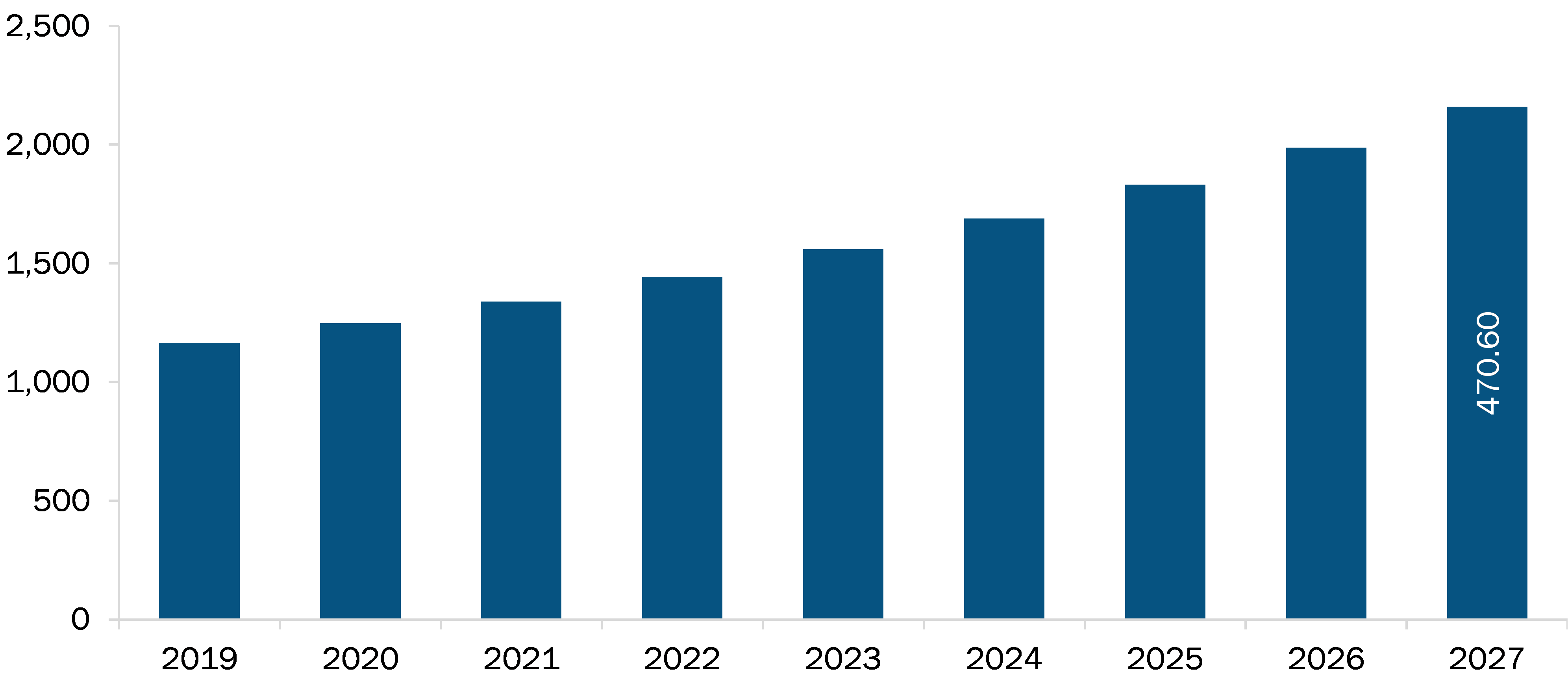

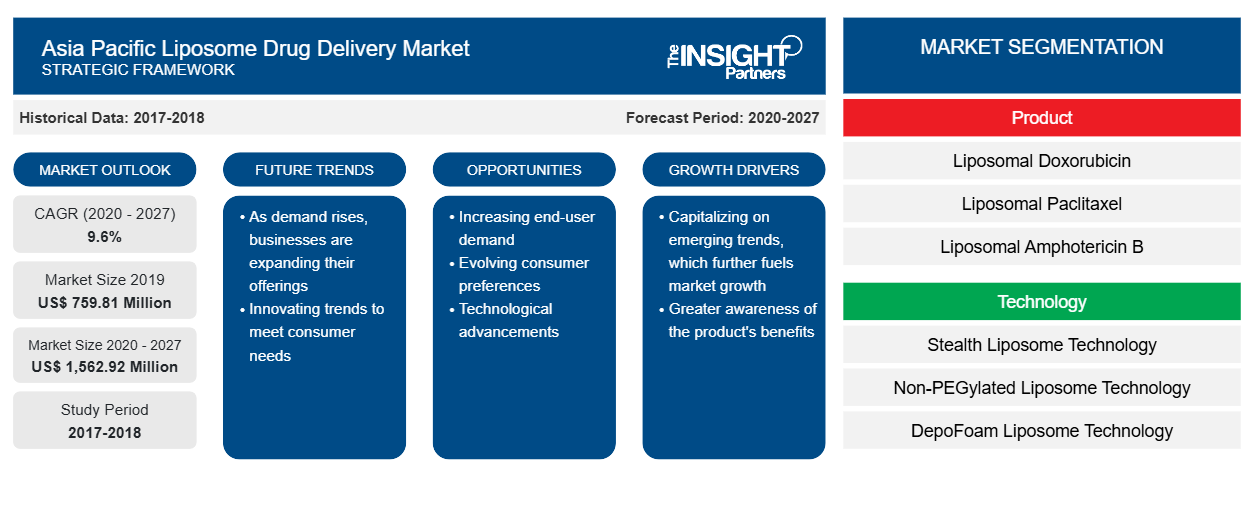

Asia Pacific liposome drug delivery market is expected to reach US$ 1,562.92 million in 2027 from US$ 759.81 in 2019. The market is estimated to grow with a CAGR of 9.6% from 2020-2027.

