infection by ramping up the testing capacity. For instance, the new “Regulation for Medical Device Administration and Supervision,” Order 739 LDT, that allows the development of laboratory developed tests (LDT) was released in China in March 2021. This new regulation relaxes the restrictions on LDTs in China—allowing China medical institutions to develop their IVD reagents under certain conditions. Also, relaxation in government regulations regarding LDTs is further driving the market growth in the region. In addition, increasing product launches by market players are further driving the growth of the market. Hence, such developments will boost the Asia Pacific laboratory developed test market.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

ASIA PACIFIC LABORATORY DEVELOPED TEST MARKET SEGMENTATION

By Type

- Clinical Biochemistry

- Critical Care

- Haematology

-

- Coagulation and Hemostasis,

- Hemoglobin Testing

- Blood Count Testing

- Others

- Immunology

- Microbiology

- Molecular Diagnostics

- Other Test Types

By Application

- Academic Institutes

- Clinical Research organizations

- Hospitals laboratory

- Specialty Diagnostic Centers

- Others

By Country

- India

- Japan

- China

- South Korea

- Australia

- Rest of Asia Pacific

Company Profiles

- Quest Diagnostics Incorporated

- F. HOFFMANN-LA ROCHE LTD.

- QIAGEN

- Illumina, Inc.

- Eurofins Scientific

Asia Pacific Laboratory Developed Test Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 2,372.68 Million |

| Market Size by 2028 | US$ 4,028.17 Million |

| CAGR (2021 - 2028) | 7.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For