Liposomes are small sphere-shaped artificial vesicles synthesized from cholesterol and phospholipids. They have multiple layers and a diameter range of 0.01 to 5.0 um. They also have hydrophilic and hydrophobic properties which help liposomes to encapsulate hydrophobic and hydrophilic drugs to be delivered to targeted body site. Liposomes provide an assured system for targeted drug delivery and thereby is the factor influencing the Liposome Drug Delivery market size growth. Liposomes are widely used for enclosing all types of drug molecules such as acyclovir, chloroquinediphosphate, paclitaxel, tropicamide, and cyclosporine. Liposomes are used as a drug carrier for drug therapy for many diseases since they are biodegradable and biocompatible. Also, they have many therapeutic properties like anticancer drugs, genetic materials, proteins, vaccines, macromolecules, and thus can be encapsulated in liposomes. The scope of the liposome drug delivery market includes product, technology, application, and region.

Japan Liposome Drug Delivery Market Revenue and Forecasts to 2027 (US$ MN)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

New Developments in Lipid Composition for Stability and Optimization of Drugs

The pharmaceutical and biotechnology companies are exploring alternative compositions with cholesterol as well as new techniques such as nanotechnology to improve the stability and drug release profiles with the help of encapsulation and other techniques. They are using liposomes for the generation of extracellular vesicles by targeted cells. According to the Department of Pharmaceutics, SPER, JamiaHamdard University, New Delhi, India a current research was done to prolong and sustain the release of erythromycin (ERY) by preparing a solid lipid nanoparticles (SLNs)-based gel formulation for the safe and effective treatment of acne. ERY-loaded SLNs were developed, and various process variables were optimized with respect to particle size, zeta potential, and entrapment efficiency using the Taguchi model. The main aim was to develop ERY-loaded SLNs-based gel with the potential to sustain and delay the release of the drug. The developed gel may be suitable for the treatment of acne. Manufacturers in the liposome drug delivery market are ramping up their R&D activities to unlock new lipid compositions and strategies that help to optimize the drug transport and stability of liposomes. Similar experiments for innovative liposome fabrication are likely to offer growth opportunities for the market players to attain a significant position and grow in the liposome drug delivery market—new development lipid composition for stability and optimization of drugs.

Product- Based Market Insights

Based on product, the liposome drug delivery market is segmented into liposomal doxorubicin, liposomal paclitaxel, liposomal amphotericin B, others. The liposomal doxorubicin segment held the largest share of the market in 2019, whereas the liposomal amphotericin B segment is anticipated to register the highest CAGR in the market during the forecast period.

Asia Pacific Liposome Drug Delivery Market, by Product – 2019 and 2027

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Technology- Based Market Insights

Based on technology, the liposome drug delivery market has been segmented into stealth liposome technology, non-PEGylated liposome technology, depofoam liposome technology. The stealth liposome technology segment held the largest share of the market in 2019, and continued to register the highest CAGR in the market during the forecast period.

Application- Based Market Insights

Based on application, the liposome drug delivery market has been segmented into fungal diseases, cancer therapy, pain management, viral vaccines, and photodynamic therapy. The cancer therapy segment held the largest share of the market in 2019, and continued to register the highest CAGR in the market during the forecast period

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAsia Pacific Liposome Drug Delivery Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

High Rise in Popularity of Liposomes in Drug Delivery

Product launches and approvals are commonly adopted strategies by companies to expand their footprint worldwide and meet the growing demand. The players operating in the liposome drug delivery market adopt the expansion, collaboration, and product launch strategies to enlarge customer base across the world. These strategies allow the players to maintain their brand name globally. For instance, Janssen Biotech, Inc. has given additional funding to support further research under its R&D Collaboration and Option to License Agreement with Dendright Pty Ltd (established by UniQuest, the main commercialization company of The University of Queensland) to develop Dendright's tolerizing immunotherapy for the treatment of patients with rheumatoid arthritis (RA). The collaboration will allow the conduct of a first-in-human safety and tolerability study in the second half of 2017 as a turning point in the development of a new liposomal drug product, DEN-181, which offers the potential to intercept RA at a very early stage.

ASIA PACIFIC LIPOSOME DRUG DELIVERY MARKET SEGMENTATION

By Product

- Liposomal Doxorubicin

- Liposomal Paclitaxel

- Liposomal Amphotericin B

- Others

By Technology

- Stealth Liposome Technology

- Non-PEGylated Liposome Technology

- DepoFoam Liposome Technology

- Lysolipid Thermally Sensitive Liposome (LTSL) Technology

By Application

- Fungal Diseases

- Cancer Therapy

- Pain Management

- Viral Vaccines

- Photodynamic Therapy

Companies Mentioned

- ASTELLAS PHARMA INC.

- JOHNSON AND JOHNSON SERVICES, INC.

- LUYE PHARMA GROUP

- TAKEDA PHARMACEUTICAL COMPANY LIMITED

- Novartis AG

- IpsenPharma

- Gilead Sciences, Inc

- Celsion, Inc.

Asia Pacific Liposome Drug Delivery Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 759.81 Million |

| Market Size by 2027 | US$ 1,562.92 Million |

| CAGR (2020 - 2027) | 9.6% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

Asia Pacific Liposome Drug Delivery Market Players Density: Understanding Its Impact on Business Dynamics

The Asia Pacific Liposome Drug Delivery Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Asia Pacific Liposome Drug Delivery Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For